On ‘Freedom’ Day, Boris Quarantined!

Good Morning,

The Pandemic aid continues! Last week Americans got $20bn in new aid for pandemic relief, more than $15bn in expanded child tax credit.

“Freedom Day” for England is Ironic, no? The country has lifted all Covid restrictions and the effect on ground was nothing short of an irony, with FTSE tumbling and the Prime Minister all set to self isolate!

Zoom in on Five9! The Video Communications platform Zoom Inc. is all set to buy Five9, a provider of cloud contact center software, in an all-stock deal valuing the company at $14.7bn. This is the second biggest tech deal of the year in the US.

Charity begins at home! Xiaomi co-founder Lei Jun has donated $2bn of shares, of the smartphone maker, to charity.

US Markets:

The US consumer sentiment - falling to 80.8 for the first half of July, lowest since February - outweighed the unexpected rise of 0.6% in retail sales for June, 18% increase y-o-y. The unexpectedly finer earnings could not save the tumble at the markets as well.

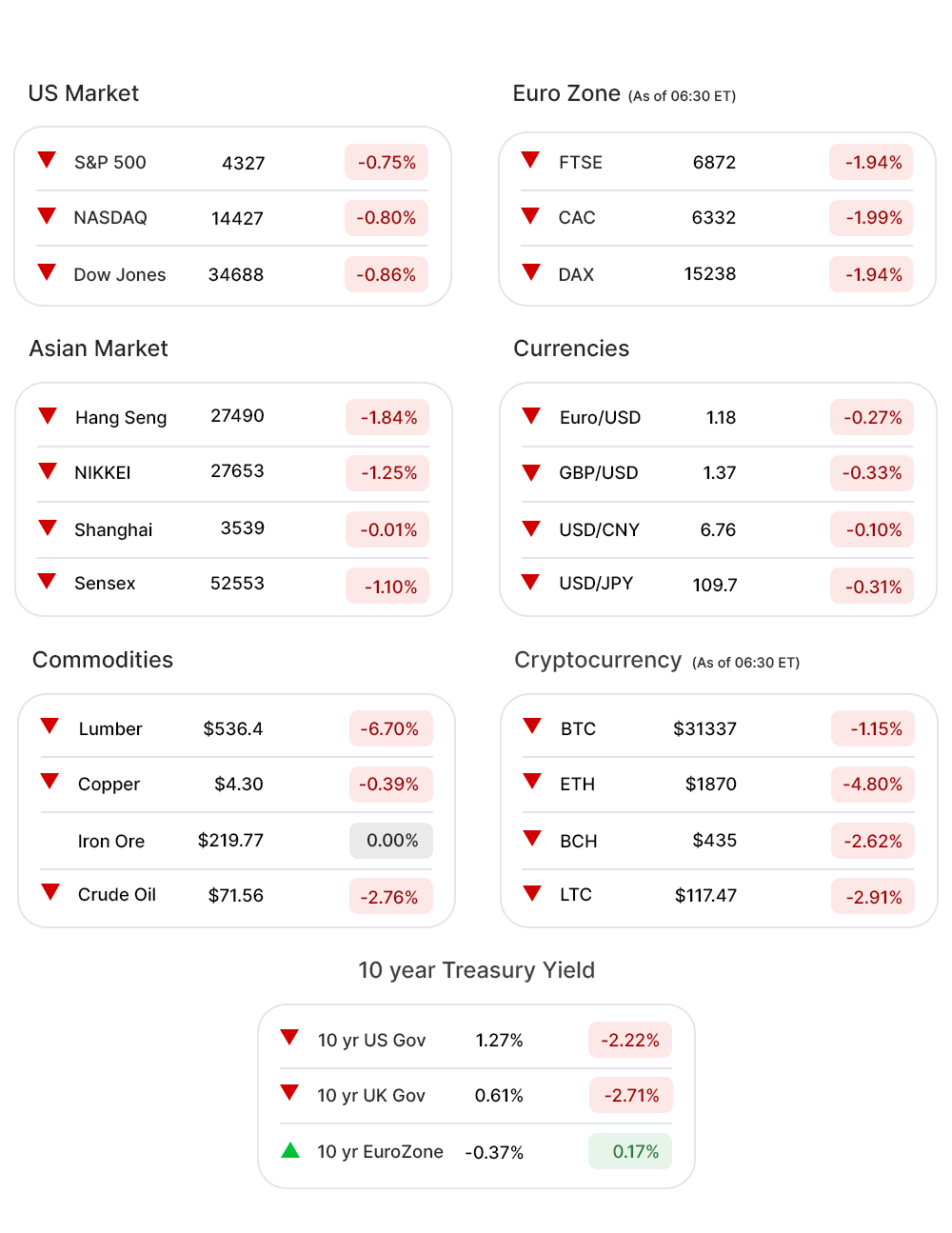

The S&P 500 (-0.75%▼) slid, more than 32 points, to end the week 0.97% lower, snapping a three-week winning streak. Tech-heavy Nasdaq (-0.80%▼) and Dow (-0.86%▼) ended their three-week winning runs as well, losing 115 and around 300 points in that order. The two indices ended the week down 1.87% and 0.52%.

The sectors were mixed! Consumer Staples (0.15%▲), Healthcare (0.22%▲), Real Estate (0.10%▲), and Utilities (1.0%▲) marginally outperform the market.

Energy (-2.76%▼) has consistently been at the bottom of the table, losing some of the gains this thriving sector has been able to garner through the year thus far. The sector, however, with 28% gains this year is still at the top of the table for 2021.

Technology (-0.97%▼) also slumped for the second consecutive day Friday, weighing the market further down.

The slide in the Tech sector was led by giants including, Apple (AAPL,-1.41%▼), Microsoft (MSFT,-0.10%▼), Alphabet (GOOGL,-0.02%▼), Nvidia Corporation (NVDA,-4.25%▼), Amazon Inc. (AMZN,-1.59%▼), and Facebook (FB,-0.96%▼).

Financials (-1.34%▼), Industrials (-0.85%▼), Communication Services (-0.57%▼), and Materials (-1.53%▼) were also among the losing sectors.

Futures!

Futures look like they have another dip in store for the opening of markets on Monday.

As of 06:30 ET, all major indices were in red, including Nasdaq Futures (-0.32%▼, S&P 500 Futures (-0.71%▼), Russell 2000 Futures (-1.72%▼), and Dow Futures (-1.01%▼).

Key Movers in Small Cap:

The sports equipment maker American Outdoor Brands (AOUT, -21.96%▼) reported a 50% increase in Q4 revenue y-o-y. It however failed to impress with the outlook for fiscal 2022, suggesting an up to 3% drop in EPS. The relative volume of the stock was 12.6.

An FDA advisory panel has voted against approving the lead drug candidate, the HIF-PF inhibitor Roxadustat, by the biotech company Fibrogen Inc. (FGEN, -42.23%▼). The relative volume of the stock was 12.0.

A provider of non-lethal, personal security solutions Byrna Technologies (BYRN, 12.83%▲) Friday announced the pricing of an upsized underwritten offering of 2.5 million common shares at $21 per share. The stock priced at $23.01 closed at $25.41. The relative volume of the stock was 11.3.

GP Strategies Corporation (GPX, 1.10%▲), a provider of sales and technical training, the stock continued to change hands after a 26.6% jump on Thursday, following its acquisition by an English company, Learning Technologies for $394m. The relative volume of the stock was 9.4.

The other movers in the small-cap segment included NOW Inc. (DNOW, 3.47%▲), with a relative volume of 4.3; Reneo Pharmaceuticals Inc. (RPHM, 5.86%▲) with a relative volume of 4.3 and NI Holdings (NODK, 2.77%▲), with a relative volume of 4.0.

Key Movers in Large Cap:

Moderna Inc. (MRNA, 10.30%▲) is slated to be added to the S&P 500 index on July 21. Potential Safety concerns around the Jhonson & Jhonson Covid vaccine was another reason Moderna stock soared more than 20% last week. The relative volume of the stock was 5.1.

The other stocks in this category included Spectrum Brands Holdings (SPB, 3.34%▲), with a relative volume of 2.4; PVH Corporation (PVH, -2.83▼), with a relative volume of 2.3; Alexion Pharmaceuticals (ALXN, -0.27▼), with a relative volume of 2.2; L. Brands (LB, -1.97▼), with a relative volume of 2.1; and Shift4 Payments (FOUR, -0.96▼), with a relative volume of 2.1.

Report Card:

The multi-national Financial Services company Charles Schwab (SCHW, -2.24%▼) reported net revenue of 4.53bn, an 85% increase in y-o-y and more than the estimated 4.47bn. The adjusted EPS was 70 Cents, beating the estimated by a penny. The stock was on a decline after hours.

The railroad operator, Kansas City Southern (KSU, -1.12%▼) Friday reported a Q2 net loss of 378.6m or $4.17 per share, plummeting down from a net income of $109.7m or $1.16 per share. The company has said the loss has been a result of more than $700m going in merger costs. The stock was down after hours.

Autoliv Inc. (ALV, -4.78%▼), the Swedish-American automotive safety supplier, has reported an adjusted EPS of $1.20, much below the estimated $1.38. The sales of $2.02bn are 93% higher y-o-y but have fallen short of the estimated $2.04bn. The stock traded flat after hours.

On the Lookout:

The week ahead will be a busy one for investors with giants like Netflix, Twitter, and AT&T ready with their Q2 earnings, scheduled later in the week.

But before that happens the National Association of Home Builders will on Monday release data on the Housing Market Index, a monthly survey designed to take the pulse of the single-family housing market.

Have a look at some upcoming IPOs:

Italian luxury brand, Ermenegildo Zenga, will go public in the US this year in a SPAC deal giving the enterprise a value of $3.2bn.

Digital manufacturing company, FastRadius Inc. is nearing a SPAC deal to go public. The deal would value the company at $1.4bn.

Phase-3 biotech, developing Oncolytic viral immunotherapies for Cancer,Candel Theraupatics, is planning to raise $85m by offering 6.1m shares at a price ranging between $13 to $15.

Infrastructure Holdings, a provider of learning management platforms, is set to raise $250m by offering 12.5m shares priced between $19 to $21.

A database software company, Couchbase, is offering 7m shares priced between $20 and $23.

18.5m shares of Cincinnati-based Paycor HCM - an HR software provider, will be on offer as the company looks to raise $361m, with shares priced between $18 and $21.

The Chicago-based specialty wholesale brokerage, Ryan Speciality Group, has announced the 56 million shares of its common stock, priced between $22 and $25.

Unusually high shorter-term CALL options activity seen on Snap Inc. (SNAP, -1.97%▼), Atossa Therapeutics Inc. (ATOS, -19.93%▼), International Game Technology. (IGT, -8.04%▼), Micron Technology Inc. (MU, -2.84%▼) and Community Health Systems Inc. (CYH, -0.34%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Jumia Technologies (JMIA, -2.93%▼), TPG Face Beneficial (TPGY,-2.27%▼), Canadian Natural Resources Ltd. (CNQ, -4.14%▼), Moderna Inc (MRNA, 10.30%▲), and Royal Carribean Cruises (RCA,-2.45%▼) among others.

Other Asset Classes:

The major Oil producers, after the resolution of a dispute between Saudi Arabia and UAE, have agreed that OPEC Plus will improve production by 400,000barrels a day indefinitely, starting August. Crude Oil prices have been soaring in wake of an OPEC deadlock and diminishing stockpiles. Brent Crude was down 1.5%, early Monday morning.

The US Dollar (92.89, 0.20%▲) is hovering around a several-month high as the worries around economic recovery, in the face of the rising Covid crisis, seem to be deepening.

There seems to be no end to the troubles for Crypto miners. Malaysian authorities have destroyed 1069 CryptoCurrency rigs accusing the miners of electricity theft.

Global Markets:

Asian markets fell across the board, following a downslide at Wallstreet Friday and a rising number of delta variant cases in Indonesia, Malaysia, and Thailand. Japan, set to host the Olympics has also reported an uptick in cases with some athletes at the Olympic Village turning positive for the infection as well. Nikkei and Hang Seng fell more than 1%.

The rising number of Covid cases, worries around growth, and inflation outweighed the zeal around the “Freedom Day” as FTSE sank 90 points to the lowest since mid-May, early Monday morning. The other European Markets also tumbled with DAX losing more than 190 points. Stoxx-600 was down 1.44% even as the pound was at its lowest since April against the US dollar.

Meanwhile on Researchfin.ai

There were 29 new trade setups identified by the AI last friday. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.