Plugging the Dam!

Good Morning!

The injection is treatment, not cure! People’s Bank of China has injected $18.6bn into the financial system as the Evergrande-debt crisis roiled the global markets. Shanghai, Hang Seng respond positively.

Doing their bit! Embattled Evergrande’s main unit, Hengda Real Estate Group, has said it would make a $35.9m onshore coupon payment, on Thursday, bringing some much-needed relief to the jittery investors.

The ‘soft’ push! Japan’s Soft Bank has is now backing the private equity fund set up by former US Treasury secretary, Steven Mnuchin - following earlier backing by Saudi’s Public Investment Fund and Abu Dhabi’s Mubadala. Mnuchin set up the fund recently, after serving 4 years in the Trump administration.

Game - Stop! A one-time darling of the meme-stock lovers, Game Stop, seems to have fallen out of favors, as the stock has tanked more than12% this month thus far worse than the 2% drops in S&P 500 and Nasdaq. The stock is down 46% since hitting a record high on January 27.

Building Permits (SAAR), for the month of August, have been reported to be 1.72m, 6% above the revised 1.63m in July and ahead of the expected 1.62m. The Housing Starts (SAAR) came out at 1.61m, a 3.9% increase from July’s 1.53m, and ahead of the estimated 1.55m.

Japan’s Mitsubishi Group is set to sell the retail banking division of its US regional MUFG Union Bank to US Bancorp in a cash and shares deal, worth around $8bn. US Bancorp shares were up 2.55% Tuesday.

Heart in the mouth moment! Pyth, a CryptoCurrency data network run by some of Wall Street's biggest players, showed a roughly 90% plunge in Bitcoin and briefly reported the price at $5402. The glitch, now being investigated by engineers, did not show on other networks.

US Markets:

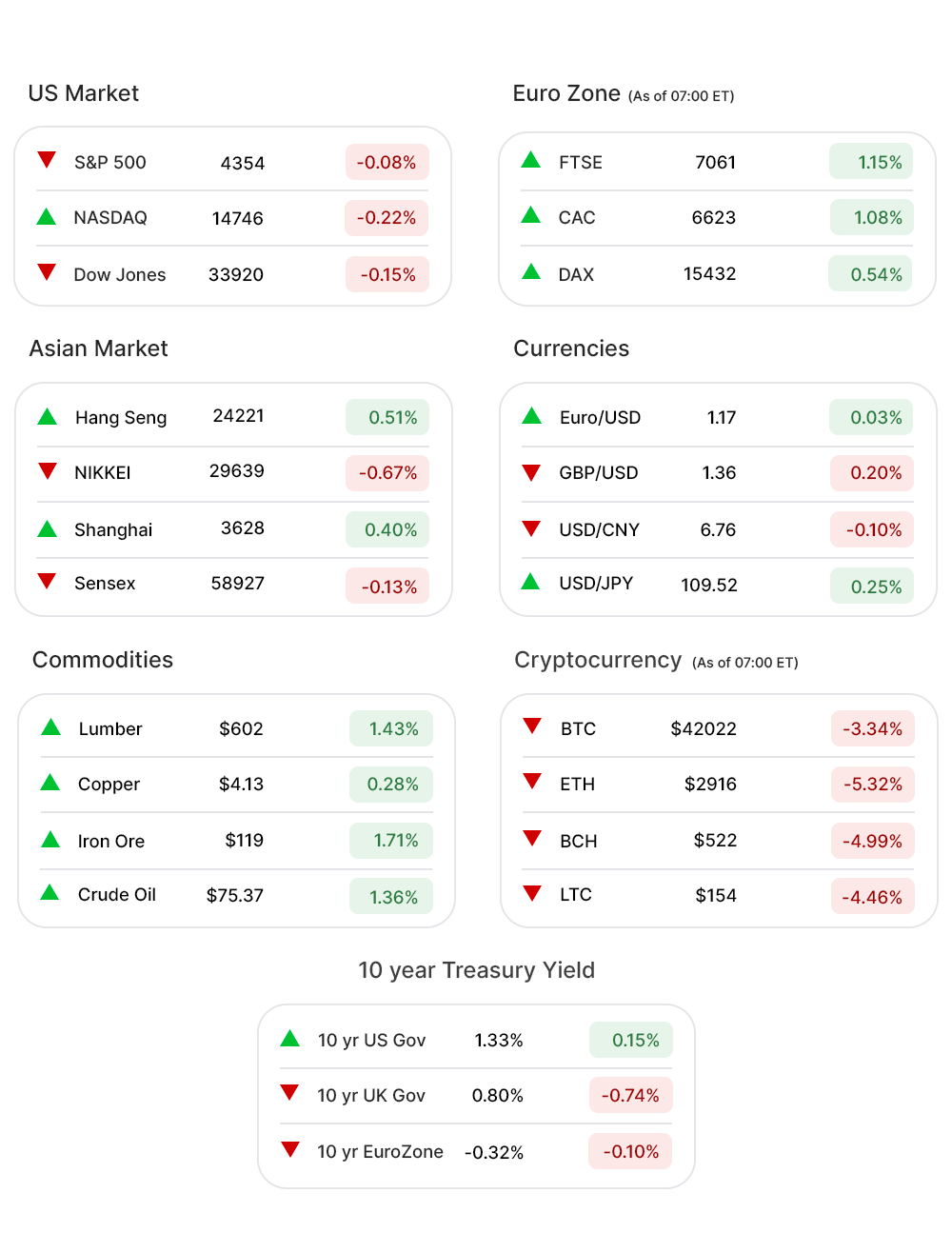

After Monday’s steep selloff, triggered by the Evergrande crisis, the stocks attempted a rebound as all major indices opened in green Tuesday morning.

A volatile day, however, ended mixed with S&P 500 (-0.08%▼) and Dow Jones (-0.15%▼) closing in the negative territory.

Russel 2000 (0.18%▲) and Nasdaq (0.10%▲), managed to cling on to early gains and closed in the green zone.

Like the indices, sectors at the S&P 500 ended mixed as well, with negative sectors outnumbering the positive ones by three.

Energy (0.37%▲), Technology (0.03%▲), Healthcare (0.15%▲), and Consumer Discretionary (0.08%▲) were the gaining sectors.

Materials (-3.95%▼) was the worst hit among the eleven sectors, with steep losses.

Financials (-0.14%▼), Communication Services (-0.34%▼), Industrials (-0.70%▼), Consumer Staples (-0.11%▼), Utilities (-0.23%▼), and Real Estate (-0.04%▼) followed Materials to the red zone.

Futures!

The Futures look set for a gaining day, ahead of the Fed statement, with all major indices in green.

As of 07:00 ET, the indices looked like this: Nasdaq Futures (0.35%▲), Dow Futures (0.62%▲), S&P 500 Futures (0.58%▲), and Russel 2000 Futures (0.80%▲).

Key Movers in Small Cap:

Solid Biosciences Inc (SLDB, 20.30%▲) is preparing to present long-term data for three patients in a phase 1/2 study of its treatment for Duchenne Muscular Dystrophy, at the World Muscle Society Virtual Congress. The relative volume of the stock was 30.8.

RBC Bearings Inc (ROLL, -12.18%▼) Tuesday became oversold, with an RSI reading of 22, after it announced that it has commenced concurrent public offerings of 3m shares of its common stock. The relative volume of the stock was 22.0.

Instead of the awaited approval of its lead candidate VP-102, Verrica Pharmaceuticals Inc(VRCA, -8.31%▼) received a letter from the FDA, citing manufacturing deficiencies. The relative volume of the stock was 7.4.

Stoke Therapeutics (STOK, 5.71%▲) announced positive interim data from phase 1/2A Monarch study in STK-001 in children and adolescents with DRavet syndrome. The relative volume of the stock was 6.0.

Inotiv Inc (NOTV, 35.64%▲) and Envigo RMS Holding Tuesday jointly announced that they have entered an agreement wherein Inotiv will but Envigo. The relative volume of the stock was 5.0.

The other movers in the small-cap segment included:

AerSale Corporation (ASLE, 8.13%▲): Relative Volume 12.3.

Cloudera Inc (CLDR, -0.06%▼): Relative Volume 5.0.

InnovAge Holding Corp (INNV, -8.34%▼): Relative Volume 4.9.

Tegna Inc (TGNA, 10.76%▲): Relative Volume 4.4.

Simulations Plus Inc (SLP, 0.77%▲): Relative Volume 4.2.

Key Movers in Large Cap:

Quantumscape Corp (QS, 16.02%▲) is already finding takers for its battery technologies, including some of the world’s largest automakers, regardless of the fact that its prime product is still in the developmental stage. The relative volume of the stock was 6.2.

Uber Technologies Inc (UBER, 11.49%▲) has boosted its financial forecast from a loss of $100m to $25m. The relative volume of the stock was 4.1.

Media reports suggested that DraftKings Inc (DKNG, -7.42%▼) made a bid to acquire global competitor Entain. The relative volume of the stock was 3.8.

The Walt Disney Company (DIS, -4.17%▼) Tuesday disclosed a disappointing forecast for growth in its Disney+ division. The relative volume of the stock was 2.9.

The other movers in the large-cap segment included:

Acceleron Pharma Inc (XLRN, 9.85%▲): Relative Volume 5.0.

Flower Foods Inc (FLO, 0.30%▲): Relative Volume 3.5.

AmeriCold Realty Trust (COLD, -8.29%▼): Relative Volume 2.8.

Oshkosh Corporation (OSK, -3.50%▼): Relative Volume 2.7.

Bill.com Holdings Inc. (BILL, -3.39%▼): Relative Volume 2.4.

Report Card:

Adobe Inc (ADBE, 0.72%▲) reported a Q3 adjusted EPS of $3.11, ahead of the prior year’s $2.57 and the consensus estimate of $3 per share. The revenue of $3.94bn surpassed the estimates by 1.41%. The stock fell by more than 4% after hours.

FedEx Corporation (FDX, 0.51%▲) came out with a net income of $1.19bn, or $4.37 per share, considerably lower than the prior year’s $1.28bn or $4.87 per share. The revenue of the company came out at $22.0bn, beating the estimated $21.8bn. The stock fell by a little less than 5%.

Online shopping and styling service Stitch Fix Inc (SFIX, -2.50%▼) reported an EPS of 19 cents, beating the estimated loss of 13 cents per share hands down. Revenue of $571.2m was also well ahead of the expected $548m. The stock soared more than 13% after hours.

On the Lookout:

The two-day FOMC meeting will end today, and apart from the statement by the Fed Chair Jay Powell is scheduled to address the media as well.

Existing Home Sales (SAAR), for the month of August, is expected to drop from the previous print of 5.99m to 5.87m.

The Silicon Valley software start-up, Freshworks, is eyeing a $10bn valuation as it is set to raise around $1bn by selling 28.5m shares of its common stock, priced between $32 and $34.

Cornell Capital LLC-backed Knowlton Development Corporation, is looking to raise $857m by offering 57.1m shares of its common stock, priced between $13 and $15.

Fintech company, Remitly Global, aims to raise $332m on a valuation of $6.5bn, by offering 12.1m shares of its common stock, priced between $38 and $42 per share.

Unusually high shorter-term CALL options activity seen on Indie Semiconductor (INDI, 14.17%▲), Lucid Group Inc (LCID, 11.38%▲), MGM Resorts International (MGM, -1.77%▼), Walt Disney Co (DIS, -4.24%▼), and Best Buy Co (BBY, 0.22%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on AMC Entertainment Holdings (AMC -3.65%▼), Taiwan Semiconductor (TSM, 0.23%▲), Uber Technologies Inc (UBER, 11.49%▲), Upstart Holdings Inc (UPST, 9.30%▲) and Corvus Pharmaceuticals (CRVS, 38.25%▲) among others.

Other Asset Classes:

Crude Oil Prices - Signals of tightening supply and growing global demand, the Crude Oil prices continued an upward rally Wednesday morning. Brent crude gained more than 1.4% early morning and was trading well above the $75 per barrel mark, while WTI crude traded 1.60% higher.

The US Dollar (93.23, 0.03%▲) looked to extend the upward momentum, early Wednesday morning, ahead of the Fed statement, scheduled later in the day as the FOMC meeting concludes.

The US Treasury Yields Wednesday morning climbed as all eyes remain fixed on the outcome of the ongoing Fed meeting. The 10 Year US Treasury Yield was trading at 1.338, in the green zone, and considerably higher than Tuesday’s 1.328%.

Global Markets:

Asian Markets: The markets were mixed as investors await the Fed’s assessment of the US economy, while a looming shadow of the Evergrande crisis continued to make the investors nervous. Tokyo’s Nikkei shed more than 200 points, down 0.67%. Shanghai climbed 0.37%, as Hang Seng also made decent gains of more than 120 points or 0.51%.

Evergrande’s bond-payment update and a rally in travel and leisure stocks led the European markets to a positive start, early Wednesday morning. All major indices were buoyed as investors have a keen eye on the outcome of the Fed meeting. FTSE (0.91%), CAC (0.94%),DAX (0.47%) , and the pan-EU index Stoxx-600 (0.53%) looked set to have another gaining day.

Indian Market: The Indian stock market has so far remained resilient to the global Evergrande-Selloff. After making decent gains on Tuesday, the trading remained volatile today and the indices ended flat with a negative bias. Sensex slid 78 points or 0.13%, while Nifty closed 15 points lower or 0.09%. Gains in some sectors, including IT, Auto, and Metals minimized the losses.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Tempur Sealy International Inc (TPX), Kornit Digital Limited (KRNT), Warner Music Group (WMG), Intra-Cellular Therapies Inc (ITCI), and Nektar Therapeutics (NKTR). Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.