Game-Stop!

Good Morning!

Beijing has temporarily suspended approvals of new games, as the crackdown on the tech sector continues. Tencent slid 8%, NetEase 13%, leading the $60bn loss in gaming stocks. Hang Seng tech index tumbled 2.30%. Tencent and other gaming companies were summoned.

Out of the Ark! Cathie Wood’s Ark has “dramatically” cut down China exposure - amid the ongoing crackdown- and is now focussing on Beijing-friendly companies like Pinduoduo and J D Logistics.

Muscling through the ‘Silicon’! Hedge funds are pushing into Silicon Valley, through investments in private companies. In 770 transactions this year, thus far, hedge funds have invested a record $153bn in private companies.

The European Central Bank is expected to kick off the tapering debate today, as people inside and out of the bank believe it is high time that the ECB reduces its monetary stimulus. FTSE slid to a three-week low, as EU markets extended losses.

Equity deal of the year! Tencent-backed e-commerce and gaming company, Sea Ltd, is aiming to raise $6.3bn, the largest equity deal of the year, by offering 11 million shares. Sea Ltd has risen 70% this year.

The pandemic story! Job Openings in the US climbed to an all-time high of10.9min the month of July, with Healthcare and Social Assistance adding most of the positions.

US Markets:

With investors concerned about economic recovery, amid a rise in delta variant cases the world over, stocks in the US continued the downward trend for the third consecutive session Wednesday.

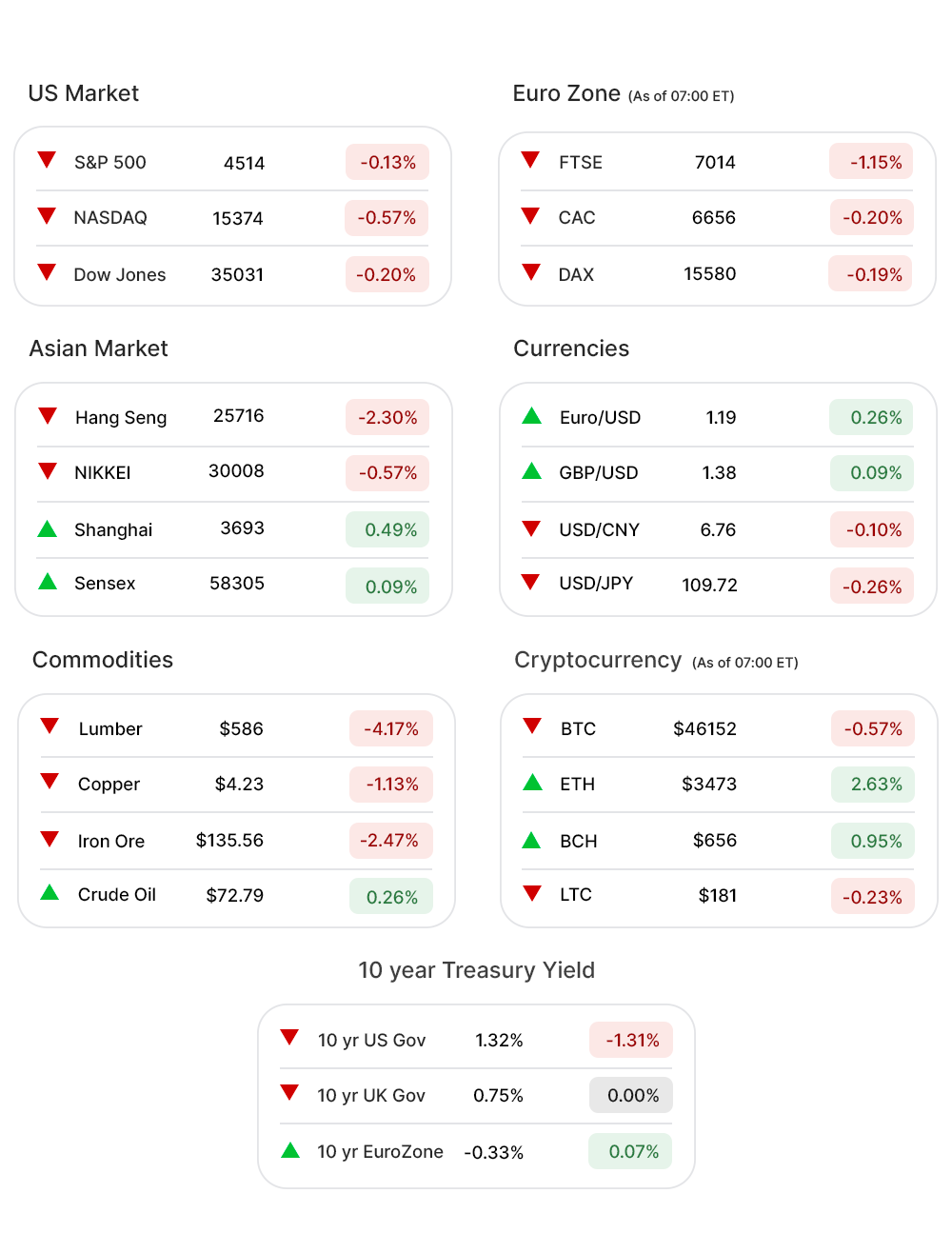

S&P 500 (-0.13%▼) closed at 4514.07, after shedding a little less than 6 points. Dow Jones (-0.20%▼) slid close to 69 points, while Russel 2000 (-1.14%▼) closed at 2249.73 after losing about 26 points.

Tech heavy Nasdaq (-0.35%▼) notched its biggest drop in two weeks, with substantial losses in big-tech stocks including Apple (AAPL, -1.01%▼), Facebook(FB, -1.21%▼), and Alphabet (GOOGL, -0.41%▼).

Sectors at the S&P 500 were mixed, with only Consumer Discretionary (0.15%▲), Industrials (0.18%▲), and Real Estate (0.56%▲) eking out some gains.

Energy (-1.30%▼) and Materials (-1.12%▼) were at the bottom of the list, followed by Technology (-0.41%▼), and Communication Services (-0.43%▼), Healthcare (-0.08%▼), Consumer Staples (-0.31%▼), Financials (-0.34%▼), and Utilities (-0.80%▼).

Futures!

The US stock futures looked set for another day of losses.

As of 07:00 ET, all the indices were in red, without an exception: Dow Futures (-0.19%▼), Nasdaq Futures (-0.18%▼), S&P 500 Futures (-0.22%▼), and Russel 2000 Futures (-0.43%▼).

Key Movers in Small Cap:

Kadmon Holdings Inc (KDMN, 71.13%▲) Wednesday announced a merger with and into Sanofi Inc, in a deal worth $1.9bn. The Relative Volume of the stock was 43.1.

Radius Global Infrastructure (RADI, -3.12%▼) has announced to offer, subject to market conditions, a $200m aggregate principal amount of convertible senior notes due 2026. The Relative Volume of the stock was 6.1.

Alector Inc (ALEC, -18.97%▼) Wednesday announced the departure of two high-level executives including the Chief Operating Officer and Chief Medical Officer. The Relative Volume of the stock was 6.0.

Cincinnati Bell Inc. (CBB, -0.06%▼) has announced the completion of its acquisition by Macquarie Infrastructure Partners. The Relative Volume of the stock was 5.8.

Rev Group Inc (REVG, -12.02%▼) reported mixed earnings. The Relative Volume of the stock was 4.5.

The other movers in the small-cap segment included:

Inozyme Pharma Inc (INZY, -14.66%▼): Relative Volume 12.1.

Kezar Lifesciences Inc (KZR, -0.76%▼): Relative Volume 6.7.

Vapotherm Inc (VAPO, 3.75%▲): Relative Volume 5.7.

Ortho Clinical Holdings (OCDX, -4.42%▼): Relative Volume 4.8.

Hingham Institution for Savings. (HIFS, -0.48%▼): Relative Volume 4.7.

Key Movers in Large Cap:

ICU Medical Inc (ICUI, 26.23%▲) announced its plans to acquire the Smiths Medical division from Smiths Group Plc, for $2.35bn cash. The relative volume of the stock was 29.1.

Spectrum Brands Holdings Inc (SPB, 17.79%▲) announced a definitive agreement to sell its hardware and home improvement segment for $4.3bn in cash. The relative volume of the stock was 11.2.

Vertiv Holdings Co (VRT, -7.31%▼) has bought E & I Engineering Ireland for $1.8bn. The relative volume of the stock was 4.5.

Perrigo Company Plc (PRGO, 8.99%▲) has announced it will acquire HRA Pharma for $2.1bn in cash. The relative volume of the stock was 4.4.

Coty Inc (COTY, -10.72%▼) has announced a secondary public offering of 50m shares. The relative volume of the stock was 4.1.

The other movers in the large-cap segment included:

First Solar Inc (FSLR, 1.01%▲): Relative Volume 3.9.

Smartsheet Inc. (SMAR, -14.38%▼): Relative Volume 3.7.

Casey’s General Stores Inc. (CASY, -4.75%▼): Relative Volume 3.6.

Agilon Health Inc (AGL, -8.88%▼): Relative Volume 3.4.

McAfee Corp. (MCFE, -8.75%▼): Relative Volume 3.3.

Report Card:

Facility management provider, ABM Industries Inc (ABM, 0.06%▲), came out with earnings of $0.90 per share, beating the estimates of $0.80 per share. Revenue of $1.54bn surpassed the estimates by 0.65%. The stock slid more than 4% after hours.

GameStop Corp (GME, -0.10%▼) reported a loss of 76 cents per share, against the estimated loss of 67 cents. Revenue of $1.18bn was ahead of the expected $1.12bn. The stock fell a little less than 9% after hours.

Lululemon Athletica Inc (LULU, -1.45%▼) reported an adjusted EPS of $1.65, ahead of the expected $1.19 with revenue of $1.45bn beating estimates of $1.34bn quite easily. The stock soared 13.75% after hours.

Rev Group Inc (REVG, -12.02%▼) reported earnings of $0.37 per share, narrowly beating the estimated $0.33 per share. The revenue of $593.3m surpassed the estimates by over 10%. The stock remained flat after hours.

On the Lookout:

Initial Jobless Claims for the week ended September 4 are expected to drop to 335,000 from the prior week’s 340,000; while the Continuing Jobless Claims for the week ended August 28 are due today as well, with a previous print of 2.75m.

Unusually high shorter-term CALL options activity seen on Wisekey International (WKEY, 13.83%▲), Advanced Micro Devices (AMD, -2.73%▼), UiPath Inc. (PATH, -9.62%▼), PVH Corp (PVH, -3.66%▼), and Vinco Ventures (BBIG, 5.80%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Micron Technology Inc (MU, -1.86%▼), International Game Technology (IGT, -3.30%▼), Bristol-Myers Squibb (BMY, -0.40%▼), Lululemon Athletica Inc (LULU, -1.45%▼), and Momentus Inc (MNTS, -7.08%▼) among others.

Other Asset Classes:

Crude Oil Prices - despite most of the US Gulf still offline, 10 days after Hurricane Ida, crippling production, and slashing of prices by Saudi Arabia for Asia, the Crude Oil prices have remained more or less static, for at least the last three trading sessions. Brent traded a little over $72 per barrel mark, while WTI Crude climbed to $69 per barrel mark.

The US Dollar (92.56, -0.10%▼) gave up some gains made over the last two days, ahead of the scheduled Jobless Claims data, due today.

The US Treasury Yields, ebbed lower Thursday morning as economists expected a drop in Jobless claims, and mounting concerns regarding economic recovery amid a rise in Covid cases. The 10 Year US Treasury Yield was trading in the red zone at 1.324%.

Global Markets:

The Asian Markets ended mixed Thursday, as investors remain worried about economic recovery amid a fresh Covid outbreak and an extended crackdown on the tech sector by Chinese authorities. Hang Seng, weighed down by the tech sector, slid well over 600 points or 2.30%.Tokyo’s Nikkei fell by 0.57%, while Shanghai closed in the green zone, up 0.49%.

European markets hit a three-week low Thursday morning as expectations on ECB setting a timeline on starting to pair its bond purchases, today. FTSE, slid 1.31% soon after the opening, while CAC was down 0.51%. DAX lost more than 70 points in, early morning, while as pan-EU index Stoxx-600 0.62% into the red zone.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

See you Friday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.