Earnings Booster Against Covid Scare!

Good Morning,

Frauds, Scams and Abuses! This is what SEC Chair, Gary Gensler, thinks the Crypto market is rife with, as he has asked the Congress for additional powers to protect investors in the “wild west” Crypto markets. Bitcoin tanks well below the 40k mark!

Resurgence of the Virus! China has imposed travel restrictions and ordered mass testing, as daily cases have been more than 90 for three consecutive days, threatening the growth in the only major economy that showed some promise last year.

With great power comes great responsibility! Amazon, with a widespread increase in its workforce, is facing a mushrooming of challenges to its ‘labor practices’, underscored by a hearing officer for the National Labor Relations Board recommending a new union election at a warehouse in Alabama.

The deepening chip shortage! With some experts thinking the Global Semiconductor shortage might extend to 2023, governments across the world are investing heavily in domestic semiconductor markets. A recent US bill allocated $52bn to semiconductor research & manufacturing. South Korea and China are spending billions as well.

After a dismal debut, Robinhood stock is back with all its might. The stock climbed 24% Tuesday, well above its IPO price.

US Markets:

The markets on Tuesday were buoyed by a bunch of better than expected earnings reports as investors, at least for now, shrugged off concerns over rising Covid cases in the country and the world over.

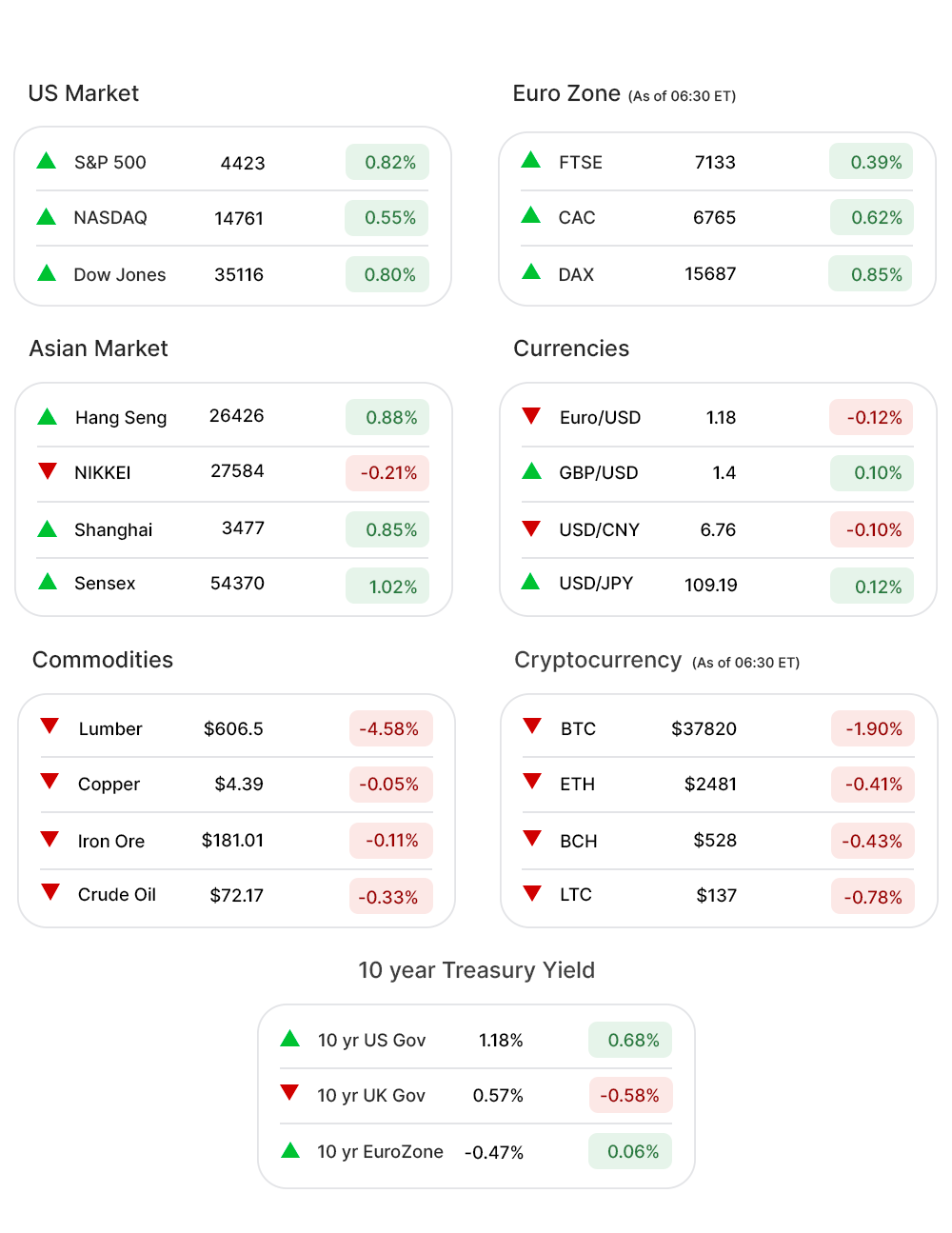

Dow Jones (0.80%▲) gained 278 points to close well over the 35k mark. S&P 500 (0.82%▲) rose as much with a gain of 35 points. Nasdaq (0.55%▲), being the only green index on Monday, slightly underperformed other indices Tuesday.

Sectors at the S&P 500 were all green, with an exception of Communication Services (-0.19%▼).

Energy (1.84%▲), Financials (1.13%▲), Healthcare (1.41%▲), Industrials (1.37%▲), and Materials (1.01%▲) were the front-running sectors at the broader index.

Technology (0.69%▲), Consumer Discretionary (0.77%▲), and Utilities (0.60%▲) made some gains as well.

Futures!

As the morning progressed, the Futures slid quietly into the red zone barring Nasdaq that remained afloat with slight gains.

As of 06:00 ET: Nasdaq Futures (0.05%▲), S&P 500 Futures (0.07%▼), Russell 2000 Futures (0.16%▼), and Dow Futures (0.11%▼).

Key Movers in Small Cap:

Translate Bio Inc (TBIO, 29.23%▲) has agreed to be acquired by French biotech giant Sanofi, in a deal valuing TBIO at roughly $3.2bn or $38 per share. The relative volume of the stock was 28.8.

Arcturus Therapeutics (ARCT, 68.06%▲) announced Tuesday that Singapore regulators have approved the advancement of two messenger RNA Covid-19 vaccine candidates into phase 1/2 clinical testing. The relative volume of the stock was 24.9.

A developer of non-invasive treatments for psychological disorders, Neuronetics Inc (STIM, -41.98%▼) reported a loss of $0.29, per share, well below the estimated loss of $0.24, for Q2. The relative volume of the stock was 20.5.

The video services provider, Harmonic Inc (HLIT, 23.03%▲) reported better than expected Q2 earnings. The revenue of $113.4m was well above the estimated 108.3m. The relative volume of the stock was 8.5.

The online insurance marketplace, EverQuote Inc (EVER, -16.12%▼) reported a loss of 7 cents per share, for Q2, narrower than the estimated loss of 10 cents per share. The relative volume of the stock was 8.3.

The other movers in the small-cap segment included:

NGM Biopharmaceuticals. (NGM, -4.00%▼): Relative Volume 10.8.

Travelcenters of America (TA, 21.36%▲): Relative Volume 7.5.

SeaSpine Holdings (SPNE, -20.73%▼): Relative Volume 7.0.

SI-Bone Inc (SIBN, -14.84%▼): Relative Volume 7.0.

Key Movers in Large Cap:

The Clorox Company (CLX, -9.50%▼) reported an adjusted profit of 95 cents per share, falling well below the estimated $1.36 - on sales of $1.8bn, also below the expected $1.92bn. The company’s outlook for fiscal 2022 is also disappointing. The relative volume of the stock was 6.1.

The fiber laser technology company, IPG Photonics (IPGP, -18.30%▼), reported a net income of $68.9m, or $1.29 per share, well below the expected $1.40 per share for Q2. The relative volume of the stock was 6.0.

The information technology company Leidos Holdings (LDOS, -10.94%▼) reported a disappointing bottom line, in Q2 earnings, with an adjusted EPS of $1.52 short of the estimated $1.58. The relative volume of the stock was 5.1.

The other movers in the large-cap segment included:

Fidelity National Information. (FIS, -6.27%▼): Relative Volume 4.8.

Take-Two Interactive Software (TTWO, -7.71%▼): Relative Volume 4.5.

Woodward Inc (WWD, -7.18%▼): Relative Volume 4.3.

Reynolds Consumer Products (REYN, -0.57%▼): Relative Volume 4.3.

Report Card:

The Chinese e-commerce giant Alibaba Group (BABA,-1.35%▼) reported an adjusted EPS of $2.57, beating the estimates of $2.22. The revenue of $31.87bn, although 34% higher y-o-y, was below the expected $32.4bn. The stock continued to be red after hours.

The athletic equipment and apparel company, Under Armour Inc (UAA, 7.53%▲), crushed the estimates on its Q2 earnings, reporting an adjusted EPS of 24 cents against the expected 6 cents. Revenue of $1.4bn was also ahead of the estimated $1.2bn. The stock fell a little less than 1% after hours.

Simon Property Group (SPG, 2.55%▲), the REIT company, reported an income of $617.26m, or an EPS of $1.88, against the estimated earnings of $1 per share. The revenue has grown 17.9% y-o-y to $1.25bn. The stock slid a little after hours.

Occidental Petroleum (OXY, 2.48%▲), after reporting a loss in Q2 last year, has announced an adjusted profit, attributable to common stockholders, of $311m or 32 cents per share. The revenue of $6.01bn is also ahead of the estimated $5.85bn. The stock continued to be in the green after hours.

On the Lookout:

The ADP Employment Report, due today, is expected to come with a print of 653,000 against the previous 692,000.

The data on Markit Services PMI (final), ISM Services Index and Treasury Quarterly Refunding Announcement is due this morning as well.

Unusually high shorter-term CALL options activity seen on Snowflake Inc (SNOW, 6.07%▲), CBS Corporation (VIAC, -5.80%▼), Advanced Micro Devices (AMD, 3.62%▲), Pfizer Inc. (PFE, 3.91%▲), and Vericel Corporation (VCEL, -2.58%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Fidelity National Information (FIS, -6.27%▼), General Motors. (GM, 1.49%▲), Uber Technologies. (UBER,-1.61%▼), Trip.Com Group. (TCOM, -5.39%▼), and Translate Bio Inc (TBIO, 29.23%▲) among others.

Other Asset Classes:

Crude Oil prices continued to slump for the third straight day as concerns keep mounting over potential trimming of global oil demand amid rising cases of the delta variant. Brent was trading below the $73 per barrel mark, early Wednesday morning while the WTI Crude made was ahead of the $70 per barrel mark.

The US Dollar (92.10, 0.02%▲) kept hovering near the 92 mark. The greenback has lost more than 1% from a 15-week peak attained a fortnight ago. With the Fed remaining dovish on monetary policy, the dollar is expected to remain bearish.

US Treasury Yields rose slightly early Wednesday morning ahead of the employment data for July, scheduled for today. The 10 Year US Treasury Yield added less than a basis point reaching 1.182% while the 30 Year Treasury Yield advanced to 1.854%, by adding less than a basis point.

Global Markets

Asian Markets, mirrored the wall street gains of Monday with most of the markets closing in green Wednesday. The investors, however, have their eyes fixed on the delta variant outbreaks across the world, China in particular. Hang Seng closed 0.88% higher as Shanghai gained almost as much for the day. Nikkei, slumped by more than 50 points.

European Markets followed the cue and opened higher, Wednesday morning. The FTSE-listed financial services company Legal and General announcing a 14% increase in its operating profit, among other earnings reports, also gave some much-needed impetus to the EU markets. Pan European index Stoxx-600 was up 0.51% early morning.

Meanwhile on Researchfin.ai

On a roll! Many trade setups identified by our AI reached their respective profit targets yesterday within their optimal holding period: Carrier Global (CARR), Avantor Inc. (AVTR), Power Integrations Inc (POWI), Atlassian Corp. (TEAM), Harmonic Inc (HLIT), Deckers Outdoors (DECK), Crocs Inc (CROX), Ares Management (ARES), Credit Acceptance Corp. (CACC), Navient Corp (NAVI), Edwards Lifesciences (EW), Hologic Inc (HOLX) and DXC Technology (DXC).

There are many more new trade setups identified by the AI yesterday. Please download our app Researchfin.ai for iOS and Android.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.