The Afghan ‘spillover’!

Quite a weekend that was,

Been binge-watching the news from Afghanistan? The turmoil at the crossroads of Central and South Asia has already impacted other global markets Monday. Will it have a bearing on the US stock markets?

China Retail Sales for July have fallen short of the estimates to 8.5%, from a year ago. Online sales, of consumer goods, have risen by a paltry 4.4%, compared to an average of 21% growth for the last five years. Asian markets slide.

The crackdown and the new opportunities! China’s crackdown on some major tech firms has led to a 446% surge in semiconductor investments, in Q2 compared to Q1, swelling to $8.9bn as Beijing hopes to manufacture 70% of its semiconductors domestically by 2025.

The underwater link to Asia! Alphabet and Facebook have announced their participation in a subsea cable network, Apricot, aimed at improving internet connectivity across the Asia-Pacific.

UMich Consumer Sentiment Index fell to 70.2 for August, against expected and prior print of 81.2. This is the lowest it has fallen to since 2011. The Import Price Index for July came out to be 0.3%, way lower than the expected 0.6%.

US Markets:

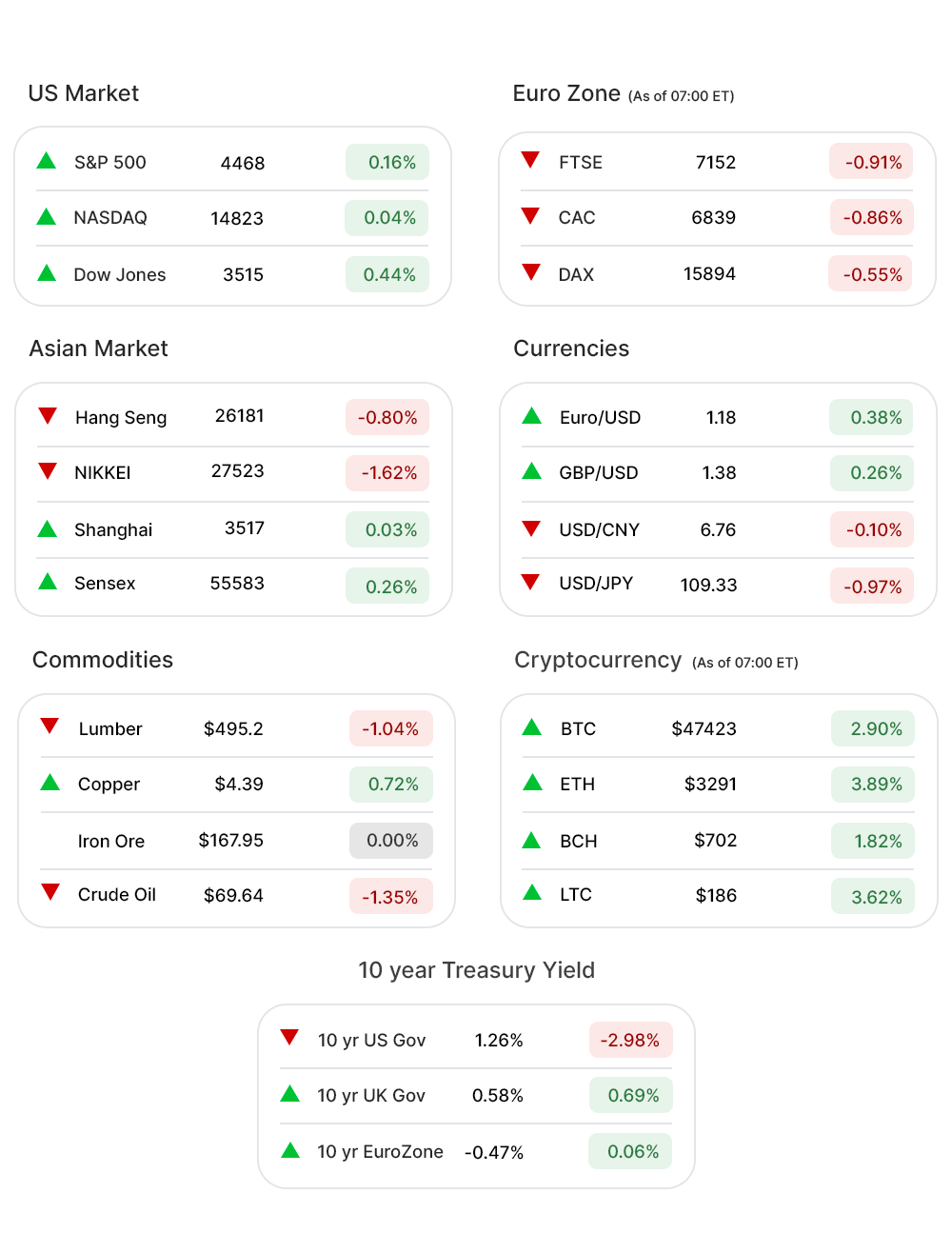

The US stock markets ended last week on a positive note, with S&P 500 (0.16%▲) and Dow Jones (0.04%▲) clinching their fourth consecutive record highs, for the first time since October 2017.

The stocks were fuelled, through the week, by some reassuring economic data and a bunch of better than expected earnings. Nasdaq (0.04%▲) closed in the green zone on Friday as well.

S&P 500 sectors were a mixed lot, with four falling below the zero-mark and the rest making gains. Energy (-1.28%▼) was the only sector moving more than 1% Friday.

Industrials (-0.31%▼), Consumer Discretionary (-0.29%▼), and Financials (-0.73%▼) were the other sectors that followed Energy into the red zone.

Healthcare (0.60%▲), Technology (0.54%▲), Real Estate (0.69%▲), Communication Services (0.25%▲), Materials (0.08%▲), and Consumer Staples (0.81%▲) were among the gainers.

Futures!

The Futures slid lower, ahead reflecting the overall mood in the Global Markets.

As of 06:00 ET, Futures were red without an exception: Russell 2000 Futures (-0.49%▼), Nasdaq Futures (-0.15%▼), S&P 500 Futures (-0.21%▼), and Dow Futures (-0.22%▼).

Key Movers in Small Cap:

Perpetua Resources Corp (PPTA, -7.36%▼) Friday announced the pricing of its underwritten marketed public offering in the US and Canada, of 9.5m ordinary shares at $5.25 per share. The relative volume of the stock was 22.4.

Global Water Resources Inc(GWRS, 12.25%▲) was among the stocks that hit their 52- week high on Friday. The relative volume of the stock was 15.3.

The Tattooed Chef Inc(TTCF, -16.25%▼) reported a 46% increase y-o-y in revenue, for Q2, to $50.7m. The company however lowered guidance for full-year gross margin from 20% - 25% to 16% - 22%. The relative volume of the stock was 11.0.

The hearing aid manufacturer, Eargo Inc(EAR, -24.46%▼) reported a 43.7% increase y-o-y in revenue to $22.9m, surpassing the estimates of $21.97m with operating expenses of $35.5m or 155.1% of net revenues. The relative volume of the stock was 6.1.

The other movers in the small-cap segment included:

Trean Insurance Group (TIG, -3.73%▼): Relative Volume 17.5.

The Honest Company Inc. (HNST, -28.33%▼): Relative Volume 11.8.

Neuropace Inc (NPCE, -5.12%▼): Relative Volume 7.8.

Marine Products Corp. (MPX, -6.61%▼): Relative Volume 6.6.

GrowGenerationl Corp. (GRWG, -11.84%▼): Relative Volume 4.4.

Key Movers in Large Cap:

Poultry processors, Pilgrim’s Pride Corp (PPC, 20.55%▲), has got a proposal for full acquisition by the meat packaging company JBS. The relative volume of the stock was 11.8.

GoHealth Inc (GOCO, -13.22%▼), continued to tumble following a Q2 loss of 12 cents per share, falling below the estimated 4 cents per share. The relative volume of the stock was 4.5.

Walt Disney Co (DIS, 1.00%▲) was buoyed following better than expected Q3 results. The relative volume of the stock was 4.4.

Provider of real estate services, Rocket Companies Inc (RKT, 10.25%▲) announced a 47% fall y-o-y in revenue to $2.8bn, leading to a net income decline of 68% y-o-y to $920m. The relative volume of the stock was 4.0.

DoorDash Inc (DASH, 3.50%▲) bounced back Friday, after Thursday’s losses in wake of a Q2 loss. The relative volume of the stock was 3.1.

The other movers in the large-cap segment included:

UWM Holdings Corp. (UWMC, 5.50%▲): Relative Volume 2.8.

Hawaiian Electric Industries. (HE, 0.49%▲): Relative Volume 2.7.

Flower Foods Inc (FLO, 6.43%▲): Relative Volume 2.2.

Upstart Holdings (UPST, 14.13%▲): Relative Volume 2.2.

Report Card:

Recursion Pharmaceuticals Inc (RXRX, -2.26%▼) reported a Q2 loss of $43.4m or 31 cents per share and revenue of $2.5m, short of the estimated $2.7m. The stock remained flat after hours.

Marathon Digital Holdings Inc (MARA, -2.84%▼) reported a 10,147% increase, y-o-y, in revenue to $29.3m, a 220% increase sequentially. The non-GAAP income from operations was $20.1m or $0.21 per diluted share. The stock soared by more than 3% after hours.

The manufacturers of power transmission equipment, Twin Disc Inc (TWIN, -4.23%▼) reported an 11.5% y-o-y increase in sales to $66.2m, beating the estimates of $60.65m, while the net loss per share widened to $0.96 from $0.13 in the same quarter previous year. The stock was flat after hours.

The Honest Company Inc. (HNST, -28.33%▼), the consumer goods company, reported a loss of $0.17 per share on sales of $74.6m, much worse than the estimated loss of $0.14 per share on sales of $79.5m. The stock climbed more than 1% after hours.

On the Lookout:

A busy week ahead with the Commerce department’s monthly Retail Sales report, due Tuesday, and earnings reports by the country’s two of the largest retailers - Walmart and Target.

The week will start with Empire State Manufacturing Index getting updated from the previous month’s print of 43.0.

Also, the company developing targeted chemotherapy for pancreatic cancer patients, RenovoRx, is planning to raise $27.6m by offering 1.8m shares of its common stock, priced between $11 and $13 per share.

Unusually high shorter-term CALL options activity seen on Context Logic Inc (WISH, -19.77%▼), Pinterest Inc (PINS, -1.27%▼), Coty Inc. (COTY, -1.20%▼), International Game Technology (IGT, -1.69%▼), and Elanco Animal Health Inc (ELAN, 2.79%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on AMC Entertainment. (AMC, 1.21%▲), American Electric Power Company (AEP, 0.83%▲), Penn National Gaming Inc (PENN,-3.24%▼), Match Group Inc. (MTCH, -2.05%▼), and Cisco Systems Inc (CSCO,0.14%▲) among others.

Other Asset Classes:

Crude Oil prices tumbled again, Monday morning, and are around 7% lower for August after four consecutive months of gains following concerns over slowing economic growth in China, indicated by a drop in retail sales for the month of July. Brent was down to the $69.45 per barrel mark with a loss of 1.62% while the WTI Crude traded down 1.83% at 67.19 per barrel mark.

The US Dollar (92.60, 0.09%▲) gained against its peers as disappointing monthly data from China helped it claw back, following losses last week. Eyes are on Fed minutes now as the greenback looks set to advance further.

US Treasury Yields continued Friday’s downward trend, propelled by a decade low consumer sentiment index. Monday morning the yields slid with focus on Fed’s minutes, to be released Wednesday. The 10 Year US Treasury Yield was trading in the red zone at 1.265%, early Monday morning.

Bitcoin breached $48000, the highest level since mid-May, before trimming some of the gains, early Monday morning. In the process, the entire Crypto market value climbed over the $2trmark - for the first time in three months.

Global Markets

Surprisingly, Shanghai (0.03%▲ ) clung into the green zone on Monday as most of the Asian Markets slid following the fall of Kabul and weak monthly economic data coming out of the mainland. Hang Seng lost more than 220 points while Nikkei slid by well over 450 points, down 1.62%.

European markets slumped, Monday morning, amid geopolitical turmoil in the Asia pacific and concerns about a Covid induced drag in the Chinese economy. Pan EU index Stoxx-600 was down 0.41%, while other major indices - including FTSE, CAC, and DAX-were trading in the red zone, as well.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Adobe Inc. (ADBE), Retail Value Inc (RVI), Chewy Inc. (CHWY), Dillard’s Inc (DDS), Meredith Corporation (MDP), AON Plc (AON), Darling Ingredients Inc (DAR), and Globant SA (GLOB). Signup, we have a 30-day free trial.

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.