No “Chicken Dinner” for Krafton!

Good Morning,

Sooner better! A growing number of officials from the Fed - including President for the Boston chapter, Eric Rosengren, and that of the Atlanta chapter, Raphael Bostic - believe that the dial back of monetary stimulus should happen sooner after another month or two of employment gains.

But risk premiums are on the rise. Investors have pulled back from the debt of Covid hit companies. Bond prices of cruise companies, cinema operators and retailers fell last week - as businesses delay return to office, some imposing vaccination requirements on their staff.

A fall in consumer spending, amid rise in cases of delta variant, has led to the retail sales in the United Kingdom growing at a much slower rate of6.4% in July, compared to 10.4% in June and a 3-month average of 14.7%. FTSE slipped on the news after a positive start.

Blue skies! Tangshan, the steel hub in China, will join a campaign to slash pollution by 40% by early February next year, by extending its existing curbs in a bid to have blue skies for Beijing’s Winter Olympics. Tangshan produces 8% of the global steel.

After recalling almost every EV, Tesla sold in China, the company’s China-made deliveries to the local market have fallen by 69% to 8621 units from June’s 28,138 units. Tesla stock was up 2% on Monday.

PUBG creator Krafton Inc. backed by Tencent became the first IPO to slide on debut, at KOSPI this year. The stock slid as much as 20% before closing 8.8% in the red zone, after pulling off a $3.8bn initial public offering.

US Markets:

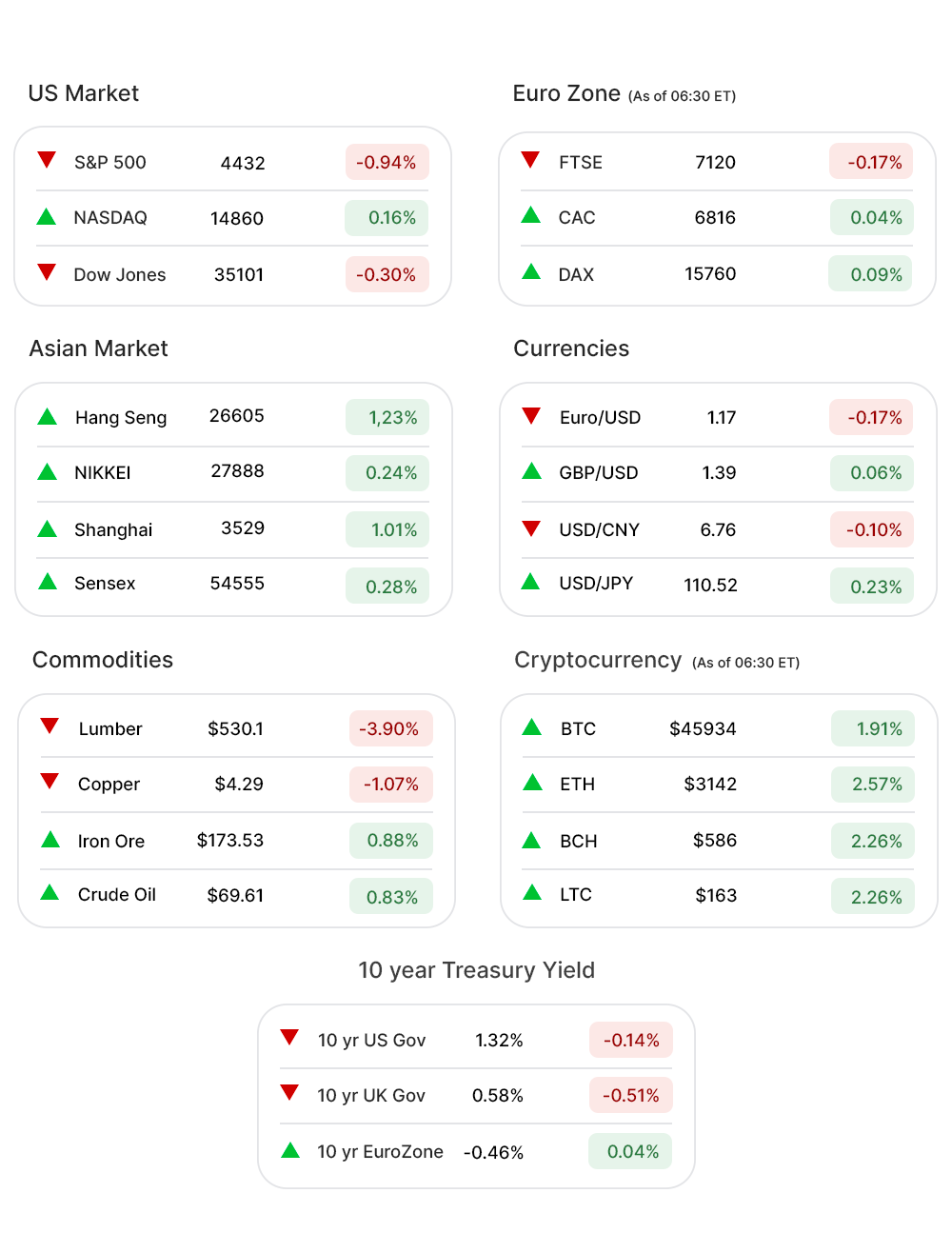

Monday was a reversal of Friday in US markets as S&P 500 (-0.09%▼) and Dow Jones (-0.30%▼) pulled a little back and Nasdaq (0.16%▲) advanced amid a resurgence of Covid and a return of mask mandates in many states.

Sectors in red at the S&P 500 outnumbered the ones in green in sync with the index.

Healthcare (0.38%▲), Financials (0.31%▲), Consumer Staples (0.31%▲), and Communication Services (0.03%▲) were the green sectors.

Energy (-1.47%▼) was the worst hit sector Monday, followed by Real Estate (-0.41%▼), Industrials (-0.40%▼), and Technology (-0.35%▼). The other three sectors slid, a little, as well.

Futures!

The Futures hovered below the zero levels, Tuesday morning, reflecting Monday’s mood in the markets.

As of 06:30 ET, only Nasdaq Futures (0.11%▲) was in green while S&P 500 Futures (-0.02%▼), Russell 2000 Futures (-0.06%▼), and Dow Futures (-0.07%▼) were all red.

Key Movers in Small Cap:

Golden Nugget Online Gaming (GNOG, 50.77%▲) will be acquired by DraftKings in a $1.56bn all-stock deal. GNOG shareholders will receive 0.365 shares of DraftKings. The relative volume of the stock was 58.3.

The chicken producer Sanderson Farms (SAFM, 7.41%▲) Monday agreed to be bought by commodities trader Cargill Inc for $4.53bn. The relative volume of the stock was 29.3.

Axsome Therapeutics Inc (AXSM, -46.50%▼) Monday announced that its drug AXS-05, a potential treatment for major depressive disorder (MDD), could take longer than expected to enter the market after hitting some regulatory roadblock. The relative volume of the stock was 28.0.

American National Group (ANAT, 8.80%▲) and Brookfield Asset Management Reinsurance Partners have entered a definitive merger agreement wherein ANAT will be acquired by Brookfield in an all-cash transaction valued at $5.1bn. The relative volume of the stock was 22.2.

Aterian Group Inc (ATER, -33.29%▼) reported dismal Q2 results, falling well short of estimates. The revenue of $68m lagged way behind the expected $94m while the company also reported a loss of $3.7m compared to a gain of $3.4m in the same quarter last year. The relative volume of the stock was 15.1.

Bluebird Bio Inc (BLUE, -27.45%▼) Monday announced that its phase-3 study evaluating Eli-cell in treating CALD has been placed on a clinical hold by the FDA. The relative volume of the stock was 10.8.

The other movers in the small-cap segment included:

Cortexyme Inc (CRTX, 47.32%▲) : Relative Volume 11.1.

National Western Life Group (NWLI, 17.75%▲): Relative Volume 7.9.

AVRO Bio Inc (AVRO, -20.64%▼): Relative Volume 6.3.

Crawford and Company (CRDA, -6.41%▼): Relative Volume 6.1.

Key Movers in Large Cap:

Elanco Animal Health Inc (ELAN, -16.09%▼), after reporting better than expected earnings, downgraded its outlook for the second half of the year asking investors to expect earnings, per share, between $0.97 and $1.03. The relative volume of the stock was 11.7.

The atmospheric gas and equipment service provider, Air Products and Chemicals Inc (APD, -5.18%▼) reported Q3 EPS of $2.31 on revenue of $2.6bn against the expected $2.36 on revenue of $2.5bn. The relative volume of the stock was 3.2.

The education technology company Chegg Inc (CHGG, -4.97%▼) reported a 30% increase y-o-y in its revenue to $198.5m and a net income of $32.8m. The relative volume of the stock was 3.0.

Tyson Foods Inc (TSN, 8.66%▲) reported an adjusted EPS of $2.70, much higher than the expected $1.62 while raising its outlook for the rest of the year as well. The relative volume of the stock was 2.9.

The other movers in the large-cap segment included:

McAfee Corp. (MCFE, -6.56%▼): Relative Volume 3.6.

FireEye Inc. (FEYE, -11.35%▼): Relative Volume 2.9.

Vimeo Inc. (VMEO, -22.06%▼): Relative Volume 2.7.

Plug Power Inc (PLUG, 8.38%▲): Relative Volume 2.7.

Report Card:

The owner of direct broadcast satellite provider Dish Network Corporation (DISH, 0.67%▲) reported an EPS of $1.06, beating the estimates of $0.90 comfortably. The revenue of $4.49bn surpasses the estimates by 1.45%. The stock climbed more than 1% after hours.

The mining company Barrick Gold Corp (GOLD, -1.15%▼) reported an adjusted EPS of $0.29, a little ahead of the estimated $0.28. Revenue of the company declined to $2.89bn from $3.05bn last year. The stock entered the green territory after hours.

Syneos Health Inc (SYNH, -2.91%▼) reported a 26% increase in revenue y-o-y to $1282.6m while the adjusted EBITDA of $174.6m increased 47% y-o-y. The stock was flat after hours.

The multinational engineering firm, Aecom (ACM, 1.13%▲) reported an adjusted EPS of $0.73, in tune with the estimates, and posted revenues of $3.41bn surpassing the estimates by 5.55%. The stock slid by more than 2% after hours.

On the Lookout:

The NFIB Small Business index will be updated today and is expected to slide from last month’s 102.5 to 102.0. Productivity (preliminary) is expected to go down to 3.25% from the previous 5.4%.

Unit Labor Costs data is due today as well and the print is expected to be 0.8%, down from the previous reading of 1.7%.

Unusually high shorter-term CALL options activity seen on International Game Technology (IGT,1.03%▲), Bed Bath & Beyond Inc (BBBY, 2.75%▲), Roblox Corp. (RBLX, 9.81%▲), Take Two Interactive Software Inc (TTWO, 1.43%▲), and Moderna Inc (MRNA, 17.10%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Travere Therapeutics Inc. (TVTX, -1.60%▼), Aurinia Pharmaceuticals (AUPH, 8.81%▲), Plug Power Inc (PLUG,8.80%▲), Micron Technology Inc. (MU, -2.18%▼), and Golden Nugget Online Gaming Inc (CNOG, 50.77%▲) among others.

Other Asset Classes:

Crude Oil prices crawled back a little Tuesday morning after witnessing one of its worst days this year on Monday, as the Oil prices tumbled by around 4% on concerns regarding rising delta variant cases around the world. After slumping to the $68 per barrel mark, Brent climbed back to the $70 level, early Tuesday morning - while the WTI Crude was up by a little less than 2%.

The US Dollar (93.02, 0.08%▲) breached the 93 mark and stayed buoyed after hawkish signals by Fed Monday, signaling that the tapering of monetary policy might be nearer than expected.

US Treasury Yields were into the red zone this morning after climbing steadily on Monday, propelled by the Fed signals. The 10 Year US Treasury Yield was trading at 1.315% early Tuesday morning, and the 30 Year Treasury Yield was trading at 1.955%.

Global Markets

Most of the markets in the Asia Pacific region rose Tuesday as investors shrugged off worries surrounding rising cases of delta virus and the travel restrictions imposed in China and Australia. Fed signals, regarding the tapering of monetary policy, affected positively as well. Shanghai was up more than 1% while Nikkei rose by 0.24%. Hang Seng climbed more than 280 points by the end of the trading day.

European markets opened on a positive note and kept advancing fuelled by positive earnings reports and a good day in the Asian markets. The pan EU index Stoxx-600 was into the green zone in early trade, up by 0.26%, for the seventh consecutive day Monday. The other major indices were in the green zone as well. F

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.