Tech Defies Crackdown!

Good morning,

JD.Com’s strong earnings helped Chinese tech stocks pop Tuesday, even as investors think the pace of China’s major data protection laws might slow, allowing tech giants to grow further. The Hang-Seng tech index closed 7% higher. JD.Com surged 15% higher, Tencent gained 8.8%, Meituan climbed 13.5%, and Alibaba popped 9.5%.

Better late than never! FDA has granted full approval to Pfizer-BioNTech’s Covid shot, paving way for more vaccine mandates. The BioNTech stock soared by 9.5%, Pfizer more than 2%, and Moderna 7.5%. Travel industry stocks gain as well.

Ever wished you could fly to work and back? Well, air taxi startups are mushrooming and investors are showing keen interest. This year investors have poured in a record $4.3bn into these startups. The money flowing into the air mobility sector, including drones, has increased 83% over the last 5 years to over $10.4bn.

Boeing to go in Orbit! Boeing has committed to invest in Richard Branson’s Virgin Orbit as part of the satellite-launching startup’s planned$3.2bnSPAC listing, later this year.

Business crimped in August! The IHS Markit manufacturing PMI for August fell to 61.2, from July’s 63.4 and against the estimated 62.4. The service sector PMI has also dropped from July’s 59.9 to 55.2 and against the expected 59.1. Delta variant worries blamed.

US Markets:

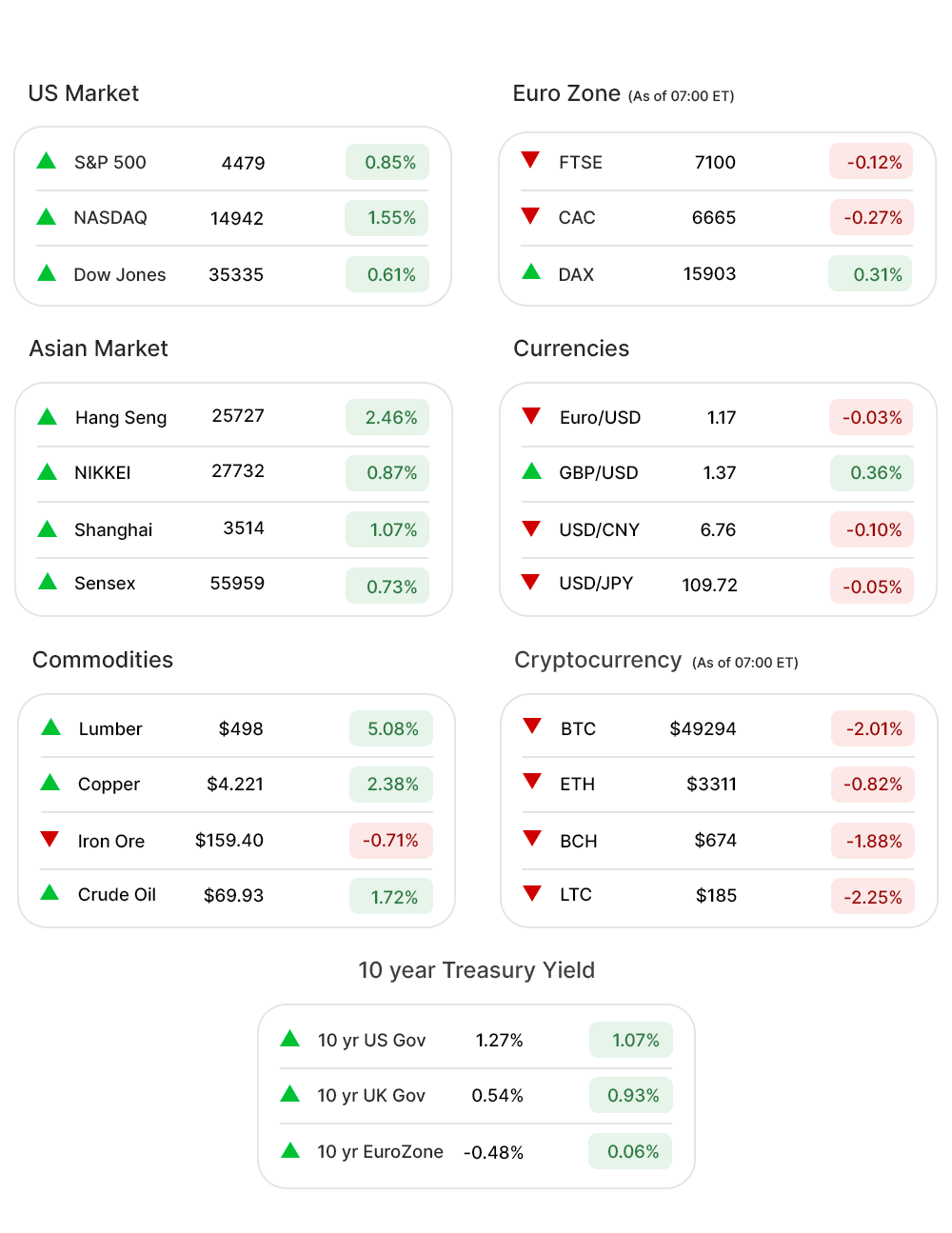

Following a volatile last week, stocks did well Monday infused with positivity at FDA’s vaccine approval. Nasdaq (1.5%▲) closed at a record high of 14942.65, even as S&P 500 (0.8%▲) reached 4479.53, a little shy of a fresh record close.

Dow Jones (0.6%▲) gained over 215 points, while Russel 2000 (1.88%▲) climbed more than 40 points.

Nasdaq (1.06%▲) was fuelled by a rally in tech giants, including Apple (AAPL, 1.03%▲), Facebook (FB, 1.11%▲), Amazon (AMZN, 2.06%▲), Alphabet (GOOGL, 1.90%▲), Microsoft (MSFT, 0.095%▲).

Sectors at the S&P 500 were, however, mixed with four of them falling short of the zero mark and the rest seven climbing up.

Energy (3.76%▲) climbed back to the top among these sectors, followed by decent gains in Consumer Discretionary (1.35%▲), Technology (1.27%▲), Communication Services (1.27%▲), Financials (0.78%▲), Industrials (0.81%▲), and Materials (0.84%▲).

Healthcare (-0.02%▼), Consumer Staples (-0.35%▼), Real Estate (-0.41%▼), and Utilities (-1.32%▼) were the losing sectors.

Futures!

The Futures gave an impression that Monday’s green run might be replicated by the stocks today.

As of 06:30 ET, Futures were green without an exception: Russell 2000 Futures (0.34%▲), Nasdaq Futures (0.31%▲), S&P 500 Futures (0.17%▲), and Dow Futures (0.14%▲).

Key Movers in Small Cap:

Trillium Therapeutics (TRIL, 188.83%▲), a clinical-stage immuno-oncology company, will be acquired by Pfizer in an all-stock cash transaction of $2.26bn or $18.50 per share. The relative volume of the stock was 74.1.

City Office REIT Inc (CIO, 24.81%▲) has announced that it will sell all of its assets in the Sorrento Mesa submarket of San Diego that will fetch it $576m, worth 80% of its current market cap. The relative volume of the stock was 23.1.

ALX Oncology Holdings (ALXO, 16.08%▲), also a clinical-stage immuno-oncology company, rallied potentially in sympathy with Trillium. The relative volume of the stock was 7.8.

Investors thought that the EV maker Canoo Inc (GOEV, 31.81%▲) was too heavily shorted with a short interest level of around 33%. The relative volume of the stock was 6.3.

The other movers in the small-cap segment included:

Esports Technologies Inc. (EBET, 6.85%▲): Relative Volume 5.0.

Nuvation Bio Inc. (NUVB, 15.92%▲): Relative Volume 4.7.

John B.Sanfilippo & Son Inc. (JBSS, 1.42%▲): Relative Volume 4.7.

Bristow Group Inc. (VTOL, 15.29%▲): Relative Volume 4.1.

Byrna Technologies Inc (BYRN, 9.39%▲): Relative Volume 3.6.

Key Movers in Large Cap:

Maxim Integrated Products (MXIM, 4.90%▲)has announced that China’s state administration for market regulation has given antitrust clearance to Analog Devices’ previously announced acquisition of Maxim. The relative volume of the stock was 4.5.

Analog Devices Inc (ADI, 1.79%▲) was also buoyed by the news of the antitrust clearance. The relative volume of the stock was 3.8.

Kirby Corporation(KEX, 1.84%▲) is expected to report earnings of at least $600.50m for the current fiscal quarter. The relative volume of the stock was 4.5.

The other movers in the large-cap segment included:

Mercury Systems Inc(MRCY, 1.11%▲): Relative Volume 3.9.

nCino Inc. (NCNO, 1.35%▲): Relative Volume 3.3.

Coherent Inc. (COHR, 0.21%▲): Relative Volume 2.7.

Ciena Corporation. (CIEN, 1.58%▲): Relative Volume 2.3.

Report Card:

Palo Alto Networks Inc. (PANW, 1.39%▲) reported an EPS of $1.60 on revenue of $1.2bn, against the estimated EPS of $1.43 on revenue of $1.17bn. The net operating income came out at $161.9m. The stock soared more than 10%, after hours.

The Chinese Smart Share Global Ltd.(EM, 1.76%▲) reported revenue growth of 52.9% y-o-y to $150.6m, beating estimates of $149.84m. The EPS for the quarter was $0.01. The stock was flat after hours.

FinVolution Group (FINV, 5.02%▲) came out with adjusted earnings of 34 cents per share, on revenue of $369.3m. The stock added another half a percent after hours.

On the Lookout:

New Home Sales data is due today and the print is expected to increase from the previous 676,000 to 700,000.

Auctions will be held today for $40bn of 67-day bills $60bn of 2-year notes.

Unusually high shorter-term CALL options activity seen on Advanced Micro Device (AMD, 3.94%▲), Twitter Inc (TWTR, 2.58%▲), Editas Medicine Inc. (EDIT, 8.25%▲), ConocoPhillips (COP, 3.85%▲), and Tilray Inc (TLRY, 4.21%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on KE Holdings Inc(BEKE, 2.98%▲), Constellium SE (CSTM, 2.16%▲), Workhorse Group Inc (WKHS, 2.70%▲), AMC Entertainment Holdings (AMC, 6.89%▲), and Alibaba Group Holdings (BABA, 9.47%▲) among others.

Other Asset Classes:

Crude Oil Prices - remained steady Tuesday morning after bouncing back Monday from the longest losing streak since 2018, last week. Brent traded at $69.25 per barrel, while the WTI was up by 0.62% early Tuesday morning.

The US Dollar (92.98, 0.03%▲) slid below the 93-mark on Monday as stocks soared and the focus went from Fed’s taper talks to FDA approving a Covid vaccine. Tuesday morning the greenback was trading in the green zone, again.

The US Treasury Yields rose, slightly Tuesday morning, a day after approval to Pfizer-BioNTech Covid vaccine. The 10 Year US Treasury Yield was trading at the 1.268% mark, early Tuesday morning.

Global Markets:

Asian markets had a fruitful Tuesday as the positivity witnessed in the US stocks on Monday, trickled down to the Asia Pacific. Shanghai climbed 1.07% while Hang Seng advanced by a little more than 600 points or 2.46%. Nikkei rose as well, by a decent 0.87%.

European markets opened with enthusiasm as well, buoyed by the approval of the Pfizer vaccine and the subsequent positivity in the US markets. Stoxx-600, FTSE, and CAC were all green, early Tuesday morning.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Kroger Co. (KR), Descartes Systems Group Inc (DSGX), Zentalis Pharmaceuticals Inc. (ZNTL), and Elastic NV (ESTC). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.