The ‘Chips’ are Down!

Good Morning!

Tiny things bringing giants down! A forecast suggests that the semiconductor chip shortage is going to cost global auto-makers $210bn in revenue this year, almost double the May forecast. 7.7m units of production will be lost in 2021.

How soon is soon? Following the two-day FOMC meeting, the Fed has kept interest rates anchored near zero. The officials indicated the stimulus tapering, or reduction in the monthly asset purchases, will begin “soon”, without giving out a timeline. Also, half of the Fed officials expect the first interest rate increase in 2022, up from just 7 in June.

Norway does it, however! The country has become first among the G10 currencies group - 10 of the world’s most traded currencies - to have tightened its monetary policy since the outbreak of the pandemic. The Bank of England is expected to keep interest rates unchanged and announce a taper in the bond-buying program, later today.

Coming back from the dead? Debt-ridden Chinese developer, Evergrande, has made a comeback from the verge of a collapse with a 17.62% gain in today’s trading - after the group’s chairman vowed to help wealth investors redeem their products. The stock is still down 80% year-to-date.

Concerns linger though. The September 23, key - $35.9m onshore coupon - payment deadline for the embattled group has ignited sales in the $428bn corner of the Asian bond market. Investors have their fingers crossed!

Existing Home Sales (SAAR), for the month of August, have declined 2% from July to a seasonally adjusted 5.88m units. Sales were 1.5% lower than August 2020, the first annual decline in 14 months.

Goal! Dutch football club PSV has announced a partnership with Bitcoin exchange, Anycoin Direct propelling the hammered CryptoCurrency on Thursday. PSV will pay its entire sponsorship in Bitcoin. Ethereum soared 6.6%, Bitcoin 4%.

US Markets:

The Central Bank commentary, post the two-day FOMC meeting, propelled the markets to snap a 4-day losing streak on Wednesday. Indices were green at the close, across the board.

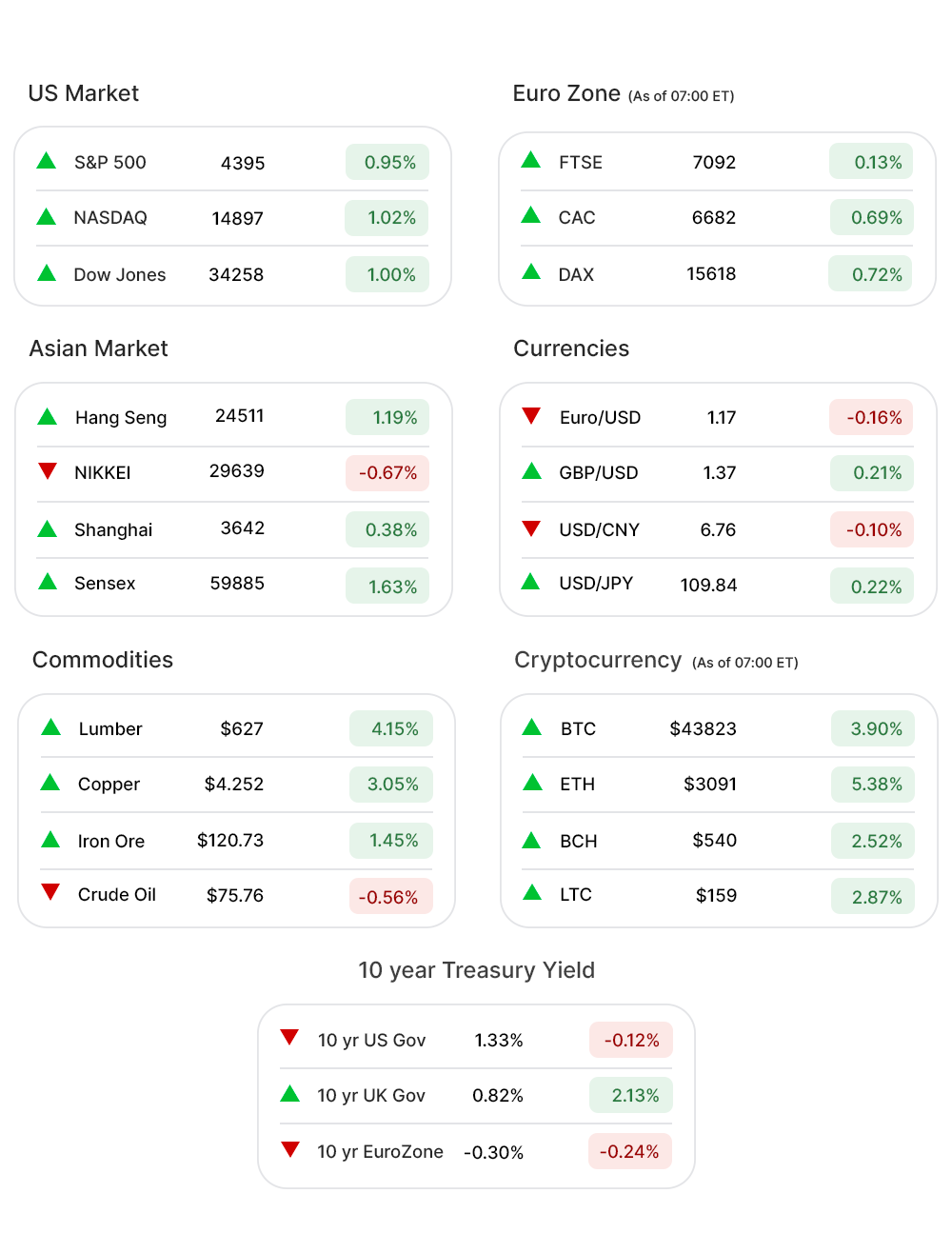

S&P 500 (0.95%▲) gained more than 40 points to end the day at 4395.64. Dow Jones (1.00%▲) notched more than 338 points for the day.

Russel 2000 (1.48%▲) and Nasdaq (0.99%▲), managed to post some decent gains as well.

Sectors at the S&P 500 ended mixed with Materials (-3.95%▼) falling, yet again, to the bottom, and Energy (3.16%▲) finishing at the top.

Financials (1.58%▲), Technology (1.40%▲), and Consumer Discretionary (1.31%▲) posted some decent gains, followed by Industrials (0.96%▲), Healthcare (0.09%▲), and Consumer Staples (0.26%▲).

Communication Services (-0.01%▼), Utilities (-0.11%▼), and Real Estate (-0.04%▼) followed Materials to the red zone.

Futures!

The Futures are pointing towards an extended rally in the markets, as the Evergrande fears are subsiding, and the Asian and the EU markets lift the spirits.

As of 07:00 ET, the indices looked like this: Nasdaq Futures (0.55%▲), Dow Futures (0.45%▲), S&P 500 Futures (0.52%▲), and Russel 2000 Futures (0.75%▲).

Key Movers in Small Cap:

Law Offices of Howard G. Smith have initiated an investigation into InnovAge Holding Corp (INNV, -24.89%▼), on behalf of the investors concerning the company’s possible violation of Federal securities law. The relative volume of the stock was 15.3.

Inotiv Inc (NOTV, -31.68%▼) tumbled a day after soaring on the announcement of acquiring Envigo RMS Holdings. The relative volume of the stock was 11.5.

RBC Bearings Inc (ROLL, 5.43%▲) Wednesday priced the previously announced public offering of 3m shares, at $185 per share. The relative volume of the stock was 8.6.

Clover Pharmaceuticals, a collaboration partner of Dynavax Technologies (DVAX, 26.45%▲), reported positive results from the pivotal Spectra trial with its Covid-19 vaccine candidate, SCB-2019. The relative volume of the stock was 6.5.

The FDA does not agree with a change Summit Therapeutics (SMMT, -20.-06%▼) made to the primary endpoint of a phase 3 trial of its Ridinilazole antibiotic drug candidate. The relative volume of the stock was 5.3.

The other movers in the small-cap segment included:

Alpine Immune Sciences Inc (ALPN, 8.78%▲): Relative Volume 5.0.

Atreca Inc (BCEL, -0.89%▼): Relative Volume 4.1.

Hemisphere Media Group (HMTV, 5.62%▲): Relative Volume 3.8.

Stitch Fix Inc (SFIX, 15.65%▲): Relative Volume 3.7.

Edgewise Therapeutics Inc (EWTX, 10.48%▲): Relative Volume 3.6.

Key Movers in Large Cap:

FedEx Corporation (FDX, -9.12%▼) underwent the biggest selloff in 18 months, following a dismal earnings report and the subsequent target slashing by the analysts. The relative volume of the stock was 6.7.

Americold Realty Trust (COLD, -1.80%▼) reached a new 52-week low on Wednesday after its price target was lowered. The relative volume of the stock was 4.2.

Incyte Corporation (INCY, -8.51%▼) tumbled despite announcing an FDA approval for Opzelura, its topical treatment for mild to moderate atopic dermatitis, in patients 12 and older. The relative volume of the stock was 4.0.

Hyatt Hotels Corporation (H, 2.36%▲) has announced a public offering of 7m shares of its Class A common stock. The relative volume of the stock was 3.9.

Signify Health Inc (SGFY, -8.30%▼) Wednesday entered the “oversold” territory, hitting an RSI reading of 29.5. The relative volume of the stock was 3.7.

The other movers in the large-cap segment included:

Bill.com Holdings Inc. (BILL, 0.07%▲): Relative Volume 3.5.

Facebook Inc (FB, -3.99%▼): Relative Volume 2.9.

Adobe Inc (ADBE, -3.07%▼): Relative Volume 2.5.

The Chemours Company (CC, 0.56%▲): Relative Volume 2.1.

Peloton Interactive Inc (PTON, -6.31%▼): Relative Volume 1.9.

Report Card:

A manufacturer of branded consumer foods, General Mills Inc (GIS, 3.29%▲), reported an adjusted EPS of 99 cents, lower 2% y-o-y, but well above the consensus estimate of 88 cents per share. Net Sales of $4539.9m increased 4% y-o-y and were well above the estimated $4352.3m. The stock rose by more than half a percent after hours.

The home building company, KB Home (KBH, 0.74%▲), reported a 47% y-o-y increase in revenue to $1.47bn, its highest revenue for the Q3 in 14 years. Diluted earnings per share of the company grew 93% y-o-y to $1.60. The stock continued to rise after hours.

Amid strong demand for its CyberSecurity products, BlackBerry Limited (BB, 2.03%▲), reported earnings of -$144m, versus last year’s -$23m in the same period last year, while the EPS came out to be -$0.25, compared to the -$0.04 in the prior year. Analysts had projected an EPS of -$0.07. The stock soared more than 6% after hours.

The adhesives manufacturing company, HB Fuller (FUL, 0.95%▲), reported earnings of $0.79 per share, ahead of the estimated $0.77 per share. The revenue of $826.83m topped the consensus estimate by 3.71%. The stock rose by more than 2.5% after hours.

On the Lookout:

Initial Jobless Claims (regular state program) is expected to come down, for the week ended September 18, from last week’s 332,000 to 320,000. The Continuous Jobless Claims, have a previous print of 2.85m.

The Markit Manufacturing PMI (flash), for the month of September, is expected to increase from August’s 61.1 to 61.7. The Markit Services PMI (flash), is expected to drop from August’s 55.1 to 54.9.

The food company, Sovos Brands, is looking to raise $429.3m by offering 23.3m shares of its common stock, priced between $14 and $16 per share.

A global provider of a background screening, Sterling Check, is set to raise $300m by offering 14.2m shares of its common stock, priced between $20 and $22.

New York-based, Thorne HealthTech, is aiming to raise $74m by offering 7m shares of its common stock, priced between $10 and $11 per share.

Unusually high shorter-term CALL options activity seen on Marin Software Inc (MRIN, 61.86%▲), Facebook Inc (FB, -3.99%▼), Pitney Bowes Inc (PBI, 6.18%▲), United States Steel Corp (X, 0.04%▲), and Barrick Gold Corporation (GOLD, -0.22%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on MGM Resorts International (MGM, 6.09%▲), Lowe’s Companies Inc (LOW, 1.27%▲), DRaftkings Inc (DKNG, -0.27%▼), Snap Inc (SNAP, 3.30%▲) and Vale SA (VALE, 3.40%▲) among others.

Other Asset Classes:

Crude Oil Prices - US Crude inventories have fallen by 3.5m barrels to 414m barrels, the lowest since October 2018. The news sent Crude Oil prices further up on Wednesday, while Thursday morning the prices still traded in the green zone. Brent crude was trading well above the $76 per barrel mark, while WTI crude traded above the $72 per barrel mark.

The US Dollar (93.21, -0.27%▼) retreated considerably from the monthly high of 93.50 levels as investors try to adjust to the outcome of the FOMC meeting, that concluded Wednesday.

With Fed saying it might soon taper on its bond-buying program, The US Treasury Yields slumped Wednesday. Today, however, the yields advanced to recover some of the gains. Early Thursday morning, the 10 Year US Treasury Yield was trading at 1.335%, in the green zone, but lower than Wednesday morning’s 1.338%.

Global Markets:

Asian Markets: The easing of fears, about the collapse of Chinese developer Evergrande, led the markets in the Asia Pacific region mostly higher on Thursday. The investors also responded to the Fed’s Wednesday commentary positively. Shanghai climbed 0.38%, as Hang Seng advanced by a healthy 1.1%. Tokyo’s Nikkei, however, shed more than 200 points, down 0.67%.

European markets looked all set for a third consecutive rally, as the market opened Thursday, amid easing Evergrande-fears. The investors also awaited the last batch of economic data. FTSE (0.54%), CAC (0.93%), DAX (1.03%) , and the pan-EU index Stoxx-600 (1.00%) looked set to have another gaining day.

Indian Market: While the global markets made decent gains, the Indian market soared to new heights Thursday. Sensex soared by 958 points to attain a lifetime high of 59885.36, up 1.63%. Nifty also breached the 17,800 mark, for the first time ever, and ended at 17,843.90 - up 1.57%. The stocks were majorly propelled by the Nifty Realty index which rose by more than 8%, and the Nifty Financial Services gaining a little less than 3%.

Meanwhile on Researchfin.ai

A few more trade setups, identified by our AI, have already hit their respective profit targets yesterday, within their optimal holding period: Group 1 Automotive Inc (GPI), Penske Automotive Group (PAG), Goosehead Insurance Inc (GSHD), ConocoPhilips (COP), Travel + Leisure Co (TNL), Controladora Vuela Co (VLRS), Intra-Cellular Therapies Inc (ITCI), and AutoNation Inc (AN). . Signup, we have a 30-day free trial.

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup!

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.