It’s Raining Dividends!

Hey! Hope you had a lovely weekend!

$1.4tr worth of dividends! The Q2 dividend payments have increased by 26%, as 84% of the companies, world over, either increased or maintained their dividends compared to the same quarter last year. Samsung surpasses Nestle as the world’s biggest dividend payer!

Lousy liquidity! Ease of trading at $22tr US bond-market has been severely hit as traders brace up for a key speech this week by Fed Chair, Jay Powell. Highly volatile price movements and uncertainty over Fed policy have kept investors from making any big bets.

Treasury cash has shrunk by more than $1.5tr to $314bn, the lowest since December 2019, after peaking in July 2020 as it ballooned due to ramped-up borrowing and spending to tackle shutdowns.

The economy in the EuroZone has lost some momentum in the current month - with IHS’s flash composite PMI falling to 59.5 versus July’s 60.2 - but is still on track to solid growth in the third quarter. A PMI reading above 50 represents an expansion in economic activity.

PayPal’s cross Atlantic leap! The company will let British customers buy, hold, and sell CryptoCurrency now, a year after it launched the Crypto services in the US. Bitcoin leaps beyond the $50k mark.

Stocks in Hong Kong soared as the Hang Seng was cleared to offer index futures for mainland Chinese shares. Tech stocks, bearing a long route, also benefited as the Hang Seng Tech Index closed 2.1% higher, after an 11% slump last week. The DiDi Global probe data might wreak havoc, again, though!

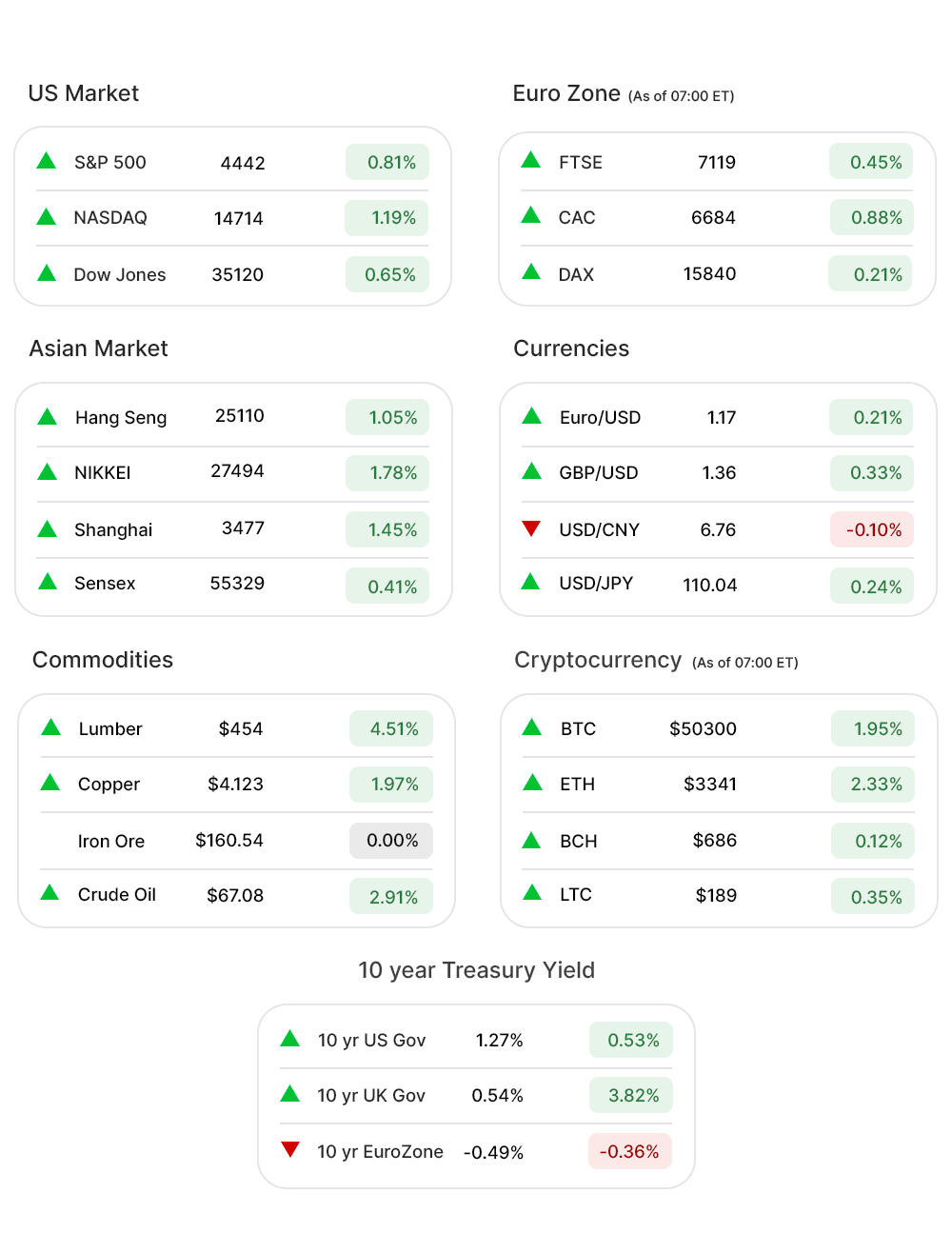

US Markets:

A rebound on Friday, could not prevent the major indices from wrapping up the week in red, as Fed’s stimulus tapering gets more evident with every passing day.

S&P 500 (0.81%▲) gained more than 35 points to eke out another high, along with Dow Jones (0.65%▲), which advanced by 225 points, and Russel 2000 (0.65%▲) which climbed by 35 points as well.

But it was the tech-heavy Nasdaq (1.06%▲) that propelled the rally in the stocks, by gaining over 158 points for the day Friday. The index was, in turn, pushed higher by tech-giants, including Apple (AAPL, 1.02%▲), Facebook (FB, 1.20%▲), Amazon (AMZN, 0.38%▲), Alphabet (GOOGL, 1.29%▲), Microsoft (MSFT, 2.56%▲) - doing well for the day.

At the S&P 500, all eleven sectors were in the green zone.

Technology (1.30%▲) was the top performer among sectors, in sync with the overall market performance, followed by Utilities (1.13%▲).

Energy (0.28%▲), Financials (0.62%▲), Industrials (0.23%▲), Materials (0.64%▲), Consumer Discretionary (0.93%▲), Consumer Staples (0.19%▲), Real Estate (0.45%▲), Healthcare (0.51%▲), and Communication Services (0.96%▲) - made decent gains for the day.

Futures!

The Futures showed some promise, early Monday morning, with hopes that the stocks might replicate Friday’s run today.

As of 06:30 ET, Futures were green without an exception: Russell 2000 Futures (0.91%▲), Nasdaq Futures (0.27%▲), S&P 500 Futures (0.29%▲), and Dow Futures (0.37%▲).

Key Movers in Small Cap:

Rafael Holdings (RFL, -13.15%▼), a developer of Cancer therapies, Friday announced that it has entered into a definitive agreement to sell securities, in a private placement, expected to result in gross proceeds of $104.2m to the company. The relative volume of the stock was 12.8.

Fate Therapeutics (FATE, -21.74%▼) announced impressive results from a clinical trial of its lead immunotherapy candidates FT596 and FT516 but the candidates aren’t going to outperform existing treatments, in all likelihood. The relative volume of the stock was 7.6.

The other movers in the small-cap segment included:

Matthews International Corp. (MATW, 3.34%▲): Relative Volume 12.2.

Oyster Point Pharma. (OYST, -5.73%▼): Relative Volume 7.1.

Accelerate Diagnostics Inc. (AXDX, 19.23%▲): Relative Volume 5.0.

Sientra Inc. (SIEN, -5.11%▼): Relative Volume 4.9.

Spero Therapeutics (SPRO, 18.65%▲): Relative Volume 4.6.

Key Movers in Large Cap:

Foot Locker Inc (FL, 7.26%▲) reported a net income of $430m, or $4.09 per share, compared with $45m, or 43 cents per share, in the prior year. Revenue surged 9.5% to $2.28bn y-o-y. The relative volume of the stock was 10.4

Petco Health and Wellness Company(WOOF, 7.75%▲) reported Q2 earnings of 25 cents per share, beating the estimates by 38.89%. The revenue is up 19% y-o-y to $1.4bn. The relative volume of the stock was 5.2

There were media reports that partners of Snowflake Inc (SNOW, -4.57%▼) are seeing cycles elongate on increased competition from hyper scalers, with Alphabet’s BigQuery cloud data warehouse being the biggest potential competition. The relative volume of the stock was 4.8

The other movers in the large-cap segment included:

BWX Technologies(BWXT, 3.60%▲): Relative Volume 4.3.

Sabre Corporation. (SABR, -6.74%▼): Relative Volume 3.6.

Dun & Bradstreet Holdings Inc. (DNB, 1.50%▲): Relative Volume 2.8.

Ross Stores Inc. (ROST, -2.73%▼): Relative Volume 2.7.

Report Card:

Fashion retailer, Buckle Inc (BKE, -2.95%▼), came out with an EPS of $1.04, ahead of the estimated $0.86 and last year’s $0.71. The revenue of $295.12m was ahead of the estimates by 0.01%. The stock remained flat after hours.

Deere & Company (DE, -2.17%▼), the agriculture equipment maker, reported a surge of 107% y-o-y in earnings to $5.32 per share, ahead of the estimated $4.49. The net sales of $10.4bn were 32% ahead of the prior year’s. The stock remained flat after hours.

On the Lookout:

Markit Manufacturing PMI (flash), with a previous print of 63.4, and Markit Services PMI (flash), with a previous reading of 59.9 are due today.

Existing Home Sales data will also be released today. The previous print is 5.86m.

Also, the Chicago Fed will release its July National Economic Activity index today.

Unusually high shorter-term CALL options activity seen on Activision Blizzard Inc (ATVI, -0.65%▼), Foot Locker Inc (FL, 7.26%▲), Hyzon Motors Inc. (HYZN, 6.27%▲), VMware Inc (VMW, 1.51%▲), and Applied Materials Inc (AMAT, -1.55%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Pinduoduo Inc(PDD, 3.48%▲), Futu Holdings Ltd (FUTU, 4.68%▲), JD.Com Inc (JD, 2.30%▲), Apple (AAPL, 1.02%▲), and Alibaba Group Holdings (BABA, -1.57%▼) among others.

Other Asset Classes:

Crude Oil Prices - following the longest losing streak since 2018 last week - were back on track Monday morning with a substantial increase. Brent and WTI both traded more than 3% up, early Monday morning.

The US Dollar (93.24, -0.27%▼) shed some gains after an extended bullish run last week reaching a new year high, with Fed’s taper talks in consideration.

The US Treasury Yields soared Monday morning with an eye on the economic data to be released today, including the PMI and national economic activity index. The 10 Year US Treasury Yield was trading at the 1.278% mark, early Monday morning.

Bitcoin, the major CryptoCurrency, breached the $50,000 mark early Monday for the first time since May, as crypto continued its march ahead after a rout recently.

Global Markets:

Asian markets, after last week’s rout, were buoyed by Friday’s positivity in the US stocks and a rise in oil prices Monday morning, even though the delta virus fears remain hovering over the investor sentiment. Shanghai advanced 1.45%, Hang Seng by more than 250 points, and Nikkei rose by 480 points.

European markets, following the bruising last week, were up into the green zone Monday morning as the positivity from the Wall Street and Asian markets seeped into the major EU indices.Stoxx-600, FTSE, and CAC were all marching ahead.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Have a great day!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.