Fed’s ‘Stop Loss’ for Banks!

Yayy! It’s Friday!

Getting better every day! Many more trade setups identified by our AI reached their respective profit targets yesterday, within their optimal holding period: Datadog Inc (DDOG), Elastic NV (ESTC), HubSpot Inc (HUBS), Mercadolibre Inc. (MELI), Daseke Inc. (DSKE), Veoneer Inc (VNE), Bancorp Inc. (TBBK), Ares Management Corp. (ARES), and EPAM Systems Inc. (EPAM).

Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

The Fed has directed Goldman Sachs and Morgan Stanely to hold the highest capital requirement ratios - 13.4%, and 13.2% respectively - to guard against losses, among 34 banks based on how well each bank performed in the June test.

And, Jeff is the winner! Amazon Inc has won a legal battle against India’s richest man, Mukesh Ambani, as the country’s Supreme Court rules in favor of the world's richest man seeking a halt over the $3.4bn acquisition of Future Retail by Ambani.

The greener pasture back home! China Telecom Corp, in World’s largest listing this year, is planning to raise $7.3bn from the Shanghai IPO after being booted out of the NYSE earlier this year. The listing will exceed TikTok rival Kuashio Technology’s $6.3bn Hong Kong IPO.

“The aim is to survive,” says Eric Xu, Huawei Chairman. The Chinese tech giant, facing a US Trade Blacklist since 2019, has reported a 30% decline in revenue for the first half of the year, from around $70bn in 2020 to $49.7.

The White House jolt to Crypto! President Biden has thrown weight behind a group of senators seeking to raise money through stricter tax rules on CryptoCurrency transactions, in the $1tr infrastructure bill. The bill is expected to raise $28bn, over 10 years, by updating IRS requirements for the Crypto brokers.

Also, Germany’s industrial output has fallen, again, by 1.3%, against an expected rise of 0.5%, driven by a drop in the production of capital goods by 2.9%. Supply bottlenecks have also led to a 0.6% drop in industrial production, with the automotive industry reporting a drop of 11.2%. DAX made gains, nevertheless.

US Markets:

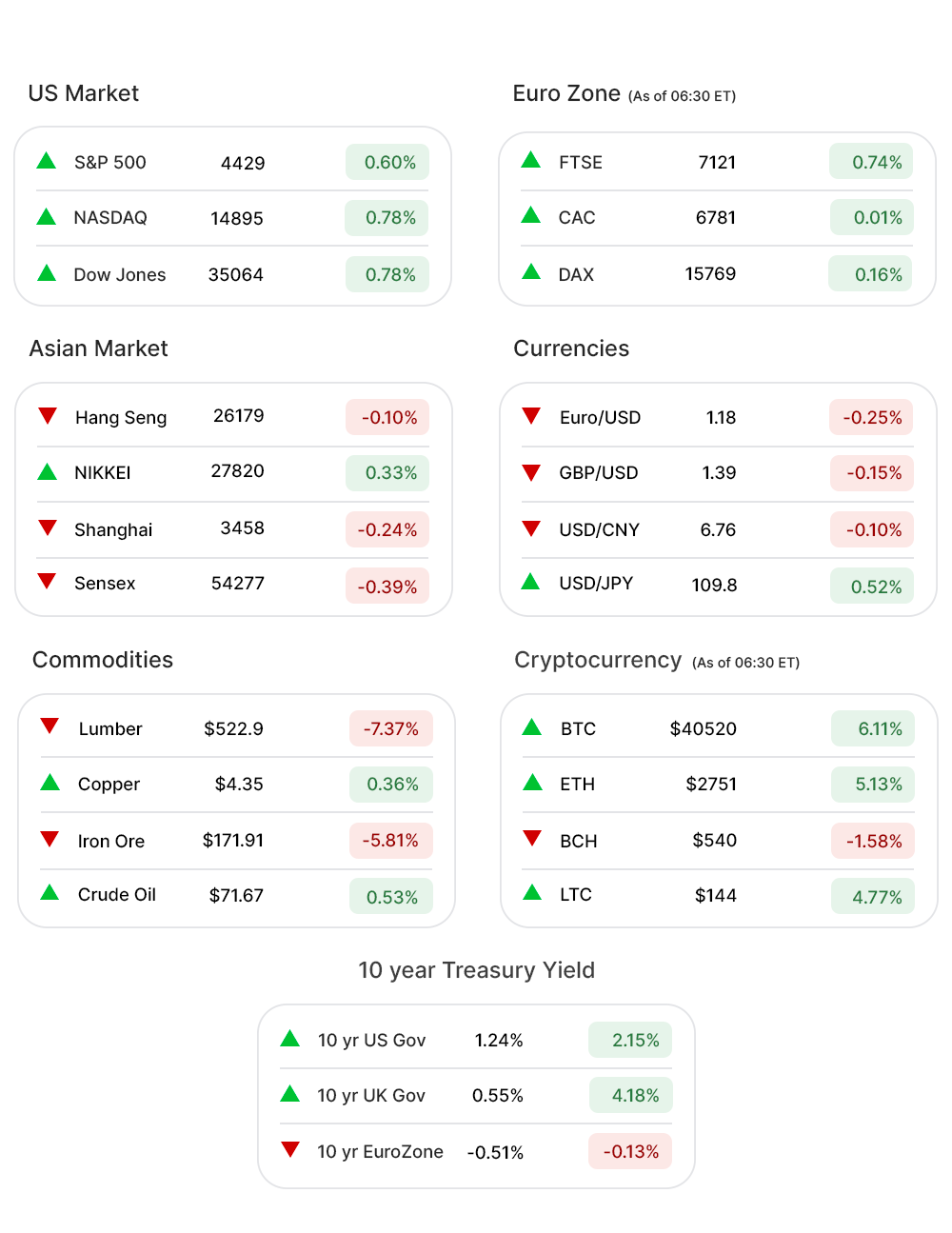

S&P 500 (0.60%▲) reached a record high of 4429 at close Thursday as US markets were buoyed by better than expected earnings and Continuing Jobless claims falling to a 16 month low, below 3 million.

The initial jobless claims for the week, ended July 31, also came out to be in sync with expectations at 385,000.

Tech-heavy Nasdaq (0.78%▲) gained more than 100 points to close at 14895 while Dow Jones (0.78%▲) climbed a little shy of 300 points and closed above 35k, recovering almost entirely the losses incurred Wednesday.

Healthcare (-0.38%▼) and Materials (-0.13%▼) were the only red sectors at the S&P 500.

Energy (1.28%▲), reversed some losses of Wednesday, along with Financials (1.24%▲), Utilities (1.13%▲), Consumer Staples (0.57%▲), Industrials (0.50%▲), and Real Estate (0.83%▲).

Communication Services (0.91%▲) and Technology (0.54%▲) continued the green run.

Futures!

The Futures inched higher, early Friday morning, after exhibiting some weakness ahead of the scheduled Unemployment report.

As of 06:00 ET: S&P 500 Futures (0.02%▲), Russell 2000 Futures (0.04%▲), and Dow Futures (0.02%▲) were all green barring Nasdaq Futures (-0.07%▼).

Key Movers in Small Cap:

Zymergen Inc (ZY, 75.15%▲), after tanking more than 76% Wednesday, bounced back as Cathie Wood’s ARK Invest decided to increase its position, in this synthetic biology upstart, by adding 2.47m shares of the company to the ARK Genomic Revolution ETF. The relative volume of the stock was 46.4.

Nevro Corp (NVRO, -22.19%▼) reported an 81% increase y-o-y in its revenue to $102.3m but missed the estimated $107.7m by a fair bit. The company posted a loss of $0.62 per share beating the consensus of $0.73. The relative volume of the stock was 13.8.

The defense and government services contractor, PAE Incorporated (PAE, -1.32%▼), posted a profit of $14.4m or 15 cents per share, missing the estimates by a cent. The relative volume of the stock was 12.8.

A service provider on energy and water resources management, Itron Inc (ITRI, -26.44%▼) reported an EPS of $0.28, for Q2, falling short of the estimates by around 42%. The sales of $489m were also well short of the estimated $535.9m. The relative volume of the stock was 12.4.

Inogen Inc (INGN, -26.71%▼) reported better than expected revenue as well as the EPS for Q2 but at the same time downgraded the outlook for Q3 and Q4 of the financial year 2021, owing to supply chain constraints. The relative volume of the stock was 12.0.

The other movers in the small-cap segment included:

Onespan Inc (OSPN, -24.12%▼): Relative Volume 10.9.

Wave Life Sciences (WVE, 8.65%▲): Relative Volume 9.8.

Modine Manufacturing (MOD, -14.77%▼): Relative Volume 7.0.

PetlQ Inc (PETQ, -13.24%▼): Relative Volume 6.4.

Karyopharm Therapeutics Inc (KPTI, -24.17%▼): Relative Volume 6.4.

Key Movers in Large Cap:

The Healthcare company, Amedisys Inc (AMED, -21.91%▼), missed the consensus on revenue for Q2 reporting a revenue of $564.2m against $566.2m. The EPS of $1.69 was well above the expected $1.67. The relative volume of the stock was 11.3.

Driven Brands Holdings (DRVN, -5.49%▼), has announced a secondary offering of 12m shares of its common stock, priced at $29.50 per share. The relative volume of the stock was 10.7.

The web hosting company GoDaddy Inc (GDDY, -12.43%▼) reported an EPS of $0.27, missing the consensus estimate of $0.30 and way lower than last year’s EPS of $4.06 for the same quarter. The relative volume of the stock was 6.8.

The network infrastructure provider, CommScope Holding Company (COMM, -20.69%▼) reported a 34.37% y-o-y increase in its EPS to $0.43 but fell short of the estimated $0.44. The revenue of $2.18bn was above the expected $2.16bn. The relative volume of the stock was 6.7.

Datadog Inc (DDOG, 15.26%▲), a monitoring service for cloud-scale applications, reported a 67% increase in its revenue to $233.5m, y-o-y. The relative volume of the stock was 6.3.

The other movers in the large-cap segment included:

Fastly Inc. (FSLY, -10.35%▼): Relative Volume 14.1.

Frontdoor Inc. (FTDR, -11.57%▼): Relative Volume 8.1.

Penn National Gaming (PENN, 9.09%▲): Relative Volume 5.7.

Cigna Corporation (CI, -10.92%▼): Relative Volume 4.5.

Report Card:

Finance and Insurance company, American International Group (AIG, 3.33%▲) reported Q2 income of $99.9m or an adjusted EPS of $1.52, beating the estimates of $1.19. The revenue of $10.88bn was also ahead of the expected $10.76bn. The stock continued to rise after hours.

Aptiv PLC (APTV, -3.66%▼), an auto parts company, reported a 94% y-o-y increase in its revenue to $3.8bn. The EPS of $0.60 however fell short of the expected $0.67.The stock was flat after hours.

Cigna Corp (CI, -10.92%▼) reported a 9.8% y-o-y increase in revenue to $43.1bn, beating the consensus estimate of $41.31bn. The adjusted EPS of $5.24 was also ahead of the expected $4.96. The company however is foreseeing a hit to full-year earnings. The stock climbed a little after hours.

Duke Energy Corp (DUK, 1.21%▲), went from an income of $898m or $1.15 per share, beating the estimated $1.09 per share and last year’s -$817m net income. The revenue of the company was $5.76bn. The stock slid a little after hours.

On the Lookout:

Non-Farm Payrolls, slated to be released today, are expected to drop down to 845,000 from the previous print of 850,000.

The Unemployment Rate, which was at 5.9% previously is set to decline by 2 basis points to 5.7%. The print on Average Hourly Earnings is expected to remain unchanged at 0.3%.

Wholesale Inventories are slated to drop from 1.3% to 0.8% while the Consumer Credit is also expected to decline from $35bn to $24bn.

Unusually high shorter-term CALL options activity seen on Himax Technologies (HIMX, -3.67%▼), Upstart Holdings (UPST, 4.06%▲), Gap Inc. (GPS, 5.20%▲), and Roku Inc (ROKU, -4.10%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Bloom Energy Corp. (BE, 3.49%▲), Home Depot Inc. (HD, 0.85%▲), ChemoCentryx Inc. (CCXI, 2.42%▲), Revolve Group Inc. (RVLV, -14.94%▼), and D R Horton Inc (DHI, 0.51%▲) among others.

Other Asset Classes:

Crude Oil prices were, after a two-day rout, marching ahead Friday morning. The prices however are on track for their biggest weekly decline since March, as travel restrictions in many countries are clouding the fuel demand. Brent was up 0.50% and trading at $71.65 per barrel, early Friday morning, while the WTI Crude was 0.37% in the green zone and was trading at $69.46 per barrel.

The US Dollar (92.34, 0.11%▲) crept higher as all eyes remain on the US employment data, expected to come in strong numbers and make a case for early tightening of monetary policy by the Fed.

US Treasury Yields climbed Thursday after Jobless Claims numbers came out in tune with the expectations. The rally continued Friday morning with the 10 Year US Treasury Yield reaching 1.242%, and the 30 Year Treasury Yield was trading at 1.888%.

Global Markets

Asian markets were mixed Friday as investors had their eyes on the US Jobs report as well as travel restrictions imposed in many countries, to contain the spread of the delta variant, including China. Shanghai was down by 0.24% while Nikkei rose by more than 90 points. Hang Seng was flat but in the red zone.

European markets opened slightly lower Friday morning but are on course to end the week in the green zone riding better than expected earnings reports, an unchanged monetary policy by the Bank of England, and positive vibes from the Wall Street.Pan European index Stoxx-600 was down 0.11% early Friday morning, along with the FTSE, which slid a wee bit more than 9 points at the opening.

Meanwhile on Researchfin.ai

There were more than 40 new trade setups, identified by the AI yesterday. Please download our app Researchfin.ai for iOS and Android.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

Have a terrific weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.