Ceaseless Whiplash!

Good Morning!

No end in sight! The tech crackdown continues in China as the government now intends to break Ant Group Co’s Alipay business, calling for “better protection” of gig economy worker’s rights. Hang Seng tech index slid 2.3% lower with Alibaba, Meituan, and Tencent propelling the slide. Earlier, ride-hailing giants were asked to improve the distribution of income and ensure rest periods for workers.

China-woes! Sensing that a government approval might be a hard nut to crack, the private equity group Blackstone has dropped its $3bn bid for a controlling stake in Soho China, one of the country’s largest real estate developers. Soho China stock fell 40% Monday.

Apple’s legal injunction! A district judge in California has ruled that Apple can no longer force developers to use in-app purchases. Shares of gaming companies including Roblox, Zynga, and Playtika soared as Apple stock tumbled on Friday.

Mark-philanthropist-Zuckerberg! Facebook has committed to buy $100mworth of unpaid invoices from small businesses run by women and minorities - supporting more than 30,000 small businesses.

The legitimacy question! South Korea’s vibrant Crypto market might face a $2.6bn wipeout, with 40 of its 60 Crypto exchanges potentially failing to meet conditions set by the government, while asking Crypto exchanges to register as legitimatetrading platforms.

The Producer Price Index has recorded a solid increase in August by 0.7%, the highest gain in 11 years as Covid’s resurgence has kept supply chains constricted. The red hot PCI suggests inflation might persist for longer than earlier expected.

US Markets:

Cleveland Fed President Loretta Mester’s comments, that she would like the Central Bank to taper asset purchases despite the weak August jobs report, further weighed on the investor sentiment Friday - making stocks tumble for the fifth consecutive trading session.

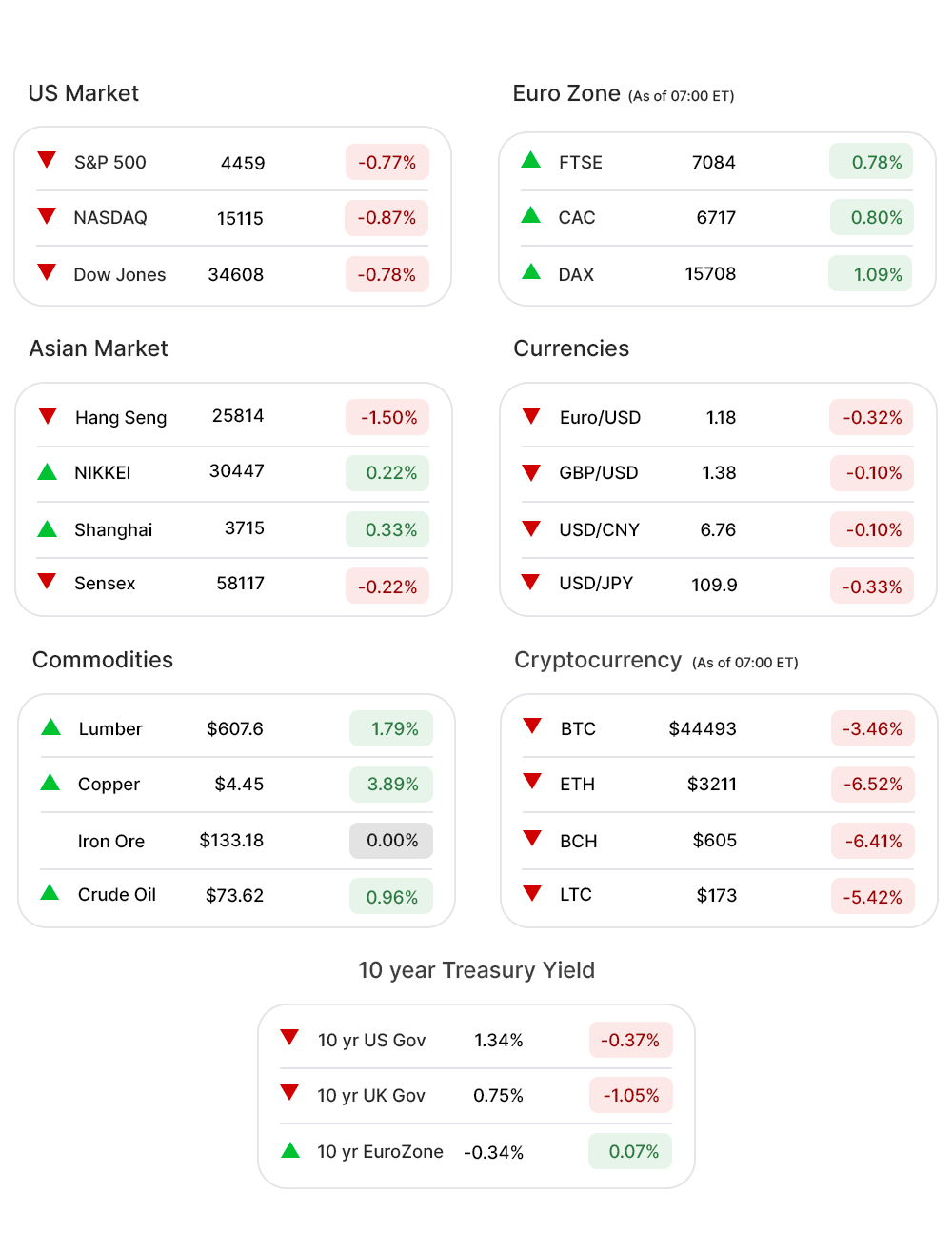

S&P 500 (-0.77%▼) slumped to its worst weekly showing, since February. Dow Jones (-0.78%▼) slid 271 points, while Russel 2000 (-0.96%▼) suffered substantial losses as well.

Tech heavy Nasdaq (-0.77%▼) shed more than 120 points Friday.

Sectors at the S&P 500 were no different, and into the red zone without any exception.

Utilities (-1.57%▼) and Real Estate (-1.23%▼) were the worst hit, followed by Technology (-0.98%▼), Communication Services (-0.90%▼), Consumer Staples (-0.94%▼), and Healthcare (-0.94%▼).

Financials (-0.65%▼), Consumer Discretionary (-0.57%▼), Industrials (-0.47%▼), Energy (-0.04%▼), and Materials (-0.05%▼), also slid, a little less than other sectors.

Futures!

The US stock futures provided some hope of a rebound.

As of 06:30 ET, all the indices were green: Dow Futures (0.52%▲), Nasdaq Futures (0.45%▲), S&P 500 Futures (0.50%▲), and Russel 2000 Futures (0.80%▲).

Key Movers in Small Cap:

Apellis Pharmaceuticals reported disappointing clinical trial data for a geographic atrophy candidate that could end up competing with Zimura, the lead candidate of Iveric Bio Inc (ISEE, 62.49%▲). The Relative Volume of the stock was 51.1.

Apellis Pharmaceuticals Inc (APLS, -37.19%▼) was hit severely after announcing the clinical trial results. The Relative Volume of the stock was 24.1.

Private equity firm, The Jordan Company has agreed to buy Echo Global Logistics (ECHO, 52.30%▲) for $1.3bn, a premium of 54% to its Thursday’s close and more than 30% above its all-time-high. The Relative Volume of the stock was 35.8.

Ortho Clinical Diagnostics (OCDX, 2.19%▲) Friday announced the pricing of its previously announced secondary offering of 22m shares of its common stock - priced at $17.50 per share. The Relative Volume of the stock was 10.1.

Mersana Therapeutics Inc (MRSN, -39.12%▼) announced disappointing interim data on the company’s phase 1 trial, evaluating Upifitamab Rilsodotin used in Ovarian cancer. The Relative Volume of the stock was 6.2.

The other movers in the small-cap segment included:

Aligos Therapeutics Inc (ALGS, -2.44%▼): Relative Volume 8.9.

Blackstone Mortgage Trust (BXMT, -4.66%▼): Relative Volume 6.6.

A-Mark Precious Metals Inc (AMRK, 12.01%▲): Relative Volume 6.1.

The Liberty Braves Group (BATRK, 1.92%▲): Relative Volume 6.0.

Dave & Buster’s Entertainment Inc (PLAY, 1.16%▲): Relative Volume 5.7.

Key Movers in Large Cap:

McAfee Corp (MCFE, -10.38%▼) Friday announced the pricing of its secondary offering of 20m shares, at $22.50 per share. The relative volume of the stock was 13.4.

Maravai Life Sciences Inc (MRVI, -11.75%▼) fell on the news that a group of stockholders had priced a substantial secondary share sale. The relative volume of the stock was 10.4.

Agilon Health Inc (AGL, 0.76%▲) announced the pricing of a secondary offering of 17m shares, at $30 per share. The relative volume of the stock was 8.8.

The other movers in the large-cap segment included:

Hexcel Corporation (HXL, 2.49%▲): Relative Volume 8.5.

VICI Properties Inc (VICI, -0.50%▼): Relative Volume 6.7.

Clarivate Plc (CLVT, -9.97%▼): Relative Volume 5.7.

Teradata Corporation (TDC, -9.35%▼): Relative Volume 4.0.

World Wrestling Entertainment (WWE, 3.65%▲): Relative Volume 3.3.

Report Card:

The retail company Kroger Co (KR, -7.50%▼) reported earnings of $0.61 per share on revenue of $31.68bn. While the revenue was in tune with the expectations, the EPS fell well short of the expected $3.06 per share. The stock was flat after hours.

The increased research and development and G&A expenses have weighed Omega Therapeutics (OMGA, 3.88%▲) making its loss widen to $15.4m or $3.36 per share compared to last year’s $6.3m or $1.58, per share. The stock was flat after hours.

The pharmaceutical company, Beyond Spring Inc (BYSI, 0.49%▲), has reported a loss of $0.49 per share, well in sync with what was expected. Revenue of the company $0.34m however missed the estimates by 97.56%. The stock continued to climb after hours.

SigmaTron International Inc (SGMA, 32.59%▲) reported quarterly earnings of $2.06 per share, compared to a loss of 21 cents per share in the same period the prior year. Revenue of $85.7m was also ahead of the prior year’s $60.5m.

On the Lookout:

The Federal Budget for the month of August will be updated, from a previous reading of $200bn.

Some IPOs to keep a look over:

Definitive Healthcare aims to raise $350m by offering 15.55m shares of its common stock, at a price ranging between $21 and $24 per share.

Dice Therapeutics is offering 10m shares of its common stock, in a bid to raise $160m, in a price range of $15 to $17 per share.

Unusually high shorter-term CALL options activity seen on Apellis Pharmaceuticals Inc (APLS, -37.19%▼), General Motors (GM, 2.21%▲), Apple Inc. (AAPL, -3.31%▼), Occidental Petroleum (OXY, -0.36%▼), and Trade Desk Inc (TTD, -0.05%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Affirm Holdings Inc (AFRM, 34.37%▲), Macy’s Inc (M, -4.62%▼), Tesla Inc(TSLA, -2.46%▼), Cytokinetics Inc (CYTK, -1.76%▼), and Las Vegas Sands (LVS, -4.19%▼) among others.

Other Asset Classes:

Crude Oil Prices - The production cut in the US, following Hurrican Ida, outweighed the bearish effect of Saudi Arabia’s price cut for Asia and China releasing its state reserves for the first time in history. Brent traded well over the $73 per barrel mark, Monday morning, while WTI Crude has crossed the $70 per barrel mark.

The US Dollar (92.80, 0.23%▲) is retargeting the 93 mark, as it trades near a multi-day high in spite of the bearish or steady performance of the Treasury Yields.

The US Treasury Yields fell a little to start off the week on a negative note. The 10 Year US Treasury Yield was trading into the negative territory at 1.334%. Also, an auction will be held for $48bn of 13-week bills and $45bn of 26-week bills.

Global Markets:

The Asian Markets were mixed after Friday’s rout in the US markets and a record high US inflation ramping up concerns that Fed will have to tighten monetary policy sooner than later. Hang Seng, fell by more than 430 points or 1.65% while Shanghai and Nikkei rose 0.33% and 0.22% respectively.

Auto-makers, Banks, and Oil shares registered some early gains propelling the European markets higher, as investors counted on strong economic recovery in the EU. FTSE, was up 0.52% soon after the opening, while CAC had gained 0.53%. DAX was up 0.71%andpan-EU index Stoxx-600 was trading higher by 0.43%.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: JAMF Holding Corp (JAMF), Prothena Corporation (PRTA), Quidel Corporation (QDEL), and Affirm Holdings Inc. (AFRM). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Have a great day!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.