Data Crunching!

Good Morning!

Now that the bulk of the S&P 500 companies have reported results, how is it all summing up! The “blended” net profit margin for the second quarter for them is 13.1 per cent, according to FactSet data, the highest on records since 2008. A 90.8 per cent year-on-year EPS growth for the quarter, marking the strongest quarterly growth since the end of 2009. Over the same quarter, revenues are on track for the strongest growth since 2008 with a 25.2 per cent increase.

Are margins still intact for Corporate America? Many companies have flagged margin pressures as supply chains reel under several issues - 35 per cent chance a vessel arrives on time, compared with 80 per cent this time last year, Air freight demand skyrocketing, larger terminals like Chicago reporting delays of up to two weeks for cargo collection and dire conditions on the trucking front severely exacerbated by Hurricane Ida.

Reviewing Thursday's economic data:

Improving Labour Market: For the week ending August 28, initial claims decreased by 14,000 to 340,000 , which is the lowest level since March 14, 2020. Continuing claims for the week ending August 21 decreased by 160,000 to 2.748 million, which is also the lowest level since March 14, 2020.

Narrowing Trade Deficit: The trade deficit for July narrowed to $70.1 billion from an upwardly revised $73.2 billion (prior -$75.7 billion) in June and slightly narrower than the average real trade deficit for Q2. That will compute as a positive input for Q3 GDP forecasts.

Slow pace of Order growth: Factory orders for manufactured goods increased 0.4% m/m in July, as expected, following a 1.5% increase in June. Shipments of manufactured goods were up 1.6% after increasing 1.9% in June. The slow pace of order growth in July owes to headwinds created by the Delta variant and supply chain bottlenecks.

Downward revision of Productivity: Q2 productivity was revised down to 2.1% from the advance estimate of 2.3% and unit labor costs were revised up to 1.3% from the advance estimate of 1.0%.

US Markets:

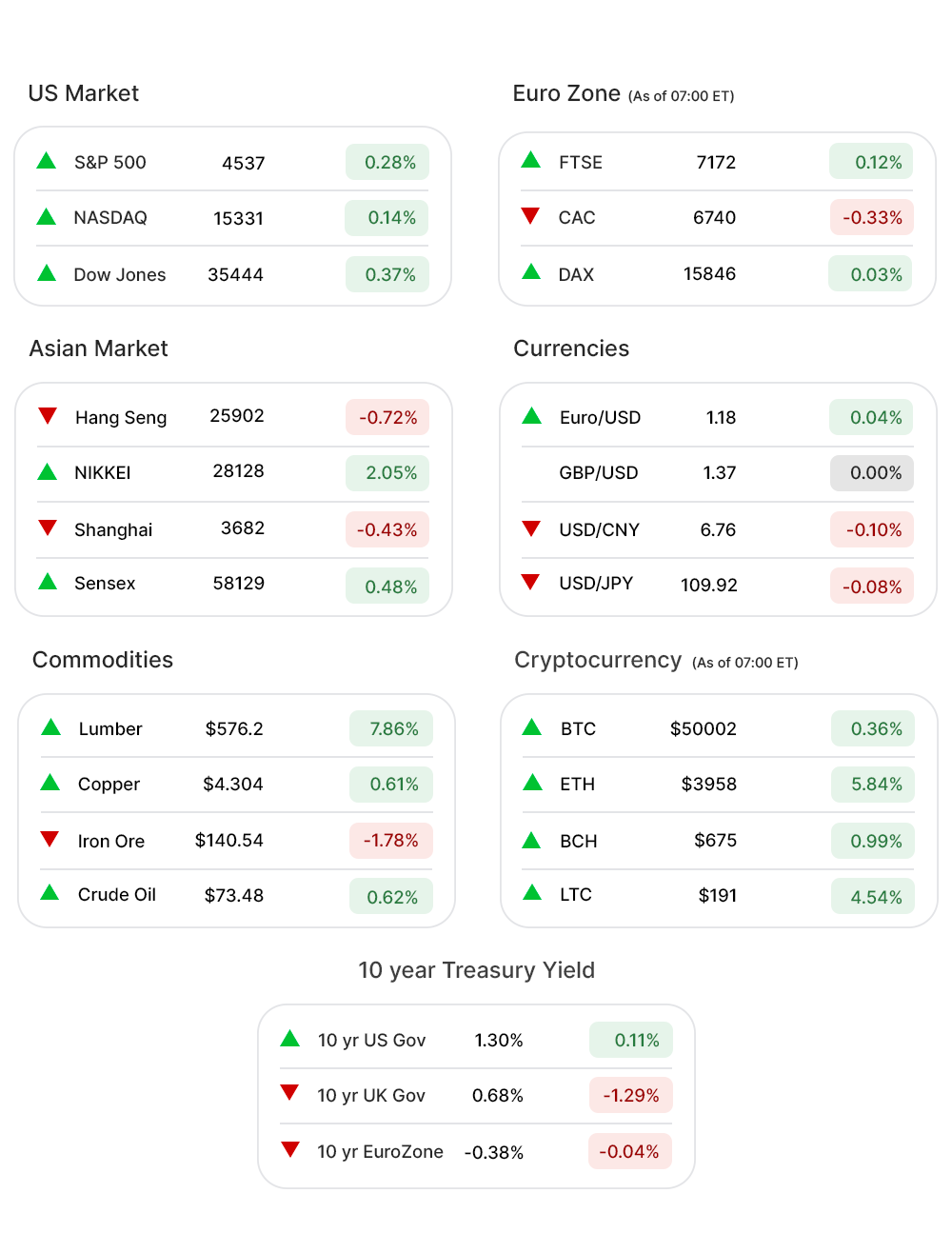

Thursday was more of a value-oriented session amid continued improvement in the weekly initial and continuing claims report. The S&P 500 (0.3%▲) and Nasdaq Composite (0.1%▲) eked out intraday and closing record highs, although they closed off session highs amid softness in the growth stocks. The Dow Jones Industrial Average increased 0.4% while the Russell 2000 increased 0.7%.

The shift into "value" was best manifested in the 0.6% gain in the Russell 1000 Value Index, while the Russell 1000 Growth Index closed flat. The S&P 500 Energy (2.5%▲) and Industrials (1.0%▲) sectors, two cyclical groups, were pockets of strength.

The S&P 500 information Technology (-0.1%▼), CommunicationServices (-0.7%▼), and Consumer Discretionary (-0.1%▼) sectors, which contain the mega-cap stocks, were the only sectors that closed lower.

Futures!

Futures looked set for a positive opening!

As of 07:00 ET, all the indices were green, without an exception: Dow Futures (0.18%▲), Nasdaq Futures (0.12%▲), and S&P 500 Futures (0.18%▲).

Key Movers in Small Cap:

Cybersecurity provider SecureWorks Corp (SCWX, 14.51%▼) reported a second-quarter FY22 revenue decline of 3.1% year-on-year to $134.2 million, missing the analyst consensus of $134.97 million. The Relative Volume of the stock was 6.5.

Asana (ASAN, 15.37▲) Q2 revenue of $89.5 million, up 72% year-on-year, beat the analyst consensus of $82.4 million and forecast higher sales. The Relative Volume of the stock was 6.

Texas Capital Bank (TCBI, 10.30%▼) drops as analysts’ downgrades amid ‘much higher’ expenses in the new strategy push. The Relative Volume of the stock was 4.9.

The other movers in the small-cap segment included:

American Outdoor Brands Inc (AOUT, 7.63%▼): Relative Volume 4.7.

Smith & Wesson Brands Inc (SWBI, 11.21%▼): Relative Volume 4.6.

Semtech Corporation (SMTC, 10.92%▲): Relative Volume 4.6.

Key Movers in Large Cap:

Hill-Rom Holdings Inc. (HRC, 4.65%▲), the medical equipment maker is all set to be acquired by Baxter International Inc. for $10.5 billion in cash a month after reports that its initial bid was rejected. The relative volume of the stock was 7.7.

Five Below Inc (FIVE, 13.01▼) is trading lower Thursday after the company announced mixed second-quarter financial results that showed earnings more than doubled but sales came in a little short of expectations. The relative volume of the stock was 7.4.

Ncino Inc (NCNO, 15.02%▲) traded sharply after second-quarter sales came in higher than expected. Second-quarter sales of $66.5 million, up 36% from a year ago and topping its previous outlook for revenue as high as $64 million. The relative volume of the stock was 5.8.

The other movers in the large-cap segment included:

Charge Point Holdings Inc (CHPT, 8.20%▲): Relative Volume 5.6.

Quanta Services Inc (PWR, 12.06%▲): Relative Volume 4.2.

Credit Acceptance Corp. (CACC, 11.76%▲): Relative Volume 3.9.

Report Card:

Hewlett Packard Enterprise Co (HPE, 0.33%▲) came out with quarterly earnings of $0.47 per share, beating the analysts’ estimate of $0.42 per share. This compares to earnings of $0.32 per share a year ago. HP posted revenues of $6.9bn for the quarter, compared to $6.82bn a year ago.

G-III Apparel Group, Ltd. (GIII, 0.43%▲) total revenues for the three-month period ending July 31 were $483 million, up from $297 million a year ago. G-III logged $19.1 million in profits as a result, compared with losses of $14.9 million last year.

Cantaloupe Inc (CTLP, 0.59%▲) delivered record revenue in the fourth quarter of $49.0 million, an increase of 14.6% versus the third quarter of 2021, and an increase of 50.2% y-o-y.

Cinedigm Corp (CIDM, -3.85%▼) generated net income of $5.0 million, or $0.03 per share, versus a net loss of $19.9 million, or $(0.21) per share, in the prior-year quarter;

On the Lookout:

Investors will receive the Employment Situation Report for August, the ISM Non-Manufacturing Index, and the final IHS Markit Services PMI for August today.

Unusually high shorter-term CALL options activity seen on Quantumscape Corp (QS, 1.17%▲), Albertsons Companies Inc (ACI, 9.61%▲), Chewy Inc (CHWY, 9.29%▼), Virgin Galactic Holdings Inc (SPCE, 2.95%▼), and Sonos Inc (SONO, 0.17%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Western Digital Corp. (WDC, 0.98%▲), Apple Inc. (AAPL, 0.75%▲), Smartsheet Inc (SMAR, 0.36%▼), Oracle Corporation(ORCL, 0.17%▼), and Garmin Ltd. (GRMN, 0.10%▲) among others.

Other Asset Classes:

The Treasury market held steady ahead of the August employment report. The 2-yr yield was unchanged at 0.21%, and the 10-yr yield decreased one basis point to 1.29%.

The dollar index (92.23, -0.2%▼), which measures the US currency against six others, traded flat on Friday at around its weakest in a month. The euro was steady against the dollar, purchasing $1.1878. Sterling was also unchanged at $1.1383. Brent crude, the oil benchmark, fell 0.1 percent to $72.93.

Global Markets:

In Asia, Japan’s Nikkei 225 closed more than 2 per cent higher, after the nation’s prime minister Yoshihide Suga said he would step down and traders bet on his successor unleashing more economic stimulus.

Hong Kong’s Hang Seng index dropped 0.8 per cent, dragged down by stocks in China’s technology sector, which has been the subject of an intense regulatory crackdown. Mainland China’s CSI 300 lost 0.6 per cent, with consumer, industrial and materials companies falling the most after the nation’s manufacturing industry slowed and the government implemented strong measures to control new outbreaks of coronavirus.

European stocks drifted Friday as investors held back from placing bets ahead of the US jobs data. The Stoxx Europe 600 index opened 0.2 per cent lower, remaining close to its all-time high following seven months of gains driven by a sharp rebound in corporate earnings from last year’s pandemic-induced downturn. FTSE 100 traded flat.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: BJs Wholesale Club Holdings Inc (BJ), DexCom, Inc. (DXCM), Avantor Inc (AVTR), Axonics Inc (AXNX), Sun Communities (SUI), ICON plc (ICLR), Builders FirstSource Inc. (BLDR), Signet Jewelers Ltd. (SIG), Semtech Corporation (SMTC), Ambarella Inc (AMBA), and Zentalis Pharmaceuticals (ZNTL). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Wish you a fab weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.