No Country for Chinese Firms!

Good morning,

S&P Dow Jones and FTSE Russel indices have decided to remove more than 45 China-based companies after an updated US executive order barred domestic investments in firms with alleged ties to China’s military. The decision comes amid China’s crackdown against some of its own major tech firms.

The repercussions! The S&P/BNY Mellon China Select ADR Index (BKTCN,-2.94%▼), which tracks the US depository receipts for 56 Chinese companies, has fallen to its lowest level in over a year. The index underperformed the S&P 500 pull back Thursday.

Covid is still here and raging! Japan has declared an emergency, just 2 weeks ahead of the Olympics-2020, and has banned fans from the venue.

US Markets:

Concerns surrounding a slowdown in economic recovery, amid a Covid resurgence and an unexpected rise in number of first time jobless claims applicants-373,000 instead of the expected 350,000-weighed heavily on the minds of investors triggering a serious pullback at Wall Street.

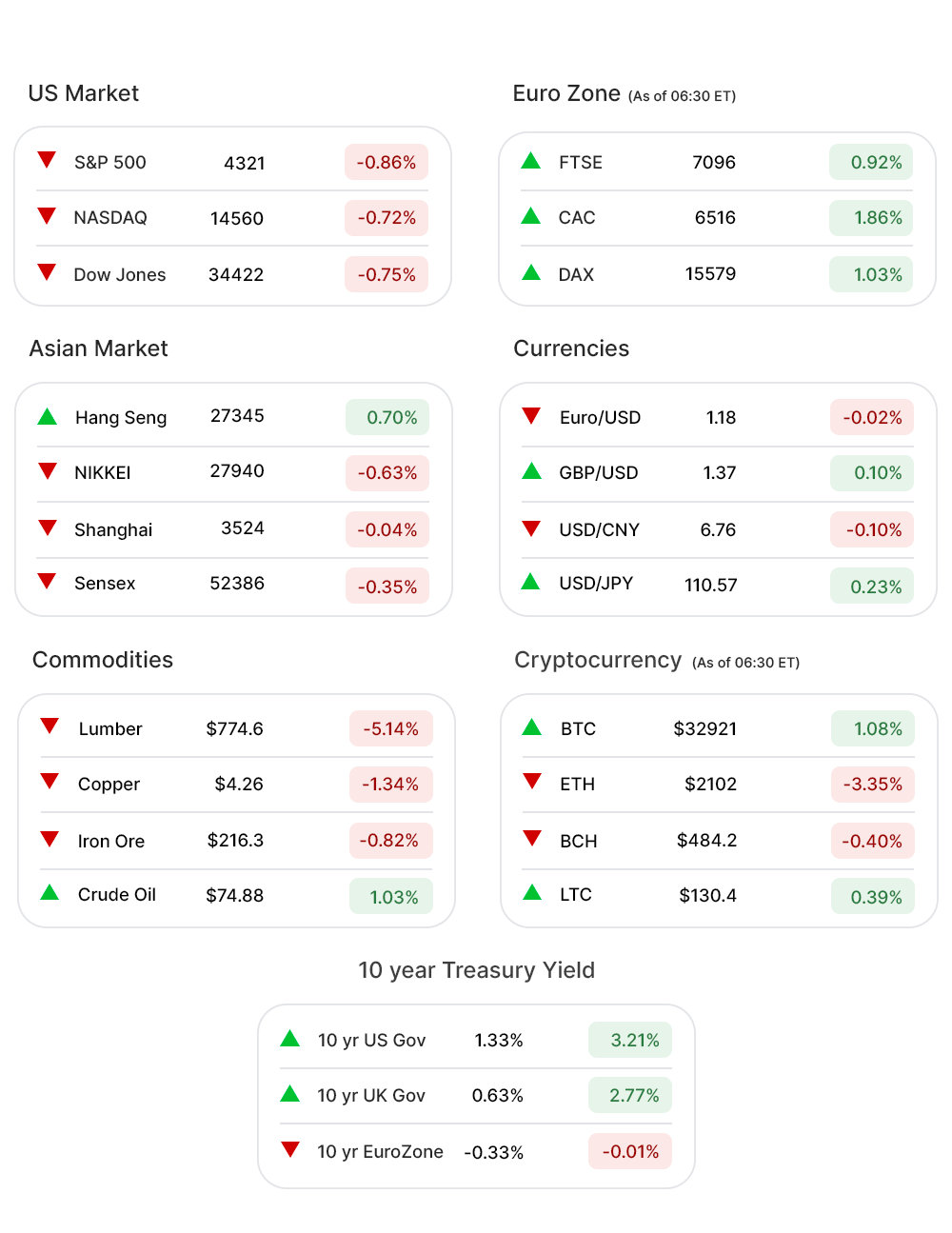

S&P 500 (-0.86%▼) lost more than 37 points on Thursday, a day after hitting a new record high. Tech-heavy Nasdaq (-0.72%▼) lost over 100 points while Dow (-0.75%▼) also witnessed a slump of more than 250 points.

Industrials (0.06%▲) was the only sector at S&P 500 to have registered some gains. All other sectors were red.

Financials (-1.97%▼) was the worst affected, followed by Materials (-1.36%▼), Communication Services (-1.05%▼), Energy (-0.47%▼) and Healthcare (-0.47%▼).

The rally in Technology (-0.92%▼) also came to a screeching halt on the gloomy day, thursday turned out to be.

Amazon Inc. (AMZN, 0 .94%▲) outperformed the sector as well as the market after it announced a deal with Comcast’s Universal.

Another stock that outperformed the market was Virgin Galactic Holdings Inc. (SPCE, 17.30%▲) as the countdown to Sir Richard Branson’s space trip has begun coupled with a bullish review for the stock.

Futures!

After a turbulent day, Thursday, and red futures after hours somem calm seems to be creeping in as the Futures ventured into the positive territory hours ahead of the market opening.

As of 07:30 ET, the US Index futures were all green-S&P Futures (0 .40%▲), Russell 2000 Futures (1 .15%▲) and Dow Futures (0 .67%▲)-barring Nasdaq Futures (-0.08%▼).

Will the futures have an impact on the trading day, remains to be seen!

Key Movers in Small Cap:

A preliminary Q2 report from GAN Limited (GAN, 15 .18%▲), an online betting company, showed that the company will break expectationsand move ahead in terms of revenue and profits as management cited strong demand across a few key markets including Europe and Latin America. Relative volume of the stock was 4.3.

Casa Systems Inc. (CASA, -1.98%▼), a provider of digital cable video and broadband services, has beaten the estimates for the last four quarters, with an average surprise of 200%. The stock is expected to inch forward. The relative volume of the stock was 4.9.

IDEAYA Biosciences Inc. (IDYA, -20.29%▼) stock continued the downward slide for the second consecutive day, after the company announced that it intends to offer common stock shares worth $80 million, without specifying the price or the number of shares. The relative volume of the stock was 2.7.

WD-40 Company (WDFC, 0.48%▲) reported a net revenue of $136.4 million for the third quarter, a 39% increase y-o-y. The relative volume of the stock was 3.2.

The Helen of Troy Limited. (HELE, -6.03%▼) was also among the key movers following its earnings report. The relative volume of the stock was 4.9.

Key Movers in Large Cap:

The transportation company with rail-road investments in the US, Mexico and Panama, Kansas City Southern (KSU, -7.87%▼) has applied for an acquisition by Canadian National and is facing some serious regulatory scrutiny. Besides, the White House is preparing an order critical of rail-road mergers, which might become an impediment in the acquisition. The relative volume of the stock was 5.7.

The White House order, in the pipeline, also affected two other transportation companies, the Norfolk Southern Corporation (NSC, -7.16%▼), with a relative volume of 2.5 and CSX Corporation (CSX, -6.16%▼). CSX was the third worst performer in S&P 500 Thursday.

The other key movers in the large-cap segment included Flowserve Corporation. (FLS, 0 .93%▲), with a relative volume of 2.3 and Invitation Homes Inc. (INVH, 0 .97%▲), with a relative volume of 2.1.

Report Card:

The ‘Jeans Giant’ Levi Strauss & Co (LEVI, -0.14%▼) has reported a revenue of $1.28 Billion for Q2, higher than the expected $1.21 Billion and 156% more than last year’s $364 Million. The company reported a payback of $65 million - which is an EPS of 16 Cents per share-while last year they had lost $364 million, or an EPS of -90 Cents per share. The stock jumped 1.43% after hours.

The Helen of Troy Limited. (HELE, -6.03%▼) found its Achilles Heel in its report card for Q1 of 2021, despite a better than expected result. The Personal and Household products company reported a 28.6% y-o-y growth to $541.2 million, from selling their products, beating the estimates of $438.9 million. Adjusted EPS of $3.48 also beat the consensus $2.62, a 27.5% y-o-y increase. The stock plunged following the results and remained flat after hours.

On the Lookout:

TheMonthly Wholesale Trade report will be released today at 10:00 am ET with a focus on the impact of Covid-19.

An opportunity for 13.856 million trustworthy homeowners to reduce their monthly payment by $290 through refinancing. The rate on the 30 years fixed mortgage, the most common home loan, has fallen to a four-month low of 2.90%, from 2.81% in February. The rate was 3.03% a year ago.

On the basis of national security, China’s ministry of commerce has decided to scrutinize foreign investment more closely. While the action might not be new, it does indicate that foreign investments in China will face greater scrutiny now.

Have the Giants decided to walk separate paths? Well in a much deliberated central bank’s decisions, we feel the ECB has made it very clear that unlike the Fed it will likely keep its easy-money policies in place for longer.

TransCode Therapeutics (RNAZ), an emerging Oncology company that believes Cancer can be defeated through the intelligent design and effective delivery of RNA therapeutics, has announced the pricing of its IPO of 6.2 million shares of common stock at a price of $4 per share.

Unusually high shorter-term CALL options activity seen on Alcoa Corp (AA, -2.40%▼), Pinduoduo (PDD, -1.38%▼), Ontrak Inc. (OTRK, 4.84%▲), and GrafTech International (EAF, -2.47%▼), Cameco Corp (CCJ, -3.57%▼) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Snap (SNAP, -4.87%▼), Li Auto Inc (LI, -0.75%▼), Alliant Energy Corporation (LNT, 0.018%▲), and KE Holdings (BEKE, 0.051%▲), Applied Materials (AMAT, -1.74%▼) among others.

Other Asset Classes:

Is the GSec Curve Flattening? The 10-year benchmark yield was down 2.8 bps to 1.293% after touching a low of 1.25%. Some caveats like covid delta, fading of reflation trade optimism and less accommodative fed signals may pressurize the rates until the market stabilizes and finds a catalyst for rates to re-price.

Traders talk of Support breaches in Bitcoin and other crypto currencies: Bitcoin (down 0.6%) and Ether (down 3.80%), other Altcoins have tanked 5% . Traders indicated that the sell-off could continue into the weekend if “crucial support levels” for either Bitcoin ($32000) or Ether ($2000) are broken.

The commodities asset class has gained 10.76% in the Q2 of 2021. It is 20.23% higher over the first six months of the year, as of June 30, 2021. Energy is leading the way for commodities with a gain of 25.08% for Q2 and 52.6% higher for the first six months of the year.

Global Markets:

Asia: Shanghai and other Chinese markets ended flat for the day and the week, balanced by high inflation of 8.8% for the month of June, and the government signaling easing of monetary policy.

In Japan, the emergency imposed to contain Covid has hit the markets taking Nikkei to a near two-month low.

The Virus is also wrecking some damage in South Korea as concerns around the rising number of cases inflicted losses at KOSPI for the third straight day Friday.

Hangseng showed some respite (+0.7%) after dropping for a series of 8 sessions due to bargain hunting. The index fell 3.4 % for the week though

European Equities bounced back from their biggest drop of the year in the previous session as investors shrugged off global economy concerns to focus on buying opportunities. The Europe Stoxx 600, which fell more than 1.7% on Thursday gained 1.1% in early trades Friday.

Meanwhile on Researchfin.ai

There are 14 new trade setups identified by the AI today. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

That is it for today! Have a joyous weekend!

See you Monday!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.