The “Chip” in the Armour!

Good morning!

Toyota, the world’s largest carmaker, will slash its global production by 40% by September as the rising cases of delta variant have meant a further constriction of the chip-shortage. US-based Ford will halt the assembly of its F-150 pick-up truck for a week.

Friday will mark the 200th consecutive session of the S&P 500 index not producing a drawdown of at least 5% from its high - if there is not a steep selloff, of course. This is the longest such stretch since 2016 when 404 sessions went by without the index falling by at least 5% from its peak.

The Biden administration is canceling another $5.8bn in student debts, with the cancellation extending to more than 323,000 severely disabled people. The US Education Department has so far canceled $9bn in student debt since Biden assumed office in January.

Classified! Beijing has passed a new law, Friday, that prohibits illegally collecting, using, processing, transmitting, disclosing, and trading personal information of people. Tech stocks in China tanked again, along with major indices.

Killing the competition! The FTC has refreshed its antitrust case against Facebook, accusing the social media giant of “buying and burying” competition. The Facebook stock slid a little.

Initial Jobless Claims fell by 29,000, from the week before, and fell to a 17-month low of 348,000 - much below the estimated 365,000. Continuing claims fell to 2.82m, also a pre-pandemic era low.

US Markets:

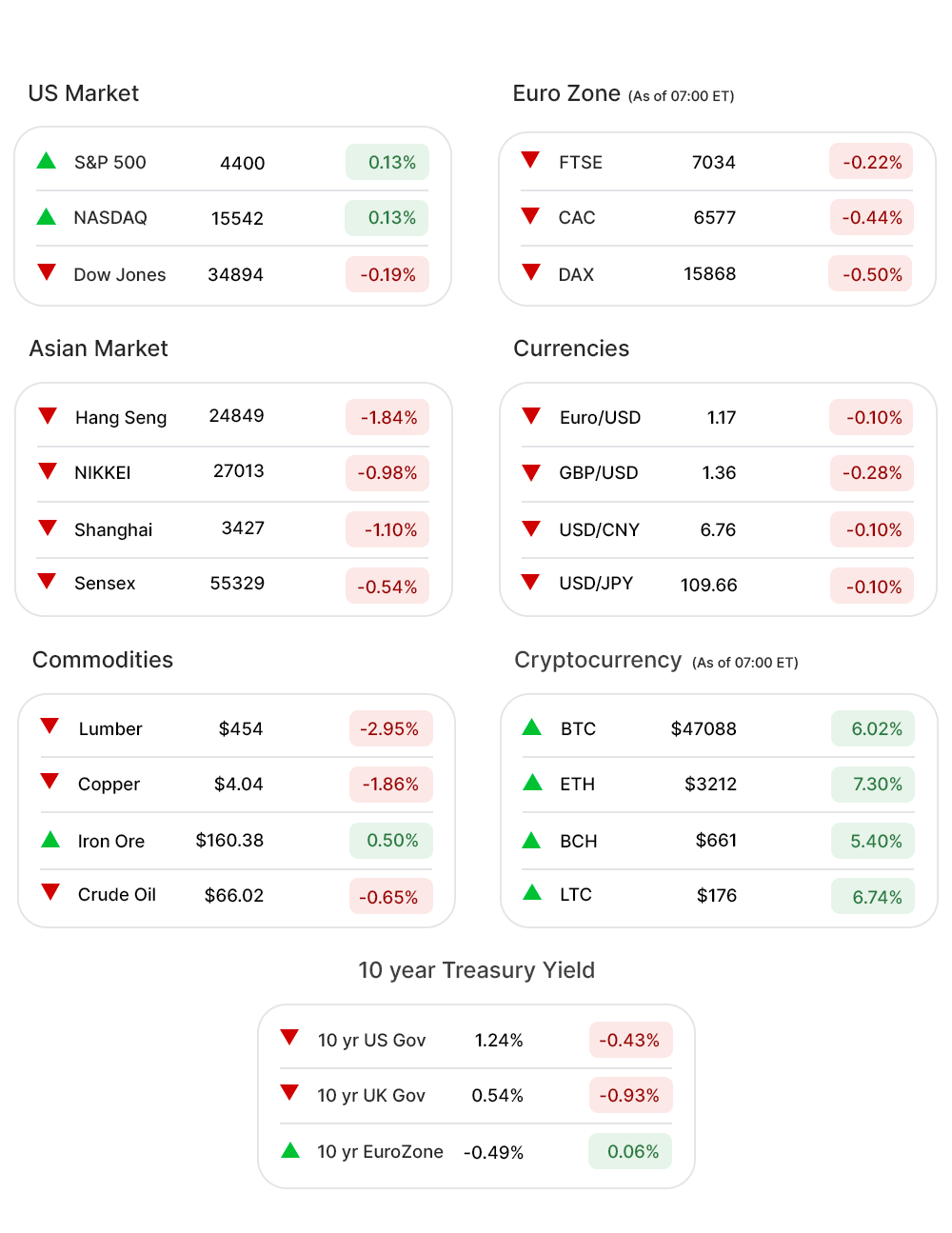

After two days of selling the US, stocks ended up mixed at close Thursday, with S&P 500 (0.13%▲) and tech-heavy Nasdaq (0.11%▲) making slight gains. Dow Jones (-0.19%▼), however, ended lower for the third consecutive day.

At the S&P 500, sectors were mixed, the red ones outnumbering the green ones by one.

Energy (-2.65%▼) continued being the worst of the sectors. Financials (-0.76%▼), Industrials (-0.77%▼), Materials (-0.93%▼), Consumer Discretionary (-0.62%▼),and Consumer Staples (-0.43%▼) incurred losses as well.

Real Estate (0.92%▲), Healthcare (0.49%▲), Communication Services (0.13%▲), and Utilities (0.02%▲) were among the gainers, including Technology (0.99%▲) which was buoyed by tech stocks doing well on the day.

Stocks that fuelled the tech sector included Apple (AAPL, 0.23%▲), Alphabet (GOOGL, 0.17%▲), Microsoft (MSFT, 2.08%▲), and Nvidia Corporation(NVDA, 3.98%▲).

Futures!

The Futures edged lower, on a day, following the downward trend in Asian as well as European markets.

As of 06:30 ET, Futures were red without an exception: Russell 2000 Futures (-0.44%▼), Nasdaq Futures (-0.18%▼), S&P 500 Futures (-0.34%▼), and Dow Futures (-0.33%▼).

Key Movers in Small Cap:

The healthcare software maker, Inovalon Holdings (INOV, 8.33%▲), Thursday announced that it has agreed to be taken private for $6.41bn by a consortium, including buyout groups Nordic Capital and Insight Partners. The relative volume of the stock was 19.2.

Ontrak Inc (OTRX, -44.51%▼) disclosed that it has lost a key customer. The company lost 35% of its workforce in March after losing its largest contract. The relative volume of the stock was 14.8.

Macy’s Inc(M, 19.59%▲) has brought back the Toys “R” Us brand to the US, through its e-commerce site and retail store network. The relative volume of the stock was 10.6.

The 71.9% y-o-y growth in revenues for Red Robin Gourmet Burgers (RRGB, -16.40%▼) was not enough to boost investor confidence in the near-term outlook, as the pandemic is far from over. The relative volume of the stock was 9.2.

The other movers in the small-cap segment included:

Impel Neuropharma Inc. (IMPL, -17.37%▼): Relative Volume 13.9.

South Plains Financial Inc. (SPFI, -2.80%▼): Relative Volume 7.7.

Verra Mobility Corporation (VRRM, -0.60%▼): Relative Volume 6.2.

Eros STX Corporation (ESGC, 7.69%▲): Relative Volume 4.8.

Key Movers in Large Cap:

Illumina Inc (ILMN, -7.88%▼) Thursday announced that it has completed its $8bn cash and stock acquisition of cancer testing company Grail, despite the fact that European Commission is still reviewing the transaction over monopoly concerns. The relative volume of the stock was 4.0.

Nutanix Inc (NTNX, -7.57%▼) has partnered with Cyxtera to launch its first Federal Innovation Lab, powered by the former’s digital exchange and enterprise bare metal. The relative volume of the stock was 3.9.

Kohl’s Corporation (KSS, 7.29%▲), reported a record Q2 EPS of $2.48 and a 31.4% y-o-y increase in net sales while raising the outlook for the year. The relative volume of the stock was 3.9.

Synopsys Inc (SNPS, 8.73%▲) reported better than expected earnings for its fiscal third quarter, ending July 31. The relative volume of the stock was 3.8.

The other movers in the large-cap segment included:

Nvidia Corporation(NVDA, 3.98%▲): Relative Volume 3.8.

Netflix Inc. (NFLX, 4.18%▲): Relative Volume 3.4.

Tapestry Inc. (TPR, -3.11%▼): Relative Volume 3.1.

East-West Bancorp. (EWBC, -3.20%▼): Relative Volume 2.9.

Report Card:

Applied Materials Inc (AMAT, 1.44%▲) reported earnings of $1.74bn or $1.91 per share, better than the expected $1.77 per share. Revenue rose 40.9% y-o-y to $6.20bn. The stock slid after hours.

Synopsys Inc (SNPS, 8.73%▲) announced an earning of $1.81 a share on sales of $1.6bn, beating the estimates of $1.78 a share on sales of $1.05bn. The stock remained flat after hours.

Macy’s Inc(M, 19.59%▲) reported an EPS of $1.29 on revenue of $5.65bn, ahead of the estimated $0.1863 on revenue of $4.97bn. The stock slid below the zero-mark after hours.

Performance Food Group Company (PFGC, -4.20%▼) came out with an EPS of $0.56, ahead of the estimated $0.50, while the revenue of $9.3bn surpassed the estimates by 5.45%. The stock was flat after hours.

On the Lookout:

At 11:00 Am ET Dallas Fed President Rob Kaplan, who believes the Fed should start tapering its bond-buying program in October this year, will speak to the media.

Unusually high shorter-term CALL options activity seen on Decarbonisation Plus Acquisition Corp (HYZN, 4.13%▲), Skillz Inc (SKLZ, -4.63%▼), Abercombie and Finch. (ANF, 3.62%▲), Element Solutios Inc (ESI, -1.22%▼), and Freeport-McMoRan Inc (FCX, -4.31%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Macy’s Inc(M, 19.59%▲), Kohl’s Corporation (KSS, 7.29%▲), JD.Com Inc (JD, -5.10%▼), Faraday Future Intelligent Electric Inc (FFIE, -7.26%▼), and Alibaba Group Holdings (BABA, -6.85%▼) among others.

Other Asset Classes:

Crude Oil Prices went further down Friday, for the seventh consecutive day, recording its longest losing streak since February 2020 - weighed down by concerns pertaining to delta variant spread and a surprise increase in US inventories, to 228.2m barrels against a 1.7m-barrel drop. Brent was trading at $66.35 per barrel, early Friday morning.

The US Dollar (93.65, 0.09%▲) buoyed by the taper-talk by the Fed has reached a new year high, with a next resistance level of 94.00 in-sight.

The US Treasury Yields continued to fall Friday morning, extending Thursday’s losses amid the ongoing discussion about Fed’s moves on tapering the bond-buying program, The 10 Year US Treasury Yield was trading in the red zone at the 1.232% mark, early Friday morning.

A rise in bond yields, from the 2020 lows, and a strengthening US dollar has pushed precious Gold Prices lower with top US-listed gold companies losing one-fifth of their market value this year so far.

Global Markets:

Asian markets extended losses on Friday with major indices falling into the red zone, again. The rise of delta variant, China’s crackdown, and Fed’s taper talk weighed on the investor sentiment. Shanghai fell by 1.10%, Hang Seng shed more than 460 points or 1.84%, while Nikkei fell by more than 250 points.

European markets were no better, as all major indices traded in red Friday morning, as the sentiment of gloom persisted in the global markets. Stoxx-600, FTSE, and CAC all fell below the zero-mark.

Meanwhile on Researchfin.ai

There were many new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

Enjoy your weekend!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.