Another One Bites the Dust!

Good Morning,

No end in sight! China goes after online insurance in widening crackdown, and a subsequent 5-year roadmap, outlining tighter regulations for strategic sectors of the economy. Despite the crackdown, Hong Kong’s IPO pipeline is full to the brim, with 200 companies on the docket.

The vaccine jab! Moderna Inc has lost around $60bn in value, in two days, as investors resisted the company’s “lofty valuations”. Other Covid vaccine makers also slid Wednesday, BioNTech by 14% and its partner Pfizer by 3.9%.

The UK economy is growing but is still well shy of the pre-pandemic levels. The country’s GDP has surged 4.8% between April and June, 1% in June alone, reversing the decline of 1.6% in the first quarter amid a lockdown. The GDP is 4.4% below the Q4 of 2019. FTSE slid, however.

The US Federal Budget Balance, measuring the difference between Federal government’s income and expenditure, for July has turned out to be -$302.0bn against the forecast of -$307.0bn. A negative number means the budget is in deficit.

Even if it glitters! Gold dropped to its lowest level since March, as tapering of stimulus by the Federal Reserve becomes more and more evident. At $1730 per ounce level, in New York, Gold is turning out to be one of the worst investments this year, even as EU investors fill Gold ETF’s by $1bn in July alone.

The Messi ‘chip shot’ for Crypto! Lionel Messi’s financial package at French soccer club, Paris Saint Germain, includes CryptoCurrency, “$PSG Fan Tokens”. These Crypto tokens have more than doubled after the news!

US Markets:

The stocks, already propelled by the Infrastructure Bill on Tuesday, gained more momentum on Wednesday as inflation data print came out in sync with the expectations. The Consumer Price Index for July was reported to be 5.4%, and more importantly, the Core inflation has come down to 4.3% from 4.5% in June.

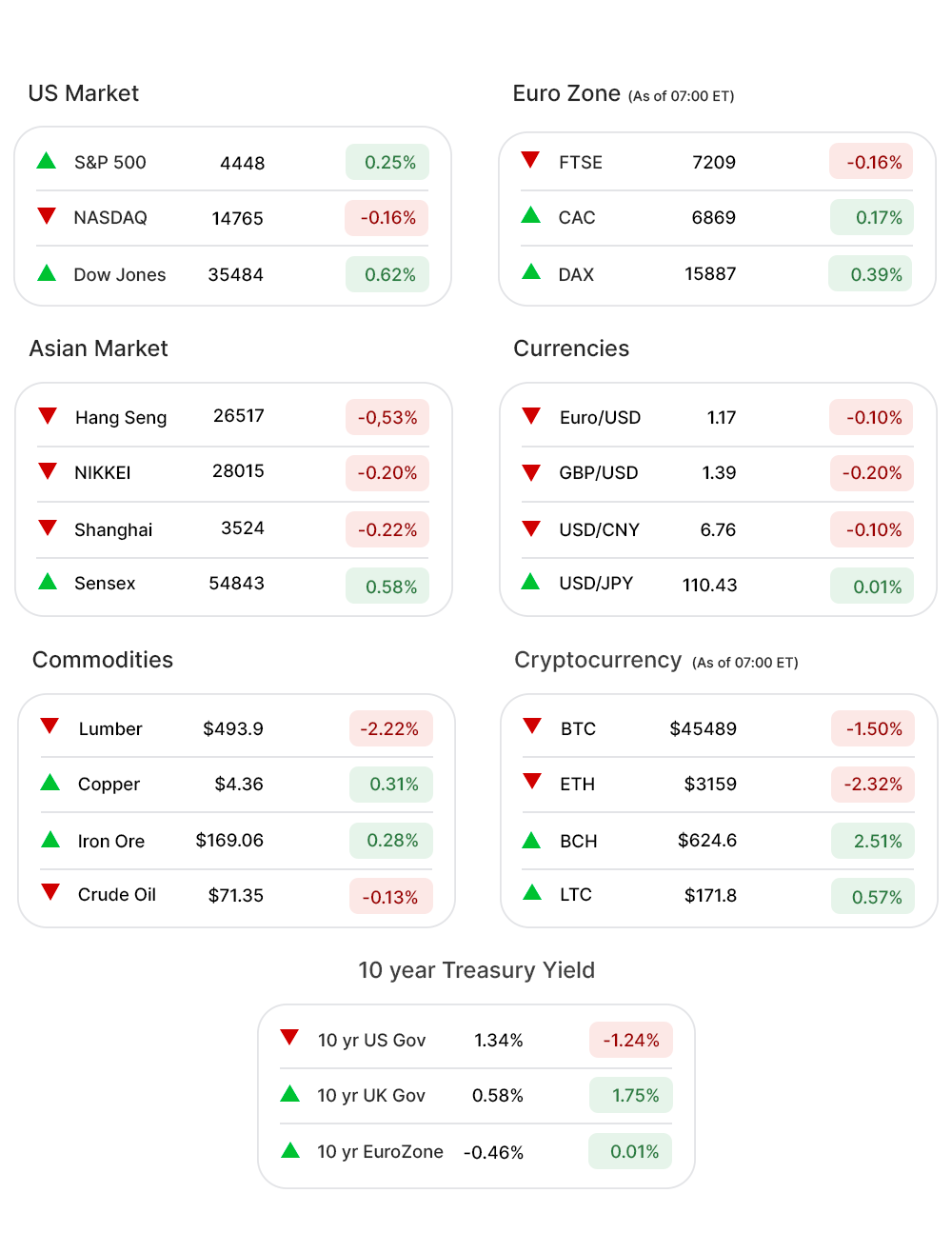

S&P 500 (0.25%▲) and Dow Jones (0.62%▲) reached record highs, but Nasdaq (-0.16%▼) slumped for the second day in a row.

Furthering losses in big-tech companies including Facebook (FB, -0.32%▼), Amazon (AMZN, -0.86%▼), Alphabet (GOOGL, -0.39%▼), and Nvidia (NVDA, -1.19%▼) pulled the tech-heavy index down.

Sectors at the S&P 500 were all green, with the only exception of Healthcare (-0.97%▼).

Materials (1.42%▲), Financials (1.16%▲), and Industrials (1.30%▲) led the gains at the broadest index Wednesday.

Energy (0.75%▲), Utilities (0.92%▲), and Real Estate (0.50%▲) made decent gains, as well, even as Communication Services (0.02%▲), and Technology (0.02%▲) remained more or less flat.

Futures!

The Futures edged lower, Wednesday morning, without exceptions in the major indices.

As of 06:00 ET, only Nasdaq Futures (-0.21%▼), S&P 500 Futures (-0.17%▼), Russell 2000 Futures (-0.27%▼), and Dow Futures (-0.10%▼) were all red.

Key Movers in Small Cap:

The agriculture tech-startup, Appharvest Inc(APPH, -28.91%▼), has downgraded the full-year outlook to revenue of $7m to $9m from earlier expected revenue of $20m to $25m. The relative volume of the stock was 16.6.

HyreCar Inc(HYRE, -48.48%▼), reported a 62% increase in revenue y-o-y but the loss of the company was reported to be $0.45 per share, way higher than the estimated $0.12 and last year’s $0.22.The relative volume of the stock was 14.0.

The real estate credit company, BrightSpire Capital Inc (BRSP, -2.44%▼) has announced a secondary offering of 8.2m shares of its common stock, priced at $9 per share. The relative volume of the stock was 11.3.

Weight lose service provider, WW International Inc(WW, -24.56%▼), reported a slide of more than 29% in the company’s subscribers as user trends returned to their pre-pandemic routines. The relative volume of the stock was 11.2.

Vine Energy Inc(VIE, 1.81%▲) is all set to be acquired by Chesapeake Energy Corp in an all stock deal valuing $615m.The relative volume of the stock was 10.1.

The recent IPO and would-be Zoom Technologies rival, ON24 Inc(WW, -24.56%▼), reported a 43% y-o-y growth in sales but the GAAP earnings crashed to a $0.05 loss per share. The relative volume of the stock was 9.8.

The other movers in the small-cap segment included:

Intercept Pharmaceuticals (ICPT, -8.84%▼) : Relative Volume 8.6.

NV5 Global Inc. (NVEE, 5.78%▲): Relative Volume 7.3.

Inari Medical Inc (NARI, -15.53%▼): Relative Volume 7.2.

Fubo TV Inc. (FUBO, 11.10%▲): Relative Volume 6.7.

Key Movers in Large Cap:

The Israeli software company, Wix.Com Ltd (WIX, -16.96%▼), reported a 34% y-o-y growth in revenue but the non-GAAP gross margin contracted 800 bps to 63% as the costs escalated 72.3% y-o-y. The relative volume of the stock was 11.8.

Gates Industrial Corporation (GTES, -6.17%▼) announced a secondary offering of 25m shares of its common stock. The relative volume of the stock was 6.3.

The consumer self-care products manufacturer, Perrigo Company PLC (PRGO, -12.57%▼), reported a Q2 net loss of %57.7m or $0.43 per share, compared to a net income of $60m or $0.35 per share, in the prior year period. The relative volume of the stock was 6.1.

Grocery Outlet Holding Corporation (GO, -10.54%▼) surpassed the sales estimate of $770.5m to $775.5m but was 3.5% down compared to the sales in the same quarter last year. The relative volume of the stock was 5.4.

The other movers in the large-cap segment included:

Valvoline Inc. (VVV, 2.94%▲): Relative Volume 5.5.

Upstart Holdings Inc. (UPST, 26.18%▲): Relative Volume 5.0.

Signify Health (SGFY, -4.18%▼): Relative Volume 4.5.

Unity Software Inc (U, 13.25%▲): Relative Volume 4.1.

Report Card:

The artificial intelligence lending platform Upstart Holdings Inc. (UPST, 26.18%▲), has reported a 1018% y-o-y increase in revenue to $194m. The total fee revenue was $187m, an increase of 1308% y-o-y. Income from operations increased from $11.4m to $36.3m. The stock slid into the red zone after hours.

The distributor of electronic components, Avnet Inc(AVTT, 0.60%▲), came out with an EPS of $1.12 beating the estimates of $1.03, with a revenue of $5.23bn surpassing the estimates by 0.55%. The stock continued to move upwards after hours.

CACI International (CACI, 0.19%▲), the information technology company, reported a Q4 net income of $137m or $5.74 per share, in line with the expectations. The revenue of $1.56bn also met the forecast. The stock slid by about 1% after hours.

The full-service financial institution, BanColombia SA ADR (CIB, 1.12%▲), reported an EPS of $1.22 on revenue of $1.01bn, ahead of the estimated $0.53 on revenue of $1bn. The stock advanced by more than 3% after hours.

On the Lookout:

The Initial Jobless Claims (regular state program) numbers are due today and expected to fall further from 385,000 to 375,000. Previous print on Continuing Jobless Claims stands at 2.93m.

The Producer Price Index is expected to slide to 0.6% from 1.0%, when the data is announced today.

Some IPOs to look out for:

EzFill Holdings, a company delivering fuel on demand through a mobile app, is planning to raise $25m by offering 6.3m shares of its common stock at a price of $4 per share.

A clinical stage bio-pharma company, RenovoRx Inc, is looking to raise $36.5m by offering 1.5m ordinary shares at a price of $12 to $14 per share.

Preclinical biotech, Pasithea Theraupatics, plans to raise $17m by offering 2.9m shares of its common stock in the price range of $5 to $7 per share.

Unusually high shorter-term CALL options activity seen on Walgreens Boots Alliance (WBA, 2.66%▲), iHeartMedia Inc (IHRT, 6.75%▲), Lithium Americas Corp. (LAC, 3.00%▲), Unity Software Inc (U, 13.06%▲), and Lightning EMotors Inc (ZEV, -12.78%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on XP Inc. (XP, -1.51%▼), Desktop Metal Inc (DM, -5.90%▼), Albertsons Companies Inc (ACI,-1.69%▼), WW International Inc. (WW, -24.56%▼), and Virgin Galactic Holdings (SPCE,-12.64%▼) among others.

Other Asset Classes:

Crude Oil prices, after two days of gains, slipped again Thursday morning following a call by White House calling on Opec to boost output, terming the present output “not enough”. The call by the United States has reinforced supply concerns. Brent was down 0.18%, early Thursday morning - while the WTI Crude traded a wee bit below the $70 per barrel mark.

The US Dollar (92.95, 0.03%▲) fell below the 93 level but looked steady as Fed talk about tapering economic stimulus still remains a much talked about aspect of the economic outlook in the US and the world over.

US Treasury Yields slid a little after the inflation data came out to be in sync with the Wall Street expectations. The 10 Year US Treasury Yield was trading in the red zone at 1.342% early Thursday morning. $41bn of 10-year notes were auctioned to strong demand on Wednesday, with primary dealers taking the smallest portion since 2008.

Global Markets

The Asian Markets slid for the first time this week, as China moves ahead to widen the legislation of the government and bring more regulatory controls for the businesses in a bid to meet, “people’s ever-growing demand for a good life,”. Shanghai fell by 0.22% while Hang Seng lost in excess of 250 points by the close. Nikkei lost 55 points for the day.

After 8 consecutive days of record gains the pan EU index Stoxx-600 went a little flat Thursday morning, even as the stocks held steady in the European markets cushioned by strong earnings from a bunch of insurers. CAC and DAX were in the green zone while FTSE hovered 0.24% below the zero level.

Meanwhile on Researchfin.ai

Trade setups identified by our AI that already has hit their respective profit targets yesterday, within their optimal holding period: Goosehead Insurance Inc. (GSHD), Tejon Ranch Company (TRC), Evoqua Water Technologies (AQUA), Brookfield Asset Management (BAM), Fidelity National Financial Inc. (FNF), Steel Dynamics Inc (STLD) and Unity Software Inc (U). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

That’s it for today!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.