Tech Giants Fight it Out for their Chunk of Star Wars!

Good morning,

Only a day after Andy Jassy took over as Amazon CEO, Pentagon cancelled a $10 Billion cloud computing JEDI deal with Microsoft, after Amazon legally challenged the award of the contract. Parts of the deal are likely to be awarded to both companies now. Amazon stock soared following the major development making Jeff Bezos the richest man. Jeff dethroned Elon Musk!

Musk’s Tesla is up against a “killer” as well! Lucid Motors, coined as the “Tesla Killer” is expected to take the luxury EV market by storm and is set to be listed on Nasdaq.

Speaking of the giants, China’s ride-hailing company, Didi Global, went spiraling down after a CyberSecurity crackdown back home meant it could not add any new users. The stock tanked almost 20% on Tuesday.

US Markets:

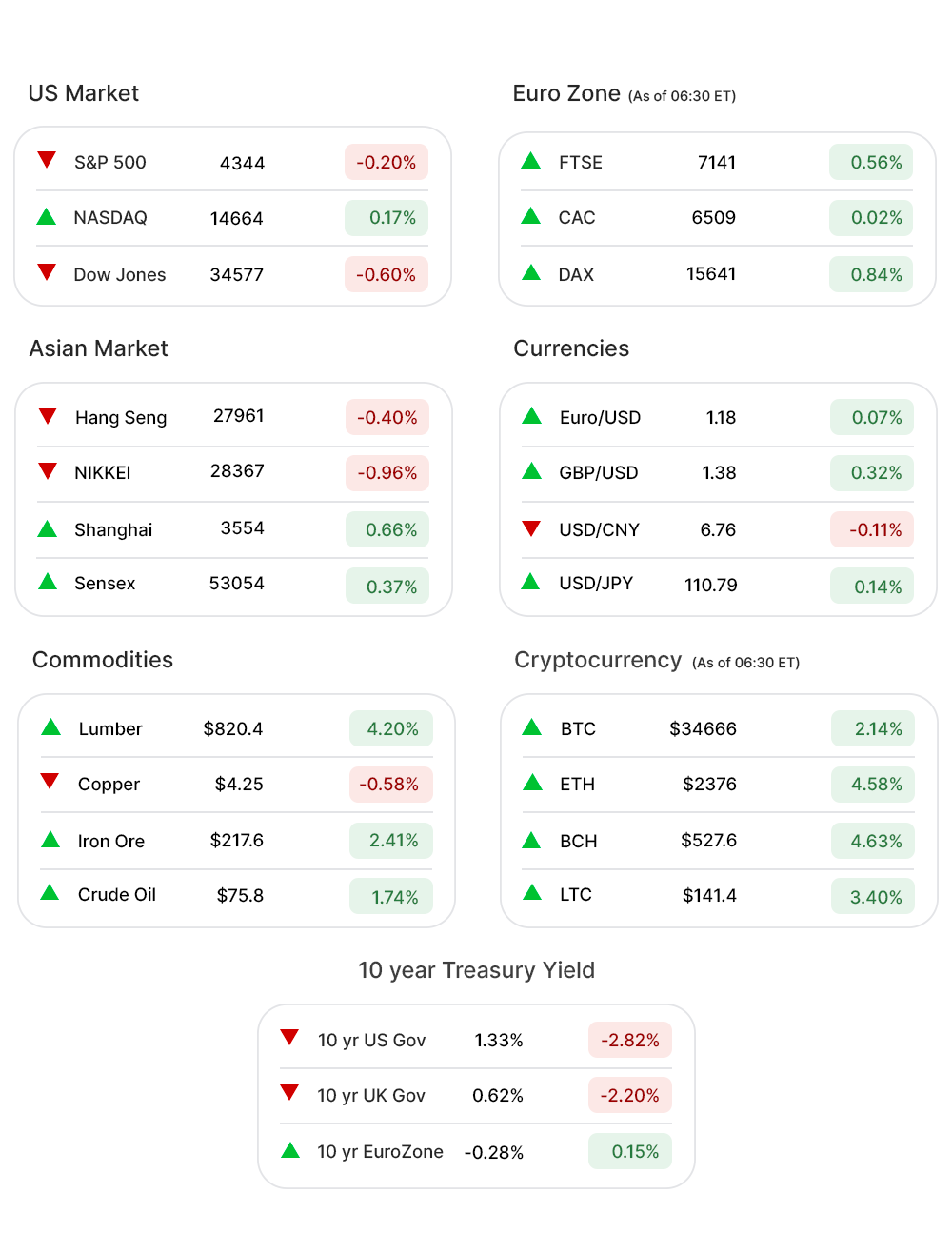

And, here comes the pause! After seven straight record high closes, the S&P 500 (-0.20%▼) slid 8.80 points Tuesday amid growth concerns. Dow (-0.60%▼) tumbled as well even as Tech-heavy Nasdaq (0.17%▲) breached another high.

Energy (-3.20%▼), the best performing sector this year, led the slide at S&P 500 followed by Financials (-1.55%▼), Materials (-1.44%▼), and Communication Services (-0.09%▼).

The other seven sectors at the broadest index were into the green zone. Consumer Discretionary (1.08%▲) was the front runner while Healthcare (0.93%▲), Industrials (0 .80%▲), and Real Estate (0 .52%▲) also did well.

Technology (0.37%▲) gained slightly in continuation with last week’s green run.

Among Tech giants, fuelling the sector, were Apple Inc. (AAPL, 1.47%▲), Microsoft Corporation (MSFT, 0.003%▲), Amazon Inc. (AMZN, 4.69%▲), Nvidia Corporation (NVDA, 1.03%▲) and Alphabet Inc. (GOOGL, 0.74%▲).

Futures!

As of 07:30 ET, the US Index futures, barring Russell 2000 Futures (-0.02%▼), were all green. S&P Futures (0.19%▲), Nasdaq Futures (0.58%▲), and Dow Futures (0.06%▲)

Let’s see how markets behave after a little slide on Tuesday!

Key Movers in Small Cap:

Cytosorbents Corp. (CTSO, 17.41%▲), sellers of a Cytokine Adsorbing Column, have received the FDA approval to conduct its STAR-T (Safe and Timely Antithrombotic Removal-Ticagrelor). The relative volume of the stock was 8.8.

Polymer maker, Kraton Corp. (KRA, 14.91%▲), popped Tuesday after a Reuters report suggested that the company might be up for sale. Relative Volume of the stock was 10.7.

Following a negative complete response letter by FDA, for a Biologics License Application, the Provention Bio Inc. (PRVB, -26.39%▼) stock crashed more than 30% before regaining some composure. The relative volume of the stock was 3.9.

Iveric Bio Inc. (ISEE, 8.19%▲) announced that they have received a written approval from FDA for the pivotal trial of Zimura, in development for treatment of Geographic Atrophy. The stock has gone up by 30% since June 30. The relative volume of the stock was 9.7.

Another Biosciences company ALX Oncology Holdings Inc. (ALXO, 9.70%▲) was among the movers after the company shared positive results from its ongoing ASPEN-01 phase 1b evaluating ALX148. The relative volume of the stock was 5.7.

Key Movers in Large Cap:

The CyberSecurity company Palo Alto Networks Inc. (PANW, 5.12%▲) made substantial gains after the Kaseya Ransomware attack. Relative Volume of the stock was 2.0.

The Phoenix based Knight Swift Transportation Inc. (KNX, 3.91%▲) announced acquisition of an Alabama trucking outfit for $1.35 Billion. Relative volume of the stock was 1.9.

Amazon Inc. (AMZN, 4.69%▲), with a relative volume of 1.9, and DT Midstream Inc. (DTM, -1.67%▼), with a relative volume of 2.0, were the other movers in the Large Cap segment.

Earnings:

Smart Global Holdings Inc. (SGH, -1.14%▼) reported $437.7 million in GAAP net sales, a 56% y-o-y increase. The net income of $7.2 million or $0.30 per diluted share is way above last year's $0.8 million or $0.03 per diluted share. The non-GAAP net income of $35.5 million or $1.39 per diluted share is up 107.6% and 98.6%, respectively, compared to the same period last year. The stock went up by 4.73% after hours.

On the Lookout:

The ISM Purchasing Managers Index fell from the May record of 64.0 to 60.1 as challenges with material shortages, inflation, logistics, and employment resources continue to be an impediment in business conditions.

Minutes of the Fed’s June FOMC meet will be made public today. Investors have been anxiously awaiting the minutes to gauge Fed’s tilt on stimulus tapering. Optimism is the key!

The Job Openings (JOLTS) report is on its way as well!

Bank of America is optimistic for sure about the rebound of corporate and international travel in 2022 as the number of respondents thinking to take a business trip has grown to 46%, compared to 40% in an earlier survey.

BoA reminds, the bank stocks have taken a hammering lately while Q2 earnings from this space are on the way. Is it a time to exploit the weakness in these stocks? The stocks have a forward price to earnings of 12.5x.and trading at a greater relative discount than S&P 500 historically.

The Ransomware attack on Kaseya has brought CyberSecurity stocks into the limelight. The Israeli CyberSecurity company SentinelOne (S, 11.01%▲), rode the wave and witnessed a new post-IPO high Tuesday.

We are in a shortened week and only two upcoming IPOs. Chinese Healthcare data company, LinkDoc Technology, is planning to raise $200 million at a $1.5 billion market cap while OTC listed Minim Inc. a networking products company will start trading at Nasdaq today.

Unusually high shorter-term CALL options activity seen on GasLog Partners (GLOP, 23.28%▲), DPerformance Food Group (PFGC, -2.35%▼), Newegg Commerce Inc. (NEGG, 41.67%▲), and Levi’s Strauss & Co. (LEVI,0.039%▲), BSQUARE Corporation (BSQR, 77.14%▲) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Constellium SE (CSTM, -3.50%▼), Colgate Palmolive Company (CL, 0.36%▲), Freeport-McMoRan (FCX, -3.07%▼), and KE Holdings Inc. (BEKE, -10.21%▼), among others.

Other Asset Classes:

The benchmark 10 Year US Treasury Yield fell as much as 8 bps on Tuesday to print under 1.35%, on slower-than-expected service-sector growth, with short covering intensifying the move.

The yield touched the lowest level since Feb.24, and is down about 42 bps from a 14-month peak of 1.77% seen on March 30. The decline in Treasury yields also reflects the view that the upside currently underway in the U.S. economy is only temporary

Could Tether trigger a ‘Black Swan’ event in the Crypto market? As we see Economists increasingly losing confidence calling the cryptocurrency a potential financial stability risk as they fear that the stablecoin issuer doesn’t have enough dollar reserves to justify its dollar peg. Tether has more deposits than many US banks.

The US Dollar rallied against a basket of currencies to 92.543 up from a low of 92.003 on Tuesday on expectations of a hawkish tone from FED in the minutes to be released on Wednesday.

Global Markets:

Asian Markets follow Wallstreet at opening hours and swing between gains and losses. China said it would impose stricter data security and other standards on Chinese companies that want to join foreign stock exchanges following the mishap by DIDI global, this announcement is a potential hurdle for Chinese entrepreneurs who have raised billions of dollars abroad.

Markets in Korea and Japan stumbled as investors fretted over the increasing COVID-19 caseload. Japan’s NIKKEI 225 fell 1% as reports emerged the nation is set to extend its coronavirus-related restrictions in Tokyo.

European stocks gained on Wednesday as economically sensitive sectors such as miners and automakers recovered from sharp falls in the previous session, triggered by falling bond yields.

Meanwhile on Researchfin.ai

There are 32 new trade setups identified by the AI today. Please sign-up for our app, if you already haven’t, to learn about these setups.

That’s all we had for today! Make profits!

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.