No Stopping This Time!

Good Morning,

10..9..8……...2..1..0 !! We have lift-off!

The much-awaited day to announce this super-exciting news that the Researchfin.ai App finally goes live and you can now have access to some of the best Trade Setups. Catch the musings and the way-forward here from Ruban Phukan, our CEO.

That was some comeback by the markets! Investors seem to have shrugged off the delta variant concerns.

The Johnson & Johnson vaccine might be less effective in battling Covid variants, than other shots, suggests a study by bioRxiv. The study is yet to be peer-reviewed though!

The author of this study suggests one should take a second jab, either from Moderna or Pfizer. Will we see a rally in these stocks today?

The battle of the giants! The US and Germany have reached an agreement on acting tough against Russia if it uses the Nord Stream 2 gas pipeline to harm Ukraine and other Eastern European countries. The $11bn Gas pipeline, now 98% complete, will supply gas from Russia’s Arctic region to Germany.

Seeing the earth from a suborbital space has changed Jezz Bezos’ perspective! “You look at the planet, there are no borders. It is one planet and we share it and it is fragile,” he said, after his space flight and asserted the trip has reinforced his commitment to fighting climate change!

US Markets:

Following a dramatic selloff on Monday, triggered by concerns around the spread of delta variant, the investor sentiment was buoyed Tuesday yet again as some of them rushed to buy shares knocked down, a day earlier.

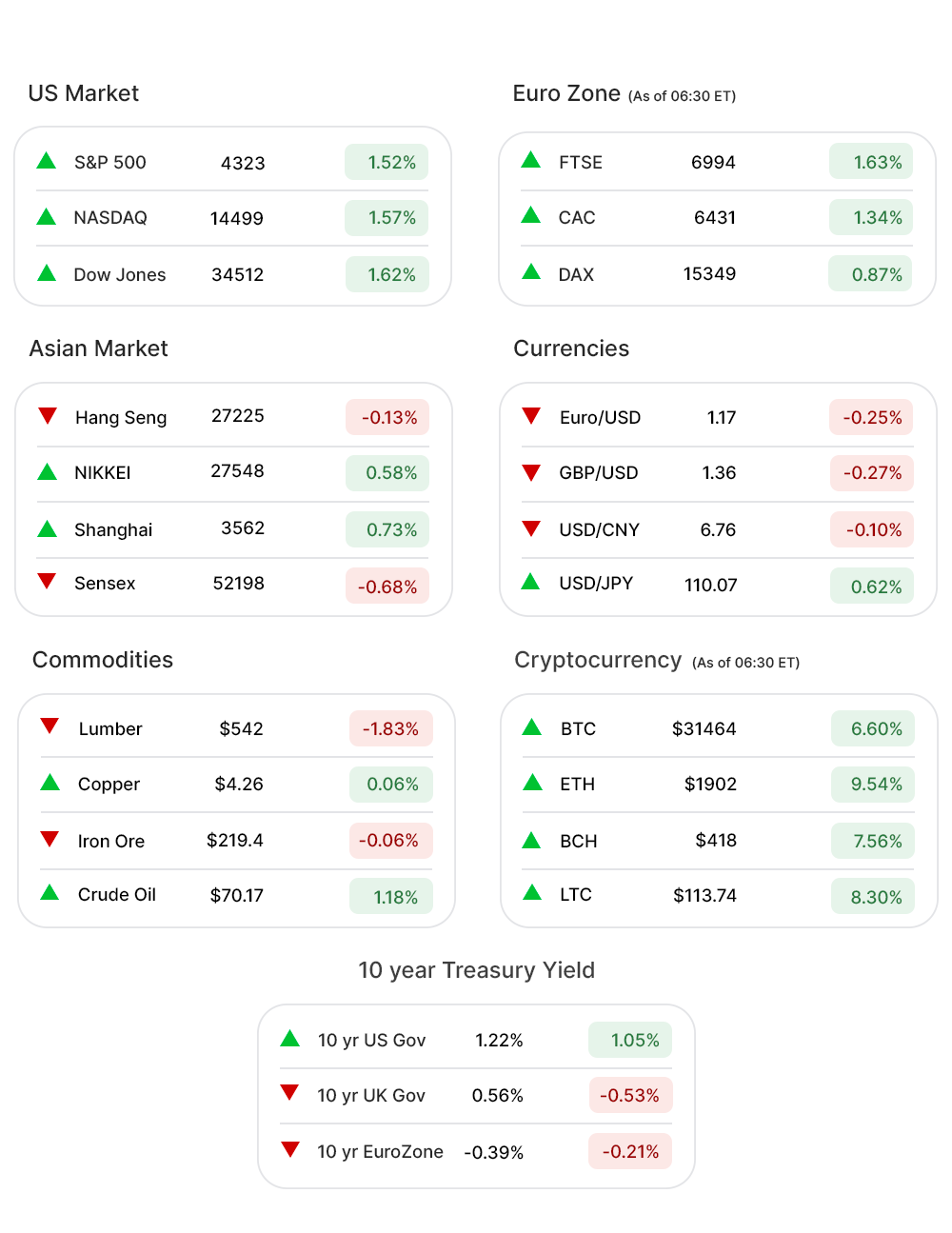

As a result, the S&P 500 (1.52%▲) registered its best day in four months, with a surge of about 65 points. Dow (1.62%▲) gained some basis points shy of 550 points while the Tech-heavy Nasdaq (1.57%▲) was well on its way as well, with a gain of more than 220 points.

Barring Healthcare (-1.07%▼) and Consumer Staples (-0.08%▼) all other sectors at the S&P 500 made gains on Tuesday.

Energy (1.38%▲) after several days of selloffs, bounced back. Financials (2.42%▲) and Industrials (2.74%▲) were the frontrunners among gainers even as Technology (1.47%▲) was right on track as well!

Futures!

As of 06:30 ET: Nasdaq Futures (-0.25%▼), S&P 500 Futures (0.15%▲), Russell 2000 Futures (0.79%▲), and Dow Futures (0.35%▲) were a pretty picture.

Key Movers in Small Cap:

Albireo Pharma (ALBO, -4.59%▼) confirmed the FDA approval of Bylvay, for the treatment of a rare liver disease in children, estimated to be affecting approximately one hundred thousand patients in the world without an approved drug therapy. Albireo holds global rights for Bylvay.

The other movers in this segment include Ikena Oncology Inc. (IKNA, 16.78%▲), with a relative volume of 33.2; Ardelyx Inc. (ARDX, -73.90%▼), with a relative volume of 23.3; Talis Biomedical Corporation (TLIS, 20.00%▲), with a relative volume of 13.5 and Endo International (ENDP, 24.70%▲), with a relative volume of 6.2.

Key Movers in Large Cap:

Shares of SolarWinds (SWI, -39.72%▼) were down more than 41%, early Tuesday morning. The embattled tech company completed its spinoff of IT service software outfit N-able into its own separate entity. The big share price drop reflects the split. The relative volume of the stock was 5.4.

HCA Healthcare (HCA, 14.37%▲), the largest health system in the U.S. by net patient revenue at over $44 billion, was buoyed by its earnings report Tuesday morning. Highlights for the quarter include revenue of over $14 billion, a net income of $4.37 per diluted share and $2.25 billion in operating cash flow. The relative volume of the stock was 4.2.

The other movers in this segment include Moderna Inc. (MRNA, -2.0%▼), with a relative volume of 4.4; PPG Industries. (PPG, -4.49%▼), with a relative volume of 4.3; nVent Electric (NVT, 4.62%▲), with a relative volume of 3.9 and Slack Technologies (WORK, 0.50%▲), with a relative volume of 3.5.

Report Card:

Netflix (NFLX, -0.23▼) has beaten its estimated revenue by $20m, reporting $7.34bn in revenue, a 19.3% increase y-o-y. The streaming giant, however, missed on the EPS by $0.19 after the print in EPS turned out to be $2.97.

The company has paid memberships of around 209.18m but has been able to add only 3.5m new members in this quarter The stock, though bogged down by earnings, did manage to enter the green zone after hours. .

PPG Industries (PPG, -4.38▼), the maker of paint and industrial coatings, reported a weaker-than-expected Q2 adjusted profit of $431 million, or $1.80 a share up from $102 million or 43 cents a share, a year ago.

The adjusted EPS of $1.94 was however below the analyst consensus of $2.20. Revenue reported of $4.36 billion for the quarter was up 44% from $3.02 billion a year earlier and ahead of the estimated $4.34 billion. The stock made some gains after hours.

On the Lookout:

Looking ahead, investors will receive the weekly MBA Mortgage Applications Index on Wednesday.

Few IPOs today -

VTEX (NYSE: VTEX), a digital commerce platform, priced its IPO of 19m shares at $19/share, above a previous range of $15 - $17.

CS Disco (NYSE: LAW), provider of legal document review and Ediscovery services to law firms, is set to go public today offering 7m shares of its common stock at a price of $32/share.

Unusually high shorter-term CALL options activity seen on Melco Resorts & Entertainment Ltd (MLCO, 2.50%▲), Lowe`s Companies Inc (LOW, 1.05%▲), BP plc (BP, 2.61%▲), Bed Bath & Beyond Inc. (BBBY, 7.04%▲) and Outfront Media Inc. (OUT, 3.98%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Mosaic Co (MOS,3.16%▲), Activision Blizzard (ATVI, 1.34%▲), CVS Health Corp (CVS, 1.49%▲), and TAL Education Group (TAL, 2.57%▲) among others.

Other Asset Classes:

The 10-yr yield increased three basis points to 1.21% after dipping below 1.14% immediately following mixed housing starts and building permits data for June. Housing starts were better than expected while permits, which are a leading indicator, declined 5.1% m/m to a seasonally adjusted annual rate of 1.598 million.

Global Markets:

In the Asian markets, Tokyo’s Topix snapped back with an 0.8 percent gain after five days of drops driven by fears of the Delta variant’s spread. Hong Kong’s Hang Seng index closed 0.2 percent lower.

European equities rallied as investors braced for further European Central Bank stimulus. The Stoxx 600 rose 1.2% while the euro held at its weakest level against the dollar since April.

Meanwhile on Researchfin.ai

Trade setups identified by our AI that successfully met their profit-taking target yesterday and within their respective target time were Inmode Ltd (INMD, 4.01%▲), Credit Acceptance Corp. (CACC,2.65%▲), Plymouth Industrial Reit Inc (PLYM, 5.33%▲), Dicerna Pharmaceuticals Inc (DRNA, 4.11%▲), and Independence Realty Trust Inc (IRT, 3.62%▲).

There are 80+ new trade setups identified by the AI today. Please download our app Researchfin.ai from App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

Will see you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.