Good Law, Good Order!

Good morning,

Just Googled some news about Google! 36 states and Washington DC have come together to file a lawsuit against the search engine, alleging that the giant’s control of its Android Appstore violates antitrust law.

Former President, Donald Trump, is set to file a class-action lawsuit against Facebook CEO Mark Zuckerberg and Twitter CEO Jack Dorsey. Trump will represent a group of people who, he says, have been unfairly censored over social media through problematic content moderation policies.

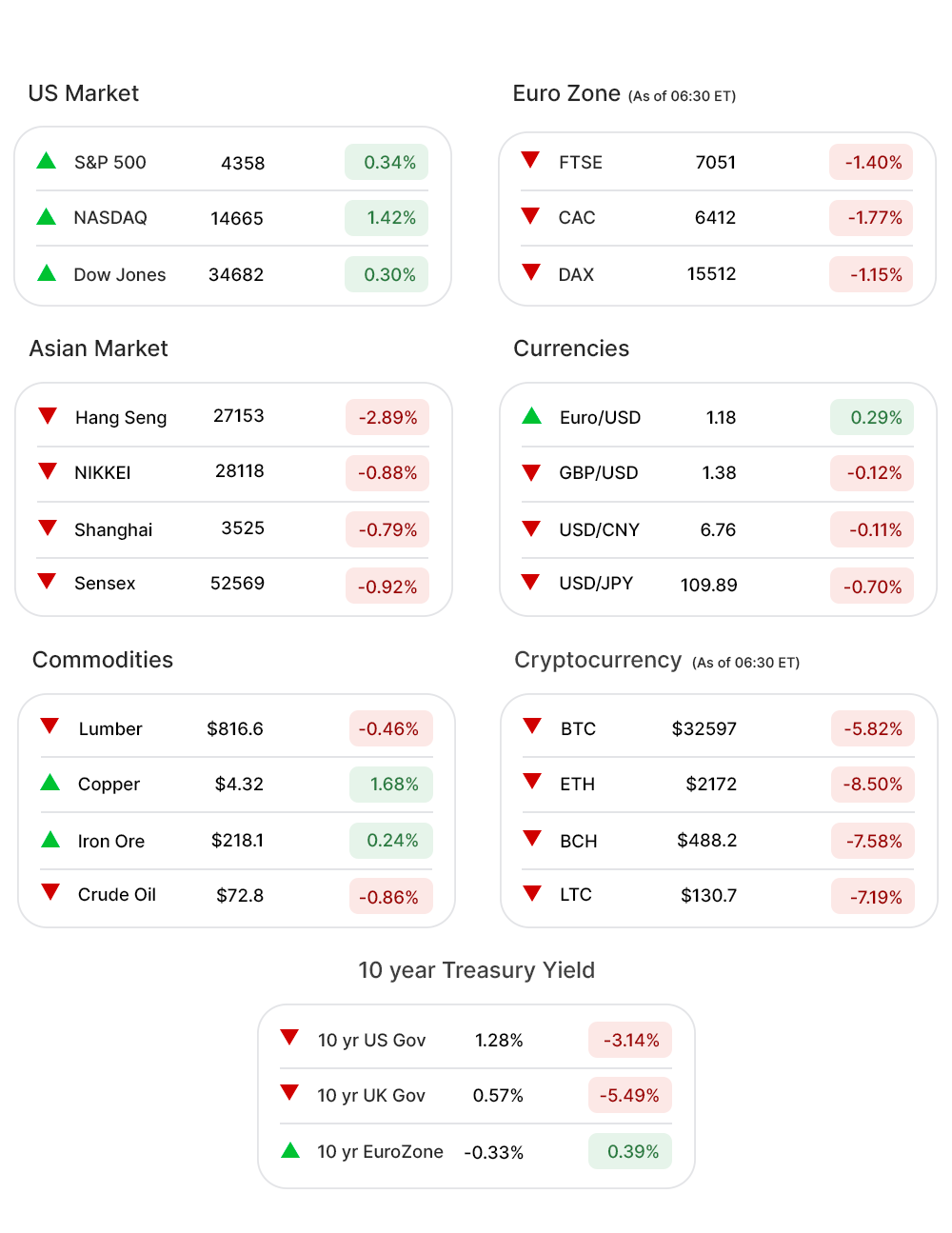

The world’s benchmark bond yield, the 10-Year US Treasury, which influences borrowing costs for companies and households worldwide, dropped to 1.26%, the lowest since early February.

US Markets:

After a choppy start, nerves eased in the equities market soon after the minutes of the Fed's June meeting, signaling a prevailing mindset of not rushing into taking the foot off the policy pedal.

Tuesday’s slide at S&P 500 (0.34%▲) was covered well on Wednesday as the broadest index hit yet another record high. Tech-heavy Nasdaq (0.009%▲) continued the winning streak while Dow (0.30%▲) also witnessed record gains.

Barring Energy (-1.73%▼), which has been marred by losses in Crude Oil prices amid uncertainty over OPEC+, and Communication Services (-0.10%▼), all the other sectors at S&P 500 recorded gains Wednesday.

Real Estate (1 .39%▲), Healthcare (1.39%▲), Utilities (1 .03%▲), and Consumer Discretionary (0.74%▲) were the highest gaining sectors even as Technology (0.49%▲) extended its green run.

Futures!

The US stock market futures have slid by more than 1%, across indices, a day after markets closed at an all time high, as investors continue to step back from bets on high growth and inflation.

As of 07:30 ET, the US Index futures were all red: S&P Futures (-1.28%▼), Nasdaq Futures (-1.24%▼), Russell 2000 Futures (-1.78%▼) and Dow Futures (-1.34%▼)

An interesting day ahead!

Key Movers in Small Cap:

The electronic components manufacturer, Smart Global Holdings Inc. (SGH, 17.81%▲) stock popped after reporting a 56% y-o-y revenue growth and an EPS of $0.30 up from $0.03 last year. The relative volume of the stock was 11.0.

The private sector coal company, Peabody Energy Corporation (BTU, 24.50%▲) stock, outperformed the actor and soared after getting buy recommendations with a price target of $5. The relative volume of the stock was 6.0.

Ellington Financial Inc. (EFC, -4.18%▼) announced an underwritten public offering of 6 million shares of common stock at $18.22 per share. The relative volume of the stock was 7.8.

Another public offering led to another slide! IDEAYA Biosciences Inc. (IDYA, -20.29%▼) stock plummeted after the company announced that it intends to offer common stock shares worth $80 million, without specifying the price or the number of shares. The relative volume of the stock was 4.5.

Biohaven Pharmaceutical Holding. (BHVN, 13.56%▲) reported that its Migraine drug, Nurtec, had $93 million in sales, a 112% increase from the first quarter. The relative volume of the stock was 3.7.

Key Movers in Large Cap:

Wynn Resorts Limited (WYNN, -3.41%▼) stock entered the oversold territory Wednesday, hitting an RSI of 26.7. The RSI indicator, used to measure the level of fear associated with a stock, has a scale of zero to 100. A reading below 30 means the stock is oversold. The relative volume of the stock was 1.7.

The other stocks that were among the movers in the large cap segment include-Ingersoll Rand Inc. (IR, 2.26%▲), with a relative volume of 2.2; Under Armour Inc. (UAA, -1.85%▼), with a relative volume of 1.9, Oracle Corporation. (ORCL, 3.62%▲), with a relative volume of 1.8 and Maxim Integrated Products Inc (MXIM, -2.46%▼), with a relative volume of 1.7.

Earnings Report:

WD-40 Company (WDFC, 1.98%▲), reported a total revenue of $136.4 million for Q3, up by 39% y-o-y. Net income of $21 million for the quarter is also up by 45% y-o-y while the year-to-date income of 61.8 million is 51% more than the prior fiscal period. Diluted earnings per share of the company is $1.52 compared to $1.06 in the corresponding quarter last year. The stock went up by more than 8% after hours.

On the Lookout:

The soaring cost of homes and the lack of properties on the market have led to the lowest level of mortgage applications since before the COVID-19 pandemic.

The Mortgage Bankers Association’s (MBA) weekly survey showed that mortgage application volume fell 1.8% from the week before, putting the index at its lowest levels since January 2020. Applications to purchase a home dropped 1%, down 14% from the same period last year, and refinancing applications fell 2%, which was 8% lower than in 2020.

A record-high number of openings have been reported by US employers. On the last day of May, the JOLTS report says, employers had 9.2 million openings. 3.6 million people have left their jobs in the month of May.

Also, the US Labor department is due to release the number of weekly jobless claims for the week ended July 3, today at 8:30.

Unusually high shorter-term CALL options activity seen on AMC Entertainment Holdings. (AMC, -9.79%▼), Oracle Corporation. (ORCL, -3.62%▲), Revlon Inc. (REV, -0.47%▼), Autohome Inc (ATHM,1.49%▲), SNAP Inc. (SNAP, -5.69%▼) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Apple Inc. (AAPL, 1.80%▲), American Eagle Outfitters Inc. (AEO, -4.88%▼), Apellis Pharmaceuticals Inc. (APLS, -2.15%▼), and Seres Therapeutics Inc. (MCRB, -0.74%▼), among others.

Other Asset Classes:

The US Treasury Yield has made a sensation in the US bond market as it continues to be under pressure and dropped to 1.26%. Many theories are making rounds to validate the move.

1.Short-covering by traders who laid a bet on ‘Reflation’ trade to economic sensitive sectors that have direct correlation with rising yield.

Variation in technical indicator ‘Death Cross’ where short-term moving averages (50-day) intersect with longer-term averages (100-day) pointing to lower yields.

Flight to Safe havens amidst growing concern of economic growth due to spread of Delta variant of Covid 19.

Brent prices have stabilized now after a 5% fall since Monday’s close amidst supply uncertainty post the failure of talks among producers which could potentially cause the current output agreement to be abandoned. Brent crude oil futures edged higher by 2 cents to $73.45 a barrel

Global Markets:

Could the fastest-growing Asian giant be slowing down? Well, Beijing has hinted at a possible rate cut which has led to softness in the Shanghai composite index with Financial and energy firms showing signs of weakness.

Hong Kong tech index touched a 9 month low led by a sell-off in Chinese tech stocks post the stricter norms announced by the Chinese government on its US listings.

Nikkei slipped to its lowest close in more than two weeks, triggered by Japan’s plan to introduce a state of emergencyto contain the resurgence of Covid -19 infections ahead of the Olympics.

Most of the European Markets fell . However, selling was intensified in Spain and Italy where the benchmark equities indices, declined more than 2%. The major catalysts behind the fall could be the spread of the Delta variant of coronavirus, softer than expected US service sector data, and a potential economic slowdown in China.

Wrapping up the biggest strategy critique in almost two decades, ECB has finally withdrawn from the previous inflation target of “below, but close to, 2%,” and agreed to raise their inflation goal to 2%.

We hope for some good news for the battered Airline Industry in the UK as the British Transport minister is expected to set out the details of a plan to scrap quarantine for fully vaccinated travelers who return from medium-risk countries.

Meanwhile on Researchfin.ai

There are 47 new trade setups identified by the AI today. Please sign-up for our app, if you already haven’t, to learn about these setups.

Ok, we are done for today! Have a ball!

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.