The ‘August’ Beginning!

Good Morning,

Buy now, pay later! The market for this installment-based purchasing, targeting millennials, is getting bigger as Twitter CEO Jack Dorsey’s other venture, Square Inc, is all set to acquire Australian fintech company Afterpay in a $29bn all-stock deal, a 30% premium to Afterpay’s last closing price.

Outdoing Pandemic! Europe’s largest bank HSBC has reported its pre-tax profit at $10.84bn more than double, in the January to June period, than the previous year. EU markets soar at the news.

An unemployment crisis, staring the US in the face! More than 7.5m people will be affected as the jobless benefits, paid by federal governments since March 2020, will come to an end September 6th and the extension of such benefits is most unlikely.

At a time China is cracking down on for-profit education companies, the 177-year-old US education company Pearson is hoping to woo 10m college students to its digital library of more than 1500 e-books, for $14.99 a month. Will this be the beginning of the demise of the physical textbooks?

Also, China’s factory activity growth has slumped to a 15 month low for July. The Asian markets rose, nevertheless.

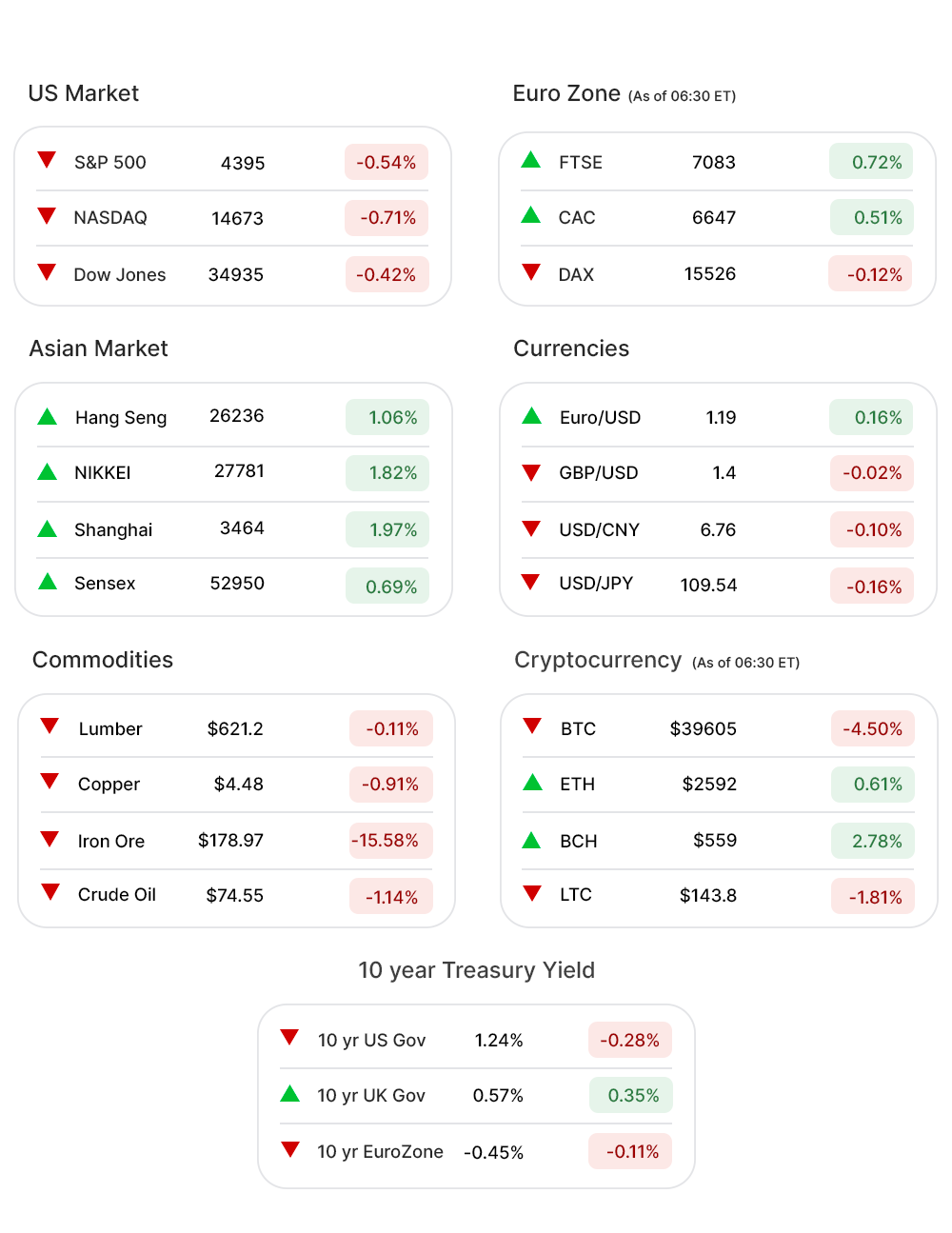

US Markets:

The losses on Friday did nothing to prevent the S&P 500 (-0.54%▼) from registering its sixth straight month of gains as investors have been looking beyond all negativity, including dismal GDP growth and more than expected jobless claims, galloping 17% so far this year. The broader index has risen 2.3% for July.

Tech Heavy Nasdaq (-0.71%▼) and Dow Jones (-0.42%▼) ended the month 1.2% and 1.3% up, respectively.

Sectors at the S&P 500 remained mixed Friday, with Energy (-1.76%▼), Consumer Discretionary (-1.95%▼), and Financials (-0.73%▼) dragging down the index.

Technology (-0.08%▼) was more or less flat, even as some tech giants, including Amazon (AMZN,-7.56%▼), fell considerably lower.

Healthcare (0.07%▲), Materials (0.40%▲), Real Estate (0.32%▲), and Consumer Staples (0.12%▲) showed some promise but not enough to lift the index.

Futures!

The Futures seem to have taken a cue from the global markets, early Monday morning.

As of 06:00 ET: Nasdaq Futures (0.58%▲) had gained 87 points, S&P 500 Futures (0.62%▲) more than 27 points, Russell 2000 Futures (1.09%▲) 24 plus points, and Dow Futures (0.54%▲) 180 points.

Key Movers in Small Cap:

Misonix Inc (MSON, 11.33%▲) will be acquired by, recently listed Bioventus Inc for $518m in a cash-and-stock transaction. The relative volume of the stock was 15.4.

This deal, where shareholders will elect to receive either 1.6839 Bioventus Inc (BVS, -9.26%▼) shares or $28 in cash, made the BVS stock tumble. The relative volume of the stock was 14.8.

The hazardous waste treatment and disposal company, US Ecology Inc (ECOL, -8.33%▼) missed the estimates on its Q2 earnings. The company reported an EPS of $0.10, falling short of the estimated $0.16. The relative volume of the stock was 7.3.

The investment advice company, AssetMark Financial Holding (AMK, 2.15%▲) reported a 33.8% y-o-y increase in assets to $84.6bn, 7.2% more than the previous quarter. The relative volume of the stock was 6.7.

The other movers in the small-cap segment included:

CEVA Inc. (CEVA, 9.41%▲): Relative Volume 6.9.

IGM Biosciences Inc (IGMS, -13.65%▼): Relative Volume 6.6.

Gritstone Bio Inc (GRTS, -6.18%▼): Relative Volume 5.8.

Vanda Pharmaceuticals (VNDA, -8.73%▼): Relative Volume 5.6.

Key Movers in Large Cap:

The social networking service Pinterest Inc (PINS, -18.00%▼) reported a drop in its monthly active users in the US by 7% y-o-y. The stock plunged despite reporting better than expected revenue as well as the EPS. The relative volume of the stock was 7.2.

The Australia-based collaboration software maker, Atlassian Corporation (TEAM, 21.86%▲) reported a 30% increase in sales y-o-y to $560m. The diluted EPS of $0.24 also beat the estimated $0.18. The relative volume of the stock was 7.1.

The customer service software company, Zendesk Inc (ZEN, -13.34%▼) reported slightly lower than expected Q2 earnings of $0.13 per share and revenue of $318.2m, also missing the estimates. The relative volume of the stock was 5.9.

The other movers in the large-cap segment included:

Skyworks Solutions Inc . (SWKS, -6.18%▼): Relative Volume 4.7.

Kemper Corporation. (KMPR, -3.61%▼): Relative Volume 4.4.

Royalty Pharms Plc (RPRX, -0.13%▼): Relative Volume 4.0.

OneMain Holdings Inc. (OMF, -0.70%▼): Relative Volume 4.0.

Report Card:

The consumer goods corporation Procter & Gamble (PG, 1.97%▲) reported an EPS of $1.13 beating the estimated $1.08 quite comfortably. The revenue of $18.95bn was ahead of the estimates by 3.31%. The stock slid a wee bit after hours.

The oil and gas entity, Exxon Mobil Corporation (XOM,-2.31%▼) reported an EPS of $1.1 on revenue of $67.74bn, beating the estimates of $1 on revenue of $63.25bn. The stock continued to slide after hours.

AbbVie Inc (ABBV,-2.16%▼) reported adjusted earnings of $3.11 per share $13.96bn of sales in Q2 of 2021, beating the estimates of $3.08 a share on sales of $13.63bn. The stock was flat after hours.

The multinational energy company, Chevron Corporation (CVX,-0.74%▼) reported a 178.6% increase in revenue y-o-y to $37.6bn, way higher than the estimated $35.6bn. The adjusted EPS of $1.71 was also ahead of the estimated $1.56. The stock continued to slide after hours.

On the Lookout:

The Markit Manufacturing PMI (final) data is set to be released today and is expected to remain unchanged at 63.1 for the month of July.

The ISM Manufacturing Index is expected to rise two basis points, from 60.6% to 60.8%. Also, data on Construction Spending is due today and expected to rise from -0.3% to 0.5%.

Some IPOs to keep track of:

The investment firm, Healthcare Royalty Inc, is set to offer 46.9m shares of its common stock, priced between $15 and $17 per share.

A wellness enterprise that develops and sells vitamins and supplements, Better Being Co, is offering 12.5m shares of its common stock, priced between $15 and $17 per share.

A provider of ethical review services and other clinical trial solutions to biopharma companies, WCG Clinical, is offering 45m shares of its common stock priced between $15 and $17 per share. The company plans to raise $720m.

The manufacturer of grills, Weber Inc, plans to raise $750m by offering 46.8m shares of its common stock priced between $15 and $17 per share.

Unusually high shorter-term CALL options activity seen on Ceasers Entertainment (CZR, -2.78%▼), Snap Inc (SNAP, -0.63%▼), Jumia Technologies Inc. (JMIA, -1.15%▼), HP Inc. (HP, 0.31%▲), and Advanced Micro Devices (AMD, 3.15%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on MGM Resorts International. (MGM, -1.70%▼), Masco Corp. (MAS,1.77%▲), Cleveland Cliffs Inc. (CLF, 0.56%▲), Pinterest Inc. (PINS, -18.00%▼), and Molson Coors Beverage (TAP, -1.05%▼).

Other Asset Classes:

Crude Oil prices took a step back Monday morning as a survey showed growth in factory activity of China, the second-largest consumer of oil, slipped sharply. The concerns were compounded with an increase in oil output by OPEC counties. Brent Crude slipped by 1.5%Monday morning.

US Treasury Yields inched a little higher Monday morning ahead of the slated PMI data. The 10 Year US Treasury Yield rose less than a basis point to 1.242% while the 30 Year Treasury Yield added two basis points advancing to 1.916%.

The US Dollar (92.00,-0.19%▼) had a difficult past week, falling against almost all major currencies of the world. The greenback recorded new lows for the month against Euro, Swiss Franc, and Sterling among the major currencies.

Bitcoin traded over $41k Saturday, the highest since May, after a 10-day winning streak, its longest streak in 8 years. The prices have fallen back since but are still above the $40k mark.

Global Markets:

Asian Markets, rallied to start the week and the month on a positive note despite a slump in China’s factory activity in July. The Caixin/Markit PMI of the country was reported to be 50.3 in July from 51.3 in June, the lowest in 15 months. Nikkei advanced a little shy of 500 points and Hang Seng by half of that. Shanghai closed 1.97% higher.

European Markets attained fresh peaks Monday morning, buoyed by a bounceback in Asian markets and strong results from Europe’s biggest bank HSBC. The pan EU Stoxx-600 was up 0.76% to 465.27. DAX gained more than 150 points, soon after the opening Monday morning. FTSE was up 1% while CAC climbed more than 60 points.

Meanwhile on Researchfin.ai

There are 30+ new trade setups identified by the AI last Friday. Please download our app Researchfin.ai for iOS and Android.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Will see you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.