GDP’s Roundtrip!

Good Morning,

Something to cheer about! The print on GDP did disappoint, for expanding way slower at 6.5% than expected 8.4%, but it is back to the pre-pandemic levels.

Much Ado About Nothing! Robinhood stood at the wrong side of history on its first trading day.The company had the worst debut ever for an IPO of its size. The stock fell 8.4% below its IPO price, the worst debut among 51 companies that raised as much cash as Robinhood or more.

Shaken but not Stirred! As the Chinese crackdown wiped billions off from stocks, investors have still pumped in $3.6bn into these stocks in the week ended Wednesday. $300m has gone into China tech-funds!

The EuroZone economy has grown by 2%, for the quarter ended June, as the 19 members tiptoed around reopening their economies. There was a contraction of 0.3% in the first quarter and of 0.6% in the last quarter of 2020, in the zone.

Hey, want to earn some quick bucks? Get vaccinated! President Biden has urged state and local governments to pay $100to everyone getting a jab.

US Markets:

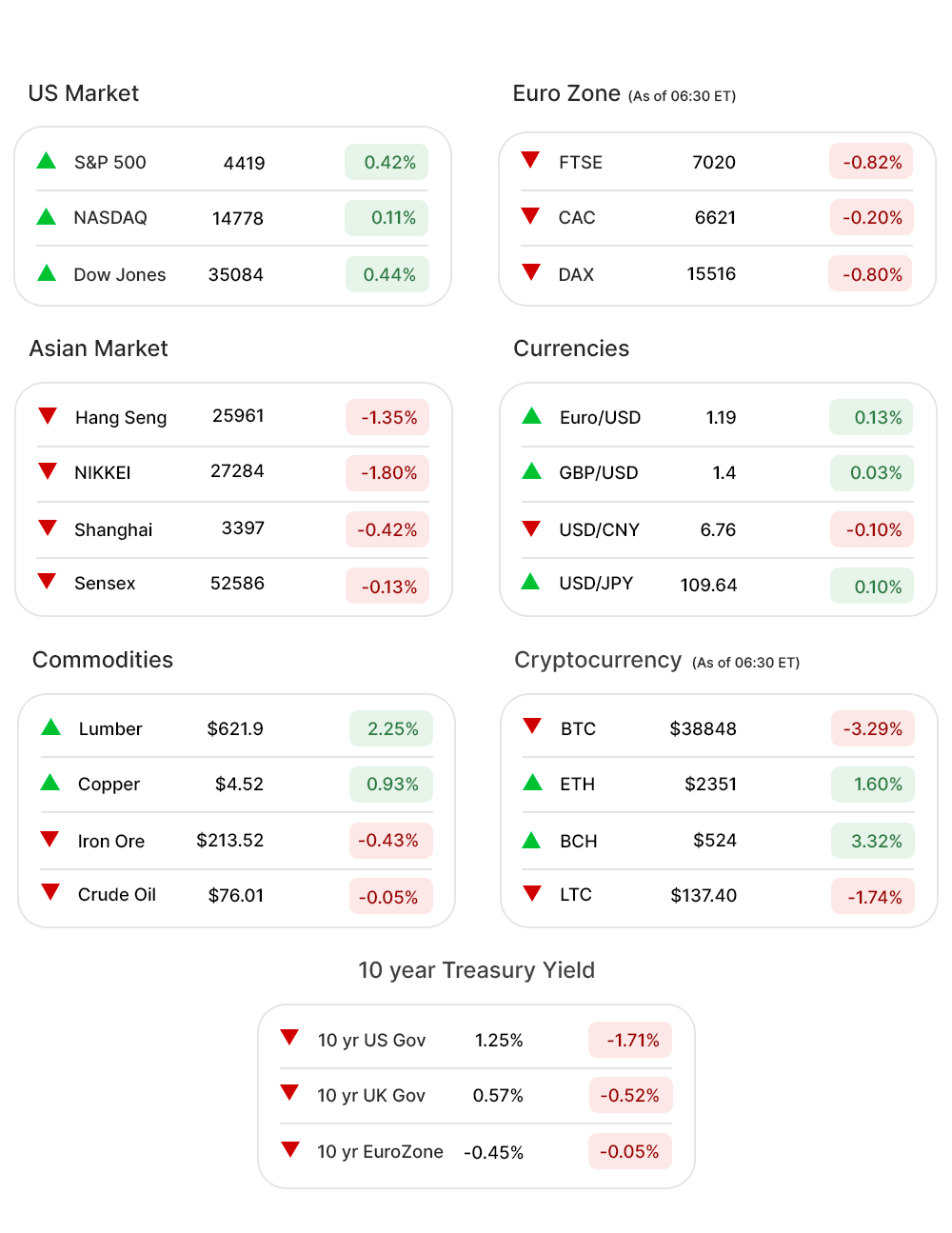

The US markets bounced back Thursday as investors looked past the disappointing print on the GDP, and 400,000 Jobless Claims last week ahead of the expected 380,000.

The S&P 500 (0.42%▲) climbed more than 18 points, to eke out a record high of 4419 along with the Dow (0.44%▲), which gained more than 150 points to close at 35085.

The rally at tech-heavy Nasdaq (0.11%▲), was scuttled a little by declines in some major tech stocks.

Sectors at the S&P 500 remained mixed with no major gains or slides in any of them.

Energy (0.94%▲) extended the gains made on Wednesday, while the Technology (0.48%▲) sector was also buoyed by positive earnings reports by some of the industry giants in recent days.

Healthcare (0.19%▲), Materials (1.08%▲), and Financials (1.07%▲) moved in tandem with the index. Communication Services (-0.92%▼), Real Estate (-0.23%▼), Utilities (-0.69%▼), and Industrials (-0.29%▼) failed to cash in on the overall positivity.

Facebook (FB, -4.01%▼) tumbled following its better than expected earnings but a negative outlook of the Q3 and Q4 of 2021. Amazon (AMZN,-0.84%▼) could not beat estimates on its Q2 earnings.

Futures!

The Futures Friday morning sank, looking set to halt Thursday’s rally at the US markets.

As of 06:00 ET: Nasdaq Futures (-1.13%▼), S&P 500 Futures (-0.70%▼), Russell 2000 Futures (-0.49%▼), and Dow Futures (-0.34%▼).

Key Movers in Small Cap:

LendingClub Corp (LC, 47.45%▲) reported an EPS of 9 Cents for Q2, beating an estimated loss of 43 Cents by a long shot. The sales of $204.4m were also way ahead of the estimated $134.55m. The relative volume of the stock was 34.5.

The cloud-based video platform, Brightcove Inc (BCOV, -14.06%▼), was weighed down by the Q3 and full-year outlook despite reporting better than expected EPS of $0.11, beating the estimate of $0.03 easily. The relative volume of the stock was 11.2.

Infrastructure and Energy Alternatives (IEA, 1.46%▲) Thursday priced its underwritten public offering, pre-funded warrants to purchase shares of underwritten public offering at $11 per share and $10.9999 per pre-funded warrant. The relative volume of the stock was 9.6.

Vaxart Inc (VXRT, -4.99%▼) has announced that clinical trials have shown, for the first time, that its Oral Vaccine platform successfully boosted immune responses in subjects. The stock after an initial bounce on Thursday fell back. The relative volume of the stock was 5.2.

Diebold Nixdorf (DBD, -7.43%▼), the financial and retail technology company, missed Q2 estimates on earnings reporting an EPS of $0.10 versus the expected $0.29. The relative volume of the stock was 5.0.

MaxLinear Inc (MXL, 12.42%▲), the hardware company, reported an EPS of $0.53 for Q2, beating the estimated $0.50. The relative volume of the stock was 4.8.

Cassava Sciences Inc (SAVA, -23.61%▼) announced political clinical data from an interim analysis of an open-label study with Simufilam, its investigational drug for the treatment of Alzheimer’s. The Relative Volume of the stock was 4.6.

The other movers in the small-cap segment included:

iRobot Corporation (IRBT, -1.94%▼): Relative Volume 6.6.

Capital Bancorp Inc (CBNK, 0.44%▲): Relative Volume 5.3.

Biomea Fusion Inc (BMEA, 2.12%▲): Relative Volume 5.3

Mirum Pharmaceuticals (MIRM, 1.58%▲): Relative Volume 4.6.

Key Movers in Large Cap:

The multinational software company, Citrix Systems (CTXS, -13.57%▼) reported mixed Q2 earnings. While the EPS of $1.24 easily beat the estimated $1.19, the sales of $812m fell well short of the $846m estimate. The relative volume of the stock was 11.1.

Novocure Ltd (NVCR, -9.85%▼) Thursday came out with a quarterly loss of $0.14 per share, a little more than the estimated loss of $0.02 per share. The relative volume of the stock was 11.0.

The cable television provider, Altice USA Inc (ATUS, -8.36%▼) reported Q2 earnings with a net income, attributable to shareholders, of $197.7m or 43 cents per share. The adjusted EPS of 52, surpassing the estimates by 5 cents. The relative volume of the stock was 7.0.

The energy company EQT Corporation (EQT, -9.93%▼) reported a surprise loss of $936m or $3.35 per share for the second quarter. The culprit was a $1.3bn loss on its commodity price hedges due to higher prices. The relative volume of the stock was 5.1.

The mattress maker Tempur Sealy International (TPX, 15.38%▲) reported a 76% y-o-y increase in sales for Q2. The adjusted EPS of $0.79 was way ahead of last year’s $0.20. The relative volume of the stock was 4.4.

The other movers in the large-cap segment included:

CyrusOne Inc . (CONE, -3.80%▼): Relative Volume 4.2.

Colfax Corporation. (CFX, 2.85%▲): Relative Volume 3.8.

Advanced Micro Devices (AMD, 5.13%▲): Relative Volume 3.7.

Cirrus Logic Inc. (CRUS, -2.69%▼): Relative Volume 3.4.

Report Card:

The tech juggernaut Amazon (AMZN,-0.84%▼) fell short on Q3 guidance as well as revenue for Q2, which came at $113.08 bn against the expected $115.06bn. The EPS of $15.12 however was way ahead of the expected $12.22. The web services revenue of $14.81bn beat the estimates of $14.18bn as well. The stock tanked more than 7% after hours.

The home appliances corporation Carrier Global (CARR, 4.53%▲) reported an EPS of 64 cents, beating estimates by 14.3%, an increase of 93.9% y-o-y. The revenue of $5.44bn was way ahead of the estimated $4.95bn. The stock remained flat after hours.

CBRE Group Inc (CBRE, 4.98%▲), a commercial real estate services and investment firm came out with an adjusted EPS of $1.36, handily beating the estimates of 78 cents and last year’s 35 cents. The revenue of $6.46bn was also ahead of the expected $6.05bn. The stock remained flat after hours.

The telecommunications conglomerate, Comcast Corporation (CMCSA, 0.22%▲) reported adjusted earnings of 84 cents per share, beating the estimates by 25.4% with an increase of 7% y-o-y. Consolidated revenues of the company increased 20.4% y-o-y to $28.5bn. The stock climbed half a percent after hours.

On the Lookout:

The Core Inflation, which was reported to be 0.5% previously is expected to remain unchanged when the data is published this morning. The Employment Cost Index is also slated to remain unchanged at 0.9%.

Personal Income and Consumer Spending data are due today as well, with the former expected to go down to -0.4% from -0.2% and the latter expected to rise from 0.0% to 0.6%.

Some IPOs to keep track of:

The SPAC, Riverview Acquisition, will raise $250m by offering 25m units at $10. Each unit consists of one share of common stock and one and a half of a warrant, exercisable at $11.50.

Postponed! Reports suggest that Clarios International, a battery supplier, has postponed its IPO, which was planned to raise as much as $1.8bn, due to prevailing “market conditions”. The company had offered 88.1m shares priced between $17 and $21.

Shanghai-based fertilizer producer, Muliang Viagoo Technology, plans to raise $40m by offering 10m shares of its common stock at a price of $4 per share.

Metals Acquisition Corporation, plans to raise $250m by offering 25m shares of its common stock, priced at $10 per unit.

Unusually high shorter-term CALL options activity seen on Exxon Mobil (XOM, 1.24%▲), Snap Inc (SNAP, -1.62%▼), Designer Brands Inc. (DBI, 3.34%▲), Fubotv Inc. (FUBO,-2.31%▼), and Advanced Micro Devices (AMD, 5.13%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Katapult Holdings. (KPLT,-1.64%▼), Molson Coors Beverage. (TAP,-0.28%▼), MGM Resorts International. (MGM, -0.65%▼), Canadian Pacific Railway. (CP, 2.03%▲) and McDonald’s Corporation (MCD, 0.95%▲).

Other Asset Classes:

The US Treasury Yields inched a little lower ahead of the Core Inflation, Consumer Spending, and Personal Income data set to be released this morning.The 10 Year Treasury Yield fell by 2 basis points to 1.247% while the 30 Year Treasury Yield, also ticked down by a basis point to 1.904%. The yields had gained a little Thursday.

Crude Oil prices continue to march higher as demand for energy continues to pick the world over in wake of more and more economies opening up. Brent Crude has breached the $76 per barrel mark while WTI Crude is trading well above the $73 a barrel mark, early Friday morning.

The US Dollar (91.82,-0.05%▼) is down spiraling and was at month’s lowest as the Fed has kept a dovish stance over tapering of monetary policy.

Global Markets:

Asian Markets, after a brief rally on Thursday asBeijing soothed the investors’ nerves, slumped yet again as investors remain wary of more possible clampdowns on companies in China. Nikkei lost a little less than 500 points while Hang Seng slumped yet again by more than 350 points. Shanghai was down 0.42%.

European Markets opened lower Friday morning, as investors looked towards the Asia pacific, despite better than expected earnings, from some of the region’s biggest companies. The GDP data is set to be released in Germany today. The pan EU Stoxx-600 slid 0.37%. DAX lost 117 points, soon after the opening Friday morning.

Meanwhile on Researchfin.ai

There are 100+ new trade setups identified by the AI yesterday. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

Have a joyous weekend!

See you in August!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.