More Than Just Sunshine!

Good Morning!

For the first time since 2014, when the sector was first tracked, prices across residential, commercial, and utility scale Solar have increases y-o-y as well as q-o-q. The supply bottlenecks and rising raw material costs are overshadowing a blueprint of increasing Solar electricity from 3% now to 45% in 2050. Also, global solar panel prices have jumped 16% this year compared to the 2020 levels.

UK’s hiring crisis! For the first time vacancies in Britain have breached the 1m mark, and rocketed 35% to 1.03m in August - despite the fact that the number of employees on company payrolls also rose by a record 241,000. Worries that this will dampen economic recovery pulled FTSE down.

Google’s South Korea glitch! The South Korean regulatory authority has fined Alphabet Inc$176.6mfor blocking customized versions of its Android operating system. This is the US tech giants second setback in the country in less than a month.

A bigger fine! Three companies linked to Guo Wengui, a US-based Chinese businessman and a known critic of the Communist government back home, will pay a $539m fine in a US securities fraud.

The vanishing cars! Chip shortage still persists worldover and is expected to prolong, even as carmakers look all set to shed 9.5m cars, by the beginning of 2022, due to the chip crisis and the subsequent plant closures.

The US Federal Budget deficit has risen to $2.7trthrough August - on track to be the second-largest shortfall in history - owing to trillions of dollars being spent in Covid relief.

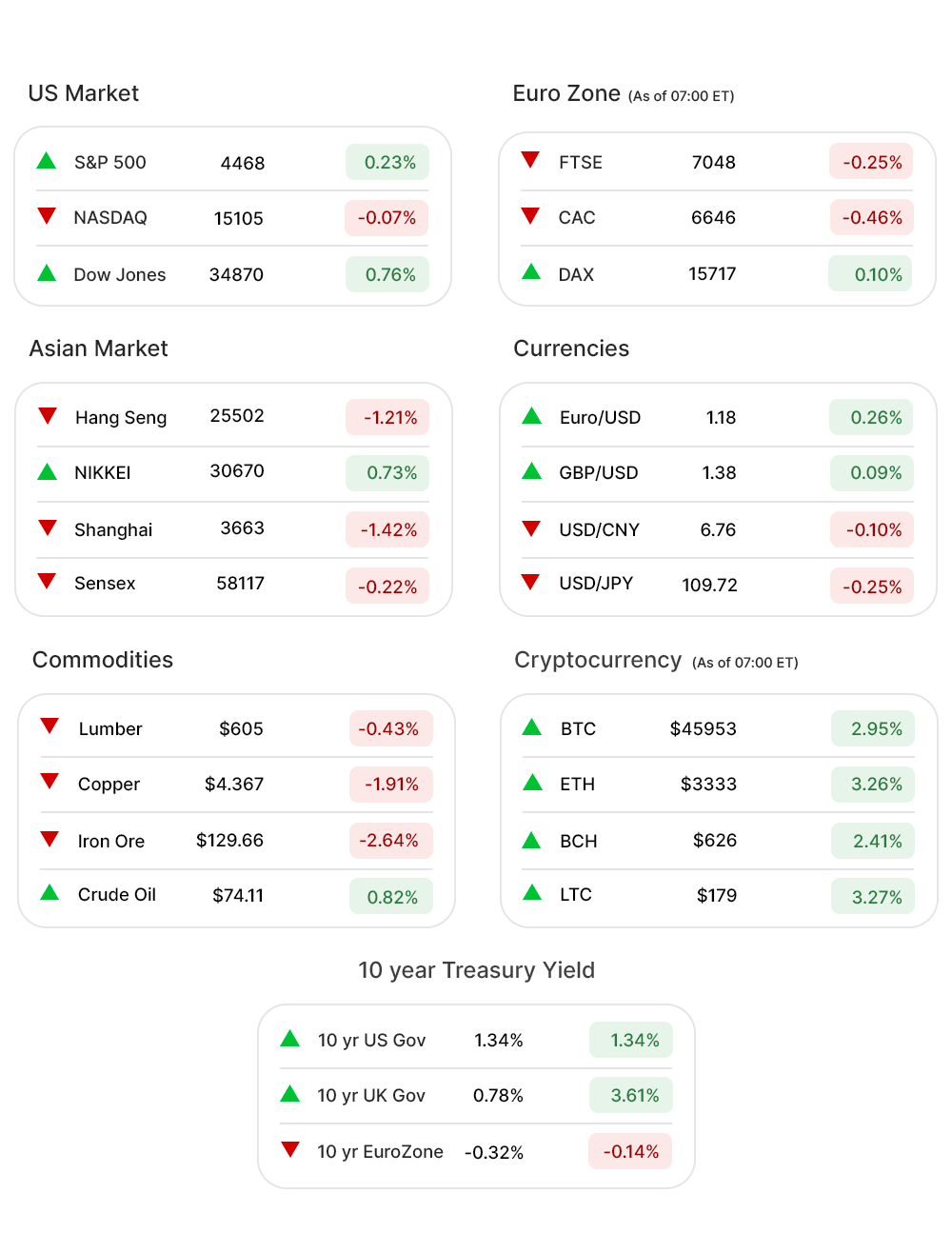

US Markets:

Stocks managed to snap a 5-day losing streak Monday, led by some major gains in energy companies.

S&P 500 (0.23%▲) added a little more than 10 points, by the close, after fluctuating between red and green through the day. Dow Jones (0.76%▲) gained 261 points and closed at 34869.63, while Russel 2000 (0.59%▲) gained over 13 points.

Tech heavy Nasdaq (-0.04%▼) ended on the losing side, with Moderna Inc (MRNA, -6.60%▼) pulling the index downwards.

Sectors at the S&P 500 were mixed, with three into the red zone and the other eight of them gaining some momentum.

Energy (2.94%▲) was the highest gainer, followed by some substantial gains in Financials (1.14%▲), Real Estate (0.48%▲), and Communication Services (0.41%▲).

The other gaining sectors included Consumer Discretionary (0.14%▲), Consumer Staples (0.17%▲), Industrials (0.27%▲), and Technology (0.03%▲).

Healthcare (-0.61%▼), Materials (-0.02%▼), and Utilities (-0.18%▼) closed into the red zone.

Futures!

The US stock futures mirrored Tuesday’s market performance.

As of 07:00 ET, only Nasdaq Futures (-0.02%▼) were in the negative territory. Dow Futures (0.02%▲), S&P 500 Futures (0.06%▲), and Russell 2000 Futures (0.09%▲) looked poised for a decent opening.

Key Movers in Small Cap:

MiMedx Group Inc (MDXG, -59.56%▼) Monday reported results from two clinical trials that did not meet the expected results. The Relative Volume of the stock was 26.3.

There were reports that Tronox Holdings PLC (TROX, 11.05%▲) has got a $4.3bn all-cash buyout offer from Apollo Global Management Inc. The Relative Volume of the stock was 19.8.

The investors seemed to be fired up about the appointment of Quentin Blackford as CEO of the wearable heart monitor maker iRhythm Technologies (IRTC, 35.00%▲). The Relative Volume of the stock was 19.2.

Bharat Biotech, a partner of Ocugen Inc (OCGN, 15.80%▲), has got a nod for its Covid-19 vaccine by the World Health Organisation. The Relative Volume of the stock was 12.8.

Mayville Engineering Company (MEC, 24.28%▲) is expected to benefit as manufacturers look to move supply chains closer to home. The Relative Volume of the stock was 10.0.

Regenxbio Inc (RGNX, 31.20%▲) has announced an eye-care collaboration with AbbVie Inc. The Relative Volume of the stock was 7.7.

The other movers in the small-cap segment included:

AXT Inc (AXTI, -16.79%▼): Relative Volume 23.9.

Rain Therapeutics Inc (RAIN, 1.86%▲): Relative Volume 13.9.

The York Water Company (YORW, -10.67%▼): Relative Volume 7.6.

Invacare Corporation (IVC, 18.43%▲): Relative Volume 7.1.

Cadiz Inc (CDZI, -8.45%▼): Relative Volume 5.7.

Key Movers in Large Cap:

Avantor Inc (AVTR, 0.00%▲)has announced the pricing of its secondary offering of 2.8m shares, at $42 per share. The relative volume of the stock was 2.6.

Leslie’s Inc (LESL, -10.36%▼) is planning to sell 14.5m shares of its stock. The relative volume of the stock was 2.4.

The other movers in the large-cap segment included:

Littelfuse Inc (LFUS, -1.61%▼): Relative Volume 3.2.

Allegro Microsystems Inc (ALGM, 8.37%▲): Relative Volume 2.8.

Datto Holding Corp (MSP, 1.15%▲): Relative Volume 2.7.

TransUnion (TRU, -2.04%▼): Relative Volume 2.5.

Mattel Inc (MAT, 2.55%▲): Relative Volume 2.4.

Report Card:

The computer technology company, Oracle Corporation (ORCL, -0.88%▼) reported a 4% y-o-y increase in revenue to $9.7bn, while the GAAP earnings per share were up 19% to $0.86. The stock slid a little less than 2% after hours.

The fourth-quarter revenue for Matrix Service Co (MTRX, 4.15%▲)increased 18% y-o-y to $174.9m, compared to the previous quarter’s $148.3m. The company has reported a strong balance sheet with no outstanding debt and a cash of $83.9m. The stock slid by around 9% after hours.

On the Lookout:

The Consumer Price Index is expected to slide by a basis point, from July’s 0.5% to 0.4%, even as the Core CPI is expected to remain unchanged at 0.3%.

The NFIB Small Business Index is also expected to decline from July’s 99.7 to 99.0.

Some IPOs to look out for:

Coffee giant Dutch Bros will be valued between $3bn to $3.3bn as it is offering over 21m shares of its common stock priced between $15 and $17, per share.

Genworth’s mortgage insurer, Enact Holdings, is offering 13.3m shares of its common stock, priced between $19 and $20 per share. The company will be valued at around $3.3bn.

Unusually high shorter-term CALL options activity seen on Affirm Holdings Inc (AFRM, -11.64%▼), GlaxoSmithKline Plc (GSK, 0.02%▲), Baidu Inc. (BIDU, -0.51%▼), Crocs Inc (CROX, -4.43%▼), and ZIM Integrated Shipping (ZIM, 0.14%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on United States Steel Corporation (X, -2.08%▼), Capri Holdings (CPRI, -0.11%▼), Coca-Cola Co (KO, 0.83%▲), Pinduoduo Inc (PDD, 0.40%▲), and SunRun Inc (RUN, 2.80%▲) among others.

Other Asset Classes:

Crude Oil Prices - Prices rose to a six-week high as Storm Nicholasposes a danger to the US Gulf Coast, which is still reeling under the effects of Hurricane Ida. Also, OPEC sees the delta variant weighing heavily on Oil demand. Brent traded well over the $74 per barrel mark, Tuesday morning, while WTI Crude has risen over the $71 per barrel mark.

The US Dollar (92.52, -0.17%▼) has fallen back post the Federal Budget deficit data, and ahead of some key economic data, after making some gains Monday afternoon.

The US Treasury Yields climbed Tuesday morning as the CPI is expected to fall, compared to July and the Core CPI is expected to remain unchanged. The 10 Year US Treasury Yield was trading into the green zone at 1.345%.

Global Markets:

The Asian Markets were mixed as the tech crackdown in China and an eye on US inflation data weighed heavily on the investor sentiment. Hang Seng fell by more than 309 points or 1.20% along with Shanghai, losing 1.42%. Tokyo’s Nikkei rose more than 222 points or 0.73%.

Apart from the US inflation data, a slide in luxury and mining stocks weighed down the European markets early Tuesday morning. FTSE, was down 0.29% soon after the opening, while CAC had slid 45 points or 0.68%. Pan-EU index Stoxx-600 was trading lower by 0.17%. The only green index DAX was up 0.08%.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.