Taper Ready!

Good Morning!

Three Fed officials - including Governor Lael Brainard, New York President John Williams, and Charles Evans of Chicago - have expressed their comfort on policy tightening, despite not feeling any pressure from inflation. How soon will the pullback begin?

The ethical controversy inside Fed! Two top Fed officials - including President of the Boston Fed, Eric Rosengren, and the Dallas Fed President Robert Kaplan - are stepping down in wake of revelations about their financial trading, exposing potential shortcomings in Fed’s rules on investments.

Walls crumble! The internet platforms in China have for the first time, started to open up for the competition - under immense pressure from the regulators. Alibaba has started integrating Tencent’s WeChat pay on some of its apps, while Tencent is responding with unblocking links from Alibaba.

‘Electric’ future! Auto giant Ford Motors has unveiled plans to spend $11bn, with South Korea’s SK Innovation, to establish an industrial backbone for its electric pickup truck business. With this largest spending in 118 years of its history, Ford is looking to establish 3 factories to supply batteries and vehicles.

Et Tu, Ferrari! The company has hired the former chief designer of Apple Inc, Jony Ive, ahead of its debut into fully electric vehicles. Ferrari will launch its first EV in 2025.

The $90 mark! For the first time in 3 years, Brent Crude has gone above the $80 per barrel mark, with global supplies exhibiting signs of further constriction. Analysts believe the $90 per barrel mark looks within reach.

Despite supply constraints and higher material costs, the Durable Goods Orders, for the month of August, increased 1.8% to a record $263.5bn, as compared with the month of July.

“Instagram Kids” paused! A scathing report, by WSJ, highlighting Instagram’s “toxic” effect on teenagers has forced Facebook to put a lid - at least for now - on the “Instagram Kids”, meant for people aged below 13.

US Markets:

Amid fears of a government shutdown, as Republicans block the spending bill, the markets ended mixed on Monday.

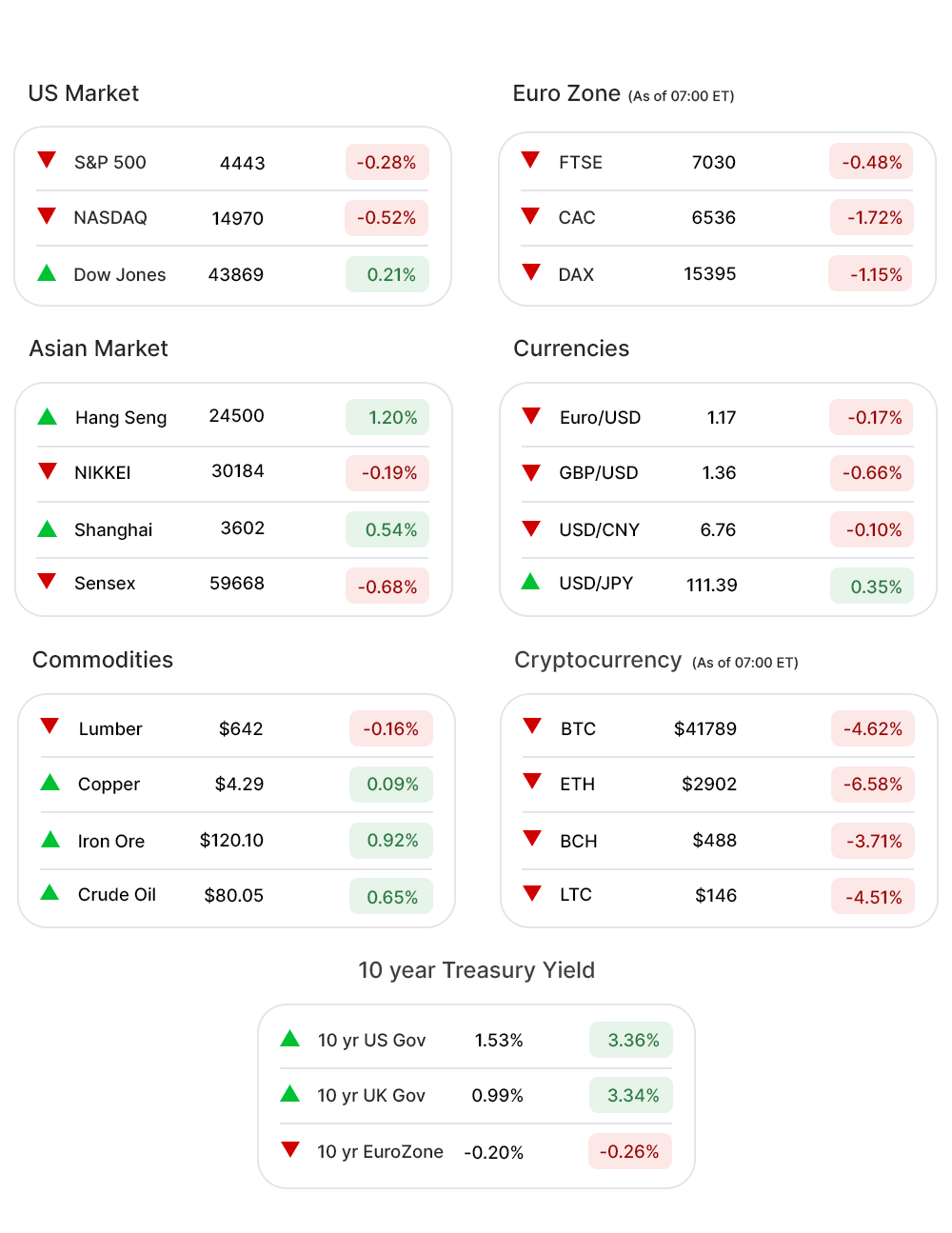

After a three-day winning streak last week, the S&P 500 (-0.28%▼) fell Monday and closed at 4443.11. Tech-heavy Nasdaq (-0.52%▼) continued the losing streak.

Dow Jones (0.21%▲) made a gain of over 71 points, buoyed by the rally in Energy stocks, while Russel 2000 (1.46%▲) ended in the green zone as well.

Sectors at the S&P 500 ended mixed as well, with five of the 11 sectors falling below the zero mark.

Energy (3.43%▲) was the leading sector, making substantial gains, followed by Financials (1.31%▲) and Materials (0.78%▲) making decent gains as well.

Consumer Discretionary (0.38%▲), Industrials (0.11%▲), and Consumer Staples (0.21%▲) managed to eke out some gains as well.

Healthcare (-1.43%▼), Real Estate (-1.21%▼), and Technology (-1.01%▼) suffered losses of more than 1%. Utilities (-0.50%▼), and Communication Services (-0.11%▼) closed in the red zone as well.

Futures!

The Futures were red without an exception, early Tuesday morning, as the EU markets tumbled and the Asian markets ended mixed.

As of 06:00 ET, the futures looked like this: Nasdaq Futures (-1.58%▼), Dow Futures (-0.52%▼), S&P 500 Futures (-0.90%▼), and Russell 2000 Futures (-0.44%▼).

Key Movers in Small Cap:

Kraton Corporation (KRA, 9.37%▲) is in the process of being acquired by DL Chemical Co Ltd, in an all-cash deal of $2.5bn. Under the terms, shareholders of KRA will get $46.50 in cash for each share. The relative volume of the stock was 36.4.

The other movers in the small-cap segment included:

Apyx Medical Corporation (APYX, 10.89%▲): Relative Volume 23.9.

AerSale Corporation (ASLE, 15.57%▲): Relative Volume 13.1.

Keros Therapeutics Inc (KROS, 32.45%▲): Relative Volume 13.1.

Adicet Bio Inc (ACET, 2.50%▲): Relative Volume 5.1.

Reliant Bancorp Inc (RBNC, 3.13%▲): Relative Volume 5.0.

Key Movers in Large Cap:

Acceleron Pharma Inc (XLRN, 6.69%▲) continued to soar on news of getting acquired in an $11bn deal. The relative volume of the stock was 3.6.

The other movers in the large-cap segment included:

Dun & Bradstreet Holdings (DNB, 0.35%▲): Relative Volume 3.2.

Globant SA (GLOB, -7.89%▼): Relative Volume 2.4.

Flowserve Corporation (FLS, 2.45%▲): Relative Volume 2.3.

Best Buy Co Inc (BBY, 5.19%▲): Relative Volume 2.1.

Dynatrace Inc (DT, -1.73%▼): Relative Volume 2.1.

Carnival Corporation Plc (CCL, 3.69%▲): Relative Volume 1.9.

Report Card:

The business services company, Concentrix Corp (CNXC, -0.76%▼) has reported a 136.4% y-o-y increase in diluted earnings per share to $2.08, while the revenue has dropped by 20.1% to $1397.3m. The operating income of the company has also increased by 97.1% y-o-y to $151.4m. The stock rose by 3.65% after hours.

On the Lookout:

The Consumer Confidence Index, for the month of September, is expected to rise to 115.3 from August’s 113.8.

Trade-in Goods, Advanced Report, for the month of August is due today, with a previous print of -$86.4bn.

The S&P Case-Shiller, Home Price Index, for the month of July, is due today with a previous print of 18.6%.

AI drug hunter, Exsceintia, is aiming to raise $100m by offering 13.0m shares of its common stock, priced between $20 and $22 per share.

The hair care company, Olaplex, will be raising $1bn by offering 67m shares of its common stock, priced between $14 and $16 per share.

The Singaporean Tech-service provider, TDCX, is set to raise $319m by offering 18.7m shares of its common stock, priced between $16 and $18.

The eyewear brand, Warby Parker, is offering 77.7m shares of its common stock, priced at $24.53 per share.

Unusually high shorter-term CALL options activity seen on Gores Guggenheim Inc (GGPI, 4.60%▲), Laureate Education Inc (LAUR, 2.90%▲), Draft Kings Inc (DKNG, 0.12%▲), Vale SA (VALE, 0.35%▲), and Tesla Inc (TSLA, 2.19%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Aurora Cannabis Inc (ACB, 7.31%▲), Wells Fargo & Co (WFC, -0.75%▼), Sarepta Therapeutics Inc (SRPT, 0.56%▲), PG&E Corporation (PCG, 0.30%▲) and BHP Group Limited (BHP, 0.99%▲) among others.

Other Asset Classes:

Crude Oil Prices - Brent Crude has breached the $80, per barrel mark, early Tuesday morning as global output disruptions, rising shipping costs, and shrinking US inventories keep fuelling the prices. Early morning Brent crude was trading 0.82% higher at $80.18 per barrel. WTI crude is has climbed over the $76 per barrel mark.

The US Dollar (93.53, 0.16%▲) supportive Fedspeak on Monday propelled the greenback to the monthly high of 93.60, and within a striking distance of YTD high of 93.70/75.

A prospect of tighter economic policy and optimism about the global economic recovery lifted US Treasury Yields on Monday, with the buoyancy continuing early Tuesday morning. The 10 Year US Treasury Yield climbed past 1.5% for the first time since June. Tuesday morning, the 10 Year US Treasury Yield was trading at 1.546%, and in the green zone.

Global Markets:

Asian Markets: Most of the markets closed in the red zone in the Aisa Pacific region, as investors grappled with an imminent fall-out of the Evergrande crisis and an unabated power shortage in China, threatening to affect the country’s GDP as well as Global Supply Chains. Nikkei, closed 0.19%, into the red zone. Shanghai and Hang Seng however outperformed the overall sentiment with gains of 0.54% and 1.30% respectively.

The Indian market With eyes on some major economic data, due later this week, closed lower. Sensex closed 410 points (0.68%) lower - after paring some losses - while Nifty shed in excess of 106 points (0.60%). Realty, IT & Media were the top drags as Metals eked out gains.

European markets: A surge in government bond yields pressured major high-growth tech stocks in the region pulling the major indices down at the opening of the markets. The bearish sentiment in Asian markets also affected the stocks in the EU. FTSE (-0.29%), CAC (-1.13%), DAX (-0.69%) , and the pan-EU index Stoxx-600 (1.22%) looked set to have a choppy session.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Triumph Bancorp Inc (TBK), Canadian Natural Resources Limited (CNQ), Six Flags Entertainment Corp (SIX), West Fraser Timber Co (WFG), Devon Energy Corp (DVN), Continental Resources Inc (CLR), Magnolia Oil & Gas (MGY), Antero Resources Corp (AR), SVB Financial Group (SIVB), Range Resources Corp (RRC), Designer Brands Inc (DBI), Digital Turbine Inc (APPS), and Overstock.com Inc (OSTK) among others. Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Same time, tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.