“Don’t” Return to Office!

Good Morning!

The pandemic is far from over! The uncertainty of Covid-19 was evident as Microsoft Inc scrapped its return-to-work date - earlier set to be October 4 without committing a new date.

Historic! Beijing has decided to auction state crude oil reserves to some domestic refineries, for the first time ever, to cool off high raw material costs for manufacturers. Crude Oil fell to a two-week low before rebounding.

The lady isn’t tapering! The ECB has slowed its bond purchases, but President Christine Lagarde said that the Bank was recalibrating and not tapering.EU inflation in August notched a decade high of 3%, and the GDP across the 19 member common-currency bloc surged 2%. EU markets inch higher.

Delta makes the UK economy crawl! In July, amid a resurgence of Covid, the Economic Output rose just 0.1%- lowest since January - way lower than the estimated 0.6%. Only 2 of the 26 analysts had predicted such a weak reading. FTSE rallied regardless.

The passage out of India! Ford Motors has decided to stop manufacturing in India and “restructure” its operations, as thousands will be left jobless. The company will spend$2bn in restructuring the India operations.

Toyota hit! The world’s largest carmaker until recent months could escape the chip shortages thanks to its large chip inventory and supply chain management experience from past natural disasters. But the carmaker announced that annual production would be trimmed by 3 percent.

Initial Jobless Claims have hit another pandemic-era low of310,000, considerably lower than the expected 335,000 and the previous week’s 345,000. Continuing Jobless Claims have fallen by 22,000 to 2.78m, higher than the estimated 2.73m.

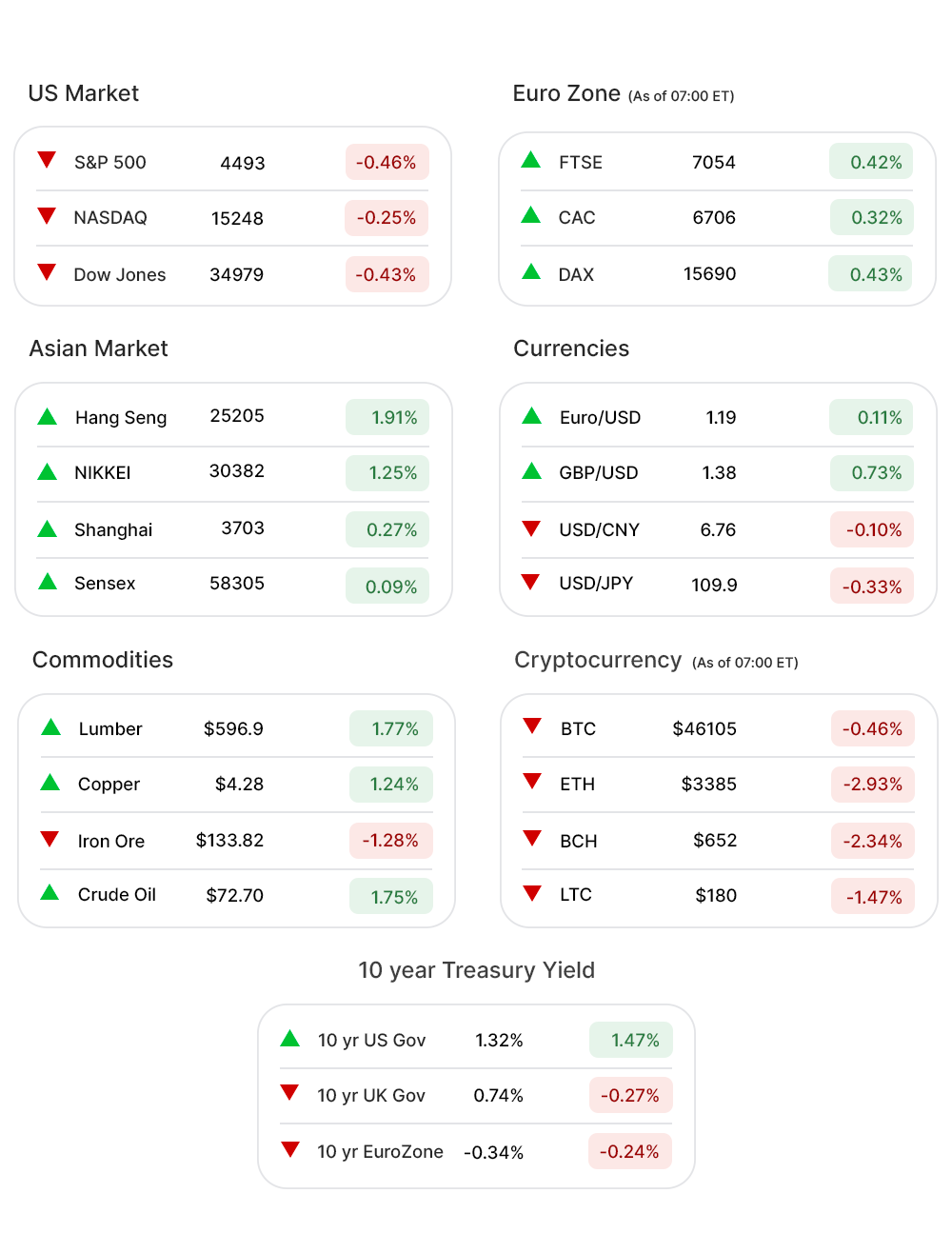

US Markets:

A volatile trading day ended with stocks suffering losses for the fourth consecutive trading session Thursday, as mixed economic data kept investors on the edge about the timing of stimulus tapering.

S&P 500 (-0.46%▼) shed an intra-day gain and closed at 4493.28. Dow Jones (-0.43%▼) tumbled more than 150 points, while Russel 2000 (-0.02%▼) closed in the negative territory, only marginally.

Tech heavy Nasdaq (-0.38%▼) also continued with the losing ways as well.

Sectors at the S&P 500 were mixed, with only Energy (0.12%▲), Materials (0.07%▲), and Financials (0.24%▲) eking out some gains.

Real Estate (-2.12%▼) and Healthcare (-1.17%▼) were at the bottom of the losing sectors, followed by Technology (-0.42%▼), Communication Services (-0.32%▼), Consumer Staples (-0.31%▼), Utilities (-0.80%▼), Consumer Discretionary (-0.28%▼), and Industrials (-0.47%▼).

Futures!

The US stock futures looked to take a cue from the Global Markets.

As of 07:00 ET, all the indices were in in the positive territory, without an exception: Dow Futures (0.48%▲), Nasdaq Futures (0.44%▲), S&P 500 Futures (0.41%▲), and Russell 2000 Futures (0.66%▲).

Key Movers in Small Cap:

Humanigen Inc (HGEN, -47.25%▼) has got its Emergency Use Authorization (EUA) request for Lenzilumab in hospitalized Covid-19 patients, rejected by the FDA. The Relative Volume of the stock was 39.7.

Gevo Inc (GEVO, 37.13%▲) and Chevron Corp have announced the intent to jointly invest in building and operating one or more new facilities that would process inedible corn to produce sustainable aviation fuel. The Relative Volume of the stock was 22.8.

Invacare Corp (IVC, -39.94%▼) expects slower growth for full-year 2021, owing to labor, material, and freight headwinds. The Relative Volume of the stock was 20.8.

AeroVironment Inc (AVAV, -12.80%▼) reported Q1 results for the fiscal year 2022 (ended July 31, 2021) delivering an adjusted loss of $0.17 per share. The Relative Volume of the stock was 8.3.

The Lovesac Company (LOVE, 24.10%▲) reported financial results, beating expectations by a wide margin. The Relative Volume of the stock was 6.8.

The other movers in the small-cap segment included:

Cardiff Oncology Inc (CRDF, -0.85%▼): Relative Volume 14.3.

Siga Technologies Inc (SIGA, 0.89%▲): Relative Volume 7.6.

Byline Bancorp Inc (BY, -0.92%▼): Relative Volume 7.5.

Oportun Financial Corp. (OPRT, -1.53%▼): Relative Volume 7.4.

Inogen Inc (INGN, -15.48%▼): Relative Volume 6.4.

Key Movers in Large Cap:

Certara Inc (CERT, -3.36%▼) announced the pricing of its secondary public offering, at $31 per share to the public. The relative volume of the stock was 10.7.

Lululemon Athletica Inc (LULU, 10.47%▲) hit an all-time high after Wednesday’s after-market financial report beat expectations comprehensively. The relative volume of the stock was 7.3.

Biogen Inc (BIIB, -6.66%▼) has reported that its newly approved Alzheimer’s drug, Aduhelm, was off to a slower-than-expected start since its commercial launch roughly three months ago. The relative volume of the stock was 4.1.

The other movers in the large-cap segment included:

PTC Inc (PTC, -1.85%▼): Relative Volume 4.9.

W. R. Grace & Co (GRA, 0.42%▲): Relative Volume 4.9.

Lennar Corporation (LENB, -0.72%▼): Relative Volume 4.1.

Agilon Health Inc (AGL, -2.54%▼): Relative Volume 4.0.

RH (RH, 7.78%▲): Relative Volume 4.0.

Report Card:

A-Mark Precious Metals (AMRK, 5.73%▲) reported an EPS of $4.28, comprehensively ahead of the estimated $2.40, and last year’s $2.49. The revenue of $2.1bn beat the expectations by 21.37%. The stock climbed more than 8% after hours.

Net sales of the Academy Sports & Outdoors Inc (ASO, 1.54%▲) increased 11.5% y-o-y to an all-time quarterly high of $1.79bn. The gross margin of the company increased 29.4% to $642.5m. The stock continued to climb after hours.

National Beverage Company (FIZZ, 1.39%▲) reported earnings of $0.58 per share, ahead of the estimated $0.48 per share, but lower than last year’s $0.55. The revenue of $311.71m surpassed the estimates by 7.34%. The stock soared more than 5% after hours.

Verint Systems Inc (VRNT, -0.99%▼) reported a profit of 58 cents per share, ahead of the estimated earnings of 48 cents per share. The revenue of $215.6m was also more than the expected $209m. The stock climbed more than 1% after hours.

On the Lookout:

The Producer Price Index for the month of August is expected to decline to 0.6% from the previous print of 1.0%.

The Wholesale Inventories (revision), for the month of July, is expected to remain unchanged at 0.6%.

Unusually high shorter-term CALL options activity seen on Gap Inc. (GPS, 1.23%▲), International Game Technology (IGT, 1.59%▲), Gevo Inc. (GEVO, 37.13%▲), Wisekey International Holding (WKEY, -6.44%▼), and BioNTech (BNTX, 4.50%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Freeport-McMoRan Inc (FCX, 1.28%▲), Rocket Lab USA Inc (RKLB, 37.31%▲), AMC Entertainment Holding (AMC, 2.38%▲), Take Two Interactive Software Inc (TTWO, -1.52%▼), and ZIM Integrated Shipping (ZIM, 4.33%▲) among others.

Other Asset Classes:

Crude Oil Prices - Prices clawed back, early Friday morning, after falling to a two-week low late Thursday as China announced plans to release state oil reserves. The US weekly crude draw being smaller than expected had pulled down the prices as well. Brent traded a little over $72 per barrel mark, Friday morning, while WTI Crude was hovering a little over the $68 per barrel mark.

The US Dollar (92.38, -0.11%▼) is struggling to find direction even as concerns on economic recovery, in wake of a Covid spike, grow louder.

The US Treasury Yields were buoyed early Friday morning as the US Jobless Claims fell to a pandemic era low. The 10 Year US Treasury Yield was trading into the green zone at 1.324%.

Global Markets:

The Asian Markets rebounded Friday as concerns eased around stimulus tapering by central banks, and China authorities clarified that Beijing won’t halt new game approvals. The tech shares in Hong Kong enjoyed a rally, after Thursday’s steep drawdown. Hang Seng gained 466 points or 1.81%, Tokyo’s Nikkei gained 373 points or 1.25%, while Shanghai closed in the green zone, up 0.27%.

European markets, after hitting a three-week low Thursday, regained some semblance as the ECB clarified that it was calibrating but not tapering emergency support. FTSE, was up 0.31% soon after the opening, while CAC had gained 0.22%. Both DAX andpan-EU index Stoxx-600 was up 0.19%.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Retail Value Inc. (RVI), Costamare Inc (CMRE), California Resources Corp (CRC), and Ambarella Inc. (AMBA). Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Have a joyous weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.