Oil’s Ebb and Flow!

How was the weekend?

A last day ‘gold-rush’ led the US to 39 gold medals, one more than China, after trailing behind China for the most part of the 16-day affair and propelled the US tally to 113. The two strongest Olympic nations spend way more than the rest of the world in sports.

A giant leap and the lingering shadows! Saudi’s trillion-dollar Oil company, Aramco, has reported a stunning 288% increase in net income y-o-y to $25.5bn compared to last year’s meager $6.6bn. Growing Oil demand has fuelled the profits but the resurgence of Covid is threatening the global demand, again.

The factory-gate inflation in China, amid a surge in delta variant cases, has remained high with the Producer Price Index (PPI) rising by 9% compared to June’s 8.8%. The country’s official Consumer Price Index (CPI) has risen by 1% in July from a year earlier, down from 1.1% in June.

The best time to be jobless in the US? There are around 10m job openings in the US and only 8.6m people are considered jobless in the country as of now. Companies are using bonuses, higher salaries, and flexible working arrangements to lure the workforce.

Taiwan’s exports have risen, for the 13th straight month, for July by34.7% y-o-y to $37.95bn as the economies world over keep opening and an ever rising semiconductor demand. The semiconductor exports have swelled by 34.3% y-o-y with the export of electronics hitting a record high of $14.67bn for July.

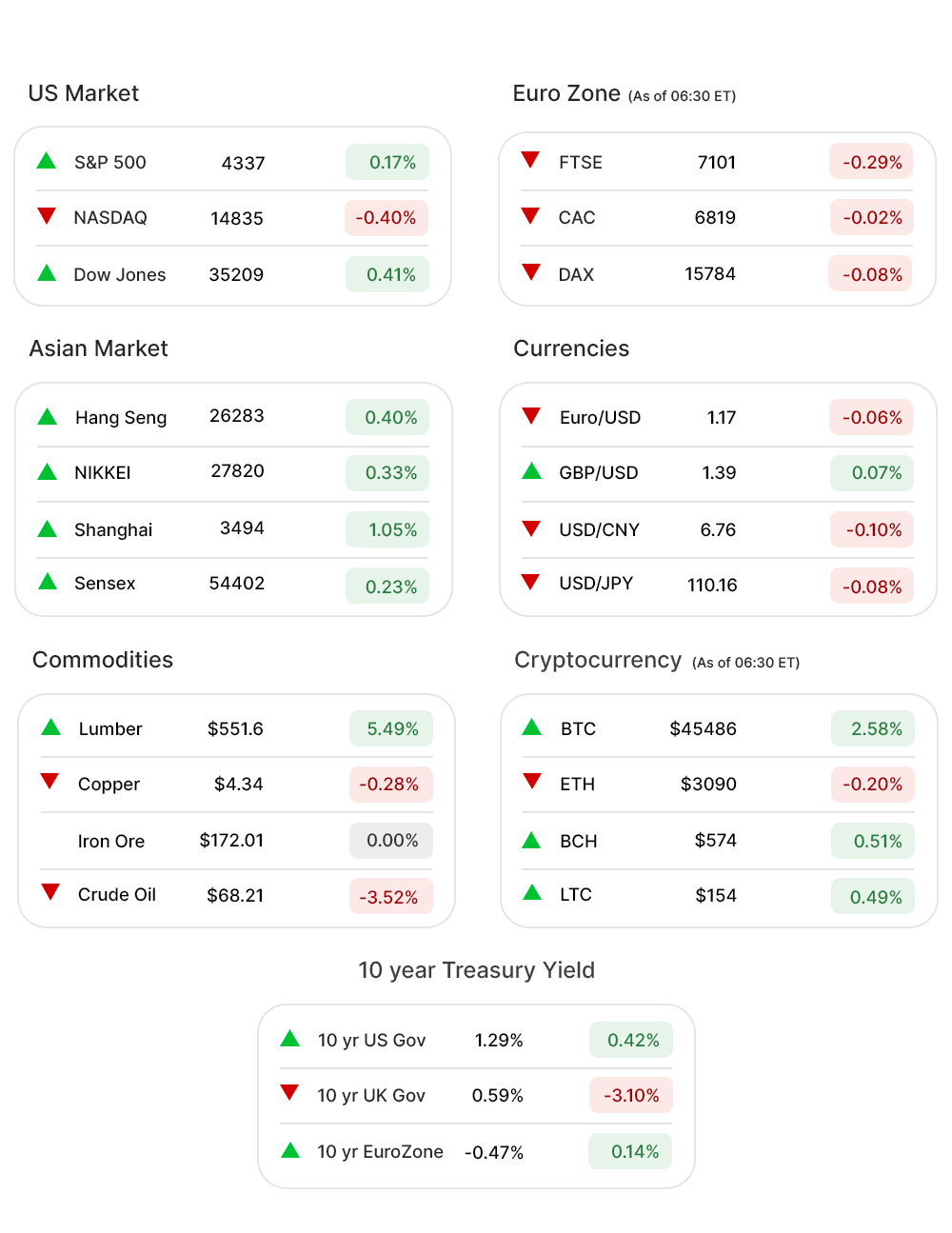

US Markets:

Nasdaq (-0.40%▼) could not cash in on the strong jobs reports, beating estimates by a long shot. The print showed non-farm payrolls increased by 943,000 as the unemployment rate dropped to 5.4%.

S&P 500 (0.17%▲) and Dow Jones (0.41%▲) were buoyed by the news and closed at record levels Friday, extending Thursday’s gains and ending the week in positive territory as well.

Sectors in red at the S&P 500 outnumbered the ones in green though.

Financials (2.01%▲) was the top gainer, followed by Materials (1.47%▲), Energy (0.93%▲), and Industrials (0.42%▲).

Consumer Discretionary (-0.74%▼) slid the most while other six sectors - including Communication Services (-0.01%▼), Healthcare (-0.11%▼), Consumer Staples (-0.05%▼), Real Estate (-0.24%▼), and Technology (-0.12%▼) - were among the losers.

Futures!

The Futures were considerably lower, early Monday morning, following mixed trading days in the Global markets and worries mounting around the surge of delta virus across the world.

As of 06:00 ET, only Nasdaq Futures (0.06%▲) was in green while S&P 500 Futures (-0.17%▼), Russell 2000 Futures (-0.64%▼), and Dow Futures (-0.29%▼) were all red.

Key Movers in Small Cap:

Imaging and early Cancer detection company, iCAD Inc (ICAD, -23.57%▼) fell short of the wall street estimates and posted a loss of $3.3m, of 13 cents per share for Q2, way lower than the estimated loss of 8 cents per share. The relative volume of the stock was 23.1.

Cloud-based software provider, Cornerstone OnDemand Inc (CSOD, 13.50%▲) has entered a definitive agreement to be acquired by Clear Lake Capital Group, in a deal valued at approximately $5.2bn or $57.50 per share. The relative volume of the stock was 21.4.

The healthcare equipment company, Intersect ENT (XENT, 11.62%▲), will be acquired by Medtronic, in an all-stock deal valuing $1.1bn or $28.25 per share. The relative volume of the stock was 20.2.

Spectrum Pharmaceuticals (SPPI, -21.54%▼) announced Friday that the FDA has turned down approval of Rolontis in treating neutropenia in patients receiving cancer drugs that decrease bone marrow activity. The relative volume of the stock was 11.7.

Dicerna Pharmaceuticals (DRNA, -28.14%▼), a clinical-stage biopharma, Friday announced disappointing results from a phase 2 clinical trial of the company’s lead candidate, Nedosiran. The relative volume of the stock was 10.5.

Quotient Technology (QUOT, -25.02%▼) posted a 48% y-o-y increase in its Q2 revenue to $123.9m but reported a loss of $0.18, nearly double of the estimated loss of $0.10. The relative volume of the stock was 9.9.

The other movers in the small-cap segment included:

CompX International Inc (CIX, 1.65%▲): Relative Volume 14.2.

Collegium Pharmaceutical (COLL, -17.31%▼): Relative Volume 8.6.

HCI Group Inc (HCI, 17.60%▲): Relative Volume 8.4.

Groupon Inc (GRPN, -14.09%▼): Relative Volume 8.3.

BenefitFocus Inc (BNFT, 0.52%▲): Relative Volume 8.0.

Key Movers in Large Cap:

The video hosting and sharing platform, Vimeo Inc (VMEO, -17.36%▼) has reported a loss of $0.13 per share, below the estimated loss of $0.05 per share. The total revenue however grew by 43% y-o-y to $96m. The relative volume of the stock was 10.1.

Cybersecurity company FireEye Inc (FEYE, -16.97%▼) entered the oversold territory Friday with an RSI of 22.3 after the company announced it has sold its product business to a consortium led by Symphony Technology Group. The relative volume of the stock was 7.1.

Switch Inc. (SWCH, 19.92%▲) reported an 11.6% increase in revenue, y-o-y to $141.7m, well ahead of the expected $134.5m even as adjusted earnings increased 14.3% y-o-y to $79m. The relative volume of the stock was 5.4.

The online game developer, Zynga Inc (ZNGA, -18.22%▼) reported a 59% y-o-y increase in its revenue to $720m but warned investors that the company’s growth was slowing. The relative volume of the stock was 5.3.

The other movers in the large-cap segment included:

Insulet Corporation. (PODD, -1.76%▼): Relative Volume 6.8.

Expedia Group. (EXPE, -7.92%▼): Relative Volume 6.1.

McAfee Corp. (MCFE, 3.30%▲): Relative Volume 5.3.

Universal Display Corporation (OLED, -10.52%▼): Relative Volume 4.5.

Report Card:

The meme favored stock AMC Entertainment (AMC, -2.42%▼) reported a 19% y-o-y increase in its revenue for Q2 to $771.4m and an adjusted EPS of $3.25, 44% ahead of prior year’s earnings - easily beating estimates on topline as well as the bottom line. The stock gained a little momentum after hours.

The power and energy company, Dominion Energy Inc (D, -0.11%▼) reported an adjusted EPS of $0.76 or $628m with a revenue of $3.04bn a little shy of prior year’s $3.11bn, falling short of the Wall Street estimates. The stock was flat after hours.

Qurate Retail Inc (QRTEA, -3.83%▼) posted a profit of $222m for Q2 or adjusted earnings of 54 cents per share. The revenue of the company for the quarter was $3.5bn. The stock rose a wee bit after hours.

Goodyear Tire & Rubber Co (GT, 6.55%▲) beat estimates comprehensively by posting an EPS of $0.32 on revenue of 3.98bn against the estimated $0.18 on revenue of $3.94bn. The stock continued to soar after hours.

On the Lookout:

Job Openings report for the month of June is due today with a previous print of 9.2m.

IPOs to lookout:

FinWise Bancorp, the parent company of FinWise Bank, is offering 4.1m shares of its common stock priced between $13 and $15.

Alabama bank, Southern States Bancshares, plans to raise $40m by offering 2m shares of its common stock, priced between $19 and $21.

Unusually high shorter-term CALL options activity seen on Moderna Inc (MRNA, -0.61%▼), Novavax Inc (NVAX, -19.61%▼), MicroStrategy Inc. (MSTR, 4.63%▲), Facebook Inc (FB, 0.15%▲), and Etsy Inc (ETSY, -2.22%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Fidelity National Information. (FIS, 3.32%▲), Snap Inc. (SNAP, -1.73%▼), Dave & Busters Entertainment. (PLAY, 2.99%▲), AMC Entertainment Inc. (AMC, -2.42%▼), and Cheniere Inc (LNG, -1.48%▼) among others.

Other Asset Classes:

Crude Oil prices have started the week with a massive slide, of more than 3%, extending last week’s losses amid concerns that travel restrictions in wake of rising Covid cases - particularly in China - will have an adverse effect on the demand for fuel. A stronger dollar played its part in pulling down the Crude oil prices as well. Brent has slumped to the $68 per barrel mark, while the WTI Crude was trading a little ahead of the $65 per barrel mark, early Monday morning.

The US Dollar (92.86, 0.07%▲) crept higher with markets betting on an earlier taper to the monetary policy by Fed. Monday morning the US dollar hit a 4 month high against the Euro.

US Treasury Yields climbed Friday, followed the better than expected Jobs data, and continued the upward run early Monday morning. The 10 Year US Treasury Yield reached 1.292%, and the 30 Year Treasury Yield was trading at 1.94% this morning.

Global Markets

Most of the markets in the Asia Pacific region climbed modestly, amid widespread concerns about fresh travel restrictions being imposed in many countries, including China, to contain the spread of the delta variant. Shanghai was up more than 1% while Nikkei rose by more than 90 points. Hang Seng climbed more than 100 points by the end of the trading day.

European markets opened mixed amid concerns about the spread of the delta virus and an after-hours report on China’s factory-gate price inflation quickening in the month of July. FTSE was down 0.27%, Monday morning, as the pan EU index Stoxx-600 traded flat.

Meanwhile on Researchfin.ai

The unstoppable AI! Many more trade setups identified by our AI reached their respective profit targets Friday, within their optimal holding period: Albemarle Corporation (ALB), Papa John’s Int’l Inc (PZZA), Exponent Inc (EXPO), CarGurus Inc. (CARG), SiTime Corp. (SITM), Mercadolibre Inc (MELI), Uniti Group Inc. (UNIT), Alkermes Plc. (ALKS), Navient Corp (NAVI), Silicon Laboratories Inc (SLAB), Prestige Consumer Healthcare (PBH), Switch Inc (SWCH), and Amkor Technology (AMKR).

Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

There were many new trade setups, identified by the AI yesterday. If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.