Fed’s Rope Walk!

Hope you had a lovely weekend!

The Fed Chair, Jerome Powell, has said that the bond-purchase program will continue at the rate of $120bn per month until the Central Bank sees “substantial further progress” in reaching the goals of average inflation of 2% and maximum employment. Keeping ‘pro and anti-tapering’ sections in good humor!

The confidence free-fall! The UMich Consumer Sentiment Index has fallen by 13.4% in August, from July, recording the least favorable economic prospects in more than a decade.

Do you have a share? Fortesque Metals Group has announced to give out $8bn in dividends, after shipping out 182.2m tonnes of iron ore within the 2020-21 fiscal year, owing to an economic rebound in China!

The ‘Hoop’ hop! A manufacturer of fitness trackers, Hoop has reached a $3.6bnvaluation, following an investment by Japan’s Softbank. Investors look eager to take on giants in fitness wearable manufacturing!

Americans are earning more, spending less! The household income has risen by 1.1%, fastest since March, as tax credits worth up to an additional $1600 per child this year enhanced savings. Consumer spending slowed to 0.3%, compared to June’s spending increase of 1.1%.

The key inflation gauge, Core PCE Price Index, has risen by 3.6%, in sync with the expectations, but also highest in around 30 years.

$9.28tr private fund industry in China will be facing tougher regulations as authorities get more assertive in a bid to weed out mismanaged private funds.

Sun-lit Europe! Sunshine produced a record 10% of total electricity in the EU, during this year’s sunny months, a leap from just 6% three years ago.

US Markets:

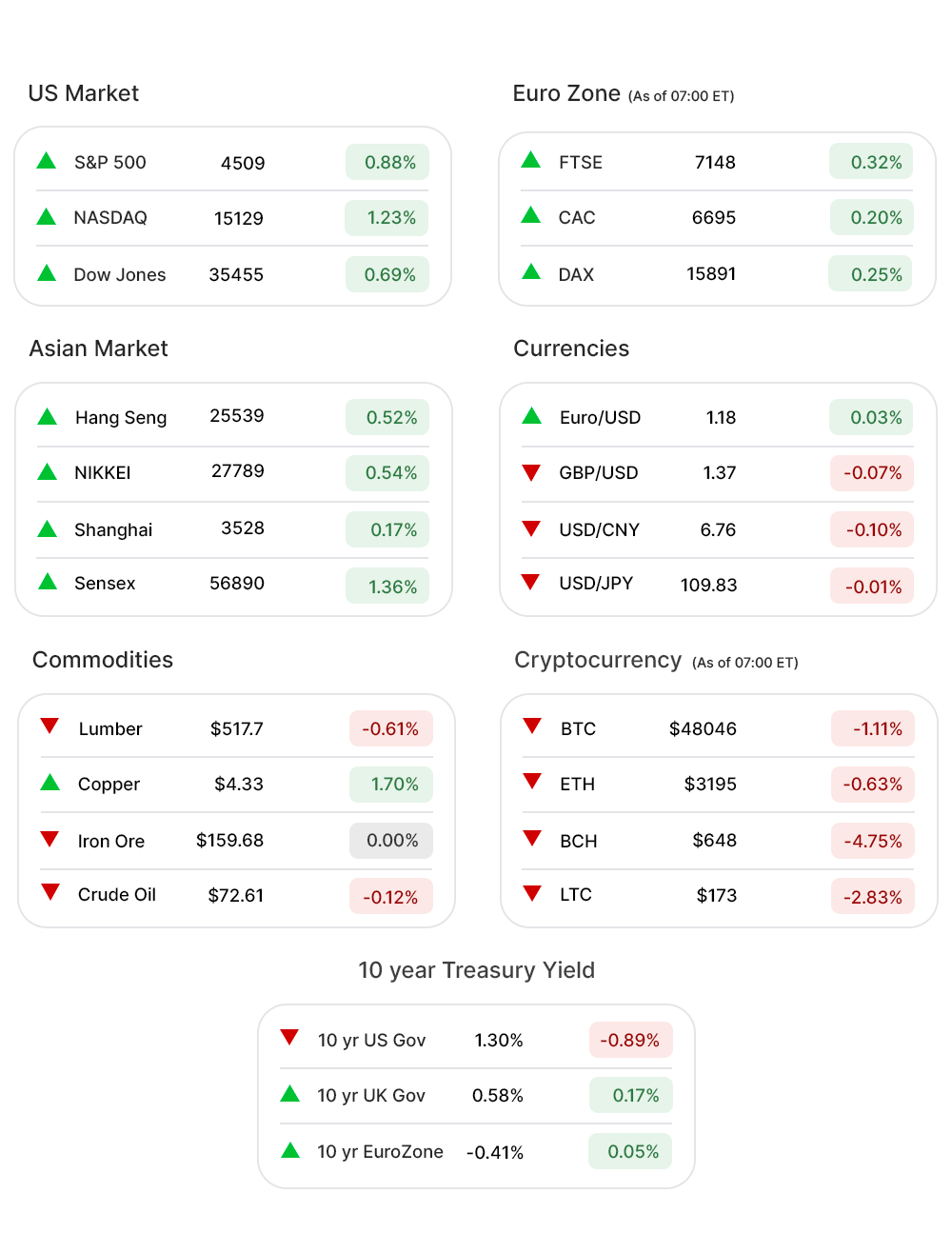

Fed Chair, Jerome Powell’s dovish tone was taken well in stride by the markets with S&P 500 (0.8%▲), breaching the 4500 mark for the first time.

Nasdaq (1.2%▲) hit a record high as well during the day and closed at 15129.50, while Dow Jones (0.6%▲) added in excess of 240 points for the day. Russel 2000 (2.85%▲) gained over 63 points.

The major indices closed the week in the green zone.

With the exception of Healthcare (-0.16%▼), and Utilities (-0.03%▼) the sectors at the S&P 500 were all green. Energy (2.62%▲) was the top gainer among the sectors, followed by Communication Services (1.60%▲), Materials (1.32%▲), Financials (1.31%▲), and Technology (0.97%▲).

Consumer Discretionary (0.90%▲), Consumer Staples (0.34%▲), Real Estate (0.87%▲), and Industrials (0.69%▲)were amongst the gainers as well.

Futures!

Futures carried Friday’s mood Monday morning as all major indices were green and upbeat.

As of 07:15 ET, Dow Futures (0.03%▲), Russell 2000 Futures (0.26%▲), Nasdaq Futures (0.12%▲), and S&P 500 Futures (0.07%▲), were all green.

Key Movers in Small Cap:

Big Lots Inc (BIG, -4.80%▼) reported an 11.4% decline in sales y-o-y, while the EPS also missed the consensus estimates. The Relative Volume of the stock was 6.9.

Hibbett Inc (HIBB, -9.23%▼) reported Q2 results, beating estimates while the company raised its full-year guidance. The Relative Volume of the stock was 5.9.

The other movers in the large-cap segment included:

Reneo Pharmaceuticals Inc (RPHM, 25.80%▲): Relative Volume 16.7.

Aterian Inc (ATER, 47.22%▲): Relative Volume 12.4.

Neolukin Inc. (NLTX, 23.38%▲): Relative Volume 7.5.

Five Star Bancorp. (FSBC, 0.29%▲): Relative Volume 6.0.

Applied Therapeutics Inc. (APLT, -13.05%▼): Relative Volume 5.1.

Altabancorp (ALTA, 0.67%▲): Relative Volume 5.1.

Cassava Sciences Inc (SAVA, -17.66%▼): Relative Volume 4.7.

Key Movers in Large Cap:

The cloud-based payments software maker, Bill.com Holdings Inc (BILL, 29.64%▲) reported a Q4 loss of $0.07 per share, worse than the estimated $0.04. The revenue, however, shot by 86% y-o-y to 78.3m. The relative volume of the stock was 10.4.

Ollie’s Bargain Outlet Holdings (OLLI, -6.69%▼) missed on both top and bottom-line estimates, in its Q2 earnings while reporting $0.53 per share on revenue of $415.9m. The relative volume of the stock was 5.9.

VMware Inc (VMW, -6.69%▼) reported a growth in revenue but fell short of estimates on the net income segment. The relative volume of the stock was 5.5.

Peloton Ineteractive Inc (PTON, -8.55%▼) reported a wider than expected loss and a dramatic tapering of revenue growth. The relative volume of the stock was 4.9.

Workday Inc (WDAY, 9.13%▲) reported an 18.7% y-o-y increase in total revenue and a 19.5% increase in subscription revenue. The relative volume of the stock was 4.8.

The other movers in the small-cap segment included:

Duck Creek Technologies (DCT, 3.31%▲): Relative Volume 8.3.

Bio-Techne Corp (TECH, 0.37%▲): Relative Volume 3.9.

Ubiquiti Inc. (UI, 7.10%▲): Relative Volume 3.4.

Dell Technologies Inc. (DELL, -4.53%▼): Relative Volume 3.4.

Report Card:

VMware Inc (VMW, -6.69%▼), an innovator in enterprise software, reported a 9% y-o-y growth in revenue to $3.14bn, while the net income of $411m or $0.97 per diluted share was down 8% on a y-o-y basis. The stock climbed a little after hours.

The cycle maker, Peloton Ineteractive Inc (PTON, -8.55%▼), reported a per-share loss of $1.05 ahead of the expected 45 cents, while the revenue of $936.9m surpassed the expectations of $927.2m. The stock fell marginally after hours.

Workday Inc (WDAY, 9.13%▲) reported earnings of $1.23 per share, up 46% y-o-y even as the revenue climbed 18.7% on a y-o-y basis to $1.26bn. Subscription revenue rose by 19.5% to 1.11bn, topping estimates of $1.09bn. The stock climbed a little after hours.

Big Lots Inc (BIG, -4.80%▼) reported earnings of $37.71m or $1.09 per share, missing the estimated $1.13 per share and down from the prior year’s $11.29 per share. Revenue fell 11.0% to $1.46bn. The stock remained flat after hours.

On the Lookout:

Pending Home Sales, for the month of July, is expected to be updated today from the previous print of -1.9%.

Unusually high shorter-term CALL options activity seen on Marvell Technology Inc (MRVL, -3.00%▼), Pinduoduo Inc (PDD, -1.28%▼), Norwegian Cruise Line Holdings Inc. (NCLH, 3.28%▲), Fastly Inc. (FSLY,1.51%▲), and Peloton Ineteractive Inc (PTON, -8.55%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Tesla Inc. (TSLA, 1.53%▲), GDS Holdings Ltd (GDS, -9.84%▼), Support.com Inc (SPRT, 33.65%▲), Domo Inc (DOMO, -8.36%▼), and Marathon Digital Holdings Inc. (MARA, 10.99%▲) among others.

Other Asset Classes:

Crude Oil Prices - The prices retreated Monday morning after climbing a three-week high in the previous session owing to Hurricane Ida slamming into the US Gulf Coast, forcing shutdowns and evacuations of hundreds of offshore Oil platforms. Brent was down 0.34% but trading above the $72 per barrel mark, in the wee hours Monday.

The US Dollar (92.68, -0.00%▼) retreated in the earlier session after Jerome Powell said that the bar has not been met yet for an interest rate hike. The greenback remained flat early Monday morning.

The US Treasury Yields slipped a little Monday morning as this week’s crucial employment data remains in focus. The 10 Year US Treasury Yield was trading in the red zone at 1.307%, early Monday morning.

Global Markets:

The Asian Markets followed the post-Jackson-Hole event positivity in US stocks and closed the day Monday with almost all major indices in the green zone. Hang Seng rose by more than 98 points, Tokyo’s Nikkei advanced more than 148 points, while Shanghai gained around 0.17%.

The positivity was also reflected in the European markets Monday morning with major indices having in sync with Wall Street and the Asian markets. FTSE was up 0.32% Monday morning, followed by CAC and DAX - advancing by 0.07% and 0.01%. Pan EU Stoxx-600 was in the green zone.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Phreesia Inc. (PHR), Workday Inc (WDAY), Celestica Inc. (CLS), Rekor Systems Inc (REKR), Thomson Reuters Inc (TRI), Inmode Ltd (INMD). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.