Lull before the Storm?

Hi, hope you are having a nice time and if you’re back to business, here is a good start!

Jerome Powell seems worried! A Saudia-UAE spat has led to deadlock on OPEC+ meet. It will mean no increase in output by the OPEC countries for now and may further spike Crude Oil prices adding to the inflation worries - this time the longer term inflation.

China’s “CyberSecurity” crackdown on several tech companies has put into jeopardy a multi billion dollar pipeline of planned New York listings of Chinese companies. The companies might head to Hong Kong for listing if things do not untangle the way they hope.

We are amidst a “she-cession”! 1.4 million women have lost their jobs in the hospitality sector between February 2020 and May 2021, nearly half of the jobs lost in the industry. The laid-off women are creating the she-cession!

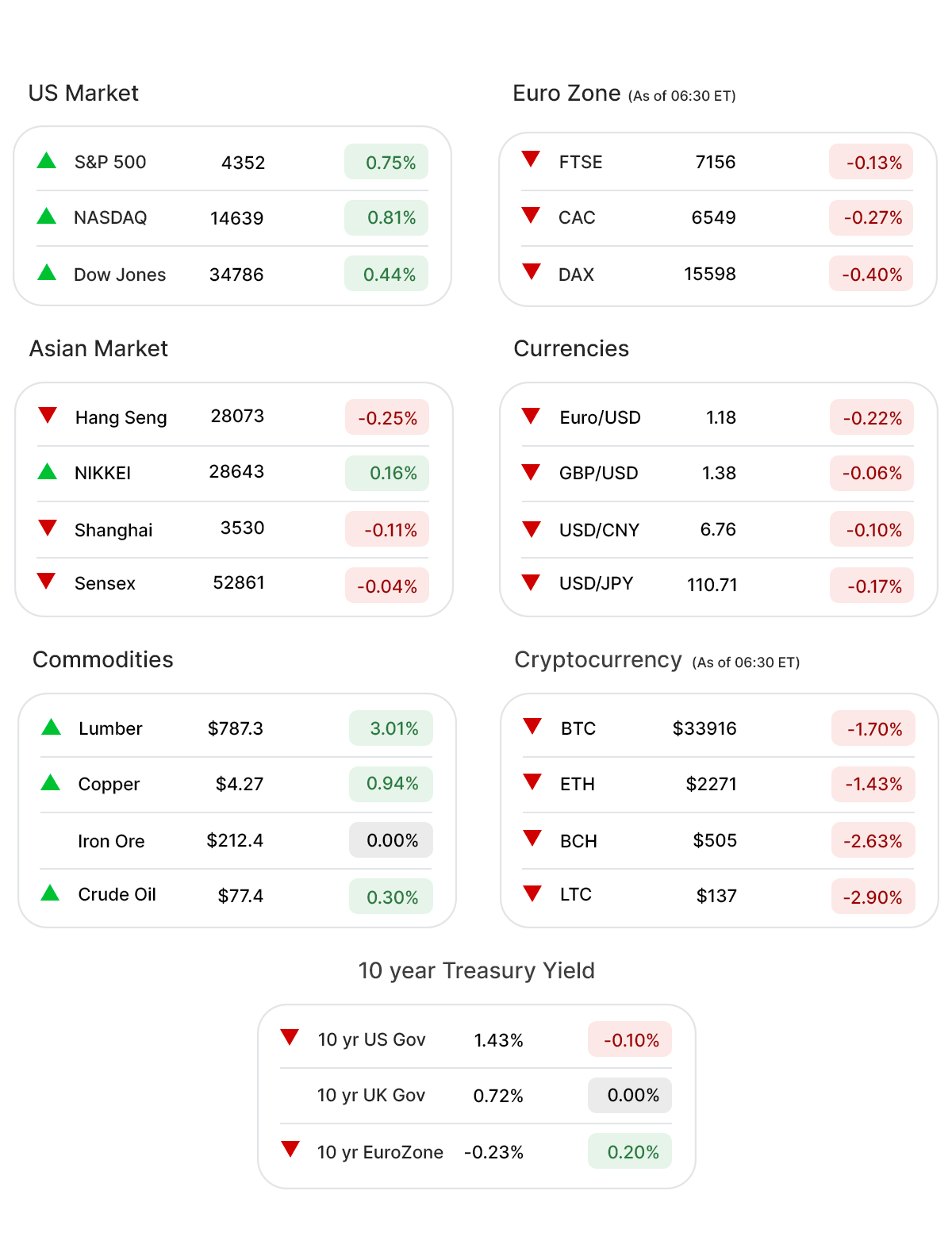

US Markets:

Markets will open today after three days. The futures look flat ahead of Fed’s FOMC meeting minutes, scheduled to be released on Wednesday.

As of 07:30 ET, the US Index futures, barring Russell 2000 Futures (-0.05%▼), were all green. S&P Futures (0.08%▲), Nasdaq Futures (0.22%▲), and Dow Futures (0.04%▲)

On the Lookout:

The volatility gauge often referred to as the fear index, VIX (15.83, 2.45%▲) has receded back into the mid-teens, lowest from its pandemic peak of 65.54 in March 2020, suggesting “complacency” in the markets.

The Total Put/Call ratio has been around 0.80 levels for nearly a year. A level of ~0.65 suggests an aggressive bullish tone.

Didi Global (DIDI, -5.02%▼) is going through a CyberSecurity review. After an exceptional IPO launch, the stock went haywire on Friday as the news of the probe hit headlines. The Didi app has been taken down from app stores in China. More trouble for the stock Tuesday?

The probe meanwhile has been extended to some other US listed ChineseTech companies, as well - truck hailing platforms Yunmanman and Huochebang, as well as job listing site Boss Zhipin among them.

Unusually high shorter-term CALL options activity from last friday seen on Keurig Dr Pepper Inc. (KDP, 0.11%▼), Altimmune Inc. (ALT, 6.97%▼), Advanced Micro Devices Inc. (AMD, 1.49%▲), and Vistra Corp. (VST,0.79%▲), Nvidia Corporation. (NVDA, 1.36%▲), among others.

On the other hand, last Friday unusually high shorter-term PUT options activity was seen on Luminar Technologies Inc. (LAZR, 1.87%▼), Nikola Corporation. (NKLA, 3.24%▼), Lordstown Motors (RIDE, 10.82%▼), Dropbox Inc. (DBX, 1.52%▲), Caesars Entertainment Inc. (CZR, 0.48%▼) among others.

Other Asset Classes:

The Ten-year U.S. Treasury Yields rose about two basis points to 1.44% due to a surge in oil prices

The US Dollar Index (92.23, 0.02%▲) was trading steady as pressure for hikes eased in the wake of mixed job data and in anticipation of clarity on FOMC minutes expected tomorrow.

Crude Oil prices are scarily close to the $80 mark as fresh supplies hit a roadblock owing to cancellation of OPEC meeting.

Gold ($1807.37, 0.86%▲) : July welcomed the bullion on a positive note 1.86% , the highest close in more than 2 weeks , after having suffered its worst month in June (~5%), since late 2016. Expectations of FED pulling back stimulus had subdued the gold prices for some time.

Global Markets:

Airline stocks gained altitude after travel restrictions from the UK and four other countries to Germany were scrapped, minimising the losses in some European Markets trading in red almost throughout the day. A gloomy trading day in Asia and an unexpected drop in German industrial orders also added to the downslide, after three winning sessions.

Meanwhile on Researchfin.ai

There are 28 new trade setups identified by the AI today. Please sign-up for our app, if you already haven’t, to learn about these setups.

That is it for today!

Have a great trading day ahead!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.