Code Red!

Hope your weekend was fabulous!

The economics of climate change! Developed countries have incurred a loss of $3.6tr from severe weather events, over the last 5 decades. A recent UN scientific report on climate change was touted as a “code red for humanity” by the UN Chief.

The rebound! Pointing to solid global demand, China’s exports have risen at a faster than expected rate of 25.6% for August y-o-y, and way ahead in comparison with July’s 19.3% gain.

Japan’s PM resigns, stocks soar! Nikkei short past the 30k mark, at the opening today, as investors speculate that outgoing PM, Yoshihide Suga’s successor might unveil a stimulus package worth $273bn.

The future is electric! As Toyota readies to unveil its first all-electric car, next year, the World’s largest car manufacturer is set to spend around $13.5bn in the next decade to develop batteries and its battery supply system.

Boris Jhonson, the UK PM, has announced that the country will announce a tax rise of more than $13.8bn a year. The European Central Bank is expected to slow bond purchases as the economy rebounds. FTSE slid and so did other major EU indices.

The ‘legitimate’ Bitcoin! El Salvador becomes the first company to recognize the most popular CryptoCurrency as a legal tender. The country bought 400 bitcoins, worth $20.9m, a day before it formally adopted bitcoin as a legal tender.

Futures!

Futures were mixed, early Tuesday morning.

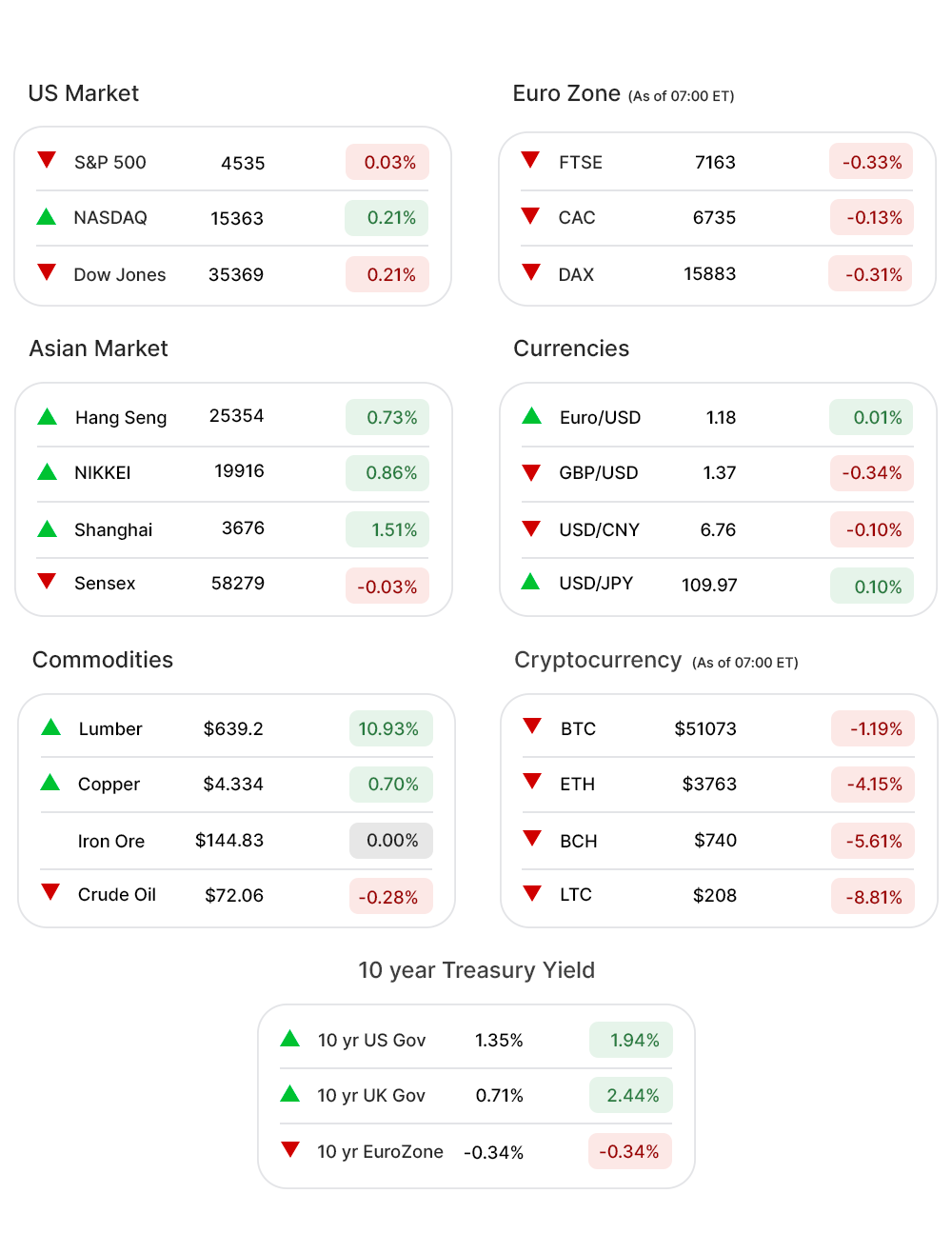

As of 07:00 ET, all the indices were red, barring Dow Futures (0.10%▲). Nasdaq Futures (-0.02%▼), and S&P 500 Futures (0.06%▲).

Other Asset Classes:

Crude Oil Prices - The prices remained more or less static after a plunge on Monday owing to Saudi Arabia, the world’s top exporter, slashing crude oil prices for Asia - indicating that global supplies were well fed. Brent traded a little over $72 per barrel mark, in the wee hours Monday, while WTI Crude was in the negative territory.

The US Dollar (92.28, 0.26%▲) crept higher and looked all set to make gains after last week’s steep sell-off to the sub-92 levels.

The US Treasury Yields Tuesday morning shrugged off Friday’s disappointing jobs data and climbed higher. The 10 Year US Treasury Yield was trading at 1.353%, considerably higher than Monday’s 1.324%, and was in the green zone. Auctions are scheduled to be held today for $51bn of 13-week bills, $48bn of 26-week bills, $34bn of 52-week bills, $45bn of 21-day bills, and $58bn of 3-year notes.

Global Markets:

The Asian markets ended mixed, with some major indices marching higher, as China’s trade data indicated solid global demand, and the investors have their eyes set on several central bank meetings, to decide on stimulus tapering, in the UK, Australia, and Canada. Shanghai closed 1.51% higher, and Hang Seng rose more than 205 points. Tokyo’s Nikkei advanced in excess of 256 points or 0.86%.

An unexpected tax hike in the UK and speculations regarding European Central Bank’s meeting weighed heavily over the sentiment in European markets, as major indices traded in red. FTSE, slid 0.20% soon after the opening, while CAC lost 0.09%. DAX and Stoxx-600 tumbled 0.19% and 0.16%, in that order.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.