So Far So Good!

Zowie! What a year it is turning out to be!

We have witnessed one of the best first halves in 23 years. The S&P 500, the broadest measure of the US stock market, has already achieved its year-end target with a growth of 14%.

Also, ADP reported Wednesday, 692,000 non-farm jobs have been added in the month of June substantially ahead of the expected 550,000. Jobs in the hospitality sector have increased by 332,000.

With the good news comes caution! The Shiller P/E ratio, the cyclically adjusted price to earnings ratio, is nearing its peak. Currently, at 38 times it is scarily close to the peak of 44 times, witnessed just before the dot-com bust of 2000.

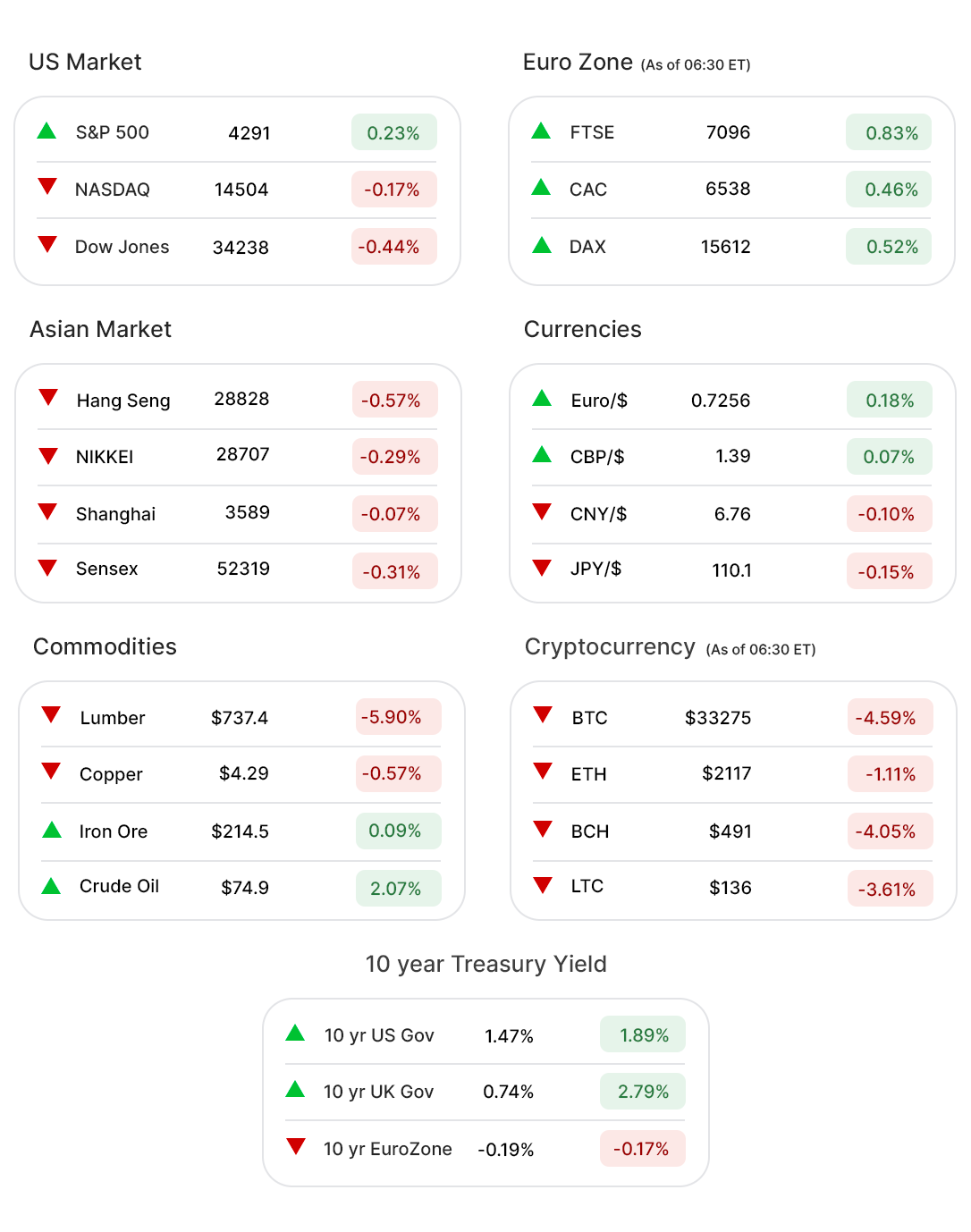

US Markets:

S&P 500 (0.13%▲) is only two points from breaching the 4300 mark. Looks like the sectors are taking turns to fuel the stock market upward rally!

For two days Technology (-0.10%▼) drove the markets, while the Energy sector kept slumping.

On Wednesday, though, Energy (1.31%▲), Consumer Staples (0.72%▲), Financials (0.47%▲)and Industrials (0.59%▲) led S&P closer to the 4300 mark.

Technology sliding took some sheen off Nasdaq (-0.17%▼) as well as some tech giants-Microsoft Corporation (MSFT, -0.18%▼), Amazon Inc. (AMZN, -0.23%▼), Facebook Inc (FB, -1.19%▼) and Nvidia Corporation (NVDA, -0.12%▼)-among them.

Apple Inc. (AAPL, 0.46%▲) defied the sector.

Futures!

As of 07:30 ET, the US Index futures, barring Nasdaq Futures (-0.14%▼), were all green. S&P Futures (0.06%▲), Russell 2000 Futures (0.34%▲), and Dow Futures (0.15%▲) give an impression of another fruitful day.

Key Movers in Small Cap:

The other day we mentioned editing genes inside the human body and the news making Intellia Therapeutics (NTLA, 6.79%.▲) jump by more than 50%. Well, the stock has a rub-off effect on its peers now!

Editas Medicine Inc. (EDIT, 22.86%▲), with a relative volume of 8.02, Beam Theraupatics (BEAM, 16.17%▲) and CRISPR Therapeutics (CRSP, 7.58%▲) have made some substantial gains following Intellia’s breakthrough!

But all Healthcare (0.02%▲) stocks were not lucky enough!

Cel-Sci Corporation (CVM, -32.0%▼), continued to be an eyesore for the investors following a report that it’s treatment for Squamous Cell Carcinoma missed its primary endpoint in a phase-3 study. The relative volume was 7.38.

Altimmune Inc. (ALT, -38.05▼) has officially thrown the towel on the development of its Covid-19 vaccine, AdCovid.

Lands End Inc. (LE, 19.78%▲) with a relative volume of 5.8; Aspen Aerogels Inc (ASPN, 24.18%▲) with a relative volume of and Grid Dynamics Holdings (GDYN, -14.36%▼) were some other small-cap stocks that made a buzz on Wednesday.

Key Movers in Large Cap:

Announcing 2.5 million shares, priced below Tuesday’s close, did not go well with the investors for MongoDB Inc. (MDB, -5.78▼). Hence the correction! The relative volume of the stock was 2.02.

Semiconductor company, Advanced Micro Devices (AMD, 4.93%▲) expanded its data-center chip market share from 1.8% in 2018 to 8.9% in the first quarter. The relative volume of the stock was 1.75.

With an uptick in the Energy Sector, Cabot Oil and Gas Corporation (COG, 7.25%▲) stock went from $16.5 to $17.4. The relative volume of the stock was 1.97.

Digital media measurement and analytics company, DoubleVerify Holdings Inc. (DV, -10.02%▼) shrugged off the gains made Tuesday. The relative volume of the stock was 1.55.

Agricultural Fertilizers manufacturer CF Industries Holdings (CF, 5.57%▲) and beauty company Coty Inc (COTY, 4.83%▲) were among other gainers in the large-cap segment.

Earnings:

Bed Bath and Beyond Inc. (BBBY, 11.30%▲): Revenue climbs 49% y-o-y to $1.95 billion, beating expectations of $1.87 billion with adjusted EPS at 5 cents against the expected 8 cents. The stock fell slightly after the earnings report but made a strong comeback later in the day. 23 million shares changed hands Wednesday compared to a 10 day tally of just 5.7 million!

On the other hand, Micron Technologies Inc (MU, 2.47%▲) stock fell after hours by 2.27% despite beating estimates except for one metric - CAPEX. Adjusted EPS was $1.88 and revenue reported at $7.42 billion.

Beer & Wine maker Constellation Brands Inc. (STZ, 1.01%▲) reported an EPS of $2.33, lower than expected $2.35. The net sales of $2026.5 million also fell short of $2050.8 million. Despite this, the stock has witnessed an after-hours surge of 0.47%.

Meanwhile, the gunbroker Ammo Inc. (POWW,11.38%▲) moved in sync with its better-than-expected earnings. The company has reported a profit of 4 cents per share even as the estimates were of a loss of 1 cent per share. The revenue is also $0.25 million higher than the estimated $23.95 million.

On the Lookout:

Apart from the scheduled OPEC + meeting today, which will define the future course for Crude Oil prices, US Jobless claims will be the focus of the trading day today.

The EV market, which surpassed $165 billion in 2020, is expected to reach a whopping $802 billion by 2027.

Speaking of EVs, Sono Motors is set to give Tesla a run for its money! The German automaker is coming up with a self-charging (solar) EV named Sion and has 13000 pre-orders in its kitty!

Need to buy an EV? Well, here are some IPOs you can encash upon!

Krispy Kreme Inc (DNUT), the doughnut maker, has priced its IPO between $21 and $24. Do you have a sweet tooth? Because, 26 million shares are on offer, today!

The financial company, EverCommerce Inc (EVCM) is offering 19 million shares priced between $16-18.

Another 56.7 million shares! The Turkish e-commerce platform Hepsiburada (HEPS) is going public today. The shares are priced between $11 to $13.

Also, Plus Size Retailer Torrid Holdings Inc. (CURV) has announced 8 million shares priced between $18 to $21. The offering has valued the company at $2.3 Billion.

Atour Lifestyle Holdings (ATAT) is another company going public today with 19 million shares priced between $13.50 and $15.50.

Wondering about the IPOs that went public Wednesday? They had a blast!

Xometry Inc. (XMTR, 98.61%▲), an industrial parts marketplace, was one of the biggest market movers on its debut!

The online Technology Company, Legal Zoom (LZ, 35.18%▲) outperformed the Tech sector on its debut Wednesday.

SentinelOne (S, -8.21%▼) became the highest valued Cyber Security IPO with a 21% gain seconds after the stock started trading, shrugging off some of the gains later in the day.

Didi Global Inc (DIDI, -13.73▼) was up 1% Wednesday after 28% on debut. The company stock had begun trading at $16.65 per share, up 19% from the offering price of $14 per share.

Unusually high shorter-term CALL options activity seen on AST SpaceMobile (ASTS, 26.74%▲), Vale SA (VALE, 0.088%▲), ACADIA Pharmaceuticals (ACAD, 1.08%▲), and Vipshop Holdings (VIPS,0.37%▲), Advanced Micro Devices (AMD, 4.93%▲) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Snap (SNAP,0.81%▲), Chewy (CHWY, -2.65%▼), SSR Mining (SSRM, 1.76%▲), and Kellogg Company (K, 0.61%▲), among others.

Other Asset Classes:

Ahead of the US manufacturing and employment data, which may indicate the economy has recovered enough for the Fed to begin reducing its emergency stimulus, the US Dollar Index (92.48, 0.05%▲) reached its highest since early April.

The 10 Year US Treasury Yield also rose along with the 30 Year US Treasury Yield, which has climbed back to more than 2%.

The EIA report is due today and the Crude Oil Prices hovered just below 52 week highs on Wednesday.

Global Markets:

Most of the Asia Pacific markets slid Thursday morning after reports that Chinese factory activity slowed in June. The Caixin/Markit manufacturing purchasing managers’ index stood at 51.3, lower than May’s 52.0.

With concerns around the direction of US monetary policy, European Markets did well today as investors look inwards after EuroZone has been showing a fine recovery after lagging behind the US in management of the Virus and economic recovery.

Meanwhile on Researchfin.ai

There are 30 new trade setups identified by the AI today. Please sign-up for our app, if you already haven’t, to learn about these setups.

The newsletter ends here! Have a great day!

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer: Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.