Grande, No Longer!

Good Morning!

The Evergrande catastrophe! Under a crushing debt of $300bn, China’s property giant is on the verge of a collapse. The potential fallout of the Evergrande collapse will not only be the biggest test of China’s financial system, but it will also spell doom beyond the mainland borders, to banks, suppliers, home-buyers, and investors. The PBOC has injected $14bn into the financial system to soothe nerves!

And the crackdown continues! Goldman Sachs has assessed that Chinese companies, worth a market capitalization of $3.2tr, might be at risk of further regulations by the mainland regulators. The crackdown has so far affected giants including Alibaba, DiDi Global, Baidu, and Meituan. Tencent’s Thursday slide means Global top-10, in market capitalization, has no Chinese stocks!

The $24bn Indian farm treasure! US tech giants, including Amazon, Microsoft, and Cisco, are emerging as contenders to harness data from the country’s farmers, in an ambitious government-led initiative aimed at transforming an outmoded agricultural industry, worth $488bn, that employs almost half of India’s 1.3bn people.

Led by Lousiana’s increase of 4000, following Hurricane Ida, the Initial Jobless Claims (regular state program), for the week ended September 11, came out to be 332,000 slightly worse than the expected 328,000 and the previous week’s revised 310,000. The numbers are still at a pre-pandemic low!

Continuing Jobless Claims (regular state program) for the week ended September 4, however, dropped to 2.665m lower than the expected 2.740m, and the prior week’s 2.783m.

Beating the delta! Despite a rise in delta variant cases and the analysts fearing a 0.8% decline in the US Retail Sales, the print has been propelled to a gain of 0.7% for the month of August.

In the UK, however, Retail Sales have plunged unexpectedly, for August, falling 0.9% m-o-m against an expected increase of 0.5%, the fourth consecutive drop and the longest losing streak since the records began. The FTSE soared regardless!

Coming out in the open! After years of secrecy shrouding their foray into digital assets, several of Wallstreet’s largest trading companies have unveiled plans to stake out territory in CryptoCurrency markets, in a bid to win lucrative business from institutional investors.

On the other hand, more than 60 Crypto exchanges will shut shop in South Korea next week as new regulations, for the largely unregulated digital currency trading, will be imposed formally.

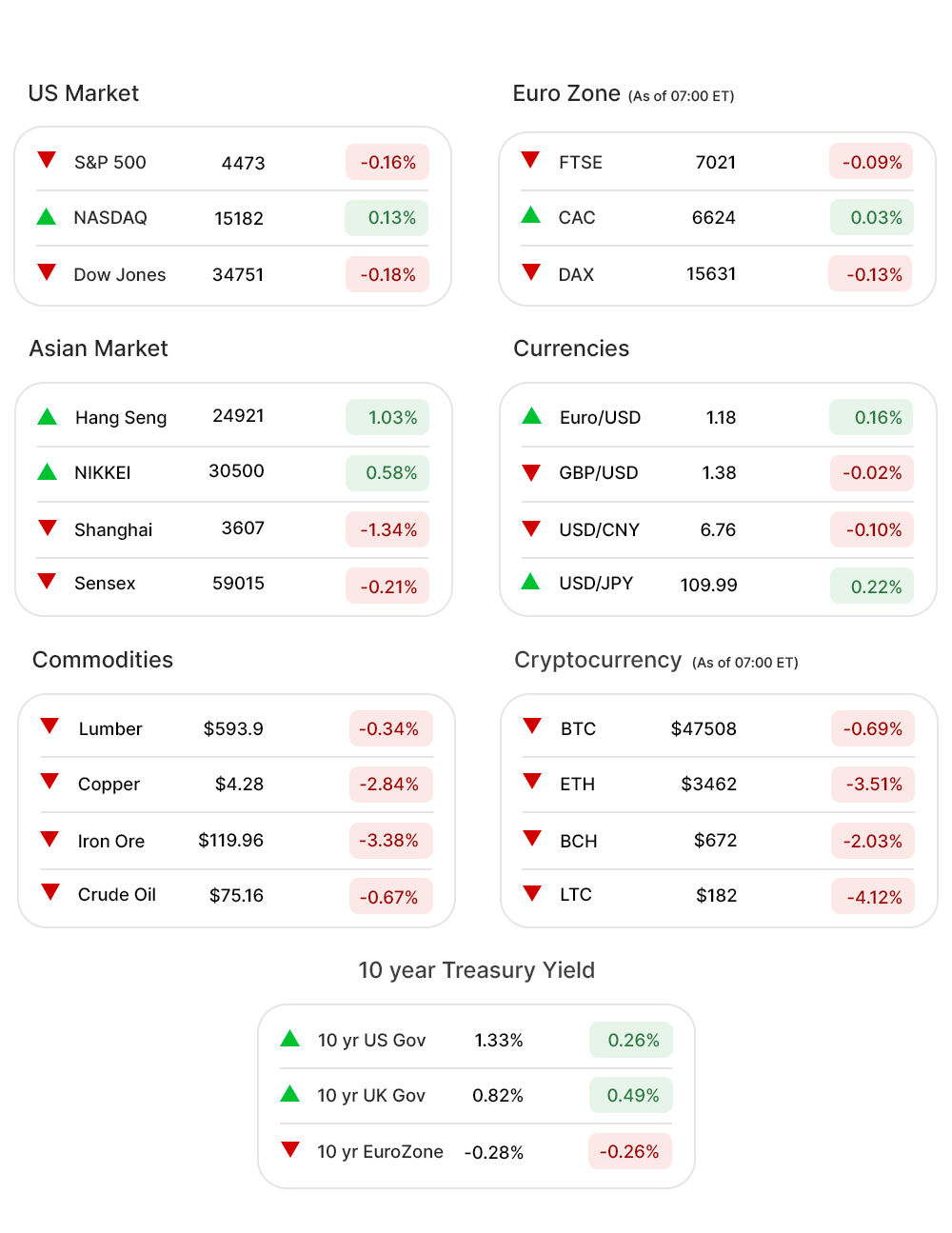

US Markets:

An unexpected surge in Retail Sales, last month, renewing expectations of Fed tapering economic stimulus sooner, pulled most of the stocks down Thursday.

S&P 500 (-0.16%▼) did trim some losses but ended in the negative territory at close. Dow Jones (-0.18%▼) slid more than 63 points, while Russel 2000 (-0.06%▼) closed flat, and in the negative territory.

Tech-heavy Nasdaq (0.08%▲) was the only major index to register some gains, amid the turmoil.

Expectedly, Technology (0.06%▲) was a gaining sector at the S&P 500. The two other sectors making some gains Thursday were Real Estate (0.16%▲), and Consumer Discretionary (0.44%▲).

The rest of the sectors, eight of them, ended in the red zone.

Energy (-1.06%▼) and Materials (-1.09%▼) were the worst hit, followed by Utilities (-0.81%▼), Industrials (-0.66%▼), Financials (-0.24%▼), Communication Services (-0.21%▼), Consumer Staples (-0.34%▼), and Healthcare (-0.25%▼).

Futures!

After some initial gains, the US stock futures, slid back into the negative territory Friday morning.

As of 07:00 ET, none of the indices was in green. Nasdaq Futures (-0.20%▼), Dow Futures (-0.18%▼), S&P 500 Futures (-0.23%▼), and Russel 2000 Futures (-0.27%▼).

Key Movers in Small Cap:

Metropolitan Bank Holding Corp(MCB, 5.85%▲) had on Wednesday announced the pricing of its underwritten public offering of 2m shares, at $75 per share. The relative volume of the stock was 19.0.

Great Western Bancorp Inc(GWB, 11.89%▲) is in the process of being acquired by First Interstate Bancsystem, in an all-stock deal worth roughly $2bn. The relative volume of the stock was 17.3.

Investors of the First Interstate Bancsystem (FIBK, -7.44%▼), however, did not seem to be very pleased with the news of the acquisition. The relative volume of the stock was 17.0.

Aerie Pharmaceuticals (AERI, -21.40%▼) Thursday announced mixed results from a phase-2b study that evaluated its investigational therapy, AR15512, in patients with dry eye disease. The relative volume of the stock was 12.7.

Berkeley Lights (BLI, -11.61%▼) continued to tumble, following accusations of fleecing its customers, leveled by an institutional short-seller. The relative volume of the stock was 11.7.

The FDA has given a nod to Biomea Fusion(BMEA, 17.31%▲), to start an early-stage Leukemia setting trial with BMF-219. The relative volume of the stock was 11.5.

The other movers in the small-cap segment included:

MedAvail Holdings Inc (MDVL, 13.15%▲): Relative Volume 5.8.

Rush Street Interactive Inc (RSI, 12.57%▲): Relative Volume 5.2.

Heritage Insurance Holdings Inc (HRTG, -8.58%▼): Relative Volume 4.5.

MacroGenics Inc (MGNX, -23.76%▼): Relative Volume 4.1.

Key Movers in Large Cap:

Analysts assigned Hayward Holdings (HAYW, 7.80%▲) a target price of $30, over 40% from its current price. The relative volume of the stock was 2.8.

It was the opposite for Beyond Meat Inc (BYND, -2.31%▼) as analysts turned bearish on the stock. The relative volume of the stock was 2.7.

Curtiss-Wright Corp (CW, 4.08%▲) Thursday announced a $400m increase in share repurchase authorization to $550m and an expansion in the 2021 share repurchase program. The relative volume of the stock was 2.4.

The other movers in the large-cap segment included:

Aspen Technology Inc (AZPN, -0.70%▼): Relative Volume 3.5.

Palantir Technologies Inc (PLTR, 5.72%▲): Relative Volume 2.7.

Pinnacle Financial Partners (PNFP, -1.94%▼): Relative Volume 2.3.

CF Holdings Industries (CF, 1.20%▲): Relative Volume 2.3.

Freshpet Inc. (FRPT, 6.11%▲): Relative Volume 2.3.

Freeport-McMoran Inc (FCX, -6.64%▼): Relative Volume 2.2.

On the Lookout:

The UMich Consumer Sentiment Index (preliminary) is expected to go up from August’s 70.3 to 72.0 in September.

Unusually high shorter-term CALL options activity seen on Vale SA (VALE, -5.11%▼), Kinder Morgan Inc (KMI, -1.34%▼), Callaway Golf Co (ELY, 3.06%▲), Ford Motor Company (F, 1.36%▲), and the Offerpad Solutions Inc (OPAD, 58.74%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Levi Strauss & Co (LEVI, -2.99%▼), Palantir Technologies Inc (PLTR, 5.72%▲), Alibaba Group Holdings (BABA, -1.01%▼), Dell Technologies Inc (DELL, 0.96%▲), and Walmart Inc (WMT, 0.33%▲) among others.

Other Asset Classes:

Crude Oil Prices - The production in the US Gulf Coast coming slowly back to life, following two back-to-back hurricanes, has slightly improved the supply outlook and pulled the Crude prices back a little. The prices however are still up around 3% for the week. Early Friday morning Brent held the $75 per barrel mark, despite a 0.40% drop.

The US Dollar (92.80, -0.14%▼) jumped, following a steep improvement in Retail Sales, on Thursday but struggled to find direction early Friday morning, and slumping a little as a result.

The US Treasury Yields climbed higher Thursday following the weekly Jobs report and the surge in Retail Sales. Early Friday morning the 10 Year US Treasury Yield was trading at 1.331%, considerably ahead of Wednesday’s 1.28%.

Global Markets:

Asian Markets: After facing some rough weather for the past few days - owing to a regulatory crackdown in China, rising cases of delta variant, and some disappointing economic data - the markets in the Asia Pacific region bounced back Friday to register some gains and end the week on a positive note. Hang Seng, climbed more than 113 points to close 0.46% higher. Shanghai andTokyo’s Nikkei were up 0.19% and 0.58% respectively.

The European markets, looked set for weekly gains as airlines and hotel stocks were boosted by the news that the UK might be mulling to ease travel restrictions. A rebound in luxury stocks further propelled the major indices in the EU. Major indices including FTSE (0.31%), CAC (0.91%), DAX (0.61%) and the pan-EU index Stoxx-600 (0.59%) looked set for a fruitful day, early Friday morning.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Dynatrace Inc (DT), Ncino Inc (NCNO), DoorDash Inc (DASH), Cloudfare Inc (NET), and Atlas Corp. (ATCO), Rush Street Interactive Inc (RSI) and Magnolia Oil & Gas Corp. (MGY). Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Have a lovely weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.