Bull’s Eye!

Good Morning,

The fastest bull-market recovery since World War-II ! S&P 500 has taken 354 days to double from its March 23, 2020 trough of 2237. On average, it takes 1000 trading days to reach the milestone.

The grip gets firmer! China Tuesday issued a set of draft regulations for the tech sector banning “unfair competition” and restricting the use of user data - following months of a crackdown on the sector. Tech shares slump, again!

Auto-Pilot hits a roadblock! Tesla’s auto-pilot will be examined and investigated by the US National Highway Traffic Safety Administration, following 11 accidents in 3 and a half years leading to 17 injuries and 1 fatality. Tesla stock tanked by more than 4%.

The UK payrolls have swelled by 182,000 between June and July as the unemployment rate has fallen to 4.7% from April to June. Job vacancies have been on a record high of 953,000, surpassing 1m in July. The FTSE slid and recovered!

One too many! A lockdown has been imposed in New Zealand after the detection of a single Covidcase in Auckland city. The country’s dollar slumped 1.4% against the USD.

The Fed’s barometer of manufacturing business activity in New York State, Empire State Manufacturing Index, has fallen 25 points to 18.3 in August, way below the forecast of 29 and July’s record high of 43.

US Markets:

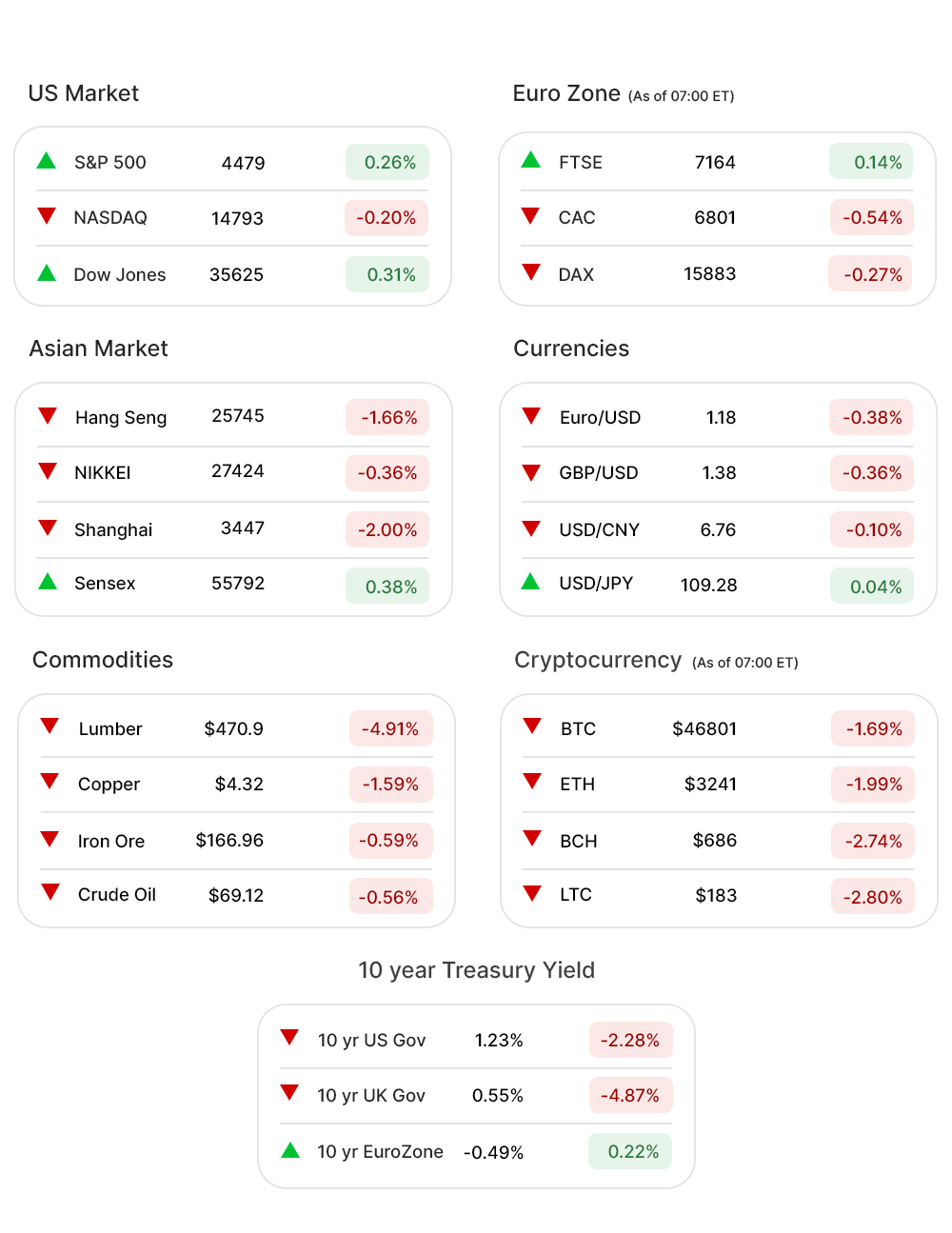

S&P 500 (0.26%▲) sprung back, after being in negative territory for the most part of the day Monday, to record its 49th record high this year. Dow Jones (0.31%▲) gained more than 110 points to close the day at another record high.

Nasdaq (-0.20%▼) slumped though, despite some tech giants - including Apple (AAPL, 1.35%▲), Facebook (FB, 0.93%▲), Amazon (AMZN, 0.15%▲), Alphabet (GOOGL, 0.42%▲), Microsoft (MSFT, 0.60%▲) - doing well for the day.

S&P 500 sectors were a mixed lot, with four falling below the zero-mark and the rest making gains. Energy (-1.83%▼) was the sector with maximum losses, for the second day in a row.

Materials (-0.49%▼), Consumer Discretionary (-0.38%▼), and Financials (-0.17%▼) were the other sectors that followed Energy into the red zone.

Healthcare (1.13%▲)was the top gainer, followed by Technology (0.44%▲), Real Estate (0.11%▲), Communication Services (0.25%▲), Consumer Staples (0.63%▲), and Industrials (0.34%▲).

Futures!

The Futures slid lower, ahead of the economic data due today, including an update on Retail Sales.

As of 06:00 ET, Futures were red without an exception: Russell 2000 Futures (-1.07%▼), Nasdaq Futures (-0.35%▼), S&P 500 Futures (-0.41%▼), and Dow Futures (-0.41%▼).

Key Movers in Small Cap:

Travere Theurapatics Inc. (TVTX, 15.34%▲) reported significant improvements among Nephropathy patients, treated with Sparsentan, in a phase-3 trial. The relative volume of the stock was 54.6.

Digital Media Solutions (DMS, 17.17%▲), will initiate a process to evaluate potential strategic alternatives to maximize shareholder value. The relative volume of the stock was 19.9.

Sonos, Inc(SONO, 4.69%▲) has won a patent battle against Alphabet Inc’s Google, which can potentially lead to more licensing revenue. The relative volume of the stock was 10.6.

DarioHealth Corp (DRIO, -12.31%▼) has reported an operating loss of $18m, a 337% increase compared to the Q2 of 2020. The relative volume of the stock was 3.6.

The other movers in the small-cap segment included:

FRP Holdings Inc. (FRPH, -4.00%▼): Relative Volume 9.9.

Poseida Theapeutics Inc. (PSTX, 4.43%▲): Relative Volume 5.0.

National Vision Holdings Inc (EYE, 1.22%▲): Relative Volume 3.8.

Capital Bancorp Inc. (CBNK, 3.91%▲): Relative Volume 3.7.

Hingham Institution for Savings. (HIFS, -0.58%▼): Relative Volume 3.6.

Key Movers in Large Cap:

Paysafe Ltd (PSFE, -15.49%▼) completed its acquisition of another payment platform SafetyPay, in a $441m all-cash transaction. The relative volume of the stock was 6.1.

UWM Holdings Corp. (UWMC, -5.09%▼) reported a gain margin of 81 bps, for Q2, compared to 243 bps in the same quarter last year. The relative volume of the stock was 2.9.

The other movers in the large-cap segment included:

CDK Global Inc. (CDK, -0.50%▼): Relative Volume 2.8.

Gohealth Inc. (GOCO, 22.11%▲): Relative Volume 2.8.

Liberty Media FormulaOne (FWONA, -0.54%▼): Relative Volume 2.4.

AutoNation Inc. (AN, 5.72%▲): Relative Volume 2.3.

Report Card:

Chinese video game streaming company, DouYu International Holdings (DOYU, -11.01%▼) reported a 6.8% y-o-y decline in revenue to $361.9m, marginally beating estimates of $361.6m. Advertising and other revenue decline 15.7% y-o-y to 24.6m. The stock went up a little after hours.

Oatly Group AB (OTLY, -2.61%▼) reported a loss of $0.11 per share, a penny worse than the estimates, and an inline revenue growth of 53.4% y-o-y to $146.2m. The stock gained more than a percent and a half after hours.

Video game developer Roblox Corporation (RBLX, -5.23%▼), reported a net loss of $140.1m, for Q2 of 2021, even as the revenue jumped 127% y-o-y to $454.1m. The stock tanked more than 7% after hours.

Tencent Music Entertainment Group (TME, -8.98%▼) reported a 32.8% increase in revenue to $277m while the subscribers increased by 40.6% to 66.2m, sequentially. The stock moved into the green zone after hours.

On the Lookout:

The Retail Sales, due today, are expected to plunge to -0.3%, compared to the prior 0.6%. Retail Sales ex-autos are also expected to drop from 1.3% to 0.2%. Industrial Production is, however, expected to rise from 0.4% to 0.5%.

Capacity Utilization and Business Inventories data is due today as well, as Fed Chair Gerome Powell will take questions from students later in the day.

Also, DatChat Inc, a communication software company, is planning to raise $12m by offering 2.8m shares of its common stock, priced at $4.15 per share.

Unusually high shorter-term CALL options activity seen on Context Logic Inc (WISH, -9.01%▼), Decarbonisation Plus Acquisition (HYZN, 9.20%▲), Advanced Micro Devices. (AMD, -2.78%▼), Walmart Inc (WMT, 0.82%▲), and Sonos Inc (SONO, 4.69%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Micron Technology (MU, 0.01%▲), IHS Markit Ltd (INFO, 0.66%▲), DiDi Global Inc (DIDI,-2.64%▼), and Match Group Inc. (MTCH, -1.13%▼) among others.

Other Asset Classes:

The US Dollar (92.65, 0.02%▲) traded higher in anticipation of the Retail Sales data and Powell’s scheduled questioning by the students.

US Treasury Yields slid ahead of the data release. The 10 Year US Treasury Yield was trading in the red zone at 1.227%, early Tuesday morning.

Global Markets

Shanghai fell by around 2% amid fresh tech-sector regulations in China, weak economic data from the mainland, and the spread of delta variant. Hang Seng fell by more than 430 points and Nikkei slid 0.36%.

European markets remain muted after the choppy Asian session. FTSE recovered after the initial slump while the other major indices continued to trade below the zero-mark.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.