Cyber (In)Security!

Good morning,

Festivities galore! People meet, shake hands and hug on July 4! Some much needed warmth amidst the cold, cold pandemic! Nothing could dampen the spirits. Independence day sparkles!

Not warm enough though! A mass ransomwarehas affected companies in as many as 17 countries. The hackers now demand $70 million to restore data, as per a ‘dark web’ posting.

Only last month JBS, world’s largest meat processing company, paid $11 million in ransom following a similar cyber attack.

Speaking of Cyber Security, days after it made an NYSE debut Didi Global has been asked to take down its app from app stores in China, following allegations of illegally collecting users’ data. The stock was down 5% Friday.

The CyberSpace Administration of China has opened a similar probe against three other Tech firms as well.

US Markets:

A solid jobs report, 850,000 new non-farm jobs added and an increase in hourly wages for June- buoyed the markets overall Friday.

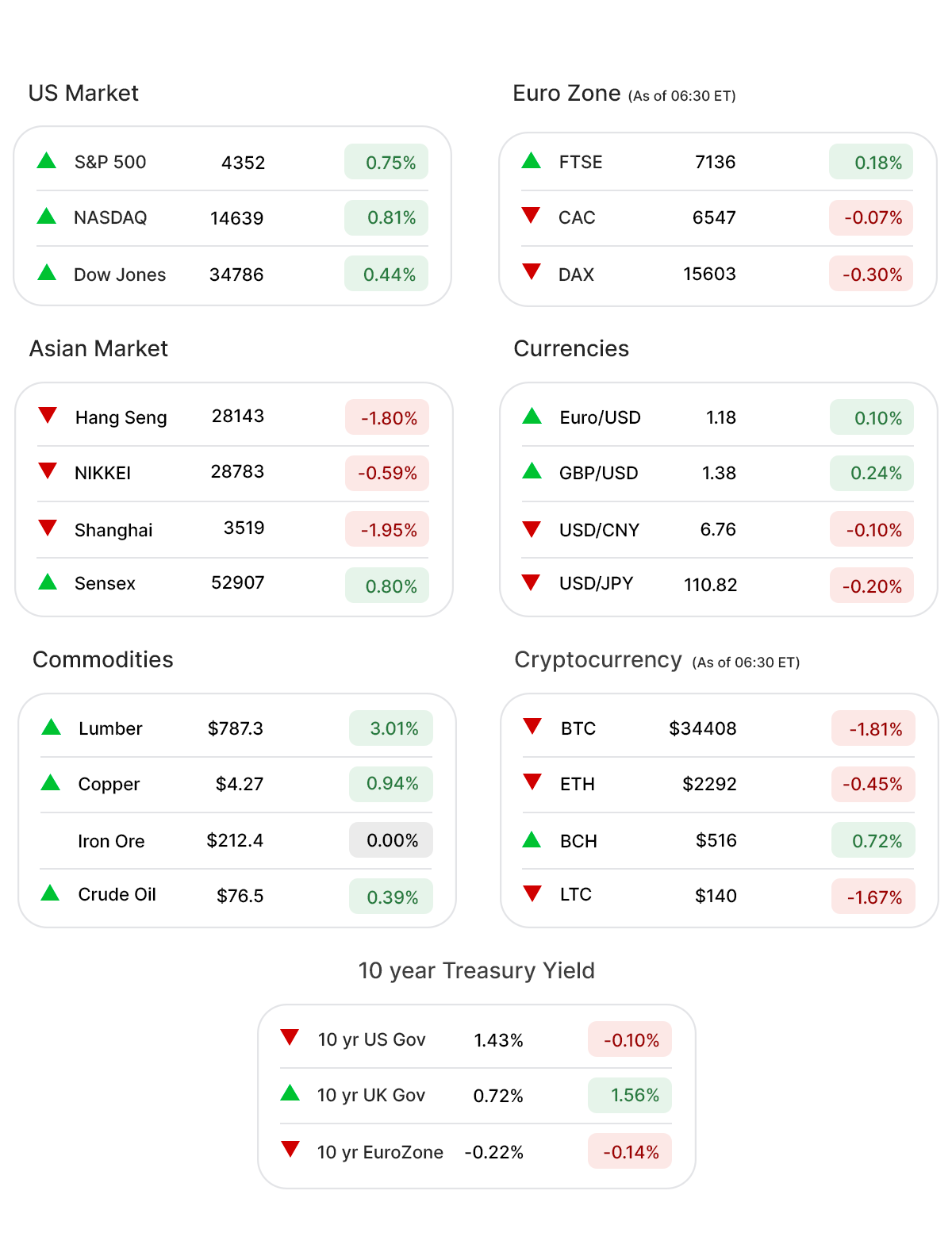

S&P 500 (0.75%▲) recorded another solid run, the seventh record close in a row!

Energy (-0.20%▼) and Financials (-0.20%▼) were the only losing sectors at S&P 500, while all the other nine were in the green zone led by Technology (1.39%▲) and Consumer Discretionary (1.08%▲).

The rally in Tech was led by the giants Apple Inc. (AAPL, 1.96%▲), Microsoft Corporation (MSFT, 2.23%▲), Amazon Inc. (AMZN, 2.27%▲), Nvidia Corporation (NVDA, 1.36%▲) and Alphabet Inc. (GOOGL, 2.30%▲).

Healthcare (0.93%▲), Utilities (1.13%▲), Industrials (0.80%▲) and Communication Services (0.91%▲) had a great run as well.

Tech heavy Nasdaq (0.81%▲) and Dow (0.44%▲), led by the Tech sector, also did well.

Well, the markets remain closed today and we guess we can have a look in hindsight, an overview of how things have panned out thus far in the S&P 500 (15.87%▲), year to date.

Pandemic is not over yet but the economies around the world have been opening up steadily creating a solid demand for fuel. Crude Oil rose from the depths of minus $38 per barrel in April 2020 to more than $75 a barrel now!

No surprises here! The Energy Sector, (+44.52%▲), has grossly outperformed the market! The sector hit 145% gains, a 52 week high, in June this year from where it was pre-pandemic, March 2020.

Energy apart, there are four other sectors that have outperformed the index, Financials (+25.21%▲), Real Estate (+22.74%▲), Communication Services (+21.28%▲) and Industrials (+16.49%▲) among them.

Among Financials, Consumer Finance (+43.78%▲), led the sector and emerged as the second best performing industry overall. The industry has a 52 week high of more than 110%.

A boom in Housing has fuelled the Building Products (+29.58%▲) industry from the Industrials sector and a liberal tax credit to the Semiconductor & Equipment (+20.84%▲) manufacturing has propelled forth the segment from the Tech sector.

Consumer Staples (+3.66%▲) and Utilities (+2.01%▲) are two of the worst performing sectors, year to date, in S&P 500. That, however, had no bearing on Personal Products (+19.30%▲) and the Tobacco (+19.31%▲) industry in the consumer staples sector.

And in case you are wondering about the stocks, here is the list that made to the Top Ten:

Marathon Oil Corporation (MRO, 107.65%▲), DiamondBack Energy Inc. (FANG, 102.60%▲), , L Brands Inc (LB, 99.11%▲), Occidental Petroleum (OXY, 88.2%▲), Devon Energy Corporation (DVN, 84.88%▲), Generac Holdings Inc. (GNRC, 82.58%▲), Nucor Corp. (NUE, 81.46%▲), EOG Resources Inc. (EOG, 72.02%▲), Ford Company. (F, 69.85%▲) and Hess Corp. (HES, 67.02%▲).

Enough of the year, let us take a look at what else is making news today!

The “Great Resignation” is here. 4 Million people left their jobs in April, the biggest spike on record!

And a retirement that took all the spotlight! Jeff Bezoshas stepped down as Amazon chief! At 57, Jeff retired with $197 Billion, 739489 times the median American’s retirement wealth! Some dough he has accumulated!

Speaking of wealth, Global Equity Funds are getting pumped in with some serious money, globally. By now $580 billion has already been injected into the category this year.

Minutes of the Fed (FOMC) June meeting will be released Wednesday and are all set to provide investors a better sense of when the Fed officials might start tapering that stimulus.

Reddit Trading group WallStreetBets has gone private, many of the 10 million members will be left out from the group that initiated a mega GameStop (GME, -0.71▼) short squeeze in January and also pushed AMC Entertainment (AMC, -4.20▼) to $70 in June.

Global Markets:

Most of Asian Markets ended in green today barring Nikkei 225 (0.64%), Hang Seng (0.59%) and Jakarta composite (0.29%). Taiwan-weighted lead the pack +1.18%, followed by Nifty +0.73%. Hang Seng remained weak as tech firms slumped after Beijing’s latest measures against online platform companies and ride-hailing firm Didi. Nikkei hits 2-week low as virus, political concerns weigh on Japanese shares.

Bloomberg economists have forecasted China’s Inflation data on Friday to rise by 8.7% after the 9% rise in May 2021 (Highest since financial crisis of 2008).

European Markets are riding the positivity! As the President of European Commission, Ursula Von Der Leyen, expressed confidence that all 27 countries of the Union will be “fully recovered from Covid crisis” by the end of next year, the commission looks all set to upgrade its growth forecasts for the next two years.

Meanwhile on Researchfin.ai

There are 28 new trade setups identified by the AI in the last trading day. Please sign-up for our app, if you already haven’t, to learn about these setups.

Thank you for taking the time out on a holiday!

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.

Thank you for taking the time out on a holiday!

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.