Calm Before the Storm!

Good Morning!

Uncertainty looms large! The Thursday deadline of Evergrande’s $84m offshore coupon payment passed off quietly, without the payments being made and the investors were left wondering about the future. The company remains tightlipped! The stock of the embattled company dropped 12% after a 17% rally Thursday. China Evergrande New Energy Vehicle Group plummeted 25%.

The authorities in the mainland have asked officials to prepare for a “possible storm”, in case the Evergrande collapses. Media reports suggest the government has cautioned officials to only step in at the last minute to prevent a spill-over from Evergrande’s demise.

The Bank of England has left its interest rates unchanged and bond-buying program of $1.2tr intact, for now, even as the consensus on tapering grows with Deputy Governor, Dave Ramsden, voting for an early end to the bond-buying program. BoE has also downgraded growth projections and thinks inflation might rise up to 4%. FTSE slid on Friday.

Initial Jobless Claims (regular state program), for the week ended September 18, totaled 351,000 worse than the expected 320,000 and last week’s 332,000. The Continuous Jobless Claims have increased by 181,000 to 2.84m, lower than last week’s 2.85m.

The economic activity continued to expand in September but at a slower rate than August, as the US Markit Manufacturing PMI (flash) declined to 60.5 from the previous print of 61.1. Analysts were expecting the print to be 62.5.

Crypto’s China woes! China’s Central Bank has vowed to crack down on illegal activities of Crypto trading, by banning overseas exchanges from providing services to investors in the mainland, via the internet. Bitcoin fell 5%.

Also, Robinhood is preparing to launch a Crypto Wallet, as early as next month, allowing users to send and receive digital currency, and trade in it as well.

US Markets:

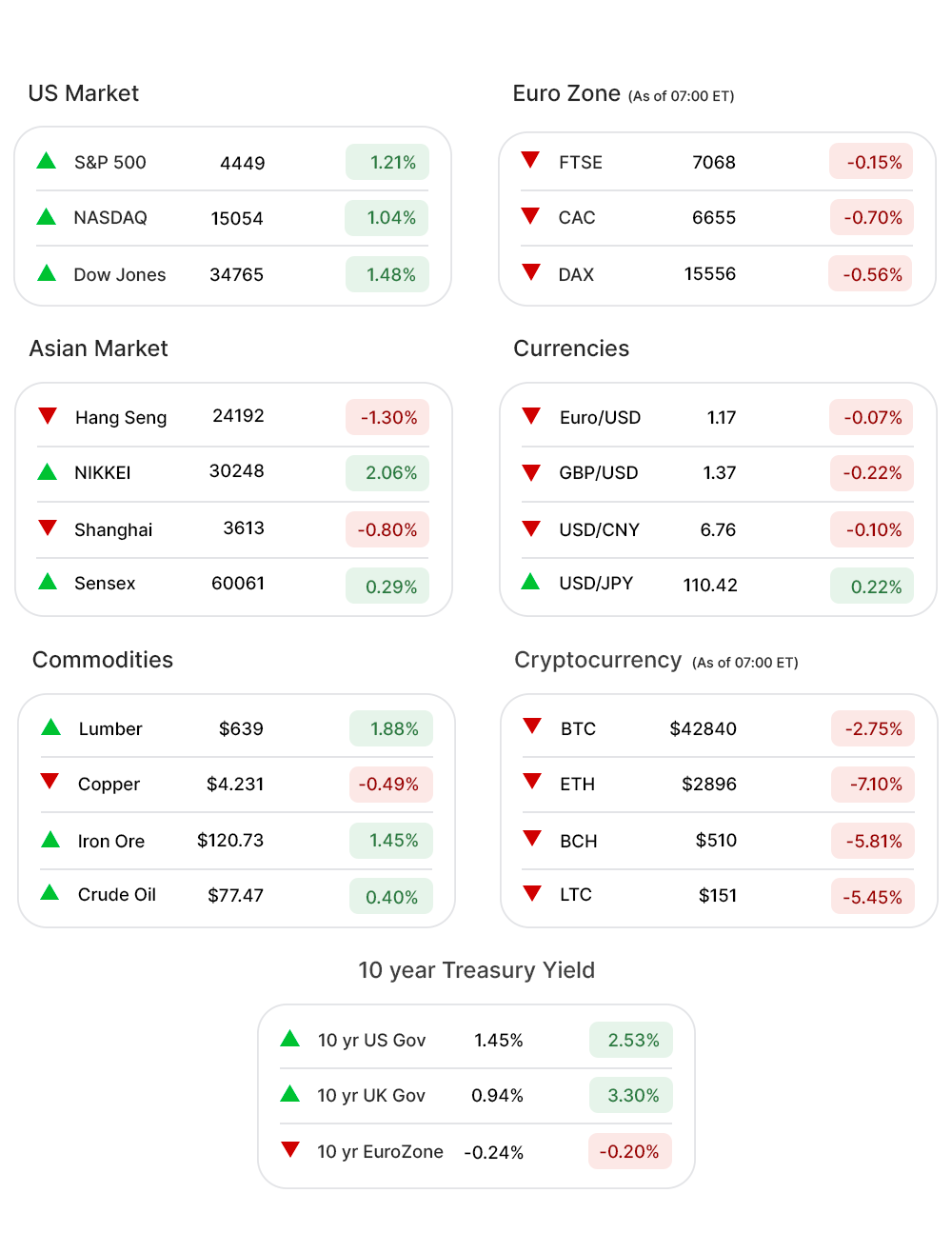

With the Fed’s taper worries fading, the markets were propelled compensating the losses for the week, with Dow Jones (1.48%▲) gaining more than 500 points completing its biggest two-day rally in six months.

S&P 500 (1.21%▲) gained more than 50 points, while the Russel 2000 (1.82%▲) and Nasdaq (0.92%▲), managed to post some decent gains as well.

All sectors at the S&P 500 ended in the green, barring Utilities (-0.50%▼).

Energy (3.42%▲) was again at the top of the sectoral indices, followed by Financials (2.50%▲), and Materials (2.23%▲).

Sectors with a gain of more than 1% included Technology (1.35%▲), and Consumer Discretionary (1.02%▲), and Industrials (1.55%▲).

Healthcare (0.77%▲), Consumer Staples (0.39%▲), Communication Services (0.82%▲), and Real Estate (0.37%▲) made some gains as well.

Futures!

As the Evergrande crisis deepened every minute, the Futures looked gloomy with all major indices in the red zone.

As of 06:30 ET, the indices looked like this: Nasdaq Futures (-0.49%▼), Dow Futures (-0.26%▼), S&P 500 Futures (-0.35%▼), and Russel 2000 Futures (-0.47%▼).

Key Movers in Small Cap:

Eargo Inc (EAR, -68.34%▼) is the target of a US Department of Justice investigation regarding insurance payments and a claims audit by an insurer that is also the company’s largest customer. The relative volume of the stock was 71.9.

Nationally ranked shareholder rights firm, Labaton Sucharow, will investigate InnovAge Holding Corp (INNV, -22.74%▼) for a potential securities violation. The relative volume of the stock was 5.8.

Safehold Inc (SAFE, 4.06%▲) has priced an unwritten public offering of 2.2 shares of its common stock, at $76 per share. The relative volume of the stock was 5.6.

International Game Technology (IGT, 5.26%▲) got its target updated from $35 to $36, fuelling the stock Thursday. The relative volume of the stock was 5.0.

The other movers in the small-cap segment included:

RPT Realty (RPT, 1.33%▲): Relative Volume 8.8.

NanoString Technologies Inc (NSTG, -5.13%▼): Relative Volume 4.3.

Summit Therapeutics Inc (SMMT, 3.86%▲): Relative Volume 4.2.

Canoo Inc (GOEV, 13.28%▲): Relative Volume 4.2.

Rite Aid Corporation (RAD, -6.63%▼): Relative Volume 4.0.

Key Movers in Large Cap:

Hyatt Hotels Corporation (H, 2.36%▲) announced the pricing of its public offering of 7m shares of its Class A common stock, at $74.50 per share. The relative volume of the stock was 10.2.

Ardagh Group SA (ARD, 3.45%▲) has announced a special cash dividend of $1.25 a share. The relative volume of the stock was 5.9.

Altice USA Inc (ATUS, -12.67%▼) warned that the company will report a net loss of broadband subscribers for the current quarter. The relative volume of the stock was 4.9.

Quantumscape Corp (QS, 14.57%▲) Thursday cashed in on the buoyancy in EV companies, following social media buzz about the EV space surpassing all other hit sectors, including Crypto. The relative volume of the stock was 4.9.

The other movers in the large-cap segment included:

Grocery Outlet Holding (GO, -1.27%▼): Relative Volume 5.1.

Rexford Industrial Realty (REXR, -2.06%▼): Relative Volume 4.1.

Darden Restaurants Inc (DRI, 6.11%▲): Relative Volume 3.1.

Signify Health Inc (SGFY, -14.24%▼): Relative Volume 3.0.

Salesforce.com Inc (CRM, 7.21%▲): Relative Volume 2.8.

Report Card:

The IT services and consulting company, Accenture Plc (ACN, 2.49%▲) reported earnings of $2.20 per share, an 11% increase y-o-y and ahead of the estimated $2.19. The revenue of $13.4bn was up 24% compared to the prior year. The stock remained flat after hours.

Darden Restaurants Inc (DRI, 6.11%▲) reported earnings of $1.76, per share, ahead of the expected $1.65 per share. Sales jumped 51% y-o-y to $2.3bn, and ahead of the estimated $2.2bn. Same-store sales increased 47% y-o-y. The stock remained flat after hours.

Nike Inc (NKE, 1.36%▲) reported diluted earnings of $1.16 per share, a 22% increase y-o-y, while the revenue increased 16% y-o-y to $12.2bn. Direct sales of the company came out at $4.7bn, up 28% on a y-o-y basis. The stock, however, tumbled by a little less than 4% after hours.

The pharmacy chain, Rite Aid Corporation (RAD, -6.63%▼), reported a 2.2% y-o-y increase in revenue to $6.11bn, falling short of the estimated $6.21bn. The company came out with a net loss of $22m, or $0.41 per share, a disaster when compared to the prior year’s income of $13.5m, or $0.25 per share. The stock slid by 0.21% after hours.

On the Lookout:

Fed Chair, Jay Powell, will give his opening remarks, while the Cleveland Fed President, Loretta Mester will speak to the bankers.

New Home Sales (SAAR) is expected to grow from July’s 708,000 to 720,000 in the month of August.

An investment management software company, Clearwater Analytics Holdings, is targeting an enterprise valuation of nearly $4bn as it aims to raise $450m by offering 30m shares of its common stock, priced between $14 and $16.

Cue Health is aiming to raise up to $100m by offering 12.5m shares of its common stock, priced between $15 and $17.

Unusually high shorter-term CALL options activity seen on Quantumscape Corp (QS, 14.57%▲), Draftkings Inc (DKNG, -1.67%▼), Robinhood Markets Inc (HOOD, -2.01%▼), Take-Two Interactive Software (TTWO, 0.98%▲), and American Eagle Outfitters (AEO, 3.37%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Tesla Inc (TSLA, 0.23%▲), Darden Restaurants Inc (DRI, 6.11%▲), General Electric Company (GE, 4.49%▲), AES Corp (AES, -0.55%▼) and Futu Holdings Ltd (FUTU, -0.11%▼) among others.

Other Asset Classes:

Crude Oil Prices - Supported by the global output disruptions and inventory draws, Crude Oil is heading for its third straight week of gains, aiming at the $80 per barrel mark. Early Friday morning Brent crude was trading well above the $77 per barrel mark and into the green zone, while WTI crude breached the $73 per barrel mark.

The US Dollar (93.16, -0.33%▼) dropped the most since late August on Thursday but has paired some of the losses since and was trading above the 93 mark, but into the red territory early Friday morning.

As the Evergrande concerns ease and stocks soar higher, the US Treasury Yields also made substantial gains on Thursday and early Friday morning. This morning, the 10 Year US Treasury Yield was trading at 1.422%, well ahead of Thursday morning’s 1.335%.

Global Markets:

Asian Markets: Rising delta variant cases across the world and lingering concerns surrounding Chinese developer Evergrande, in the Asia Pacific left investors on the edge. Most of the Asian markets slid into the red zone Friday. Tokyo’s Nikkei, advanced by over 600 points, or 2.06%, while Shanghai and Hang Seng slid by 0.80% and 1.30% respectively. Indian market is still aloof from the Evergrande crisis. Sensex breached the crucial 60k mark for the first time ever Friday and Nifty attained yet another record high of 17,853. Bank and IT indices propelled the market, even as the metal index plunged.

European markets, after three positive sessions in a row, finally seem to have succumbed to the Evergrande fiasco, as the major indices looked set to end the week in the red. Bank-of-England downgrading growth projections also played on the investors’ minds. FTSE (-0.37%), CAC (-0.98%), DAX (-0.77%) , and the pan-EU index Stoxx-600 (-0.77%) looked set to end the week on a negative note.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Hilton Grand Vacations Inc (HGV), Manchester United (MANU), Avis Budget Group Inc (CAR), SPDR Bloomberg Barclays (GTLS), Diamondback Energy Inc (FANG), Magnite Inc (MGNI), Nektar Therapeutics, (NKTR), Antero Resources Corp (AR), Legend Biotech Corp (LEGN) and Joby Aviation Inc (JOBY) among others. Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Enjoy your weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.