Is the Dragon Out of Fire?

Good Morning,

China’s GDP grew slower than expected at 7.9% y-o-y in the second quarter, falling short of an estimated 8.1% growth. However, the 12.1% growth in the retail sales and 8.3% in industrial production, for the month of June, have outperformed expectations.

Blockbuster release! Mark Wahlberg-backed fitness chain F45 has gone public and raised $300 million in shares at $16 a share, scoring a valuation of more than $1.4 billion.

The ‘hazardous’ Amazon! The US Consumer Product Safety Commission has sued the e-commerce giant for distributing hazardous products and is asking for a recall.

Netflix and Chill! The streaming giant is venturing into developing video games, giving the “chill” a fresh twist!

US Markets:

Fed Chair, Jerome Powell, has emphasized in his Congressional testimony that the US economy should heal a little more before the economic stimulus is tapered and has added that inflation was going to remain higher for a few months before cooling off.

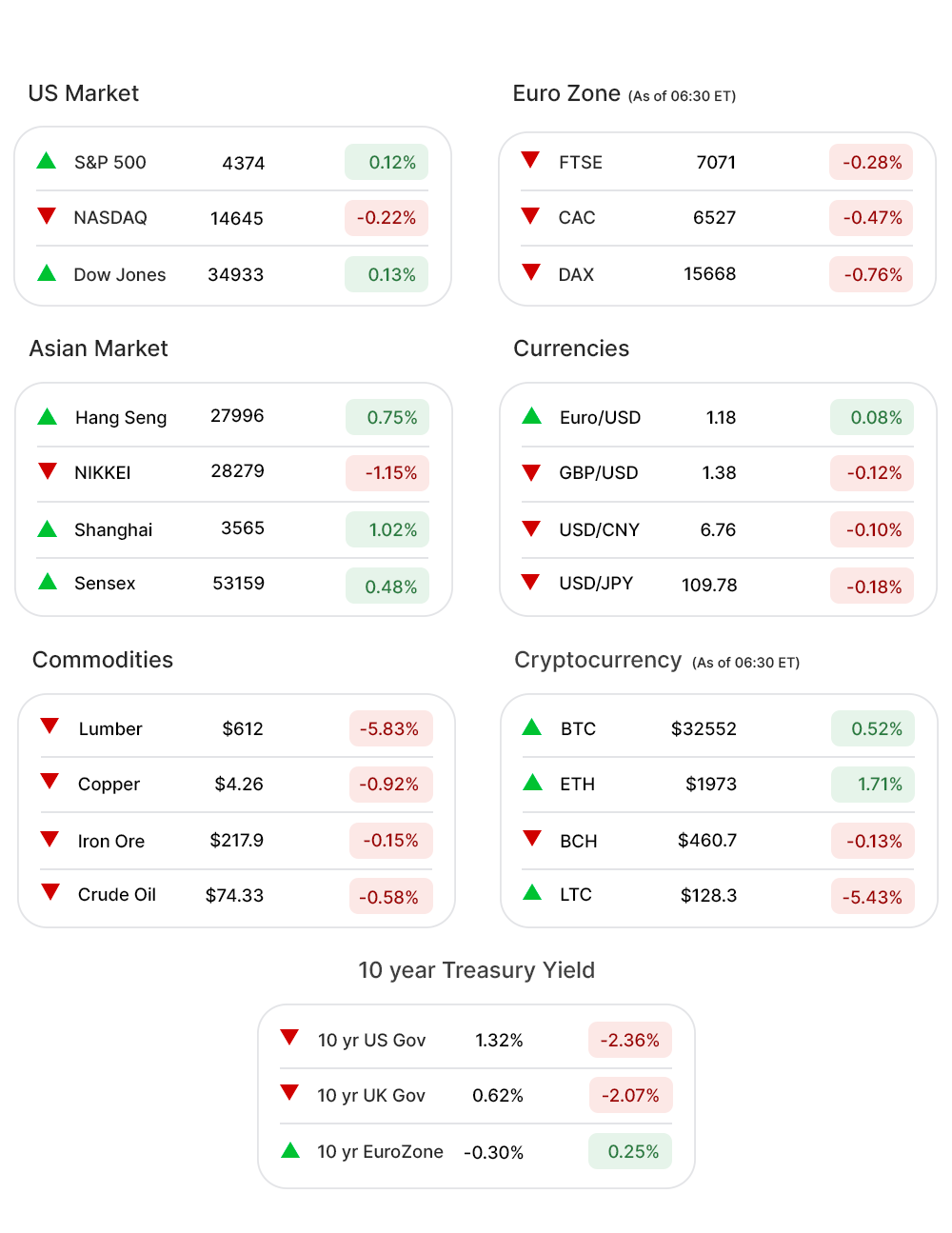

The S&P 500 (0.12%▲) made a slight gain of around 5 points, along with Dow (0.13%▲), which gained some 44 odd points. The Tech-heavy Nasdaq (-0.22%▼) could not pull itself into the green zone, however.

The sectors were mixed! Energy (-2.94%▼) continued to shrug gains, made over the past months. Financials (-0.49%▼) failed to ride on the results from some of the major banks.

Industrials (-1.00%▼), Consumer Discretionary (-1.34%▼), Materials (-0.95%▼), and Healthcare (-0.20%▼) were the other losers.

Technology (0.73%▲), despite the slump in Nasdaq, remains buoyed. Apple (AAPL, 2.41%▲) reached an all-time high while Microsoft (MSFT, 0.54%▲) and Alphabet (GOOGL, 0.70%▲) also hit record highs.

Real Estate (0.89%▲), Consumer Staples (0.91%▲), Utilities (0.83%▲), and Communication Services (0.07%▲) were the other sectors making some gains Wednesday.

Futures!

Futures today look like the exact opposite of the markets on Wednesday.

As of 06:00 ET, Nasdaq Futures (0 .37%▲), which incurred losses on Wednesday, while other indices - S&P 500 Futures (-0.11%▼), Russell 2000 Futures (-0.72%▼), and Dow Futures (-0.31%▼) hovered in the red zone, after making gains yesterday.

Key Movers in Small Cap:

Covanta Holding Corporation (CVA, 7.37%▲), a ‘waste to energy’ solutions company, has announced its acquisition by EQT Infrastructure for $20.25 per share. The relative volume of the stock was 35.0.

Kura Sushi USA Inc (KRUS, 23.15%▲) was one of the tastiest stocks on Wednesday. The restaurant has reported a seven-fold increase in revenue, as compared to last year. The relative volume of the stock was 22.5.

The ophthalmic medical technology and pharmaceutical company, Glaukos Corporation (GKOS, -21.41%▼) has been “extremely disappointed” with the proposed physician fee schedule by Center for Medicare and Medicaid Services (CMS), for the fiscal year 2022. The proposed fee schedule will significantly reduce Galukos’ revenue. The relative volume of the stock was 10.4.

Compass Minerals International (CMP, 13.18%▲), a salt and plant nutrients company, Wednesday announced that it has discovered a Lithium Brine resource, with nearly 2.4 million metric tonnes of Lithium Carbonate Equivalent, at its solar evaporation site in Utah. The total identified Lithium reserves in the US stand at around 7.9 million tonnes. The relative volume of the stock was 7.7.

The other stocks among key movers in this category include Ambac Financial Group (AMBC, 0.73%▲), with a relative volume of 10.3; Core Point Lodging (CPLG, 21.83%▲), with a relative volume of 7.6 and LeMaitre Vascular (LMAT, -9.18%▼), with a relative volume of 6.2.

Key Movers in Large Cap:

Lennox International (LII, -7.66%▼), a company of climate control products for heating and ventilation markets, announced that the Chairman and CEO, Todd Bludorn, will be stepping down after fifteen years in mid-2022. The relative volume of the stock was 3.7.

Among the other key movers in this segment were, Insulet Corporation (PODD, -3.03%▼), with a relative volume of 3.4; ICU Medical (ICUI, -4.56%▼), with a relative volume of 3.3; Norton LifeLock (NLOK, -1.07%▼), with a relative volume of 2.4, and Lululemon Athletica (LULU, 1.68%▲), with a relative volume of 2.3.

Report Card:

Bank of America Corporation (BAC, -2.51%▼) disappoints after missing the top line due to disappointing trading-revenue with FICC sliding 38% y-o-y. Unlike JPM, which at least reported solid NII, BoA's net interest income (NII) has tumbled 6% to $10.2 billion. Revenue at $21.47bn, down -3.9% y-o-y. The stock dropped pre-market as well as through the trading day and after hours.

Delta Airlines (DAL, -1.57%▼) snapped a 5 quarter negative streak by posting a gain of $652 million, thanks to Fed’s CoronaVirus aid. The revenue of $6.3 billion was slightly ahead of the estimated $6.2 billion while as load factor, implying the percentage of seats filled by passengers, was 69% beating estimates of 65%. The stock however fell but remained flat after hours.

CitiGroup (C, -0.29%▼) reported an EPS of $2.85 versus the estimated $1.96 and revenue of $17.47 billion, better than the estimated $17.2 billion. The revenue was 12% down y-o-y, though. The stock continued to slide after hours.

Assets of BlackRock Inc. (BLK, -3.06%▼), the world's largest asset manager, have grown to $9.49 Trillion from $7.32 a year earlier. The company has reported an EPS of $10.03 beating the estimate of $9.44. The stock gained some strength after hours.

On the Lookout:

The Labor Department will today (8:30 am ET) release Jobless data, for the week ended July 10. The numbers are expected to fall to the lowest level since March 2020. The continuing jobless claims report for the week ended July 3 will also be released, alongside.

The Import Price Index, for the month of June, will be released today as well. The index grew by 1.1% in May, the fastest since 2011.

The Beige Book report is here and it is contradicting Fed’s own belief that inflation was transitory. The majority of the contacts have expected further increases in input costs and selling prices in the coming months. The report also calls economic recovery in the US “moderate to robust” from late May to early July.

Unusually high shorter-term CALL options activity seen on LordsTown Motors (RIDE, -7.66%▼), Endeavour Group Holdings (EDR, -3.86%▼), Alibaba Group (BABA, 0.95%▲), Jumia Technologies (JMIA, -7.72%▼), Havaiian Holdings (HA, -4.50%▼) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Beyond Meat Inc (BYND, -6.10%▼), Snap Inc (SNAP,-2.31%▼), Abbott Laboratories (ABT, -0.87%▼), First Solar (FSLR,-2.96%▼), and Tencent Music Entertainment (TME,-2.30%▼) among others.

Other Asset Classes:

The 10 Year US Treasury Yield, after Tuesday’s gains following CPI data, fell again on Wednesday following Jerome Powell asserting that tapering of bond purchasing was still ways off. The yield on the benchmark 10 Year Treasury note fell 6 basis points to reach 1.36% while the yield on the 30 Year Treasury note fell by 5 basis points to 1.99%.

The US Dollar (92.44, 0.03%▲) stabilized somewhat after retreating from the recent highs, following Powell’s assurance on monetary policy.

Crude Oil gained around 2% on Tuesday but shed all of the gains on Wednesday following a compromise between the major global Oil producers, under OPEC. Thursday morning Brent Crude was trading around $73.59/bbl, down by more than 1.5%.

Global Markets:

China’s growth report was enough to push most Asian Markets into the green zone, following a dismal Wednesday’s trading. Japan’s Nikkei did not join the party though. The index lost more than 300 points Thursday.

Not cashing in on the overall positivity, the European Markets too looked gloomy with the Stoxx-600 down 0.43%. All major indices, including CAC, DAX, and FTSE were in the red zone as well.

Meanwhile on Researchfin.ai

There were 5 new trade setups identified by the AI yesterday. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

Have a great trading day ahead!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.