“An Apple a Day...” is passé!

Happy Friday,

The battle of the giants! China’s Xiaomi has overtaken the US smartphone giant, Apple Inc., for the first time in the global market by expanding its smartphone share to 17%, only behind Samsung’s 19%, in Q2. Apple had a 14% share.

The trouble for Didi Global is deepening though. Chinese regulators have visited the tech giant for a CyberSecurity review. The US-listed stock of the firm tanked 7% pre-market, following the news.

President Biden, is not pleased with the “deteriorating” situation in Hong Kong and will issue an advisory to US companies warning them of the ‘perils’ venturing there might bring.

Hey, do you create content over social media? Facebook will pay $1bn to content creators, on its networks, through 2022.

US Markets:

Thursday’s pullback in the stocks was a reaction to Fed Chair, Jerome Powell, agreeing that the recent inflation was uncomfortably above the levels the Central bank seeks. He, however, resisted a policy shift even as he sounded less confident about the economic outlook than earlier in the year.

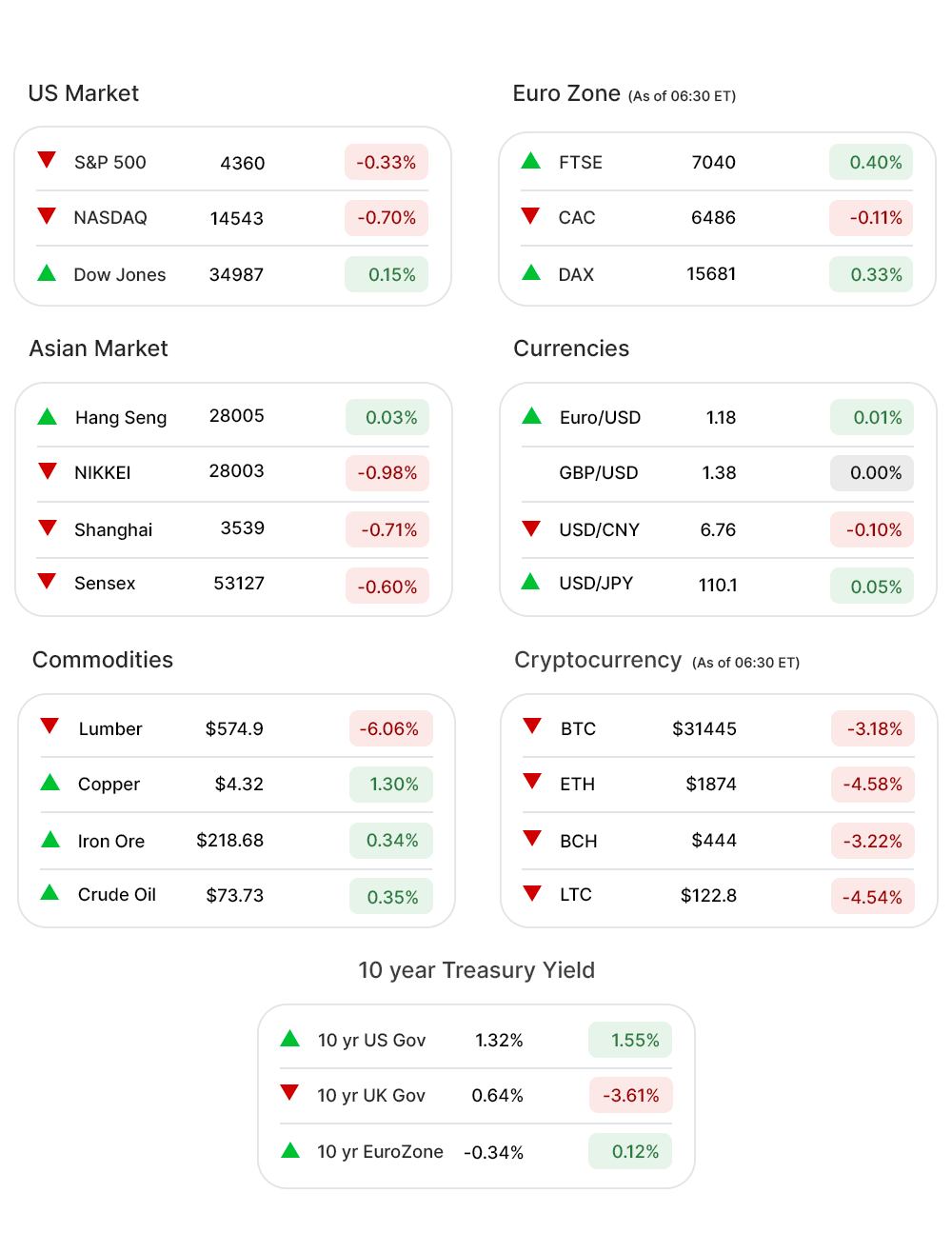

The S&P 500 (-0.33%▼) slid more than 14 points, despite the Q2 earnings continuing to beat expectations. The Tech-heavy Nasdaq (-0.70%▼) lost more than 100 points even as Dow (0.15%▲) somehow continued the green run and gained over 50 points.

The sectors were mixed! The six negative sectors outnumbered the positive sectors by one.

Energy (-1.41%▼) was again at the bottom, further shedding its gains made so far this year. Healthcare (-0.26%▼), Communication Services (-0.53%▼) and Consumer Discretionary (-0.64%▼) were among the losers.

Financials (0.38%▲), Real Estate (0.14%▲), Utilities (1.20%▲), Industrials (0.22%▲) and Consumer Staples (0.42%▲) outperformed the S&P 500.

Technology (-0.84%▼) hit the speed breaker on Thursday after a smooth ride for a while now, following a major sell-off in the sector led by some Tech giants.

The slump was witnessed in major Technology companies including, Apple (AAPL,-0.45%▼), Microsoft (MSFT,-0.52%▼), Alphabet (GOOGL,-0.96%▼), Nvidia Corporation (NVDA,-4.41%▼), Amazon Inc. (AMZN,-1.37%▼), and Facebook (FB,-0.91%▼).

Apple Inc. meanwhile has become the first public US company to hit a $2.5 trillion market cap, less than a year after it hit the 2 trillion cap.

Futures!

Futures made decent recovery after sliding lower, at the end of the week, following the pullback in the markets Thursday.

As of 05:30 ET, all major indices were in green, including Nasdaq Futures (0 .02%▲), S&P 500 Futures (0 .06%▲), Russell 2000 Futures (0 .46%▲), and Dow Futures (0 .11%▲).

Key Movers in Small Cap:

GP Strategies Corporation (GPX, 26.91%▲), a provider of sales, technical and e-learning training; has announced its acquisition by Learning Technologies Group, in a $394 million deal. The relative volume of the stock was 25.2.

Reliant Bancorp (RBNC, 6.37%▲) has announced that it will be acquired by United Community Bank in a deal of approximately $517 million or $30.58 per share. The deal, however, has come under cloud as Rowley Law PLCC is investigating potential securities law violations in the merger. The relative volume of the stock was 21.5.

Clinical stage biotech, Immunic Inc (IMUX, -21.45%▼) on Thursday announced an unwritten public offering of 4.5 million shares of common stock, priced at $10 apiece, lower than Wednesday's closing price of $11.94. The stock plummeted with a relative volume of 13.3.

Acutus Medical Inc (AFIB, -9.37%▼) has announced that it was offering 5.5 million shares of its common stock at a price of $14 per share in an underwritten public offering. The stock went from $15.69 to $13.64 Thursday. The relative volume of the stock was 8.7.

The other movers in the small-cap segment included FRP Holdings (FRPH, 0.16%▲), with a relative volume of 18.0; Retail Value Inc. (RVI, 11.14%▲) with a relative volume of 9.5 and Arlo Technologies (ARLO, 7.04%▲), with a relative volume of 8.6.

Key Movers in Large Cap:

Teleflex Inc. (TFX, -9.84%▼), a provider of specialty medical devices, entered the “oversold” territory on Thursday with its Relative Strength Index (RSI) falling to 28.9, well below the 30 mark for a stock to be declared oversold. The relative volume of the stock was 5.4.

Monday’s news of share dilution by Shoals Technologies Group (SHLS, -2.89▼) had made the stock fall more than 14% on Tuesday. The bad run continues for the stock. The relative volume of the stock was 4.2.

The other stocks in this category included Spectrum Brands Holdings (SPB, 2.26%▲), with a relative volume of 6.1; World Wrestling Entertainment (WWE, -6.98▼), with a relative volume of 4.2; HEICO Corporation (HEIA, 0.05%▲), with a relative volume of 3.7; L. Brands (LB, -1.21▼), with a relative volume of 3.0; and Coupa Software (COUP, -9.91▼), with a relative volume of 2.9.

Report Card:

Morgan Stanely (MS, 0.18%▲) outperformed estimates, posting an EPS of $1.85 versus expected $1.65. The revenue column looks upbeat with the bank reporting $14.8bn almost $1bn ahead of the estimate. Investment banking revenue of $2.38bn also beats the expected $2.1bn. The stock remained volatile through the day and ventured into negative territory after hours.

Alcoa Corporation (AA, -1.68▼), reported its highest ever quarterly net income and earnings per share. The EBITDA stood at $618m, higher than the expected $599.8m. The stock rose slightly after hours.

The Bank of Newyork Mellon Corp. (BK, -1.22%▼) has reported a net income of $991m, up 16% from Q1 and 10% y-o-y. The diluted EPS of $1.13 was also ahead of Q1 by 16% and by 12% y-o-y. The stock remained flat after hours.

Cincinnati based Cintas Corporation (CTAS, -2.59%▼), the biggest work uniform manufacturer, has reported a Q4 diluted EPS of $2.47 an 83% y-o-y increase. Revenue for the quarter was $1.84bn, compared to $1.62bn last year.

On the Lookout:

The US Census Bureau is set to release the Retail Sales report for June. After a contraction of 1.3% in May, retail sales are expected to slump by 0.4% on a monthly basis. The Consumer Sentiment Index and Business Inventories reports are due today as well.

Some upcoming IPOs we thought you might want to have a look at:

Voxeljet AG, a provider of large-scale 3D printers, today announced an offering of 1.1 million shares at a purchase price of $8.88 per ordinary share.

Imago Biosciences, a phase 2 biotech developing molecules for bone marrow cancers, has raised $134 million by offering 8.4 million shares at $16, the higher end of the $14-$16 price range.

Core and Main Inc., a leading specialized distributor of water, wastewater, storm drainage and fire production products is offering 34.8 million shares of its common stock, expected to be priced between $20 and $23.

AbSci, a platform for discovery and development of proteins and biologics, plans to raise $200 million by offering 12.5 million shares, priced between $15 to $17.

The Israeli Video Cloud management company Kaltura, after postponing its US listing in March is set to offer 15 million shares, in an attempt to raise between $244 million to $278 million at a company valuation of $2 billion. The shares will be priced between $9 and $11.

Unusually high shorter-term CALL options activity seen on Royal Carribean Cruises (RCL, -2.61%▼), Canopy Growth Corp. (CGC, -1.50%▼), Wayfair Inc. (W, 2.22%▲), Academy Sports and Outdoors (ASO, -4.27%▼) and JD.Com Inc. (JD, 1.87%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on ON Semiconductor Corporation (ON, -3.61%▼), Sunnova Energy International (NOVA,-2.41%▼), AT&T Inc. (T, 0.60%▲), eBay Inc (EBAY, 0.16%▲), and Square Inc (SQ,-1.61%▼) among others.

Other Asset Classes:

The 10 Year US Treasury Yield, continued its slide following a dovish message from Fed Chair Powell. The yield on the benchmark 10 Year Treasury note fell 6 basis points to reach 1.296% while the yield on the 30 Year Treasury note fell by 6 basis points, as well, and reached 1.923%.

The US Dollar (92.59,-0.03▼) reached around a monthly top of 92.80 before shrugging off some gains ahead of the retail sales and consumer sentiment data, to be released later in the day.

Crude Oil prices decline and might be on the way for their biggest weekly decline in months as supply prospects are looking good in face of an agreement between major global Oil producers, under OPEC.

Global Markets:

Asian Markets closed mixed as concerns pertaining to economic recovery, amid rising delta variant cases, continued to weigh on investors’ minds. The continuing crackdown on Didi Global also pushed the markets down. Nikkei lost 276 points while Shanghai was down 25 points.

Car Sales in EuroZone increased by 10% for the month of June and shot up 25% in the first half of the year, compared to 2020, infusing some strength into the European Markets despite the lackluster Thursday in the US. Stoxx-600 was up 0.18%, followed by DAX, and FTSE into the green zone.

Meanwhile on Researchfin.ai

There were 7 new trade setups identified by the AI yesterday. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Have a joyous weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.