Beginning of the End!

Good Morning,

All good things come to an end! The Central Bank’s massive bond-buying program might be in its last leg, as the Fed officials agree on tapering by the end of this year!

Insider trading is not chill! Three former software engineers of Netflix and two close associates have been sued by the SEC for insider trading. They are accused of profiting by $3m by trading on the company's subscriber growth information.

Fresh regulations imposed by Chinese authorities have led to a rout in the tech sector of the country, with the Hang Seng Tech-Index closing 2.9% lower Thursday - lowest since its inception in July 2020. Alibaba sank 5.5% to a record low, Tencent was down 3.4%.

The stick and the carrot! While the crackdown on certain economic sectors in China continues, some state-backed investors will move to bail out Huarong Asset Management, as the under-pressure bad asset manager disclosed losses of around $15.9bn.

Despite its shares falling to a third this year, amid a regulatory crackdown, China’s search engine giant Baidu has raised $1bn in a heavily oversubscribed bond sale. The debt sale has attracted between $5bn and $6bn of orders.

The July US Housing Starts, have fallen by7% to a three-month low of 1.53m. The Building Permits, however, have grown 2.6% for July owing to an increase in applications for multi-family dwellings.

US Markets:

Stocks Wednesday swayed between small losses and gains before a final pullback, in the last hour, fuelled by minutes of Fed meeting indicating most officials were increasingly in agreement to pull back its bond-buying program.

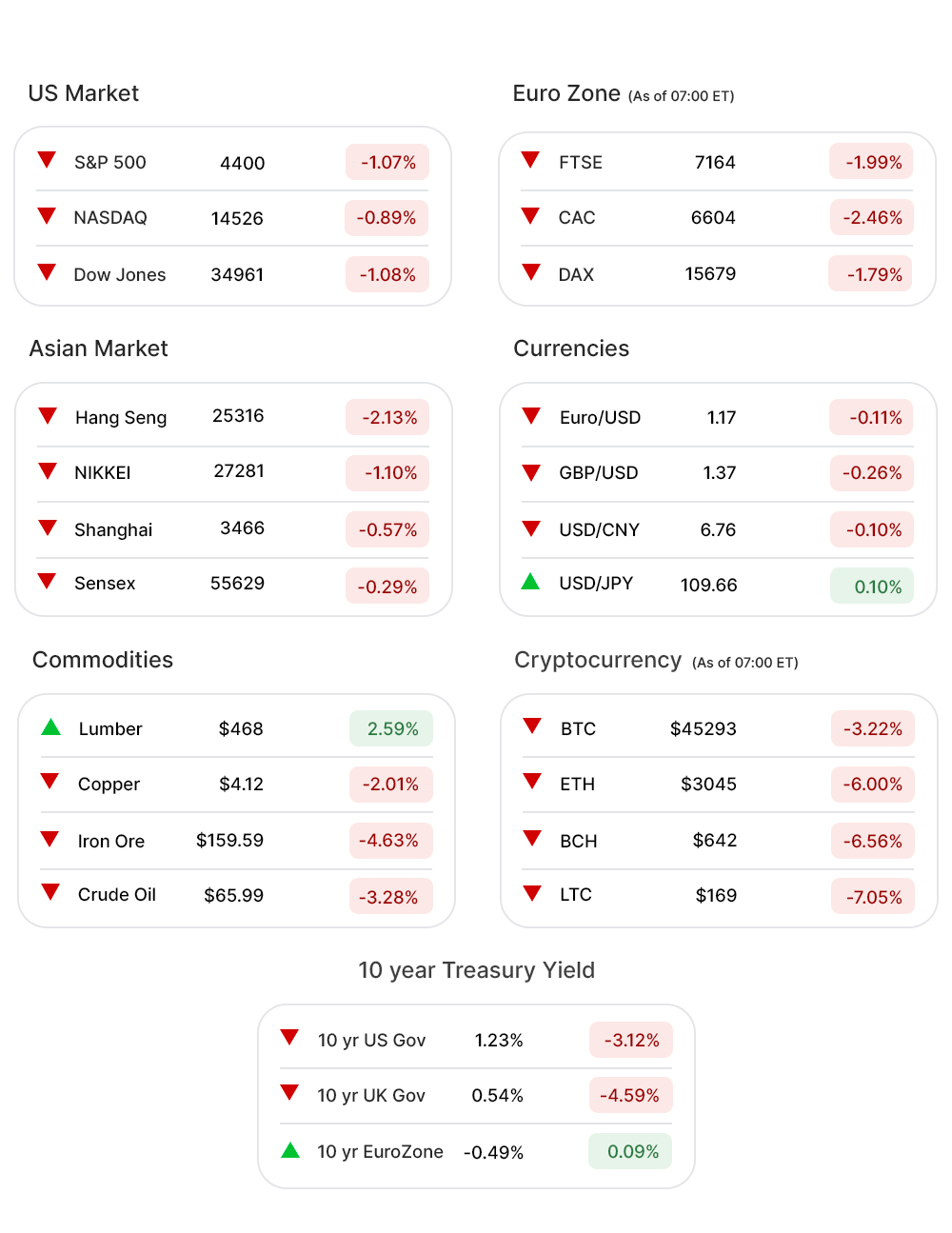

S&P 500 (-1.07%▼) lost more than 47 points to close at 4400. Dow Jones (-1.08%▼) slid by a little less than 400 points, while Nasdaq (-0.93%▼) lost 130 points.

At the S&P 500, most of the sectors incurred substantial losses and even the green ones were marginally above the zero mark.

Energy (-2.40%▼) was the worst hit, again. Healthcare (-1.46%▼), Industrials (-1.10%▼), Materials (-1.13%▼), Technology (-1.39%▼), Real Estate (-1.08%▼), Communication Services (-0.71%▼), and Financials (-1.16%▼) were amongst the losers, as well.

Only Consumer Discretionary (0.15%▲), Consumer Staples (0.04%▲), and Utilities (0.02%▲) gained, a little.

Futures!

The Futures edged lower, on a day a rout was witnessed in Asian as well as European markets.

As of 07:00 ET, Futures were red without an exception: Russell 2000 Futures (-1.39%▼), Nasdaq Futures (-0.47%▼), S&P 500 Futures (-0.63%▼), and Dow Futures (-0.71%▼).

Key Movers in Small Cap:

America’s Car-Mart Inc (CRMT, -18.60%▼) reported better than expected earnings, with a 49% y-o-y increase in revenue. The stock tanked regardless. The relative volume of the stock was 9.0.

Retailer of children’s apparel and accessories, The Children’s Place Inc (PLCE, -6.54%▼) reported a 150% increase in gross profit to $167m, for Q2, but the sales of $413.9m missed estimates of $417.31m. The relative volume of the stock was 3.8.

The other movers in the small-cap segment included:

Value Line Inc. (VALU, 3.05%▲): Relative Volume 15.8.

Chinook Therapeutics Inc. (KDNY, 4.26%▲): Relative Volume 5.5.

PTC Therapeutics Inc (PTCT, -3.59%▼): Relative Volume 4.6.

Black Line Inc. (BL, -2.19%▼): Relative Volume 4.0.

Marlin Business Services. (MRLN, -0.99%▼): Relative Volume 4.0.

Key Movers in Large Cap:

The stocks of exchange operator Cboe Global Markets Inc (CBOE, -1.19%▼) climbed more than 12% Wednesday, before falling back, on media reports that CME Group had made an acquisition offer to the company. The relative volume of the stock was 14.3.

The semiconductor manufacturer, Cree Inc (CREE, -9.15%▼), reported $147.6m in its fiscal fourth quarter. The relative volume of the stock was 6.3.

CME Group Inc (CME, -3.80%▼) denied media reports suggesting that it has offered $16bn to Cboe Global Markets Inc. in an all-stock acquisition proposal. The relative volume of the stock was 4.8.

Lowe’s Companies Inc (LOW, 9.59%▲), bounced back after trading lower Tuesday despite beating consensus estimates on both EPS of $4.53 and revenue of 41.10bn. The relative volume of the stock was 4.7.

CDK Global Inc. (CDK, -8.49%▼) continued to slide after it reported an EPS and revenue lower than what was estimated. The relative volume of the stock was 4.7.

The other movers in the large-cap segment included:

Jupiter Networks Inc. (JNPR, 1.51%▲): Relative Volume 2.9.

Jack Henry & Associates Inc. (JKHY, -3.47%▼): Relative Volume 2.9.

The TJX Companies Inc. (TJX, 5.57%▲): Relative Volume 2.6.

Target Corporation. (TGT, -2.78%▼): Relative Volume 2.5.

Report Card:

Analog Devices Inc (ADI, -0.31%▼) reported a record-high revenue of $1.76bn, 21% higher y-o-y, while the company returned $400 to shareholders, in Q3, through dividends and share repurchases. The stock went slightly up after hours.

Bath & Body Works Inc (BBWI, 0.30%▲), formerly known as the L Brands, reported an EPS of $1.34 compared to a loss of 18 cents in the prior year’s corresponding quarter, even as the revenue climbed 36% y-o-y to $1.7bn. The stock soared more than 4% after hours.

The multinational tech conglomerate, Cisco Systems Inc (CSCO, -1.54%▼), reported an EPS of 84 cents, beating the estimates of 82 cents, while the revenue of $13.13bn was ahead of the estimated $13.03bn. The company however said it continues to see pressures from component shortages. The stock tumbled by more than 2% after hours.

The retail chain, Target Corporation. (TGT, -2.78%▼), reported an EPS of $3.64 on revenue of $25.16bn, beating the estimated EPS of $3.49 on revenue of $25.08bn. The stock climbed by half a percent after hours.

On the Lookout:

Initial Jobless Claims (regular state program), for the week ended August 14 are expected to fall further down to 365,000 from last week’s 275,000. The Continuing Jobless Claims data is due today, with the previous print of 2.87m.

Philadelphia Fed Manufacturing Index is expected to raise from 21.9 to 22, while the Index of leading economic indicators is expected to remain unchanged at 0.7%.

Unusually high shorter-term CALL options activity seen on Dollar Tree Inc (DLTR, 0.95%▲), Gilead Sciences Inc (GILD, -1.47%▼), Pfizer Inc. (PFE, -2.20%▼), Sonos Inc (SONO, -1.76%▼), and Edwards Lifesciences (EW, -0.85%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on IHS Markit Limited. (INFO, -3.60%▼) , and GDS Holdings Ltd (GDS, -1.66%▼) among others.

Other Asset Classes:

Crude Oil Prices continue to tumble with the Brent Crude price falling below $67 per barrel mark, for the first time since May 24 - down by 2.76%. The WTI crude was down 3.36%, early Thursday morning. Other commodities extended recent losses on Thursday - including Iron Ore, down by 7.2%, and Copper by 2% to a 5-moth low below $9000 a tonne.

The US Dollar (93.07, 0.23%▲) reached a year high of 93.50, as the bullish stance of Fed officials, on tapering the bond-buying program, came to the fore through the Fed meeting minutes released Wednesday.

Despite the Fed taper talk, the US Treasury Yields fell Thursday morning, after gaining some momentum on Wednesday. The 10 Year US Treasury Yield was trading in the red zone at the 1.227% mark.

Global Markets:

Asian Markets slid Thursday, imitating Wall Street’s two-day losing streak and amid rising delta variant fears. The Fed minutes also had an impact on the Asian pull-back. Shanghai fell by 0.57%, Hang Seng shed more than 550 points or 2.13 percent, while Nikkei fell by more than 300 points.

The impact stretched across the Atlantic, where the European markets slid and considerably.Stoxx-600, FTSE, and CAC fell by more than 2% while DAX was down more than 1%.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you Friday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.