Fed’s Moment of Truth!

Good Morning,

First, we have an update before we share news from around the world. We have updated our app to enhance your stock analysis experience. The Ideal Trade Setup feature will provide better visibility of price points, while the Progress Tracker works to help you track stocks to their targeted profit or stop-loss with ease.

Here is the link to our user-manual guide.

Will Fed Chair, Jerome Powell, announce a tapering of monetary stimulus as he speaks, virtually, at the Jackson Hole event today, or will the Delta variant concerns weigh heavier - investors buckle up!

No country for Chinese tech firms! China is planning to ban overseas IPOs of tech companies whose data poses potential security risks and the companies with “ideology issues”. Hang Seng tech index fell by 0.2% after rising 2% in the morning.

EU Trouble for Nvidia! The EU regulators have initiated a probe into Nvidia’s $54bn takeover of the British tech company Arm, amid competition concerns.

Initial Jobless Claims edged a little higher, for the first time in five weeks, to 353,000 from last week’s revised 349,000 but remained near the pre-pandemic low. In January this year, the claims exceeded 900,000. Continuous Claims fell slightly, to 2.9m.

A sustained consumer-led rebound from the pandemic recession has allowed the US GDP to grow by a 6.6% annual rate in the last quarter, slightly lower than the expected 6.7%.

US Markets:

Stocks in the US wobbled throughout the day, Thursday and closed in the negative territory, snapping the three-day winning streak this week.

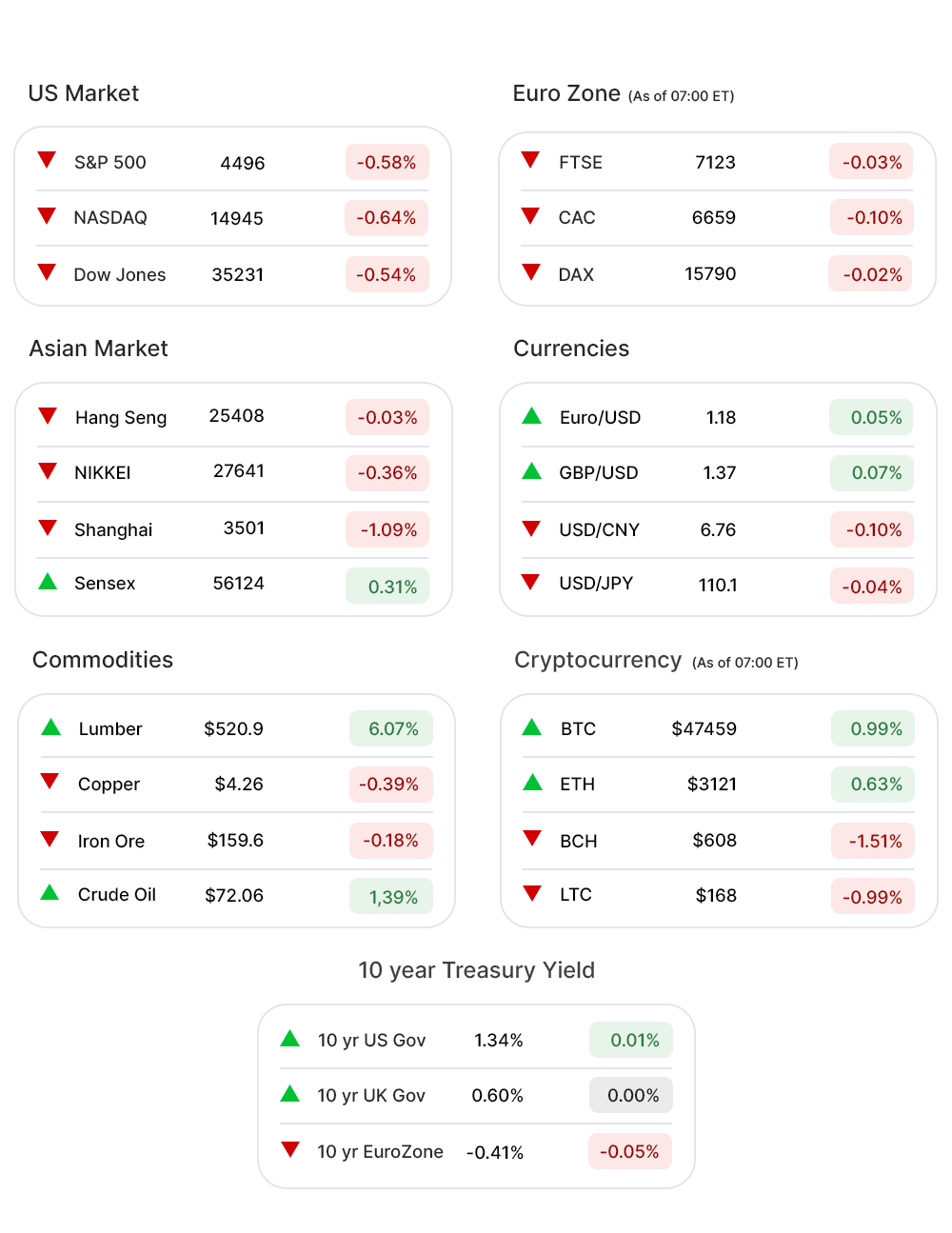

S&P 500 (-0.6%▼), retreated from Wednesday’s all-time high and slid by more than 26 points. Nasdaq (-0.6%▼) dropped 96 points, Dow Jones (-0.5%▼) lost in excess of 92 points, while Russel 2000 (-1.13%▼) shed a little more than 25 points.

Sectors at the S&P 500 were all red, barring Real Estate (0.10%▲).

Energy (-1.50%▼) was at rock bottom, followed by Consumer Discretionary (-0.73%▼), Communication Services (-0.72%▼), Technology (-0.62%▼), and Financials (-0.54%▼).

Healthcare (-0.40%▼), Consumer Staples (-0.50%▼), Utilities (-0.35%▼), Industrials (-0.43%▼), and Materials (-0.68%▼), were well below the zero mark.

Futures!

Futures looked upbeat despite the EU and Asian markets falling flat for the day.

As of 07:30 ET, all major indices were in green: Dow Futures (0.22%▲) Russell 2000 Futures (0.28%▲), Nasdaq Futures (0.32%▲), and S&P 500 Futures (0.27%▲).

Key Movers in Small Cap:

SelectQuote Inc (SLQT, -45.02%▼) reported a Q2 net income of $3.3m, down $16.7m y-o-y while the adjusted EBITDA of $21.3m was 47% down y-o-y. The relative volume of the stock was 17.2.

Lordstown Mortos (RIDE, 17.79%▲) has appointed Daniel Ninivaggi, a long-time auto veteran and former leader of Icahn Enterprises, as its CEO. The relative volume of the stock was 12.0.

Abercombie & Fitch (ANF, -10.35%▼) failed to meet expectations in its Q2 results. The relative volume of the stock was 5.2.

Beyondspring Inc (BYSI, 18.70%▲) has announced promising clinical trial results from its investigational lung cancer treatment. The relative volume of the stock was 5.1.

The other movers in the small-cap segment included:

Napco Security Technologies (NSSC, 3.98%▲): Relative Volume 9.3.

Monmouth RE Inv. Corp (MNR, -1.01%▼): Relative Volume 6.1.

Quanterix Corp. (QTRX, -9.21%▼): Relative Volume 5.3.

Aviat Networks. (AVNW, -13.25%▼): Relative Volume 5.1.

Key Movers in Large Cap:

Dollar Tree Inc (DLTR, -12.08%▼) reported better than expected earnings but the sales fell short of estimates. The relative volume of the stock was 7.7.

Pure Storage Inc (PSTG, 13.79%▲) managed to beat the estimates on earnings, ever so slightly. The relative volume of the stock was 6.3.

Maxim Integrated Products. (MXIM, -1.18%▼) will no longer trade, following its acquisition by Analog Devices Inc. Shareholders of Maxim will be granted 0.63 of a share of ADI common stock. The relative volume of the stock was 6.2.

Autodesk Inc (ADSK, -9.37%▼) earnings met the expectations but guidance fell short of estimates. The relative volume of the stock was 5.0.

Williams-Sonoma Inc (WSM, 9.34%▲) has announced a 20% quarterly dividend increase and a new $1.25bn stock repurchase authorization. The relative volume of the stock was 5.0.

The other movers in the large-cap segment included:

Bentley Systems Inc (BSY, -2.30%▼): Relative Volume 5.5.

Coty Inc. (COTY, 14.70%▲): Relative Volume 5.1.

Ulta Beauty Inc. (ULTA, -0.31%▼): Relative Volume 4.3.

Burlington Stores Inc. (BURL, -9.18%▼): Relative Volume 4.1.

Report Card:

Coty Inc. (COTY, 14.70%▲), the beauty company, reported adjusted earnings of -$0.09, falling short of the estimated $0.06, per share. The revenue came in at $1.06bn versus $0.56bn in the same period last year. The stock fell by 0.74% after hours.

Abercrombie & Fitch (ANF, -10.35%▼) reported sales of $865m, falling short of the estimated $879m. The EPS of $1.70, however, significantly beat the estimates of $0.77. The stock climbed by 0.14% after hours.

Dollar Tree Inc (DLTR, -12.08%▼) came out with an EPS of $1.23, ahead of the estimated $1.01. The revenue of $6.34bn fell short of the estimated $6.44. The stock made slight gains after hours.

Autodesk Inc (ADSK, -9.37%▼) reported a 16% y-o-y growth in revenue to $1.06bn, while the net income was up 18% to $115.6m, or $1.21 per share above the $1.13 per share estimate. The downgraded guidance spooked the investors. The stock went up by 0.59% after hours.

On the Lookout:

Personal Income is expected to rise from the previous print of 0.1% to 0.3% while Consumer Spending might go down from 1.0% to 0,3% as the date is revealed today.

Core PCE Price Index is expected to fall from 0.4% to 0.3%. The UMich Consumer Sentiment Index might increase from 70.2 to 71.0.

Fed’s Jackson Hole symposium will be held virtually today and Chair Jay Powell is expected to speak.

Unusually high shorter-term CALL options activity seen on Snap Inc (SNAP, -4.12%▼), Opendoor Technologies (OPEN, -3.30%▼), Avantor Inc. (AVTR, 0.02%▲), United Microelectronics (UMC, -1.33%▼), and Coty Inc (COTY, 14.70%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Gap Inc. (GPS, -4.11%▼), Walmart Inc (WMT, -1.08%▼), GDS Holdings Limited (GDS, 0.00%), Pure Storgae Inc (PSTG, 13.79%▲), and Texas Instrumentals Inc. (TXN, -0.06%▼) among others.

Other Asset Classes:

Crude Oil Prices - after a pullback on Thursday climbed again Friday morning as data showed that US Crude inventories fell, for a third consecutive week. Brent was up 1.52% and trading above the $72 per barrel mark, in the wee hours of Friday.

The US Dollar (93.05, -0.01%▼) kept hovering near the 93 mark as all eyes remained on Fed’s Chair Jerome Powell’s speech at the virtual Jackson Hole event.

The US Treasury Yields made slight gains Friday morning, ahead of the Fed event. The 10 Year US Treasury Yield was trading at 1.339%, early Friday morning.

Global Markets:

A quiet day at the Asian Markets with most of the indices in red as investors looked for guidance from Fed, on tapering, and Thursday’s pullback at wall street. Hang Seng fell by -0.03%, while Tokyo’s Nikkei slid over 100 points to end 0.36% lower. Shanghai made a 20 point gain by the close.

European markets behaved in sync with the Asian markets and for the same reasons. FTSE climbed a marginal 0.03% as CAC and DAX were into the negative territory, son after the markets opened. Pan EU Stoxx-600 was in the green zone.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Enjoy your weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.