Alphabet Worth Trillions!

Good Morning!

Google owner Alphabet Inc. advanced 7% in August, the eighth monthly gain in a row, and longest since a 10-month streak in 2009. With gains of 65%, this year Alphabet is closing in on the $2tr market cap behind only Apple & Microsoft.

Why so wary? Investors in the US are increasingly turning towards low-risk derivative strategies, as they suspect the steam in the equities might be running out any time soon. S&P 500 has returned more than 20% this year thus far!

The ‘August’ August, for a change! Historically August has been the worst month for US equities, with S&P 500 remaining in negative for the month, over the last 10 and 20 year periods. Not this year though!

China’s factory growth slowed in August. From July’s 50.4, the manufacturing Purchasing Managers Index (PMI) has fallen to 50.1 this month. After a choppy start Asian markets recovered well.

Eurozone inflation highest in a decade! The European Central Bank has pledged to keep borrowing rates negative as inflation hits 3%. Global stocks rise, nevertheless!

All work and no play! Children in China can play video gamescfor only three hours a week now. These ‘harshest’ regulations on the gaming sector had a mixed impact as gaming giant Tencent rebounded 3.31% after falling by 4%, while Netease dropped 2.07%.

The US, safe no more! The EU has removed the US from the safe list and restricted non-essential travel in wake of rising delta variant cases. Travel stocks slide in European markets, Tuesday morning.

Pending Home Sales, a leading indicator of the health of the housing market, fell for the second month in a row by 1.8%in the month of July from the prior month. The sales were expected to increase by 0.4%.

US Markets:

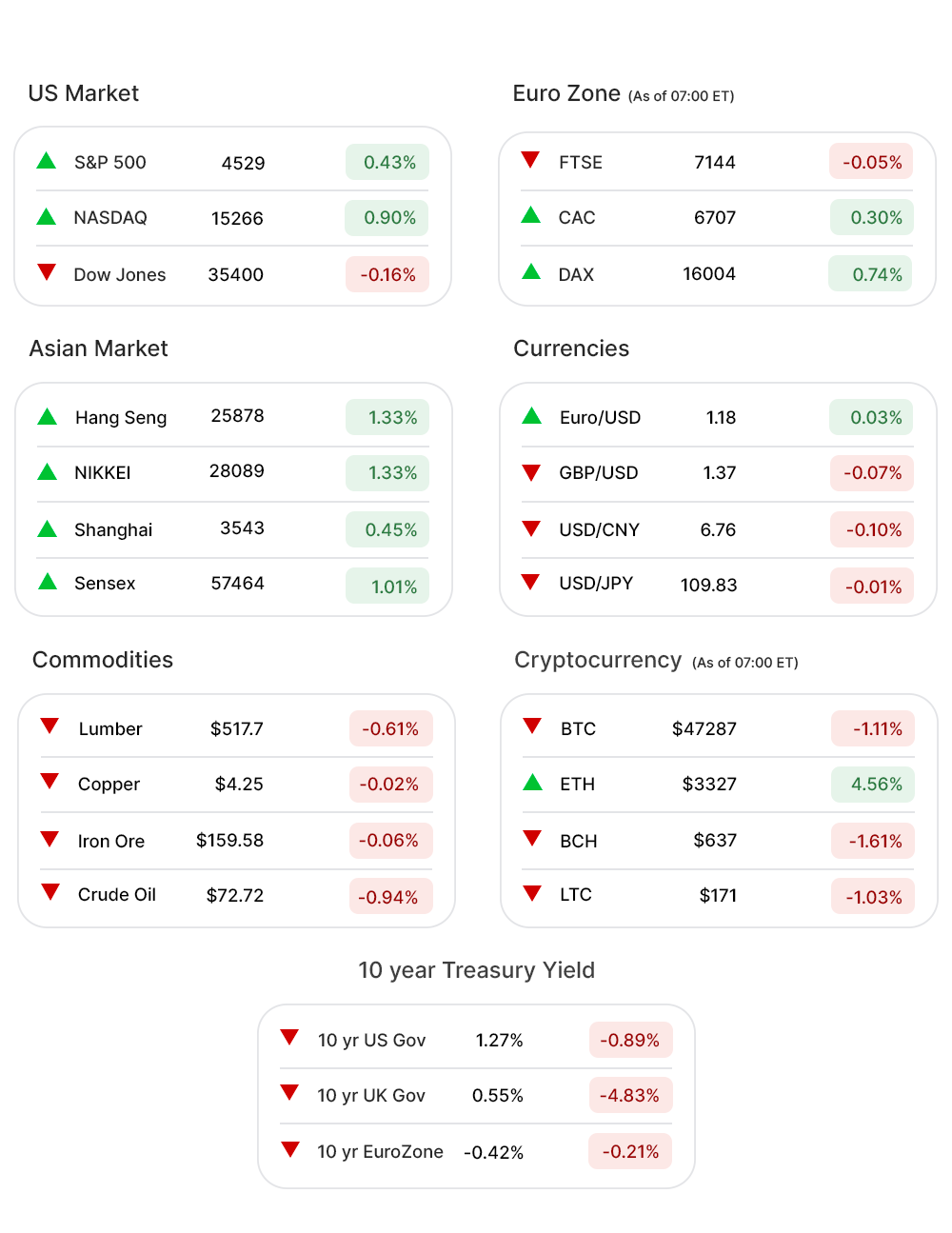

500 (0.4%▲) clinched the 53rd record high of 2021, as technology and other growth stocks boosted the market Monday.

Nasdaq (0.9%▲) climbed more than 136 points to reach its 32nd record close of the year. Dow Jones (-0.2%▼), however, slipped in excess of 55 points, along with Russell 2000 (-0.49%▼).

Tech giants that propelled Nasdaq included Apple (AAPL, 3.04%▲), Facebook (FB, 2.15%▲), Amazon (AMZN, 2.15%▲), Alphabet (GOOGL, 0.41%▲), and Microsoft (MSFT, 1.29%▲).

Sectors at the S&P 500 were mixed, with four of them falling below the zero mark and seven in positive territory.

Financials (-1.47%▼) and Energy (-1.16%▼) were at rock bottom followed, in losses, by Industrials (-0.16%▼) and Materials (-0.17%▼).

Real Estate (1.16%▲) and Technology (1.09%▲) topped the gainer chart. Other sectors among gainers were Consumer Discretionary (0.92%▲), Consumer Staples (0.54%▲), Healthcare (0.61%▲), Communication Services (0.74%▲), and Utilities (0.17%▲).

Futures!

Futures looked set to extend Monday’s gains.

As of 06:00 ET, all the indices were green, without an exception: Dow Futures (0.20%▲) Russell 2000 Futures (0.26%▲), Nasdaq Futures (0.24%▲), and S&P 500 Futures (0.19%▲).

Key Movers in Small Cap:

DSP Group Inc (DSPG, 17.85%▲), the small fabless semiconductor designer, is being acquired by a larger peer Synaptics for $22 per share. The Relative Volume of the stock was 15.9.

Independence Holding Company (IHC, 18.78%▲) has received a preliminary non-binding offer from Geneve Holdings Inc to acquire all outstanding shares of the former at a purchase price of $50. The Relative Volume of the stock was 14.3.

Adtran Inc (ADTN, -16.52%▼) has offered to buy German telecommunications equipment maker ADVA at about $930m. The Relative Volume of the stock was 10.1.

Aterian Inc (ATER, 8.88%▲) has announced that its shareholders will get discounts on best-selling products on its website. The Relative Volume of the stock was 5.8.

The other movers in the large-cap segment included:

Plymouth Industrial REIT (PLYM, 4.50%▲): Relative Volume 8.5.

Reneo Pharmaceuticals Inc (RPHM, 19.75%▲): Relative Volume 6.5.

Lexicon Pharmaceuticals Inc. (LXRX, -1.95%▼): Relative Volume 6.1.

Big 5 Sporting Goods Corp. (BGFV, 18.12%▲): Relative Volume 4.4.

Iridium Communications Inc. (IRDM, 15.41%▲): Relative Volume 4.4.

Key Movers in Large Cap:

Hill-Rom Holdings(HRC, 9.69%▲), the medical equipment maker, is in advanced talks with Baxter International to be bought for about $10bn or $150 per share. The relative volume of the stock was 13.3.

Baxter International (BAX, 2.74%▲) made gains on the news, however. The relative volume of the stock was 3.1.

Virtu Financial Inc (VIRT, -3.84%▼) will begin trading ex-dividend today. A cash dividend payment of $0.24 per share is scheduled to be paid on September 15, 2021. The relative volume of the stock was 4.2.

The digital payments platform PayPal Holdings (PYPL, 3.64%▲) is exploring a stock-trading platform for customers in the US. The relative volume of the stock was 2.8.

The other movers in the small-cap segment included:

Allison Transmission Holdings (ALSN, -0.56%▼): Relative Volume 8.3.

Armstrong World Industries (AWI, -1.57%▼): Relative Volume 3.1.

Proofpoint Inc. (PFPT, -0.02%▼): Relative Volume 2.6.

Nordson Corporation. (NDSN, 2.26%▲): Relative Volume 2.3.

DoubleVerify Holdings Inc (DV, 4.94%▲): Relative Volume 2.3.

Report Card:

The pharmaceutical company, Catalent Inc (CTLT, 0.35%▲), reported a 26% y-o-y increase in revenue to $1.19bn, while the adjusted EBITDA for Q4 increased 30% y-o-y to $348m. The stock remained flat after hours.

Zoom Video Communications (ZM, 1.96%▲), reported a revenue of $1.02bn beating estimates of $990m easily, while the EPS of $1.36 was ahead of the expected $1.16. The Q3 guidance however fell short of expectations making the stock slide by more than 11% after hours.

Nordson Corporation. (NDSN, 2.26%▲) came out with net sales of $647m, a 20% increase y-o-y, while the operating profit increased by 57% y-o-y to $188m. The diluted EPS of $2.42 was 70% ahead of last year’s earnings. The stock climbed by 1.33% after hours.

On the Lookout:

The Consumer Confidence Index for August is expected to slip down to 123.1 from July’s 129.1.

Chicago PMI due to be updated today is also expected to decrease from July’s 73.4 to an estimated 69.4 for August.

Unusually high shorter-term CALL options activity seen on Apple (AAPL, 3.04%▲), Wisekey International Holdings (WKEY, 13.10%▲), Academy Sports and Outdoors Inc. (ASO, 2.87%▲), Southwest Airlines Co (LUV, -3.36%▼), and Clover Health Investments (CLOV, -1.51%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Vinco Ventures Inc. (BBIG, 33.21%▲), Affirm Holdings Inc (AFRM, 46.67%▲), Support.com Inc (SPRT, 38.21%▲), DoorDash Inc (DASH, 2.55%▲), and Hill-Rom Holdings(HRC, 9.69%▲) among others.

Other Asset Classes:

Crude Oil Prices - The prices remained more or less steady Tuesday morning as an assessment of the damage caused by Hurricane Ida, to the oil and gas industry on the US Gulf Coast, begins. Brent traded at the $73 per barrel mark, in the wee hours Tuesday.

The US Dollar (92.49, -0.17%▼) retreated to a four-week low, early Tuesday morning, still reeling under Fed’s dovish tone at the Jackson Hole event held Friday.

The US Treasury Yields dipped Tuesday morning as the US Jobs data, to be released later this week, remained in focus. The 10 Year US Treasury Yield was trading at 1.275%, early Tuesday morning.

Global Markets:

The Asian Markets bounced back later in the day Tuesday, following a choppy start over concerns surrounding slowing factory growth in China, for August. After the initial rout, Shanghai closed 0.45% higher, and Hang Seng rose by 1.33%.Tokyo’s Nikkei advanced more than 300 points or 1.08%.

The Covid related restrictions hitting travel stocks and weak economic data from China had a little bearing on European markets where stocks traded mostly higher early Tuesday morning. Barring FTSE, other major indices advanced into the green zone - including CAC, DAX, and Stoxx-600.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: CarGurus Inc. (CARG), CrowdStrike Holdings Inc (CRWD), eBay Inc. (EBAY), Charles River Laboratories (CRL), Thomson Celestica Inc (CLS), Lightspeed Commerce Inc (LSPD), Harmony Biosciences Holdings (HRMY), RedHill Biopharma Ltd (RDHL), and Affirm Holdings Inc (AFRM). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.