360 Degree!

Good Morning!

The EU is returning to pre-pandemic consumer activity. Latest data shows a surge in the use of public transport, recovery in box office revenues, Covid infections falling, and flight numbers stabilizing. Are we reaching the end of the pandemic? Or is it too soon to speculate?

The US government is running out of money! Republicans are refusing to increase the borrowing limit, leaving Chuck Schumer, the Senate’s top democrat with a 20-day window to find out a way to raise the debt ceiling - ahead of October 18, when the Treasury Secretary has warned the government will run out of money.

The Evergrande crisis! The debt-ridden property giant will sell 1.75bn shares worth $1.5bn, the company owns in Shengjing Bank, as it faces another bond interest payment due today. The company has already missed one key $83.5m coupon payment last week.

Meanwhile, in the US, the Fed has questioned several big banks regarding their exposure to Evergrande, following other global regulators in gauging the domestic potential fall-out from Evergrande’s debt crisis.

The Consumer Confidence Index, for the month of September, was expected to rise but has instead fallen to a 7-month low of 109.3, after declining 5.9 points from August. The Goods Trade deficit has risen 0.9% to $87.6bn in August.

Morgan Stanley’s Bitcoin bet! The US investment giant has reported acquisition of around 30,000 shares in the investment vehicle Grayscale Bitcoin Trust. The transaction has made MS the second-largest shareholder within Grayscale.

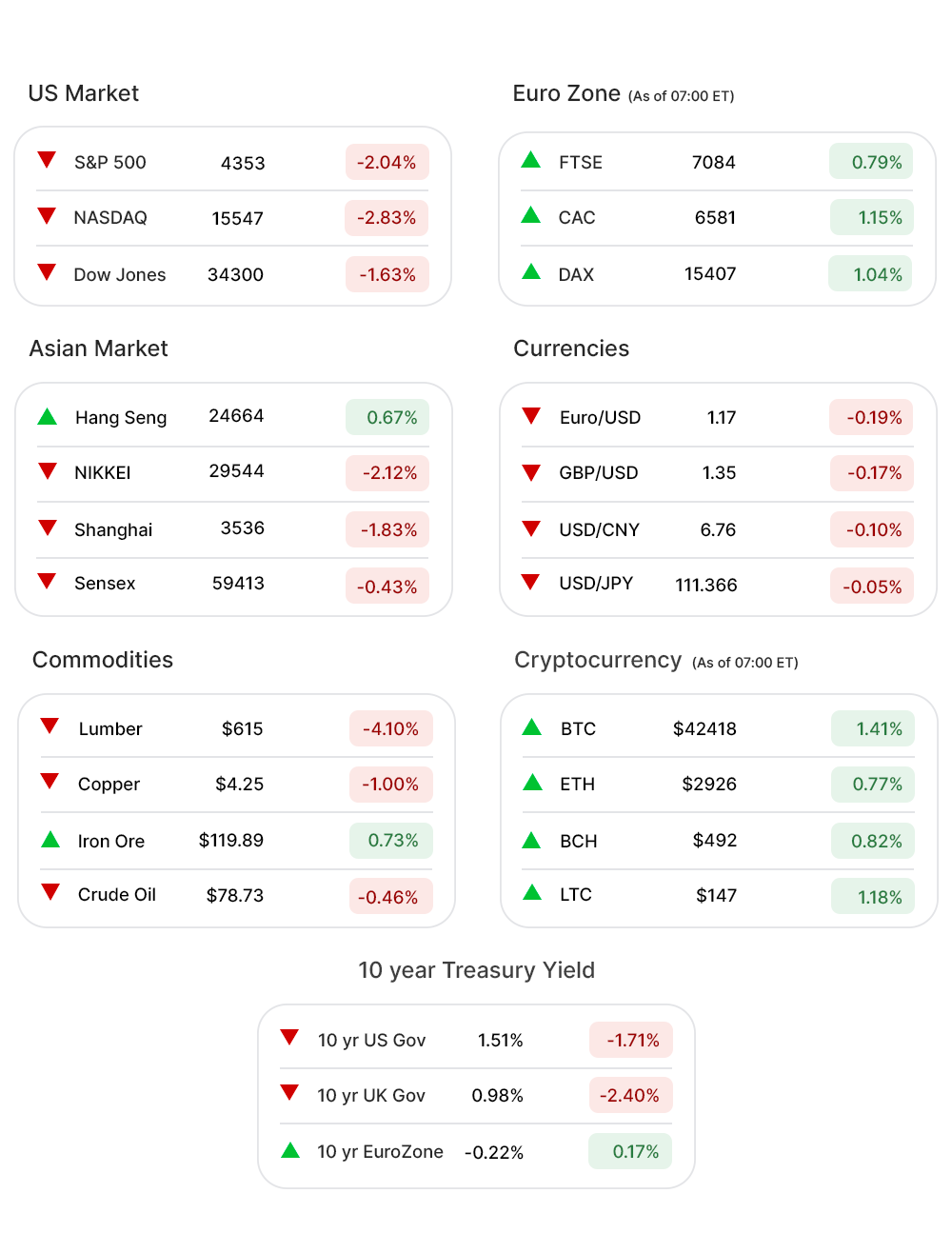

US Markets:

The markets Tuesday exhibited the first signs of a “taper tantrum”, with a serious pullback led by tech stocks, as investors nervously watched a swift rise in US Treasury Yields.

Tech-heavy Nasdaq (-2.86%▼) recorded its worst day since March, as the index shed some 434 points by the end of the day Tuesday.

S&P 500 (-2.04%▼) fell more than 90 points, to close the day at 4352.63. A slide of 569 points pushed Dow Jones (-1.63%▼) substantially down as well, while Russell 2000 (-2.25%▼) was the second worst-hit index, with a loss of more than 50 points.

Sectors at the S&P 500 ended overwhelmingly into the red zone, with the only exception of Energy (0.46%▲), which continues to remain buoyed by the rising crude prices.

Expectedly, Technology (-2.98%▼) was at rock bottom, with Consumer Discretionary (-2.01%▼), Real Estate (-2.32%▼), Communication Services (-2.80%▼), and Utilities (-2.56%▼) almost matching the losses in the tech sector.

Financials (-1.59%▼), Materials (-1.28%▼), Industrials (-1.15%▼), Consumer Staples (-1.92%▼), and Healthcare (-1.70%▼) also incurred losses of more than 1% for the day.

Futures!

As the treasury yields eased a little from highs, the Futures made gains Wednesday morning with all major indices in green.

As of 07:00 ET, the futures looked like this: Nasdaq Futures ( 1.04%▲), Dow Futures (0.62%▲), S&P 500 Futures ( 0.77%▲), and Russell 2000 Futures ( 0.88%▲).

Key Movers in Small Cap:

Gogo Inc (GOGO, 37.64%▲) Tuesday said that its margin, based on adjusted earnings before interest, taxes, depreciation, and amortization, will climb to 45% in 2025. The relative volume of the stock was 69.3.

United Natural Foods (UNFI, 23.73%▲) smashed the estimates on its earnings, in its Q4 financial report. The relative volume of the stock was 18.0.

One of the patients treated with Pemvidutide, the lead candidate of Altimmune Inc (ALT, -2.50%▼), showed signs of liver damage even as the drug overall exhibited that it helps in weight loss. The relative volume of the stock was 14.7.

The other movers in the small-cap segment included:

FRP Holdings (FRPH, -0.03%▼): Relative Volume 5.6.

Retail Opportunity Investments (ROIC, -0.62%▼): Relative Volume 4.5.

Brookdale Senior Living Inc (BKD, -2.28%▼): Relative Volume 3.8.

SOC Telemed Inc (TLMD, -3.31%▼): Relative Volume 3.8.

US Ecology Inc (ECOL, -2.37%▼): Relative Volume 3.5.

Key Movers in Large Cap:

TD Synnex (SNX, -6.82%▼) posted disappointing fiscal Q3 sales, Tuesday, as it announced the financial results for the quarter. The relative volume of the stock was 6.0.

Media reports suggested that CyrusOne (CONE, 6.89%▲) was exploring strategic alternatives, which included a potential sale of the company. The relative volume of the stock was 4.7.

Thor Industries Inc (THO, 7.93%▲) presented an excellent Q4 financial report, propelling the stock higher. The relative volume of the stock was 4.2.

Acceleron Pharma Inc (XLRN, 2.19%▲) continued to soar on news of getting acquired in an $11bn deal. The relative volume of the stock was 3.1.

The other movers in the large-cap segment included:

Double Verify Holdings (DV, -2.02%▼): Relative Volume 3.1.

Cabot Oil & Gas (COG, -1.09%▼): Relative Volume 2.5.

Cimarex Energy Co (XEC, -1.12%▼): Relative Volume 2.5.

Novavax Inc Inc (NVAX, -11.34%▼): Relative Volume 2.4.

Dynatrace Inc (DT, -5.42%▼): Relative Volume 2.2.

Report Card:

United Natural Foods (UNFI, 23.73%▲), the organic food company, reported adjusted earnings of $1.18 per share, better than the estimated 80 cents, with quarterly revenue of $6.7bn, a little less than the expected $6.85bn. The stock fell by 0.81% after hours.

The Manufacturer of recreational vehicles, Thor Industries Inc (THO, 7.93%▲) reported an EPS of $4.12, comprehensively beating the estimates of $2.91 per share and $2.14 per share in the prior year. The revenue of $3.59bn surpassed the estimates by 7.98%. The stock continued to be in the green zone after hours.

TD Synnex (SNX, -6.82%▼), the B2B It services provider, came out with an operating income of $148m, ahead of the prior year’s $132m. The revenue of $5.2bn was however 1.9% lower than the prior year’s revenue in the same quarter. The stock managed to crawl into the green zone after hours.

On the Lookout:

Fed Chair, Jerome Powell, is scheduled to speak at the European Central Bank forum.

The Pending Home Sales Index is expected to go from July’s -1.8% to 0.4% in August.

Unusually high shorter-term CALL options activity seen on Hyzon Motors Inc (HYZN, -28.01%▼), Teva Pharmaceuticals (TEVA, 3.90%▲), DraftKings Inc (DKNG, -2.84%▼), Occidental Petroleum Corporation (OXY, -0.96%▼), and Teladoc Health Inc (TDOC, -3.33%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Cisco Systems Inc (CSCO, -1.25%▼), Freeport-McMoRan Inc (FCX, -1.00%▼), Ondas Holdings Inc (ONDS, 17.46%▲), Carnival Corp (CCL, 0.80%▲) and Crispr Therapeutics AG (CRSP, -4.36%▼) among others.

Other Asset Classes:

Crude Oil Prices - After hitting their highest mark in around 3 years, the Crude Oil prices pulled back a little early Wednesday morning. Early morning Brent crude was trading 1.00% lower at $78.30 per barrel. WTI crude slid below the $75 per barrel mark, and was 1.06% lower this morning.

The US Dollar (93.82, 0.06%▲) recorded a new 2021 high at 93.90, before pulling back a tad bit this morning. The taper talk by Fed is fuelling the greenback, with a target of 94 in clear sight.

Ahead of Powell’s speech at the ECB forum, the US Treasury Yields retreated a little Wednesday morning. The 10 Year US Treasury Yield was trading in the red zone but was still above the 1.5% mark at 1.503%.

Global Markets:

Asian Markets: Following the selloff in the US and the EU markets on Tuesday, most of the markets in the Asia Pacific region tumbled Wednesday, as fears of weak growth and lasting inflation weighed heavy on investors’ minds. Tokyo’s Nikkei, tumbled by around 640 points to close 2.12%, into the red zone. Shanghai slipped down 1.83%. Hang Seng however outperformed the overall sentiment with gains of 0.67%.

The Indian market followed the overall selloff in Asia today. Financials tanked, dragging Sensex down 254 points (-0.43%), and Nifty lower 37 points (-0.21%). Metals, Pharma, PSU Banks, and Realty sectors outperformed the indices, however.

European markets: Despite the fears of a global slowdown the EU markets rebounded this morning. FTSE (0.80%), CAC (0.87%), DAX (0.89%) , and the pan-EU index Stoxx-600 (0.74%) looked set to make up for Tuesday’s losses today.

Meanwhile on Researchfin.ai

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you, tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.