A Crisis, an Opportunity?

Hey, hope you had a great weekend,

The journey is the reward! China bans profit-making from education, sets tougher regulations for for-profit education companies, worth $100bn, in the country.

The billionaire teacher, no more a billionaire! Larry Chen, the former school teacher and an education tycoon lost his billionaire status as his US-listed education company Gaotu TechEdu Inc tumbled 63% on Friday, following the news. Tal Education Group plunged 70%.

The worst anniversary ever! The Hang Seng Tech index, turning one on Tuesday, has become the worst performing tech sector in the world. Up 59% in February the index has witnessed $551bn in market value being wiped out as China keeps crackdown on its tech companies unrelenting. Hang Seng slid 4% Monday!

The Covid Cloud over the Olympics! The infections associated with Tokyo-2020 have risen to 148 after 16 new cases were detected today, 3 of them athletes. Nikkei rose, regardless!

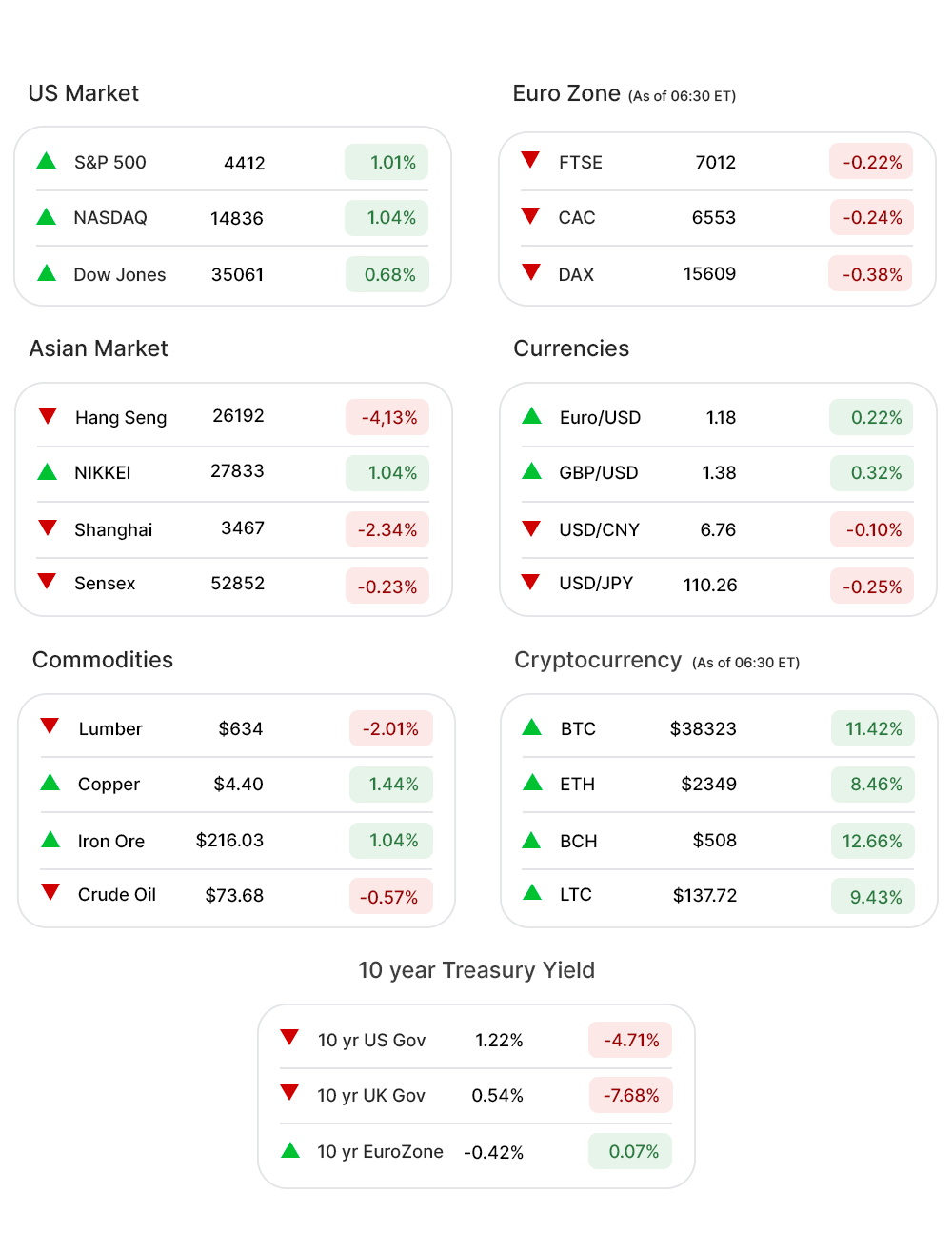

US Markets:

All three major indices were on record highs at Friday’s close and wrapped up the week in gains. The markets were buoyed by great earnings reports and the investors seem to have shrugged off concerns surrounding the surge of the delta variant.

The S&P 500 (1.01%▲) gained, a little shy of 45 points, to close on a record 4412. Tech-heavy Nasdaq (1.04%▲) gained more than 150 points while Dow (0.68%▲) climbed 238 points by the close on Friday.

Energy (-0.43%▼) and Industrials (-0.35%▼) were the only two non-performing sectors in the S & P 500.

Communication Services (2.66%▲) led the gainers, followed by Healthcare (1.18%▲), Consumer Staples (1.23%▲) and Consumer Discretionary (1.44%▲).

Technology (0.99%▲) continued to surge as some major tech giants propelled the sector yet again, keeping the winning streak from snapping.

Apple Inc. (AAPL, 1.20%▲), Microsoft (MSFT, 1.23%▲), Amazon (AMZN, 0.51%▲), Facebook (FB, 5.30%▲) and Alphabet (GOOGL, 3.58%▲) lend support to the Tech sector.

Futures!

Futures looked grim, early Monday morning, following a turbulent day in Asian and European stock markets. Will the gloom be extended to the US markets?

As of 06:30 ET: Nasdaq Futures (-0.10%▼), S&P 500 Futures (-0.20%▼), Russell 2000 Futures (-0.15%▼), and Dow Futures (-0.32%▼) looked gloomy.

Key Movers in Small Cap:

Atlantic Capital Bancshares (ACBI, 1.60%▲) has announced that it will be merged with and into South State Corp, in a deal worth $542m or $26.43 per share. The relative volume of the stock was 17.9.

Clearfield Inc (CLFD, 19.05%▲), the manufacturer of passive connectivity products, received a consensus recommendation of buy from the analysts. The relative volume of the stock was 7.7.

The metalworking company, DMC Global Inc. (BOOM, -11.30%▼) lagged on the estimates on Q2 earnings, reporting an earnings surprise of -28%, with an EPS of $0.10 falling short of the expected $0.14%. The relative volume of the stock was 7.1.

Seres Therapeutics (MCRB, -7.04%▼) continued to tumble after its phase 2b study of SER-287, targeting ulcerative colitis, did not meet the primary endpoint. The relative volume of the stock was 5.4

The other movers in the small-cap segment included:

Kimball Electronics (KE, 5.04%▲): Relative Volume 8.8.

Spruce Biosciences (SPRB, 2.25%▲): Relative Volume 7.5.

Impel NeuroPharma (IMPL, 16.44%▲): Relative Volume 6.4

EVI Industries Inc (EVI, 0.18%▲): Relative Volume 5.1.

TPI Composites (TPIC, -10.16%▼): Relative Volume 4.9.

Key Movers in Large Cap:

The Boston Beer Company (SAM, -26.02%▼) not only fell behind earnings expectations but also downgraded its future outlook. The relative volume of the stock was 9.1.

Facebook (FB, 5.30%▲) stock gained, propelled by stellar earnings report by social media peer Snap Inc. and an upgraded 12-month target for Facebook shares. The relative volume of the stock was 2.6.

The other movers in the large-cap segment included:

Roku Inc. (ROKU, 12.60%▲): Relative Volume 3.6.

VeriSign Inc (VRSN, -4.71%▼): Relative Volume 3.2.

Skechers U.S.A Inc (SKX, 5.88%▲): Relative Volume 3.1.

Intel Corporation (INTC, -5.29%▼): Relative Volume 3.1.

Twitter Inc. (TWTR, 3.05%▲): Relative Volume 3.0.

Report Card:

The multinational financial services company, American Express (AXP, 1.33%▲) reported an earnings spike of 866% y-o-y, with an EPS of $2.80. Revenue of the company also grew by 33% to $10.24bn. The stock made some gains after hours as well.

Roper Technologies (ROP, 1.02%▲), the industrial equipment maker, has beaten estimates on its earnings for Q2 with an EPS of $3.76 versus the estimated $3.66. Revenue of $1.59bn has beaten the estimate by 1.55%. The stock remained flat after hours.

The Boston Beer Company (SAM, -26.02%▼) earnings fell short of estimates by a long shot! The EPS of $4.57 on net sales of $603m was below the estimated EPS of $6.69 on net sales of $658m.

The semiconductor giant, Intel Corporation (INTC, -5.29%▼), reported a 12% increase in its EPS y-o-y to $1.14, above the expected $1.06. Revenue was flat y-o-y at $19.6bn. The stock continued to sink after hours.

NextEra Energy (NEE, 1.42%▲) reported revenue of $3.93bn, falling short of the estimate by 23%. The EPS of $0.71 however beat the expected EPS of $0.67. The stock slid a little after hours.

On the Lookout:

The New Home Sales report is due today with a median forecast of 795,000, a drop from 800,000 reported last month.

Besides, the week ahead is going to be a busy one with a two day Fed meeting, focussing on economic policy, set to start Tuesday, followed by a presser by the Chair Jerome Powell on Wednesday.

Also, tech giants Apple, Facebook, Microsoft, Amazon and Alphabet are set to release their Q2 earnings this week, along with some major pharma companies.

Aspire Global, an e-cigarette and vaping brand, looks to raise $120m by offering 15m shares of its common stock priced between $7 and $9.

A leader in advanced storage solutions, Clarios International, has announced an offering of its 88m shares of common stock, priced between $17 and $21.

Icosavax, a company developing Covid-19 vaccines, has announced an offering of 10m shares of its common stock, priced between $14 and $16. The company has decided to go public only after 4 years of coming into being.

The mortgage technology company, Meridian Link, is set to go public with an initial offering of 12m shares of its common stock, priced between $24 and $26 per share.

An education platform for teachers, PowerSchool Holdings, is offering 39.4m shares of its common stock, priced between $18 and $20, per share.

Unusually high shorter-term CALL options activity seen on Arcimoto Inc. (FUV, 4.06%▲), Skillz Inc. (SKLZ, 4.44%▲), Lordstown Motors (RIDE, -8.67%▼), India Globalization Twitter Inc. (TWTR, 3.05%▲) and Advanced Micro Devices. (AMD, 1.03%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Snap Inc. (SNAP,23.82%▲), Delta Airlines (DAL,-1.58%▼), Futu Holdings Ltd. (FUTU, -7.47%▼), Gaotu Techedu Inc. (GOTU, -63.26%▼), Acadia Pharmaceuticals (ACAD, -3.46%▼) and Fisker Inc. (FSR,-1.12%▼).

Other Asset Classes:

The 10 Year Treasury Yield, ahead of the Fed meeting fell 5 basis points to 1.233% while an equal dip was witnessed in the 30 Year Treasury Yield, which stood at 1.872 early Monday morning.

Crude Oil squeezed out its first weekly gain in three weeks Friday following indications that the global demand is holding up despite rising cases of the delta variant. Crude Oil prices have climbed 50% this year so far, as vaccinations have led to opening up of economies world over.

The US Dollar (92.73,-0.19%▼) shrugged off some of its gains, early Friday morning, but is still up 3.8% from a recent low on May 25. The US dollar is expected to get stronger with FOMC meet in focus.

The CryptoCurrency, Bitcoin surged on Sunday past $39000, for the first time since mid-June, following the recent selloff. The entire crypto market added $114bn in 24 hours, as on Sunday, 11:05 pm ET, following speculation over Amazon Inc being potentially involved in the Crypto sector.

Global Markets:

The Asian markets slid today, considerably, as China continues to crack down on its tech giants. Nikkei was an exception with a gain of around 1%, while other markets witnessed a free fall. Hang Seng slid more than 4% while Shanghai fell 2.34%, its lowest in 10 weeks.

The Asian markets handed over negativity to the European Markets as well. All major EU markets were down early Monday morning with Stoxx-600, down 0.51% in early trade. The German lfo business climate index falling to 100.8, from a revised 101.7 precious month, also weighed the European markets down.

Meanwhile on Researchfin.ai

Trade setups identified by our AI that successfully met their profit-taking target yesterday and within their respective target time were Safehold Inc. (SAFE, 1.85%▲), Cloudflare Inc. (NET,3.05%▲), Rapid7 Inc (RPD, 2.18%▲), Atlassian Corporation (TEAM, 0.80%▲), and Credit Acceptance Corp. (CACC, 0.23%▲).

There are 50+ new trade setups identified by the AI last friday. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

Let’s set the tone for the week, with a fabulous Monday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.