The Carrot After the Stick!

Good Morning,

Our AI is on a roll! Several trade set-ups identified by the scanner are meeting their targets everyday. Rapid7 Inc (RPD), Avalara Inc. (AVLR), Illumina Inc (ILMN) have successfully met their profit target of 20% yesterday, among a few others! Hope you are making the most of it.

Just a little callous! The investigation in ‘Archegos Saga’ has revealed that Credit Sussie had failed to “effectively manage risk” in dealing with the US hedge fund Archegos Capital. The callousness has caused an 80% fall in Q2 profits of the Swiss bank.

Chinese regulators stepped up for damage control and addressed the big banks, bringing some semblance of normalcy to the country’s markets, following a three day rout. Too little too late? Nine out of ten biggest losers in shareholder value this month are Chinese companies, including Alibaba Group and Meituan, the food delivery platform.

From a ‘darling’ to a ‘loser’ pretty quick! Chinese internet giant Tencent Holdings, plunged 23% in July, as of Wednesday, wiping out $170bn from its market value. This is the fastest evaporation of shareholders wealth, worldwide in this period.

The ‘hood’ set to become the ‘wolf’? Or a memestock, maybe! Robinhood is expected to start trading today in the public market, under the ticker HOOD, with an initial price of $38. The outsized retail allocation of 35% of the 55m shares for its own customers might make some money managers sit out the listing, however!

US Markets:

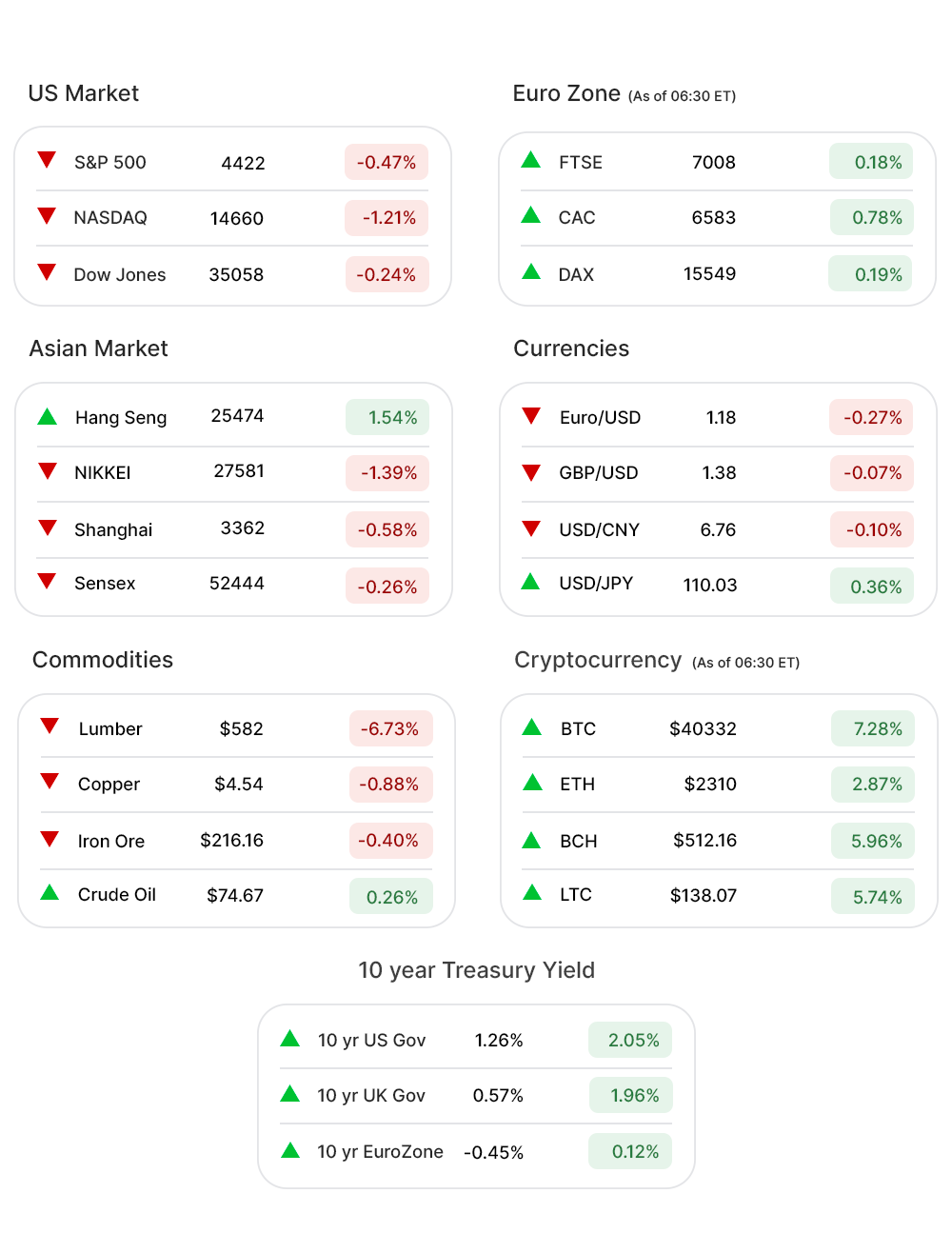

Only Nasdaq eked out some gains on Wednesday following the monthly FOMC meet where the central bank left interest rates and asset purchases unchanged. The Chair, Jay Powell, said there was no set timeline for tapering asset purchases, and plenty more improvement needed to happen first.

The S&P 500 (-0.02%▼) at 4401 is still hovering around the all-time highs. Tech-heavy Nasdaq (0.70%▲), propelled by a rally by some of the tech giants, gained more than 100 points while Dow (-0.36%▼) slid over 120 points to close below the 35000 mark.

Sectors at the S&P 500 were mixed.

Technology (-0.10%▼) underperformed the overall positivity in the tech stocks and a green Nasdaq. Energy (0.97%▲), continued being volatile, trimming some of the losses incurred Tuesday.

Healthcare (0.38%▲), Materials (0.26%▲), and Communication Services (0.76%▲) were the other sectors exhibiting some positivity even as Real Estate (-0.63%▼), Utilities (-0.69%▼), and Financials (-0.21%▼) fell below the zero mark.

Tech giants that propelled Nasdaq Wednesday included - Amazon (AMZN, 0.11%▲), Facebook (FB, 1.49%▲), Alphabet (GOOGL, 3.18%▲), and Nvidia Corporation (NVDA, 1.54%▲).

Apple Inc. (AAPL, -1.22%▼) and Microsoft (MSFT, -0.11%▼) could not cash in on the better than expected earnings.

Futures!

The Futures Thursday morning looked the exact opposite of Wednesday’s intraday picture, with Nasdaq in the red and others in green.

As of 06:30 ET: Nasdaq Futures (-0.08%▼), S&P 500 Futures (0.14%▲), Russell 2000 Futures (0.75%▲), and Dow Futures (0.34%▲).

Key Movers in Small Cap:

Lakeland Financial Corporation (LKFN, 10.49%▲) announced that the bank is all set to join the S&P SmallCap 600 index. The relative volume of the stock was 27.6.

The RMR Group Inc. (RMR, 0.75%▲), part of the Real Estate sector, is all set to release its Q2 earnings following the market close today. The relative volume of the stock was 10.3.

Strategic Education Inc (STRA, 7.97%▲) has reported a net income of $20m for Q2, falling below the expectations and last year’s net income of $34.2m. The relative volume of the stock was 9.5.

Investors Bancorp Inc (ISBC, 10.98%▲) has announced that it has entered a definitive merger agreement with Citizen's Financial, in a deal worth $3.5bn. The relative volume of the stock was 8.0.

The Independence Realty Trust (IRT, 2.52%▲) has announced the offering of 14m shares of its common stock, priced at $17.75 per share. The relative volume of the stock was 7.3.

The other movers in the small-cap segment included:

World Fuel Services (INT, 8.12%▲): Relative Volume 5.4.

Applied Molecular Transport (AMTI, -8.34%▼): Relative Volume 5.4.

Invacare Corporation (IVC, -2.04%▼): Relative Volume 5.3

The Cheese Cake Factory (CAKE, -13.20%▼): Relative Volume 5.3.

KKR Real Estate Finance (KREF, 2.13%▲): Relative Volume 5.3.

Key Movers in Large Cap:

The stock of medical equipment maker, Hill-Rom Holdings (HRC, 7.16%▲), was buoyed by the reports that the company has rejected a takeover bid from Baxter International, of $144 per share. The relative volume of the stock was 10.2.

The investors chose to focus on a technical glitch leading to a disappointing user sign-up for Spotify Technology (SPOT, -5.74%▼), for Q2 and ignored a 23% y-o-y increase in net sales for the company. The relative volume of the stock was 5.7.

The headline net loss for CoronaVirus stock, Teladoc Health (TDOC, 0.53%▲), has deepened to nearly $134m or $0.86 per share from a Q2 loss of $26m in 2020. The relative volume of the stock was 5.0.

Manufacturer of home-backup generators, Generac Holdings (GNRC, -1.80%▼) stock had already propelled 93% up y-o-y, before the company reported an adjusted EPS of $2.39, ahead of the estimated $2.35. The relative volume of the stock was 4.2.

Advanced Micro Devices (AMD, 7.58%▲), the semiconductor company, has reported an EPS of $0.63 on sales of $3.85bn against the estimated $0.54 on sales of $3.6bn. The relative volume of the stock was 3.9.

The other movers in the large-cap segment included:

CoStar Group Inc . (CSGP, -2.33%▼): Relative Volume 4.0.

Discovery Inc. (DISCK, -0.18%▼): Relative Volume 3.8.

Amdocs Limited (DOX, 0.34%▲): Relative Volume 3.4.

Humana Inc. (HUM, -5.71%▼): Relative Volume 3.4.

Report Card:

The social media giant Facebook (FB, 1.49%▲) has beaten the Wallstreet estimates and reported an EPS of $3.61 on revenue of $29.08bn, ahead of the expected $3.04 on revenue of $27.85bn. The company, however, said that it expects y-o-y total revenue growth rates, for Q3 and Q4 of 2021, to decelerate significantly on a sequential basis. The stock fell more than 3% after hours.

McDonald’s Corp (MCD, -1.86%▼) has reported an increase of 26% in same-store sales y-o-y, while beating the Wallstreet estimates. The adjusted EPS of $2.37 and revenue of $5.89bn have surpassed the expected $2.11 and $2.6bn. The company has said its collaboration with Korean pop group BTS was to be credited. The stock gained a little after hours.

Despite losing the production of about 700,000 vehicles, amid a global chip shortage, automaker Ford Motor Company (F, 0.51%▲) has reported a surprise profit for Q2. The adjusted EPS of 13 Cents is way above the expected loss of 3 cents a share even as the revenue of $24.13bn is a little short of the estimated $24.25bn. The stock rose by a little shy of 4% after hours.

Automatic Data Processising Inc (ADP, -0.49%▼) has reported an adjusted EPS of $1.20, for Q4, beating the estimates by 6.2% with an increase of 5.3% y-o-y. Total revenue of $3.74bn has topped the estimates by 2% with a y-o-y improvement of around 11%. The stock was flat after hours.

The provider of supplemental insurance, AFLAC Inc. (AFL, -0.037%▼) has reported an adjusted EPS of $1.59, ahead of the estimated $1.27 and last year’s $1.28. The revenue of $5.56bn has surpassed the estimates by 4.53%. The stock climbed by 0.95% after hours.

On the Lookout:

The Jobless Claims data will be published today. The Initial Jobless Claims are expected to drop to 380,000 from the previous 419,000. The previous print on Continuing Jobless claims was 3.24m.

The Gross Domestic Product, first estimate (SAAR) is expected to rise to 8.5% from the previous 6.4%. The data is due today.

Also, Pending Home Sales Index will be updated today, from the previous 8.0%.

Some IPOs to keep track of:

ROX Financial LP is offering 8.3m shares of its common stock, priced at $10 per share, in a bid to raise $94.8m.

Intraocular Lens platform, RxSight Inc, plans to raise $125m by offering 7.4m shares of its common stock, priced between $16 and $18.

Rallybio Corporation, a clinical-stage biotech company, is offering 6.2m shares of its common stock, priced between $13 and $15.

A phase-1 Oncology Biotech, IN8BIO Inc, plans to raise $44m by offering 4m shares of its common stock, priced between $10 and $12.

Unusually high shorter-term CALL options activity seen on United Parcel Service. (UPS, -1.61%▼), Barrick Gold Corp (GOLD, 1.67%▲), Plug Power Inc. (PLUG, 4.82%▲), Pinduoduo Inc. (PDD,15.54%▲), and Constellation Brands Inc (STZ, 0.027%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Newmont Corporation. (NEM,0.91%▲), Skyworks Solutions Inc. (SWKS, 2.08%▲), Tesla Inc. (TSLA, 0.34%▲), Alibaba Group. (BABA, 7.70%▲) and JD.Com Inc (JD, 8.51%▲).

Other Asset Classes:

The US Treasury Yields remained rather unchanged as the Fed concluded its 2-day FOMC meet and kept interest rates in the target range near zero, as expected. The 10 Year Treasury Yield fell by less than 1 basis point to 1.229% while the 30 Year Treasury Yield, also ticked down by less than a basis point to 1.887%.

Crude Oil inventories in the US have dropped by 4.1m barrels, in the week ended July 23. The dip was more than expected and further strengthened the bullish Oil Prices. Brent Crude was up 0.96% and has already breached the $75 per barrel mark. WTI Crude rose 1.15% and was trading above the $73 a barrel mark, early Thursday morning.

The US Dollar (92.04,-0.31%▼) has dipped following the dovish stance by the Fed in tapering monetary policy.

Global Markets:

Asian markets bounced back Thursday afterBeijing soothed the investors’ nerves, following an absolute rout in the markets owing to a state crackdown on certain companies. The nation’s securities regulator held a video conference with banking executives conveying that the “education policy” was not intended to hurt companies in other industries. Hang Seng gained more than 800 points, while Shanghai climbed more than 1%.

European Markets continued to be buoyed by a string of positive earnings reports and Beijing reaching out for damage control.Thursday morning, all major European indices were green with the pan EU Stoxx-600 gaining 0.39%. FTSE, CAC, and DAX were marching ahead quite comfortably, as well.

Meanwhile on Researchfin.ai

There are 40+ new trade setups identified by the AI yesterday. Please download our app Researchfin.ai from the App Store and Play Store, if you already haven’t.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Will see you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.