“Rocket” that!

Good morning,

You never know! 82-year-old Wally Funk, trained to be an astronaut in the 1960s, will join Jeff Bezos and his brother Marc to fly to space. Dreams do come true!

“I have always been a dreamer,” 70-year-old founder of Virgin Galactic, Richard Branson, said Thursday as he announced he will fly to space before Jeff does. Let’s call it the Billionaires’ race to space!

Jeff and Branson are not the only ones with dreams! AST SpaceMobile Inc is building the first and only global broadband cellular network in space to operate directly with standard, unmodified mobile devices.

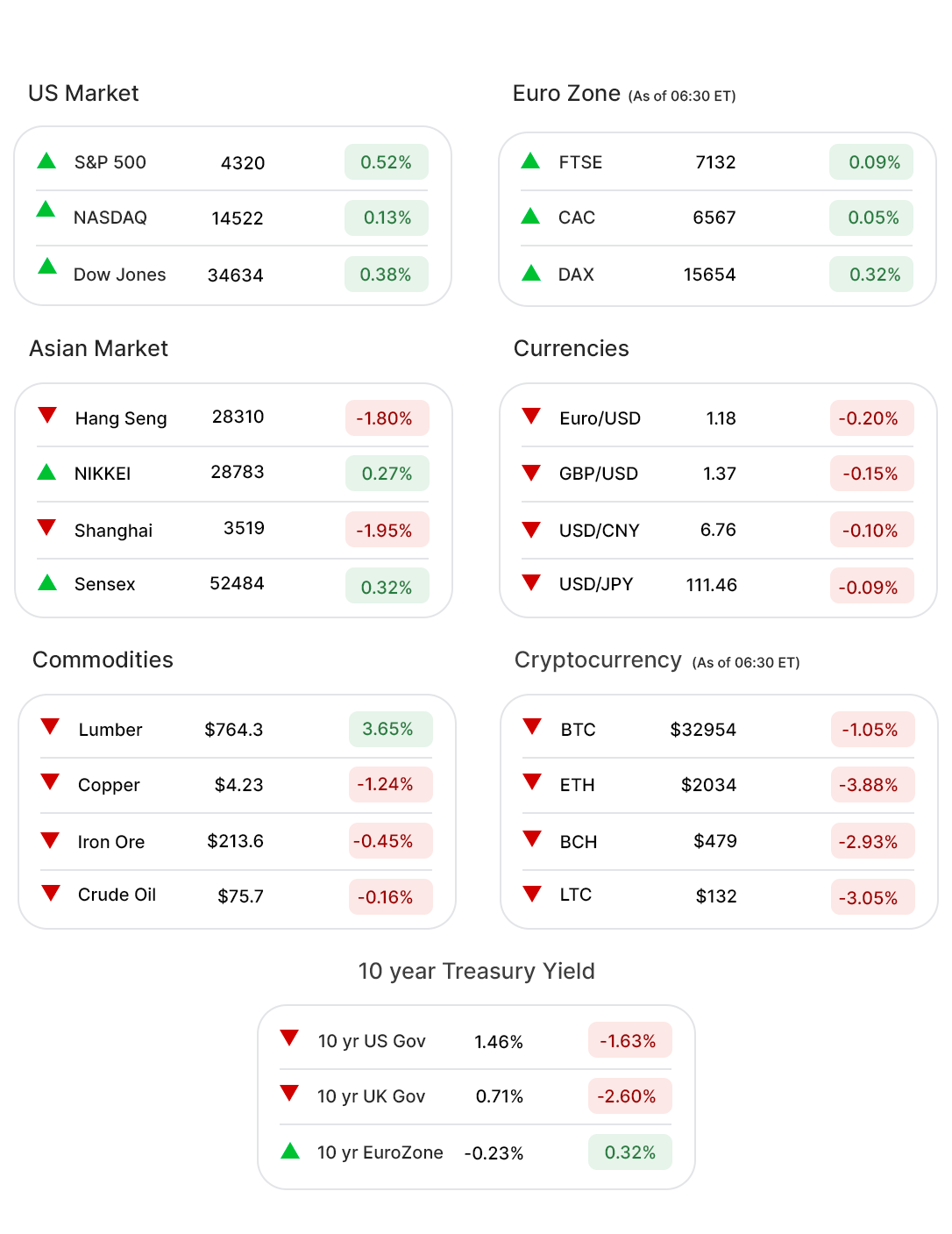

US Markets:

S&P 500 (0.52%▲) has breached the 4300 mark! The index booked its sixth record close in a row, the longest such streak since August 2020.

Each one of the 11 sectors was in the green zone with Energy (1.72%▲) topping the gainers’ chart for the second consecutive day Thursday.

Technology (0.10%▲) bounced back after a slide on Wednesday. Healthcare (0.93%▲), Utilities (1.13%▲), Financials (0.77%▲),and Industrials (0.59%▲) also performed well.

Nasdaq (0.13%▲) and Dow (0.38%▲) also edged up!

Futures!

As of 07:30 ET, the US Index futures, barring Russell 2000 Futures (-0.05%▼), were all green. S&P Futures (0.08%▲), Nasdaq Futures (0.22%▲), and Dow Futures (0.04%▲)

Another record-breaking day in the offing!

Key Movers in Small Cap:

Pulse Biosciences Inc. (PLSE, 27.0%▲), a novel bioelectric medicine company, announced entering a stock purchase agreement with Robert Duggan, Pulse’s board chairman, that cancels the debt of $41.6m that the company owed to him. The relative volume was 39.49.

After registering major losses on Wednesday, Grid Dynamics Holdings (GDYN, 25.0%▲) announced an offering of 10 million shares to the public priced at $15.03 per share. The relative volume of the stock was 16.89.

Another public offering of 4.4 million shares by Aligos Therapeutics Inc. (ALGS, -17.29%▼), at $19 per share, made the stock tumble from $18.25 to $16.86. The relative volume of the stock was 8.39.

Spero Therapeutics Inc. (SPRO, 17.0%▲), a pharmaceutical and biotechnology firm, has received a $40 million equity investment from Pfizer. The relative volume of the stock was 6.12.

Another (clinical stage) biotechnology firm, Kymera Therapeutics Inc. (KYMR, 16.0%▲) rallied backing on the announcing 4.7 million underwritten public offering at $47 per share. The relative volume of the stock was 3.72.

US Silica Holdings Inc. (SLCA, 21.0%▲), with a relative volume of 2.74, Aspen Aerogels Inc. (ASPN, 16.0%▲), with a relative volume of 3.30, and Franklin Covey Co. (FC, 11.0%▲), with a relative volume of 4.72 were the other movers in the small-cap segment.

Key Movers in Large Cap:

Novocure Ltd. (NVCR, -14.47%▼) announced disappointing results from a study of its anti-cancer device, in advanced Liver Cancer patients. The relative volume of the stock was 3.58.

Despite reporting better than expected earnings, the stock of Pharmaceutical Holdings company, Walgreen Boots Alliance Inc. (WBA, -7.0%▼) slumped. The relative volume of the stock was 4.82.

Micron Technology Inc. (MU, -5.73%▼), also slid despite better earnings as investors remain concerned more about the future uncertainties in the semiconductor market, than the profits. The relative volume of the stock was 2.33.

Other movers in the large-cap segment were Acuity Brands Inc. (AYI, -6.0%▼) with a relative volume of 2.12, Amedisys Inc. (AMED, 1.46%▲) with a relative volume of 2.10, Diamondback Energy Inc. (FANG, 6.0%▲) with a relative volume of 2.03 and Tempur Sealy International Inc. (TPX, 6.0%▲) with a relative volume of 1.54.

Earnings:

Not so bright for the lighting company, Acuity Brands Inc. (AYI, -6.0%▼). They reported net sales of $899.7 million, a 15.9% increase in sales y-o-y. Diluted EPS were $2.37, 55.9% more than the previous year. However, the stock price fell 1.82% after hours on Thursday.

The retail Pharmaceutical giant, Walgreen Boots Alliance Inc. (WBA, -7.0%▼) reported revenue of $34.03 Billion, 12% higher than expected. EPS of $1.51 also beat the expectations of $1.17. The stock rose after hours by 0.68%.

Micro Focus International (MFGP, -15.14%▼) reported an EPS of -$ 0.65 on revenue of $1.43 billion. The reported EPS is way lower than the estimate of $0.83 but the revenue has outdone estimates of $1.37 billion. The stock made 1.25% gains after hours.

We spoke of Micron Technology Inc. (MU, -5.73%▼) in the above section. The EPS of $1.88 on revenue of $7.42 billion has topped the estimates of $1.72 on $7.24 billion. After a bad day post good earnings, the stock has further slid 0.19% after hours Thursday.

On the Lookout:

The Labor Department's June jobs report is due today. The print is expected to show an acceleration in hiring with the economy well on recovery but we are still 7 million jobs short of where we were pre-pandemic.

It’s not all amazeballs, though! Compared to its 3 decade average of 119 points the Skew Index, which rises when fear outpaces greed, breached the 170 mark last week. It did dwindle to 161.8 points on Wednesday but is still way ahead.

Robinhood (HOOD), the trading platform, finally filed for an IPO on Thursday, targeting a valuation of $40bn plus. The IPO prospectus reveals the company’s revenues tripled to $959m last year and has 18.5 million funded accounts with an average revenue per customer at $137 (Q1,2021).

Let’s see how the IPOs fared Thursday!

Krispy Kreme Inc. (DNUT, 23.53%▲), despite an almost flat beginning on its debut, soared later in the day. The doughnuts are baking well!

Torrid Holdings Inc. (CURV, 15.0%▲) tries their clothes on employees and not mannequins to ensure a proper fit. Looks like they are ‘fitting well’ in the stock market!

EverCommerce Inc (EVCM, 3.53%▲), the software company, did well too!

Unusually high shorter-term CALL options activity seen on Halliburton (HAL, 2.94%▲), Discovery (DISCA, 1.69%▲), Apple Inc. (AAPL, 0.23%▲), and Airbnb (ABNB, -0.039%▼), Adamas Pharmaceuticals (ADMS, 5.68%▲) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Tesla (TSLA, -0.26%▼), Avis Budget Group (CAR, 5.12%▲), Freeport-McMoRan (FCX, -0.054%▼), and Snap (SNAP, 0.70%▼), among others.

Other Asset Classes:

The US Dollar Index (92.67, 0.08%▲) is moving from strength to strength as speculations around Fed’s tightening monetary policy gain momentum. The index is near a three month high.

Crude Oil Prices continue to climb as reports suggested that the OPEC + consideration of two million barrels per day output hike from August through December, was thrown into disarray by UAE. Oil prices have surged more than 45% this year, nearing the $80 per barrel mark. Is $100 a barrel in sight?

Global Markets:

While Nikkei was doing well, the markets in China and Hong Kong of the Asia Pacific region tumbled Friday following a “broken heads and bloodshed” speech by the Chinese president, Xi Jinping.

With investors trying to pick the direction of Fed’s monetary policy from June Jobs report, the European Markets edged higher after a positive start.

Meanwhile on Researchfin.ai

There are 28 new trade setups identified by the AI today. Please sign-up for our app, if you already haven’t, to learn about these setups.

That is it for today!

Wish you Peace, Love and Happiness on Independence Day!

See you next week!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.