First Bite!

Good Morning!

Apple and Google will have to open their app stores to alternative payments systems in South Korea, a new law demands, threatening their lucrative commissions on digital sales. This is the first such law, world over. More to come?

China’s most valuable company Tencent has accelerated its global expansion by increasing its investment in startups 7-fold this year - making 34 international investments in the first 6 months of 2021 - as an extended tech crackdown continues back home.

Canada’s GDP woes! Putting a question mark on the country’s economic resiliency, Canada’s GDP has fallen, at an annualized 1.1% pace from April to June, against an expected 2.5% growth and a far cry from a revised 5.5% growth in the first 3 months of the year.

The acquisition! In what would be the largest acquisition in India’s digital payments space, Prosus-backed PayU is set to acquire one of India’s largest and earliest payment gateway, BillDesk - in an all-cash transaction of $4.7bn.

$2tr and unregulated! The SEC Chair, Gary Gensler, believes the $2tr Crypto market cannot sustain without regulation, and the markets were putting their own survival in jeopardy by not being inside a public coverage framework.

Consumer Confidence Index has fallen considerably lower than what was expected in wake of rising inflation and an uptick in Covid cases. The print, at a six-month low, tumbled to 113.8 from July’s 125.1.

The deteriorating business conditions were depicted by a sharp drop in Chicago PMI, which fell to66.8in August from July’s 73.4.

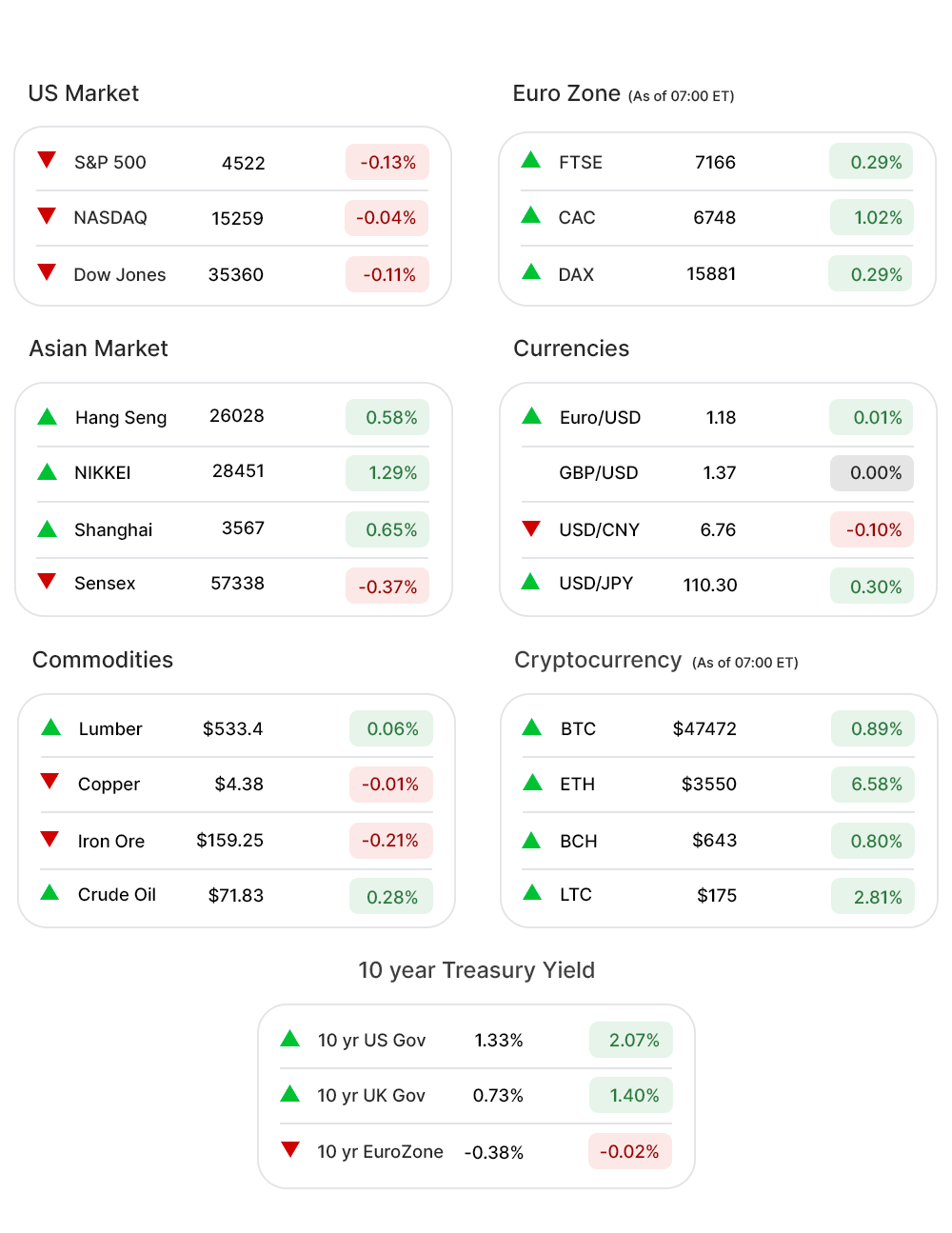

US Markets:

The markets notched a 7-month win streak, as August ended, despite the pullback Tuesday.

500 (-0.13%▼) dropped a little more than 6 points to close at 4522.68. Tech heavy Nasdaq (-0.04%▼), pulled back by 6 points as well and closed at 15259.24.

Dow Jones (-0.11%▼) was in the red zone as well. Russel 2000 (0.34%▲) outperformed other indices, however, and clinched in excess of 7 points to close at 2273.77.

Sectors at the S&P 500 were mixed, with four of them making some gains and seven in the negative territory.

Consumer Discretionary (0.37%▲), Consumer Staples (0.54%▲), Real Estate (0.61%▲), and Communication Services (0.27%▲) were the sectors making gains.

Financials (-0.09%▼), Energy (-0.73%▼), Industrials (-0.28%▼), Materials (-0.17%▼), Technology (-0.56%▼), Utilities (-0.10%▼), and Healthcare (-0.13%▼) were in sync with the overall market performance.

Futures!

Futures looked set for a market rebound from Tuesday’s rout.

As of 07:00 ET, all the indices were green, without an exception: Dow Futures (0.32%▲) Russell 2000 Futures (0.77%▲), Nasdaq Futures (0.21%▲), and S&P 500 Futures (0.34%▲).

Key Movers in Small Cap:

American Superconductor Corporation (AMSC, 20.75%▲) and ComEd have successfully integrated AMSC’s REG system, which utilizes high-temperature superconductor wire to enhance the security and performance of the electric power grid. The Relative Volume of the stock was 9.0.

American Woodmark Corporation (AMWD, -12.36%▼), the cabinet maker, reported a sizeable miss on its fiscal first-quarter 2022 earnings. The Relative Volume of the stock was 7.3.

Digital Turbine Inc (APPS, 14.07%▲), a company specializing in app installation software, announced that its stock was being added to the S & P MidCap 400 index. The Relative Volume of the stock was 4.9.

Chico’s FAS (CHS, -11.47%▼), the women’s apparel retailer, announced Q2 earnings beating expectations and returning to profitability, while the company raised its full-year guidance. The Relative Volume of the stock was 4.6.

Poseida Therapeutics Inc (PSTX, -19.33%▼) Tuesday presented positive preliminary results from the phase-1 clinical trial of P-PSMA-101, the company’s solid tumor autologous CAR-T product candidate, to treat patients with a type of prostate cancer. The Relative Volume of the stock was 4.0.

The other movers in the small-cap segment included:

RBB Bancorp (RBB, 1.90%▲): Relative Volume 7.3.

Daily Journal Corporation (DJCO, 3.03%▲): Relative Volume 5.6.

Ikena Oncology Inc. (IKNA, -2.13%▼): Relative Volume 5.4.

Vonage Holdings Corp. (VG, 4.44%▲): Relative Volume 4.5.

Alpine Immune Sciences Inc. (ALPN, 2.59%▲): Relative Volume 4.4.

Key Movers in Large Cap:

Zoom Video Communications (ZM, -16.69%▼) continued to reel under the worse than expected sales growth, announced on Monday. The relative volume of the stock was 9.5.

Zoom’s dismal performance has had an effect on Five9 Inc (FIVN, -14.39%▼) as well given that Zoom recently announced its intention to acquire Five9’s an enterprise communications platform. The relative volume of the stock was 5.9.

The US rail regulator rejected a voting trust structure that would have allowed Canadian National Railway Co to proceed with its $29bn acquisition of US peer Kansas City Southern (KSU, -4.39%▼). The relative volume of the stock was 7.6.

Wells Fargo & Co. (WFC, -5.60%▼), as per media reports, is not sending restitution payments to victims of its numerous scandals fast enough, and regulators are not apparently happy. The relative volume of the stock was 3.8.

StoneCo Ltd (STNE, -5.98%▼) has reported disappointing results for its second quarter. The relative volume of the stock was 3.3.

The other movers in the large-cap segment included:

Proof Print Inc (PFPT, -0.02%▼): Relative Volume 5.0.

Ashland Global Holdings (ASH, 4.41%▲): Relative Volume 3.0.

Walgreens Boots Alliance Inc. (WBA, 4.36%▲): Relative Volume 2.6.

Virgin Galactic Inc. (SPCE, 8.96%▲): Relative Volume 2.5.

NXP Semiconductors N.V (NXPI, -5.50%▼): Relative Volume 2.5.

Report Card:

American Woodmark Corporation (AMWD, -12.36%▼) reported earnings of $0.70 per share, missing the estimates of $1.41 per share. The revenue of $442.58m missed the estimates by over 4%. The stock was flat after hours.

Chico’s FAS (CHS, -11.47%▼) reported earnings of $0.21 per share, way ahead of the estimated loss of $0.08 per share and prior year’s loss of $0.33 per share. The revenue of $472.06m surpassed the estimates by 15.89%. The stock climbed by half a percent after hours.

StoneCo Ltd (STNE, -5.98%▼) came out with a loss of $0.09 per share, way lower than the estimated earnings of $0.18 per share. The revenue of $115.79m fell short of the estimates by around 32%. The stock climbed a little after hours.

Caleres Inc. (CAL, -1.09%▼) reported a 34.7% y-o-y increase in net sales to $675.5m, while the net income came out at $37.4m or $0.97 per diluted share. The stock soared a little shy of 8% after hours.

On the Lookout:

The ADP employment report is expected to come at a sharp spike, with an estimated 600,000 jobs being added by the private sector, compared to 330,000 in July.

The Markit Manufacturing PMI (final) is expected to remain unchanged in August at 61.2, while the ISM Manufacturing Index might drop to 58.6% from the previous print of 59.5%.

Construction Spending might reach an estimated 0.2% from the previous print of 0.1%. Data on Motor Vehicle Sales is due today as well, with a previous print of 14.8m.

Unusually high shorter-term CALL options activity seen on Elys Game Technology (ELYS, 42.98%▲), Vinco Ventures Inc. (BBIG, 15.44%▲), GrowGeneration Corp (GRWG, 4.65%▲), Pinduoduo Inc (PDD, 5.31%▲), and Fubotv Inc (FUBO, 5.85%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Children’s Place Inc. (PLCE, -0.36%▼), Wells Fargo & Co (WFC, -5.60%▼), AC Immune SA (ACIU, 16.31%▲), Tesla Inc (TSLA, 0.66%▲), and Ventas Inc (VTR, 0.92%▲) among others.

Other Asset Classes:

Crude Oil Prices - The prices climbed Wednesday morning even as production on the US Gulf Coast is slowly being restored, following the passing of Hurricane Ida, and a likely improvement in production by OPEC countries. Brent traded over the $73 per barrel mark, in the wee hours Wednesday.

The US Dollar (92.75, 0.14%▲) bounced from a four-week low of 92.40, it hit on Tuesday. The economic data due today will have a bearing on the future course of the greenback.

The US Treasury Yields were buoyed in anticipation of the economic data after a dip Tuesday morning. The 10 Year US Treasury Yield was trading at 1.326%, early Thursday morning.

Global Markets:

Despite the pullback in US stocks, the Asian Markets were mostly in the green zone on Wednesday as investors weighed whether recovery from the delta variant will be resilient enough. Shanghai closed 0.65% higher, and Hang Seng rose by 133 points. Tokyo’s Nikkei advanced by over 360 points or 1.29%.

Investors, across the Atlantic, shook off concerns surrounding rising inflation and started September with certain positivity. All major indices in European markets were green early Wednesday morning. FTSE, gained 0.67% soon after the opening, while CAC was up 1.16%. DAX and Stoxx-600 were considerably higher as well.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Inmode Limited (INMD), DexCom Inc (DXCM), Hill-Rom Holdings Inc. (HRC), Thomson Reuters Corp (TRI), Sea Ltd. (SE), Xylem Inc (XYL), America Movil SAB (AMX), Information Services Group (III), Rekor Systems Inc (REKR), Zentalis Pharmaceuticals Inc (ZNTL), and RedHill Biopharma (RDHL). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.