Global Economy’s China Challenge!

Welcome back!

China’s electricity squeeze! At least 10 provinces in the mainland are facing power shortages, forcing factories to cut production. The phenomenon is not only further squeezing the global supply chains but is expected to result in a cut to GDP growth of 0.1 to 0.15 percentage points in Q3 and Q4.

Crisis, far from over! The EV division of debt-ridden Evergrande has canceled its Shanghai listing, as bond-holders remain in limbo after the property developer missed a vital cost final week. The Hong Kong-listed stock of the EV company closed 10% lower, even after pairing most of the losses. $84bn wiped out of the company valuation since its April high.

Don’t panic, the army is here! After the weekend of panic-gasoline-buying in the UK, the country might bring in the army to deliver fuel to stations. The spiraling crisis has also forced the UK to suspend the “Competition Law” to help Oil companies work together. FTSE rose this morning as oil company stocks soared.

New Home Sales (SAAR), in August, has risen by 1.5% to a seasonally adjusted annual rate of 740,000. The rate was, however, 24.3% below the August 2020 reading of 977,000.

Actor Leonardo DeCaprio backed, Swedish EV company Polestar, also backed by the Volvo Group, is set to go public in a SPAC deal at a valuation of $20bn.

The “crime” called Crypto! Chinese government declares all virtual currency-related transactions illegal. Huobi, one of the world’s largest crypto exchanges, said it has stopped registering new users and will complete the removal of all Chinese users by the end of this year. Other exchanges to follow. Bitcoin was up 4.8%, Ethereum 10.4%.

US Markets:

After a gloomy start to the week, stocks in the US managed to eke out some gains Friday, for the third day in a row, wrapping up the volatile week.

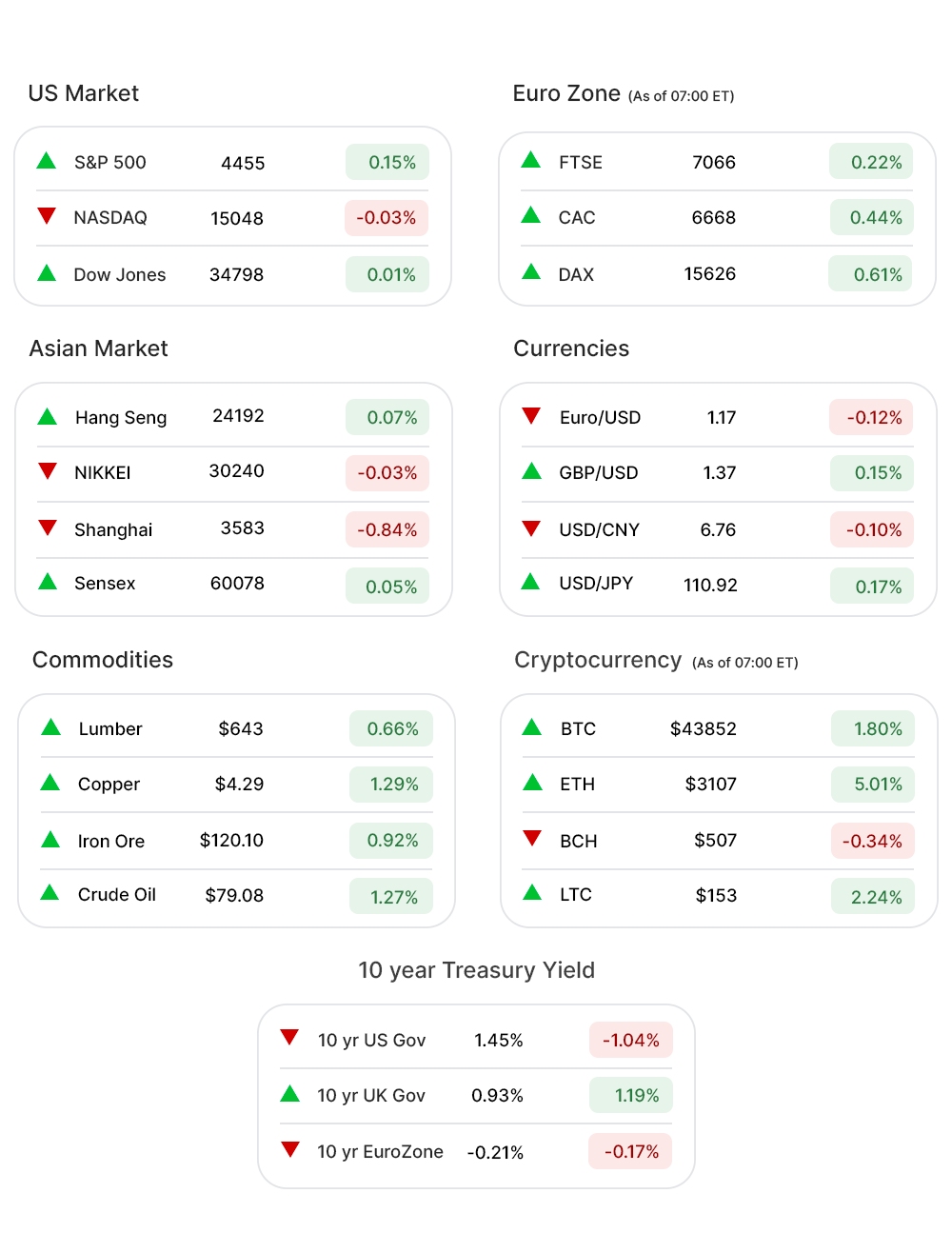

S&P 500 (0.15%▲) managed to notch a little more than 6 points to close the day at 4455.48. Dow Jones (0.09%▲) gained more than 33 points.

Nasdaq (-0.03%▼) and Russel 2000 (-0.49%▼) could not, however, cash in on the overall positivity in the markets.

Sectors at the S&P 500 ended mixed, with four out of the 11 sectors falling below the zero mark.

Real Estate (-1.21%▼), was the worst-hit followed by Utilities (-0.50%▼), Healthcare (-0.42%▼), and Materials (-0.15%▼).

Energy (0.84%▲) gained the most, followed closely by Communication Services (0.68%▲) and Financials (0.54%▲).

Technology (0.07%▲), Consumer Discretionary (0.31%▲), Industrials (0.16%▲), and Consumer Staples (0.21%▲), managed to eke out some gains as well.

Futures!

The Futures were mostly red, early Monday morning, as German elections, China’s power crisis, the fuel crisis in the UK, and rising energy costs will decide the course of the trading day.

As of 06:30 ET, only Nasdaq Futures (-0.29%▼) was in red. Dow Futures ( 0.29%▲), S&P 500 Futures ( 0.05%▲), and Russel 2000 Futures ( 0.40%▲) made gains early in the day.

Key Movers in Small Cap:

Meredith Corporation (MDP, 25.42%▲), as per media reports, is all set to be acquired by IAC Interactive Corp, in a deal valued at $2.5bn. The relative volume of the stock was 15.7.

Progress Software Corporation (PRGS, 14.91%▲), in its Q3 financial results, crushed expectations and raised the outlook for the fiscal year. The relative volume of the stock was 8.3.

Canoo Inc (GOEV, 21.83%▲) created some buzz on Reddit, following a post pointing out the strong short-squeeze potential the stock has. The relative volume of the stock was 6.2.

Macquarie Infrastructure Corp (MIC, 0.47%▲) is planning to buy back senior notes and completes the divestment of Atlantic Corporation.

InnovAge Holding Corp (INNV, 6.51%▲) eked out some gains after tanking substantially, amid an investigation pertaining to a potential securities violation. The relative volume of the stock was 3.3.

The other movers in the small-cap segment included:

Secureworks Corp (SCWX, -20.75▼): Relative Volume 5.4.

Celcuity Inc (CELC, -12.10%▼): Relative Volume 3.4.

Brookdale Senior Living Inc (BKD, -5.78%▼): Relative Volume 3.3.

Keros Therapeutics Inc (KROS, 7.18%▲): Relative Volume 3.2.

OrthoPediatrics Corp (KIDS, -1.58%▼): Relative Volume 3.1.

Key Movers in Large Cap:

After falling on anticipated losses on broadband internet customers, Altice USA Inc (ATUS, -6.71%▼) further plunged as analysts downgraded the stock. The relative volume of the stock was 3.6.

Acceleron Pharma Inc (XLRN, 4.89%▲) is in advanced talks to be acquired by a large pharma company for a deal worth $11bn, or $180 per share. The relative volume of the stock was 3.2.

Vail Resorts Inc (MTN, 7.37%▲) reported financial results for Q4, beating estimates on the top and bottom line. The relative volume of the stock was 2.6.

The other movers in the large-cap segment included:

Nike Inc (NKE, -6.26%▼): Relative Volume 3.7.

Arch Capital Group (ACGL, 0.46%▲): Relative Volume 2.9.

Deckers Outdoors Corp. (DECK, -8.96%▼): Relative Volume 2.3.

LPL Financial Holdings Inc (LPLA, 1.53%▲): Relative Volume 2.1.

Hyatt Hotels Corporation (H, 3.58%▲): Relative Volume 2.1.

Report Card:

Progress Software Corporation (PRGS, 14.91%▲) reported a 40% jump, y-o-y, in revenue to $152.6m, with a profit of $1.18 per share, beating the estimates of $131m in revenue and 82 cents in profit per share. The stock remained flat after hours.

The net income of Vail Resorts Inc (MTN, 7.37%▲) reported a loss of $3.49 per share, narrower than the estimated $3.64 and the prior year’s $3.82. The revenue of $204.2m was up 164.5% on a y-o-y basis and more than the estimated $177m. The stock remained flat after hours.

On the Lookout:

The Durable Goods Orders, for the month of August, are due today with a previous print of -0.1%. The Core Capital Goods Orders has a previous print of 0.1%.

Fed Governor, Lael Brainard, is scheduled to speak about the economic outlook at the annual meeting of the National Association of Business Economics.

The investment management software provider, Allvue Systems Holdings, aims to raise $275m by offering 15.3m shares of its common stock, priced between $17 and $19.

The digital optimization company, Amplitude, is offering 35.3m shares of its common stock, priced at $35 per share.

The First Watch Restaurant Group, is looking to raise $218m by offering 9.4m shares of its common stock, priced between $17 and $20.

Unusually high shorter-term CALL options activity seen on Canoo Inc (GOEV, 21.83%▲), International Game Technology (IGT, 5.55%▲), Draft Kings Inc (DKNG, -0.81%▼), Salesforce.com Inc (CRM, 2.80%▲), and Prologis Inc (PLD, -0.73%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Gap Inc (GPS, -1.16%▼), Energy Transfer LP Unit (ET, -2.21%▼), United States Steel Corp (X, -0.14%▼), General Electric Company (GE, 0.89%▲) and Skillz Inc (SKLZ, -0.18%▼) among others.

Other Asset Classes:

Crude Oil Prices - Global output disruptions, rising shipping costs, and shrinking US inventories propelled prices to an almost three-year high on Friday. Monday morning the winning streak continued, for the fifth consecutive day as Brent crude was trading 1.18% higher and over $79 per barrel mark. WTI crude is approaching the $75 per barrel mark.

The US Dollar (93.46, 0.15%▲) has been oscillating, in a narrow range, between the 93 and 93.50 marks, for the most part of the past week. The gains made after the outcome of Wednesday’s FOMC meeting were not long-lasting either.

Ahead of Fed Governor’s address today, the US Treasury Yields gave up some gains but are still substantially higher than what they were last week. This morning, the 10 Year US Treasury Yield was trading at 1.449%, well ahead of Friday morning’s 1.422%.

Global Markets:

Asian Markets: The surging Energy prices and the risks looming large from China’s financial system kept nagging at the investors’ minds, leading to mixed markets in the region on Monday. Tokyo’s Nikkei, closed falt with a downward bias of 0.03%, along with Shanghai, which closed 0.84% lower. Hang Seng also closed flat with an upward bias of 0.07%. The Indian market closed flat, with a positive bias, as Sensex rose 29 points (0.05%), and Nifty closed at an all-time high of 17855.10, up 1.90 points. A gain in Auto stocks and a crack in the IT sector held the indices in balance.

European markets: The border EU markets cheered a surge in Crude prices that propelled the Oil stocks, while stocks in Germany rose to a 10-day high after the outcome of the Federal election reduced the chances of a left-wing coalition forming the government. FTSE (0.30%), CAC (0.62%), DAX (0.90%) , and the pan-EU index Stoxx-600 (0.36%) looked set to start the week on a positive note.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Group 1 Automotive Inc (GPI), Penske Automotive Group (PAG), Salesforce.com Inc (CRM), ONEOK Inc (OKE), Hyatt Hotels (H), Travel + Leisure Co (TNL), Marriot Vacations Worldwide (VAC), Cabot Oil & Gas (COG), and AutoNation Inc (AN) among others. Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.