Recession Today, Gone Tomorrow!

Good Morning,

Researchfin.ai App went live yesterday - get ready for the future of trading!

It’s official now! The US-Covid recession has been the shortest in history lasting just two months, the National Bureau of Economic Research has confirmed. Previous 8 recessions, since 1960, have lasted 12 months on an average.

European Central Bank has kept the rates unchanged while the 1.8 Trillion PEPP will continue till March 2022.

Carbonaceous! US coal firms, after falling idle for some time last year, are up and thriving with huge orders from China - as the mainland bans import of Australian coal - and rising prices globally.

Here comes yet another “antitrust” probe! This time for Amazon and Ebay, in Australia, to ensure fairness. The country’s regulator, which has slapped the toughest content licensing rules on Facebook and Google, has called for industry submissions.

Also, Salesforce has acquired messaging app Slack Technologies for a whopping $27.7bn.

US Markets:

After the one-day rout in the markets on Monday, the equities have bounced back well, registering substantial gains on Tuesday as well as Wednesday. Some better-than-expected earnings reports also added some impetus to the rally.

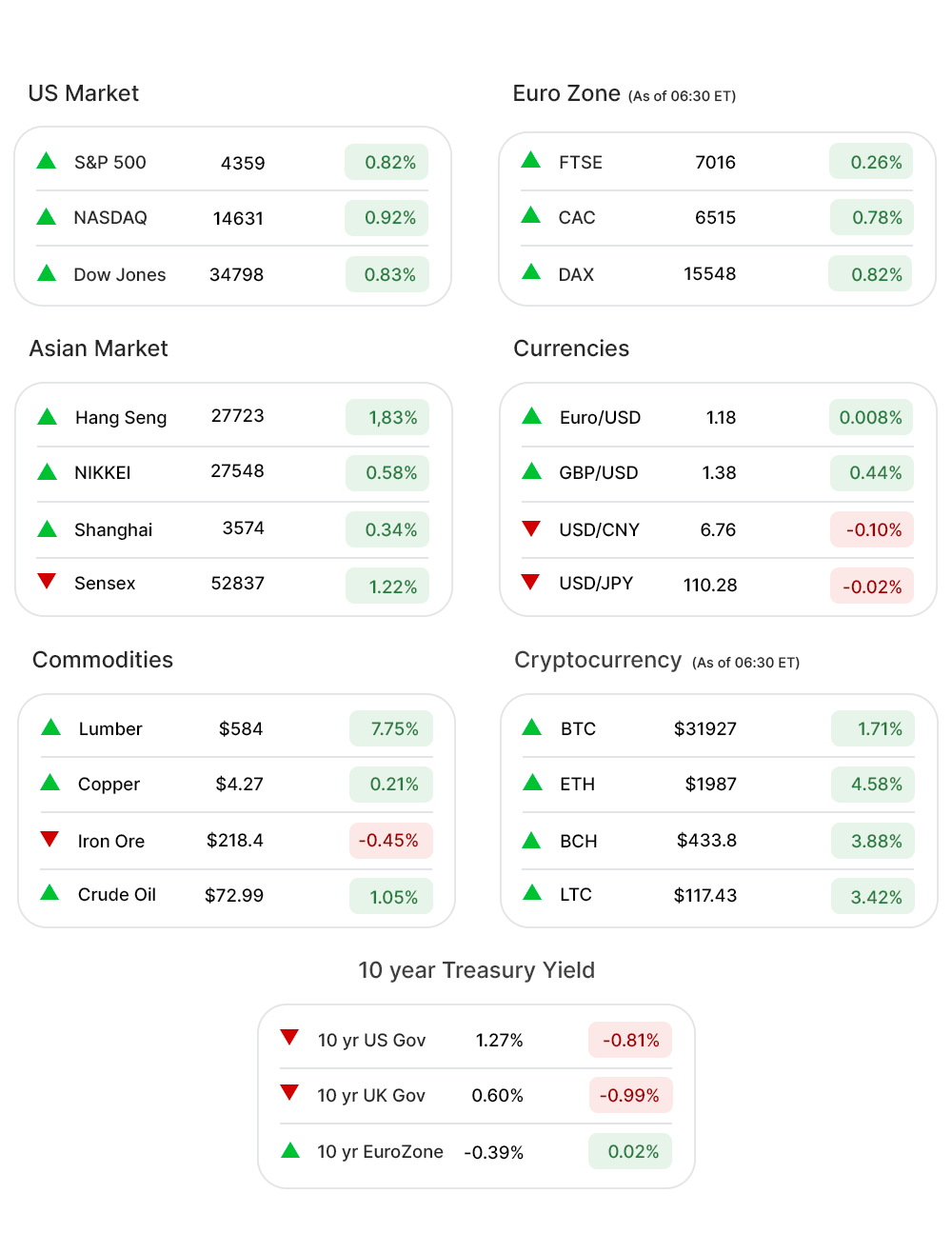

Dow (0.83%▲) added 286 points for the day. The S&P 500 (0.82%▲) advanced more than 35 points while the Tech-heavy Nasdaq (0.92%▲) climbed more than 130 points by the time the markets closed.

The bullish sentiment was reflected in the S&P 500 sectors as well, with only 3 out of 11 sectors falling below the zero mark. Energy (3.53%▲) extended gains made on Tuesday and led the pack on Wednesday.

Healthcare (1.41%▲) shrugged off the recent negativity and was well within the green zone, along with Technology (0.98%▲), Financials (1.70%▲), Industrials (1.00%▲), and Materials (1.09%▲).

Real Estate (-0.35%▼), Consumer Staples (-0.14%▼) and Utilities (-1.10%▼) were in the red.

Futures!

Futures looked green, raising expectations that the green run in markets might extend.

As of 06:45 ET: Nasdaq Futures (0.014%▲), S&P 500 Futures (0.19%▲), Russell 2000 Futures (0.24%▲), and Dow Futures (0.22%▲) were rallying.

Key Movers in Small Cap:

A maker of high-tech beds and beddings, Sleep Number Corp (SNBR, -12.88%▼) announced that their Q2 revenue advanced 70% y-o-y and the EPS of $0.88 was way ahead of a loss of $0.45 per share in 2020. The investors, however, expected more. Also, the company’s admission that supply constraints limited deliveries in June and July had investors selling off the stock. The relative volume of the stock was 6.6.

The clothing and home decor retailer, Land’s End Inc (LE, 16.57%▲) raised its outlook for the Q2 earnings maintaining that the revenue will grow between 21.8 to 23.4% y-o-y. The relative volume of the stock was 4.9.

The Healthcare Services Group (HCSG, -12.37%▼) reported a net income of $9.57m, way lower than the Q2 income of $23.1m last year. The revenue also fell $398.17m, from $452.03m last year. The expected revenue was $407.4m. The relative volume of the stock was 4.1.

The other movers in the small-cap segment included Kinnate Biopharma. (KNTE, 0.74%▲), with a relative volume of 17.6; SIGA Technologies. (SIGA, 9.56%▲) with a relative volume of 8.6; National Storage Affiliates Trust (NSA, -0.83%▼), with a relative volume of 6.6 and HNICorporation (HNI, -0.34%▼), with a relative volume of 4.0.

Key Movers in Large Cap:

Shift4 Payments (FOUR, -6.11%▼) has announced a secondary public offering of 1.8m shares, seeking an estimated gross proceeds of $157.72m. The relative volume of the stock was 8.0.

The messaging app, Slack Technologies Inc. (WORK, 0.09%▲) has been formally acquired by software giant Salesforce for $27.7bn, following the dropping of an antitrust probe into the deal by the Department of Justice. The relative volume of the stock was 5.3.

Chipotle Mexican Grill (CMG, 11.54%▲) has reported a 10.5% increase in digital restaurant sales for Q2, accounting for 48.5% of the total sales. The result is being seen as a change in consumer behaviour. The good vibes spilled over to some other restaurant stocks as well.

The global advertising and marketing services company, Interpublic Group of Companies (IPG, 11.32%▲) has reported that its revenue grew 22.5% y-o-y to $1.85bn for Q2. The EPS of $0.70 is also higher than the estimated $0.43. The relative volume of the stock was 3.5.

The other stocks in this category included Harley Davidson. (HOG, -7.19▼), with a relative volume of 4.1; Lithia Motors (LAD, 4.38%▲), with a relative volume of 3.0; Signature Bank (SBNY, 2.24%▲), with a relative volume of 2.9; Netflix Inc (NFLX, -3.28▼), with a relative volume of 2.7; and NVIDIA Corporation (NVDA, 4.29%▲), with a relative volume of 2.3.

Report Card:

The soft drink giant Coca Cola (KO, 1.29%▲) has beaten estimates for Q2 earnings. The adjusted EPS at 68 cents against the estimated 56 cents while the revenue of $10.13bn was also higher than the estimated $9.32bn. Emboldened by the earnings, the company has now raised its full year outlook and expects to deliver organic revenue growth of 12% to 14%, from its prior outlook of single digit growth. The stock continued to rise after hours.

Johnson & Johnson (JNJ, 0.62%▲) has reported a revenue of $23.31bn, for Q2, beating the estimate of $22.21bn. The adjusted EPS of $2.48 was also better than the estimated $2.27. The company has announced that they expect $2.5bn in global sales of the Covid vaccine this year. The stock rose slightly after hours.

The motorcycle company Harley Davidson. (HOG, -7.19▼) reported adjusted EPS of $1.33, beating the estimate of $1.15. The revenue of $1.33bn, however, fell 2.49% short of the estimate.

Verizon Communications Inc (VZ, 0.67%▲) has generated a Q2 income of $5.95bn, or $1.40 per share, a sharp departure from an income of $4.84bn, or $1.13 per share, a year earlier. The company’s operating revenue has risen to $33.76bn from $30.4bn a year ago, beating the estimated revenue of $32.77bn. The stock continued to make gains after hours.

On the Lookout:

The day will start with Initial Jobless Claims and Continuing Jobless Claims, followed by Existing Home Sales and the Index of Leading Economic Indicators.

The initial jobless claims are expected to fall to 348,000 from the previous 360,000 while the existing home sales are expected to grow to 5.93m from the previous 5.80m.

Here are some upcoming IPOs:

The e-commerce risk management platform, Riskified, is targeting a valuation in excess of $3bn as the company announces an offering of 17.3m class A ordinary shares. The shares are priced between $18 and $20.

The cloud-based technology company, Project Angel Parent, is offering 12m shares of its common stock, priced between $24 to $26. The company eyes to raise $358m.

Dole Plc, the fruits and vegetables distributor, is eyeing a $2.1bn valuation through a public offering of 26m shares of its common stock, priced between $20 and $23. The company is set to raise $686.7m.

The smart home integration company, Snap One Holdings, has announced an offering of 13.85m shares of its common stock, priced between $18 and $21.The company will raise $334.4m.

Unusually high shorter-term CALL options activity seen on Petróleo Brasileiro. (PBR, 2.29%▲), Air Products and Chemicals (APD, 0.29%▲), Daqo New Energy (DQ, 20.13%▲), 3M Co. (MMM, -0.02%▼) and Workhorse Group (WKHS, 3.01%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Sibanye Stillwater Ltd. (SBSW,2.29%▲), Carnival Corp (CCL, 9.44%▲), BHP Group Ltd. (BHP, 2.53%▲), and Freeport McMoRan (FCX, 5.16%▲).

Other Asset Classes:

Despite US Oil inventories rising for the first time since May, by 806,000 barrels for the week ended July 16, the Crude Oil prices extended Tuesday’s rally on Wednesday. Brent is presently trading at $72 per barrel, rebounding from the recent low of $68.63 a barrel. Early Thursday however the prices shrugged off some of the gains.

The US Dollar (92.76, 0.00%▲) pulled back from a three-and-a-half month high of 93.194, it touched Wednesday.

The 10 Year Treasury Yield, was up 7.9 basis points to 1.288% while the 30 Year Treasury Yield climbed 7.7 basis points to 1.946%, following buoyancy in the markets as concerns around delta variant eased.

Tesla CEO, Elon Musk, said his company will most likely resume accepting Bitcoin for payments. The statement made the CryptoCurrency jump 7.9%, its highest since mid-June and is trading north of $32000. Ether jumped 12%, as Musk acknowledged that he owned this Crypto.

Global Markets:

Optimism about economic recovery, despite a rise in delta variant cases, seems to have spilled beyond the US markets. The Asian markets continued to trail the buoyancy in the US on Wednesday with all major indices in the green zone. Hang Seng gained more than 430 points even as the Nikkei rallied over 200 points higher.

Stoxx-600, after closing 1.7% higher on Wednesday and recovering fully from a selloff earlier this week, opened in the green on Thursday as investors in European Markets have their eyes fixed on positive earnings and a dovish policy stand by the European Central Bank, later in the day.

Meanwhile on Researchfin.ai

There are 100+ new trade setups identified by the AI today. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

Have a lovely day!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.