Bumper Earnings, Sloppy Stocks!

Good Morning,

Hope you are making the most of the trade setups identified by our App, every day!

Rich Americans’ Corona Charm! The US household Wealth has increased by $19 trillion, amid the pandemic, to $137 trillion, making wealth inequality worse. People in the top 1% of the income distribution had their wealth increase by 23%, while those in the bottom quintile saw only 2.5% growth in their wealth.

$1.5 trillion has been wiped out in the panic selling in mainland China and Hong Kong in three sessions. The Chinese crackdown aftermath has left two major indexes in the country as the worst-performing markets of Asia Pacific. CSI-300, which tracks the largest stocks listed in China, is down 8.83% for the year while Hang Seng has fallen 7.88% for the period.

Binance, the world’s largest crypto exchange, is seeking to set up a number of regional headquarters and get licenses wherever they are available. Is this the first step towards the regulation of the largely unregulated Crypto market?

Tesla is a world leader in the EV market and by a long shot. The company has sold 382,831 EV’s year to date and has a market share of 21%, followed by General Motors with a market share of only 12%.

US Markets:

Snap! The 5 session winning streak in the US markets came to an end Tuesday as major indices pulled back from their record highs. The choppy session was followed by bumper earnings from three of the largest companies in the world!

The rout in the markets came amidst Fed’s FOMC meeting, which will conclude today.

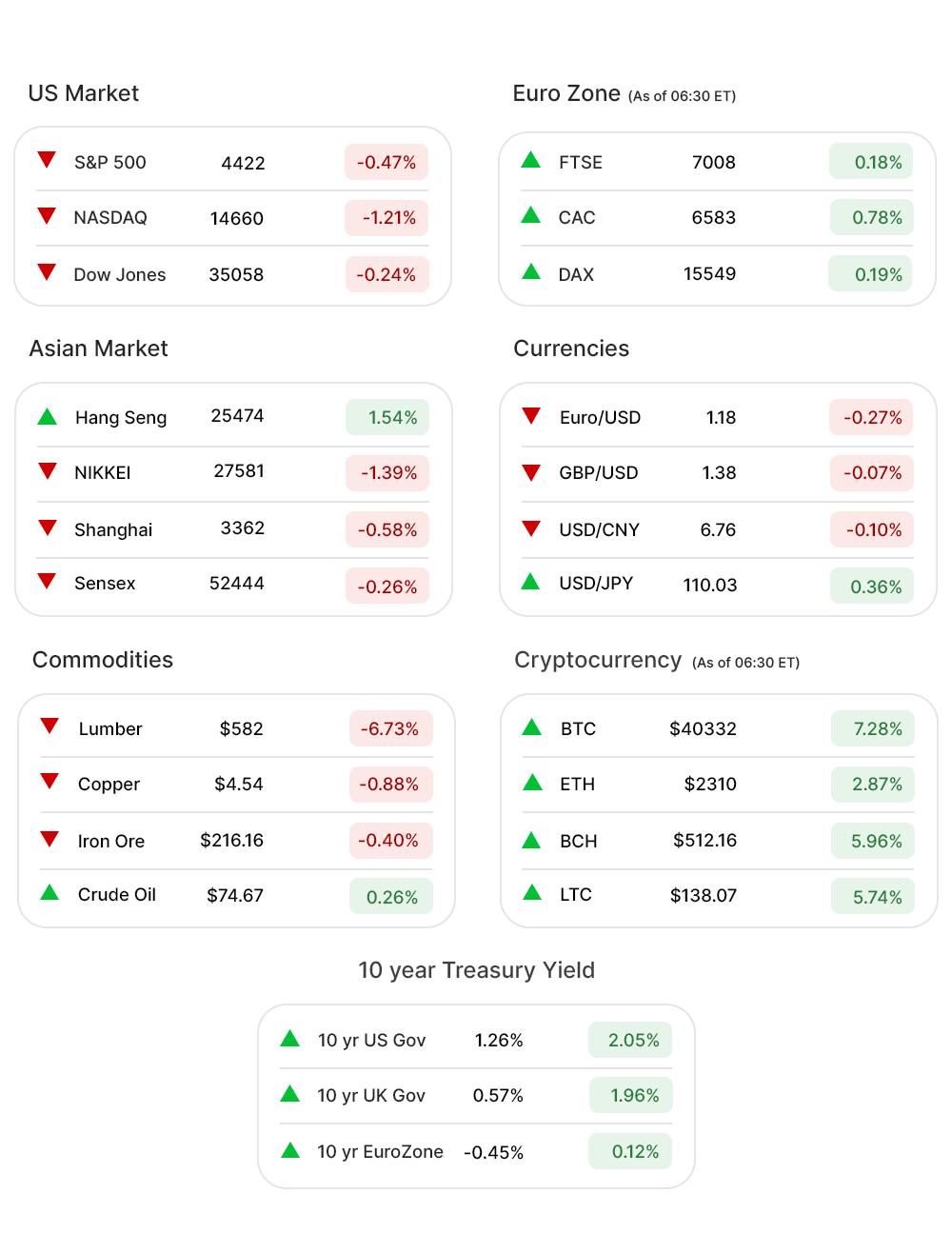

The S&P 500 (-0.47%▼) lost 20 points to close at 4401. Tech-heavy Nasdaq (-1.21%▼), despite eyes on the earnings by big tech companies, lost more than 120 points and closed at 14661 while the Dow (-0.24%▼) slid 85 points to reach 35059.

Sectors at the S&P 500 were mixed, six of them in green and the rest five in red.

Technology (-1.01%▼) was among the losers, again, followed by Energy (-1.01%▼), Communication Services (-1.06%▼), and Consumer Discretionary (-1.16%▼).

The gainers included Utilities (1.72%▲), Real Estate (0.82%▲), Healthcare (0.44%▲), and Consumer Staples (0.22%▲).

Tech giants that tumbled, ahead of their earnings reports, include - Apple Inc. (AAPL, -1.49%▼), Microsoft (MSFT, -0.87%▼), Amazon (AMZN, -1.98%▼), Facebook (FB, -1.25%▼), and Alphabet (GOOGL, -1.59%▼).

Futures!

After extending Tuesday’s losses, the Futures Wednesday morning made some steady gains and moved into the green territory, barring Dow Futures.

As of 06:30 ET: Nasdaq Futures (0.09%▲), S&P 500 Futures (0.02%▲), Russell 2000 Futures (0.51%▲), and Dow Futures (-0.15%▼) looked gloomy.

Key Movers in Small Cap:

Relmada Therapeutics (RLMD, 1.95%▲) reported positive results from its human abuse potential trial with the company’s lead candidate REL-1017. The relative volume of the stock was 8.8.

The semiconductor company, Skywater Technology (SKYT, -45.43%▼) reported disappointing Q2 results, facing a loss of $7m to $8m, with an adjusted EBITDA loss of $500,000 to $1.5m. The relative volume of the stock was 6.7.

Independence Realty Trust (IRT, -8.29%▼) has announced the pricing of its public offering of 14m shares of common stock at a price of $17.75 per share. The company will also acquire Steadfast Apartment REIT. The relative volume of the stock was 5.9.

Inovalon Holdings (INOV, 12.96%▲), a maker of software used to analyze healthcare data from researchers, is in the process of being acquired by a private equity firm Nordic Capital. The relative volume of the stock was 4.6.

Commercial safety services provider, APi Group (APG, 9.44%▲), announced on Tuesday that it would buy Chubb Fire and Security Business from Carrier Global Corp for $2.9bn in cash. The relative volume of the stock was 4.5.

The other movers in the small-cap segment included:

US Physical Therapy (USPH, 17.38%▲): Relative Volume 4.6.

Inozyme Pharma (INZY, -11.30%▼): Relative Volume 4.3.

The Beauty Health (SKIN, -9.36%▼): Relative Volume 4.0

Ibex Limited (IBEX, -2.56%▼): Relative Volume 2.8.

Turning Point Brands (TPB, 10.53%▲): Relative Volume 2.8.

Key Movers in Large Cap:

Workday Inc (WDAY, -3.33%▼), fell more than 7% before rebounding a little Tuesday, following reports that Amazon ended its contract, with the HR Software firm, of using its software company-wide. The relative volume of the stock was 4.4.

United Parcel Service (UPS, -6.99%▼) fell to a three-month low on worries that growth from the pandemic fuelled e-commerce boom may be fading - despite the fact that UPS reported better than expected earnings for Q2, with topline increasing by 14.5% y-o-y. The relative volume of the stock was 4.0.

Medallia Inc. (MDLA, 0.00%), had announced Monday that the private equity firm Thoma Bravo will take the company private for $6.4bn in cash. The relative volume of the stock was 3.6.

Despite reporting a pretty solid EPS of $0.44, on sales of $1.01bn for Q4, the specialist in frozen potato products Lamb Weston (LW, -13.53%▼) plummeted as the company's guidance for the current fiscal year spooked investors. The relative volume of the stock was 3.5.

F5 Networks Inc (FFIV, 6.20%▲) has reported an EPS of $2.76 beating the estimates of $2.47, while its revenue has grown 11% y-o-y to $651.1m. The relative volume of the stock was 3.3.

The other movers in the large-cap segment included:

Willis Towers Watson. (WLTW, -0.03%▼): Relative Volume 2.9.

Yum China Holdings (YUMC, -5.02%▼): Relative Volume 2.9.

Activision Blizzard Inc (ATVI, -6.76%▼): Relative Volume 2.9.

Repligen Corporation (RGEN, 9.89%▲): Relative Volume 2.7.

Report Card:

Propelled by iPhone-12 sales, Apple Inc. (AAPL, -1.49%▼), has beaten estimates, comprehensively. The overall revenue has grown by 36% y-o-y to $81.4bn, way ahead of the estimated $73.8bn. The EPS of $1.30 has also shot past the expected $1.01. The company has beaten estimates in services, Mac, and iPad revenues as well. Surprisingly, the stock fell further after hours - by more than 2%.

Alphabet (GOOGL, -1.59%▼) came out with thumping earnings as well. The Q2 revenue of the company has skyrocketed 62% y-o-y to $61.88bn, beating the estimates of $56.23bn quite easily. The GAAP EPS has soared to $27.26 versus the expected $19.32. Ad revenues of the company have grown by 69% y-o-y. The stock soared more than 3% after hours.

Another tech giant and yet another giant earnings report! Microsoft’s (MSFT, -0.87%▼) earnings were propelled by cloud and personal computing with the company reporting a revenue of $46.15bn versus $44.25bn expected. The EPS of $2.17 was also ahead of the estimated $1.92. The company has reported solid growth in productivity and business processes as well as intelligent cloud segments.

The cold beverages make Starbucks hot! A surge in US cold beverages has fuelled Q3 earnings of coffeehouse chain Starbucks (SBUX, -0.024%▼) with the company reporting an adjusted EPS of $1.01 against the expected 78 cents. The revenue of $7.5bn has topped estimates of $7.29bn as well. The stock fell almost 3% after hours.

On the Lookout:

The FOMC meeting of the Fed will conclude today. At 2:30 pm ET the Chair, Jerome Powell, will address a presser. But before that data on Advance Trade in Goods will be released in the morning.

Also, more than 100 companies are set to report their earnings through the day today. A busy day for investors!

Some IPOs to keep track:

Oncology Biotech, Immuneering, plans to raise $105m by offering 7m shares of its common stock, priced between $14 and $16.

Preclinical Biotech, Ocean Biomedical, is offering 6.3m shares of its common stock priced between $7 and $9, in a bid to raise $50m.

Alpha Partners Technology Merger Corp, has announced an offering of 25m shares of its common stock priced at $10. The company plans to raise $250m.

Mercury e-Commerce Acquisition has also priced its initial offering of 17.5m shares, of its common stock, at $10. The company will raise $175m.

The edtech company, Duolingo Inc, will be offering 5.1m shares of its common stock, priced between a whopping $95 and $100.

Unusually high shorter-term CALL options activity seen on CVS Health Corp. (CVS, 0.93%▲), Zynga Inc. (ZNGA, -2.03%▼), Alibaba Group. (BABA, -2.97%▼) and Blackberry. (BB,-2.46%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Spirit Airlines. (SAVE, -3.14%▼), Nikola Corp. (NKLA,-5.84%▼), NIO Inc. (NIO, -8.83%▼), Activision Blizzard. (ATVI, -6.76%▼) and Futu Holdings (FUTU, -14.47%▼).

Other Asset Classes:

Tuesday afternoon, as the FOMC meeting was in progress, the US Treasury Yields retreated a little. The 10 Year Treasury Yield fell four basis points to 1.236% while the 30 Year Treasury Yield, slipped 3.7 basis points and reached 1.888%. The investors are trying to get a glimpse of where the central bank stands vis-a-vis the monetary policy.

Crude Oil prices were soaring again, early Wednesday morning. Brent Crude was up 0.50% and hovering just below the $75 per barrel mark. WTI Crude rose 0.60% to a little more than $72 a barrel.

The US Dollar (92.52, 0.09%▲) followed the equities and went down to the 92.42 level Wednesday afternoon. The greenback was on the way to some recovery early Wednesday morning.

Global Markets:

With eyes on the Chinese crackdown on its tech and other companies, the Asian markets continued their downward run, for the fourth consecutive session, following a pullback in the US markets. Nikkei and Hang Seng had a role reversal today, with the latter rising 333 points and the former falling by a little more than that.

European Markets responded positively to upbeat earnings reports from some of Europe’s largest banks and other companies, while investors shrugged off concerns surrounding China’s crackdown on some of its major companies. The markets were green, early Wednesday morning, and looked set to gain for the day after two sessions of losses.

Meanwhile on Researchfin.ai

Trade setups identified by our AI that successfully met their profit-taking target yesterday and within their respective target time were TFI International Inc (TFII, 7.15%▲), Karat Packaging Inc. (KRT,-7.84%▼), Translate Bio Inc (TBIO, -2.35%▼), and Repligen Corporation (RGEN, 9.89%▲).

There are 40+ new trade setups identified by the AI last Friday. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

Add the email, support@researchfin.ai to your contact list and make sure that does not get accidentally miscategorized as either promotion or spam.

Will see you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.