China’s ‘V’ is faltering!

Hello, hope you had a wonderful weekend!

It did not come ‘home’, it went to Rome! Hugs, tears of joy and that of heartbreak-inside that football field and across the world as Italy ended a 52 year wait to become the Euro Champions!

Richard Branson also waited for 17 years and finally on Sunday, he soared to space! The 70-year-old Virgin Galactic CEO had a message from space, “To the next generation of dreamers, if we can do this imagine what you can do,”.

China’s V-shaped economic rebound, post Covid, is slowing, and that could be alarming to economic recoveries globally. The People’s Bank of China has cut 50 basis points to the Reserve Ratio Requirement to stimulate lending.

ECB President, Christine Lagarde, has said that the Eurozone will usher into a “new format” on stimulus after the present $2.2 Trillion bond buying program is over in March 2022.

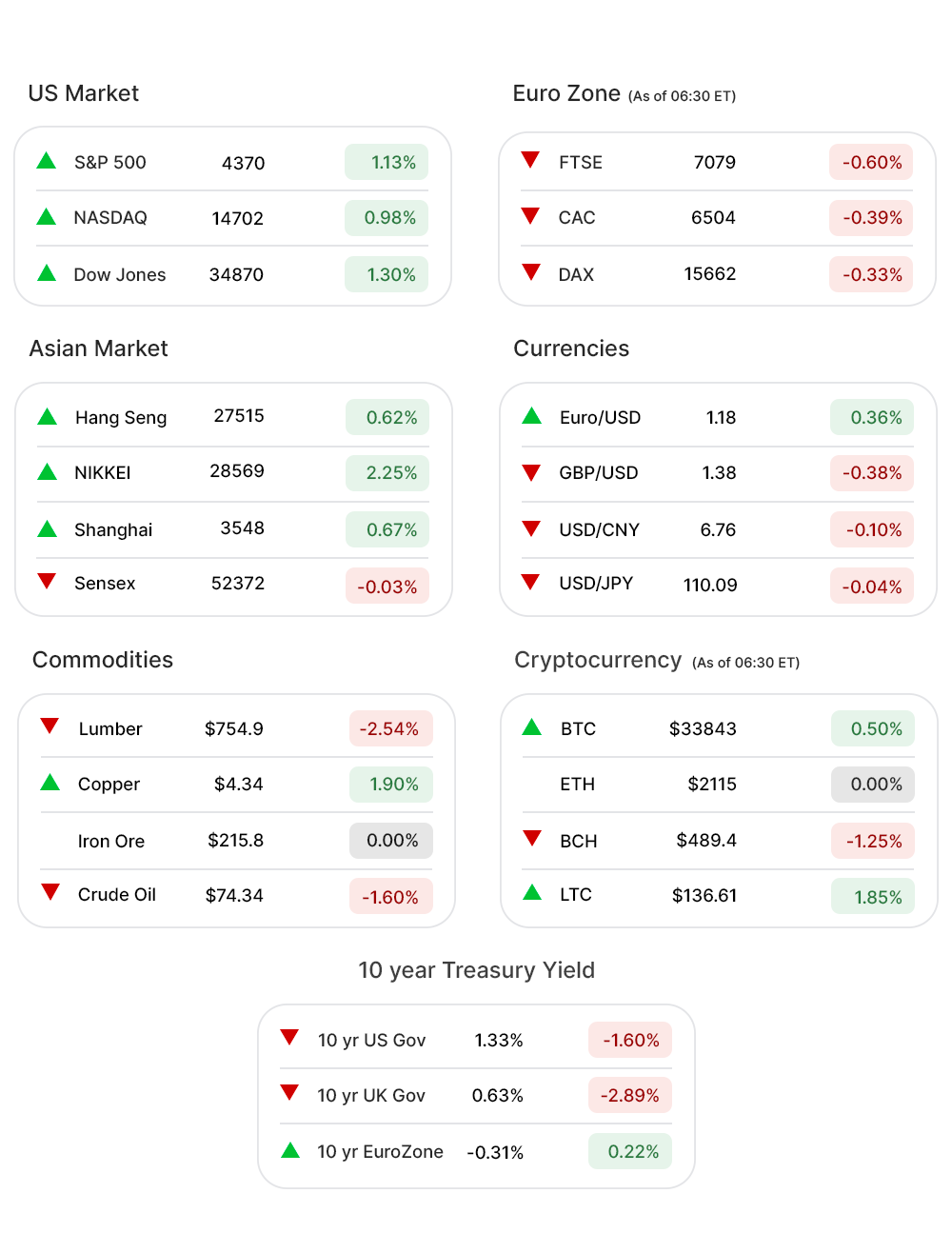

US Markets:

Following a serious slump, with concerns around slow economic recovery on Thursday, the markets soared yet again Friday registering some major gains and closing in green for the week.

S&P 500 (1.13%▲) earned its sixth week of gains in the last seven, rising 48.73 points. Tech-heavy Nasdaq (0.98%▲) remained a little shy of a gain of 1% adding 142 points even as Dow (1.30%▲) soared by 448 points.

Financials (2.87%▲) led to the recovery. The stocks that propelled this sector included Capital One Financial Corporation (COF, 5 .31%▲), American International Group Inc. (AIG, 4.48%▲) and Bank of America Corporation. (BAC, 3 .25%▲).

Energy (2.01%▲) bounced, yet again, and so did Technology (0.95%▲) and Real Estate (1.31%▲).

Healthcare (-0.47%▼) and Materials (-1.36%▼) failed to cash in on the overall gains in S&P 500.

Futures!

Ahead of the key inflation data and expected reports on performance by companies, the futures look a little bleak.

As of 07:00 ET, only Nasdaq Futures (0 .22%▲) was in the positive zone. S&P 500 Futures (-0.28%▼), Russell 2000 Futures (-0.84%▼) and Dow Futures (-0.50%▼) were all red.

Key Movers in Small Cap:

The internet-based mailing and shipping company Stamps.com (STMP, 63 .98%▲) is being bought by Thoma Bravo, the e-commerce shipping provider, for $6.6 Billion. Thoma Bravo agreed to pay $330 per share, a 67% premium to the company’s closing price of $192.72 on Thursday. The relative volume of the stock was 23.2.

The Thoma-Stamps deal made investors take a fresh look at Pitney Bowes (PBI, 14 .86%▲), a Stamps.com rival. The stock soared more than 20% on Friday before losing some gains. The relative volume of the stock was 9.1.

The biotechnology startup, Sigilon Therapeutics (SGTX, -25.32%▼) tanked Friday following the announcement of a clinical hold for its experimental Haemophilia drug. Investors worried that the testing might be shelved altogether. The relative volume of the stock was 6.5.

Among the other movers in this segment were Luminex Corporation (LMNX, 0 .63%▲), with a relative volume of 4.1 and Sientra Inc. (SIEN, 3 .69%▲), with a relative volume of 3.5.

Key Movers in Large Cap:

The key movers in the large-cap category included JB Smith Properties (JBGS, 1.99%▲), with a relative volume of 2.9; Snowflake Inc. (SNOW, 7.67%▲), with a relative volume of 2.7; Seaboard Corporation. (SEB, -5.75%▼), with a relative volume of 2.1 and Kansas City Southern. (KSU, 4.25%▲), with a relative volume of 2.0.

Report Card:

This week this section is turning out to be a busy one! The Q2 gains for S&P 500 stocks are expected to be up 65% from the corresponding quarter last year. The growth is being attributed to a nearly 570% gains Industrials sector has made, after being the worst hit sector during the pandemic.

The earnings are expected from JP Morgan Chase (JPM, 3.20%▲), Delta Air Lines (DAL, 2.02%▲), PepsiCo (PEP, -0.25%▼) and Goldman Sachs (GS, 3.57%▲) on Tuesday; Bank of America Corporation. (BAC, 3 .25%▲), Citigroup Inc. (C, 2.58%▲) and Wells Fargo & Co. (WFC, 3.76%▲) on Wednesday while Morgan Stanely (MS, 3.07%▲) and Truist Financial Corp. (TFC, 4.21%▲) reports are expected Thursday.

On the Lookout:

Investors are gearing up for a busy week ahead. Apart from the earnings the much awaited Consumer Price Index (CPI) data will be out Tuesday. The CPI for June is expected to be 0.5% and will be the first proof of recent sharp annual price gains being temporary.

President Biden signed an executive order aimed at cracking down on “anti-competitive” practices in the Big Tech, labor and other sectors. “Capitalism without competition is not capitalism, its exploitation,” the President said before signing the order.

Today is going to be a busy day in the IPO segment with as many as 10 companies set to offer their IPOs Monday. Some of the IPOs are listed herein.

Mortgage focussed software startup, Blend Labs Inc. is targeting an IPO of nearly $4 Billion. The company will be offering 20 million shares priced between $16 and $18.

Bridge Investment Group Holdings Inc. will be offering 18.75 million shares priced between $15 and $17.

The fitness franchisor F45 Training Holdings Inc. is eyeing a $1.53 billion valuation in IPO. 20 million shares of the company are on offer with a price ranging between $15 and $17.

The Membership Collective Group Inc. is ready with its $450 million IPO plan. The physical and digital membership platform has 30 million shares on offer priced between $14 and $16.

The internally managed Real Estate Investment Trust (REIT), Phillips Edison and Company 17 million shares on offer, with a price ranging between $28 and $31.

Unusually high shorter-term CALL options activity seen on Pinduoduo (PDD, 2.11%▲), ConocoPhillips (COP,1.55%▲), Sientra Inc. (SIEN, 3.69%▲), and Upstart Holdings (UPST, 0.21%▲), Arrival SA (ARVL, 0.97%▲) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Intel Corporation (INTC,1.08%▲), PBF Energy Inc (PBF, 1.14%▲), Fossil Group Inc (FOSL, 4.84%▲), and Chewy Inc (CHWY, 5.33%▲) among others.

Other Asset Classes:

There is no denying the rising demand for Crude Oil and the fast diminishing US inventories, amid an OPEC deadlock threatening supplies. However, concerns pertaining to a slowing down of global economic recovery, amid a Covid resurgence, are outweighing, resulting in the Oil prices slipping on Monday. Brent Crude prices hovered around $74/bbl while WTI Crude was placed at around $74, in the wee hours today.

The US Dollar (92.18, 0.05%▲) is on yet another upward run ahead of the CPI data scheduled this week and Fed Chairman, Jerome Powell’s testimony before the Senate Banking Committee on Wednesday and Thursday.

Volatility is thy trait! The Crypto Currency continues to be a mix of red and green, today as well. The cumulative global cap of this asset for today, early morning was $1.41 trillion, a 1.24% increase over the last day. The total volume in the last 24 hours was down 9.17% at $52.79 billion!

Global Markets:

Asian Markets picked up the threads where the US market had left them on Friday. Most of the markets made gains shrugging off concerns over the rise in the number of Delta Variant cases across the globe. The Central Bank of China’s decision to slightly loosen monetary policy for lenders also provided some support to the markets, strengthening after a volatile week.

The European Markets could, however, not shrug off the concerns around Delta Variant and the adverse effect it was going to have on economic recovery. While Stoxx-600 and the DAX in Germany did open in the green territory, the gains did not sustain as two indices joined FTSE and CAC in the red zone.

Meanwhile on Researchfin.ai

There are more than 100 new trade setups that were identified by the AI Friday. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

We are done for today! Have a wonderful trading day ahead!

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.