The Contagion!

Hey! How was the weekend?

The tip of the iceberg! Debt-ridden, Chinese Real Estate giant, Evergrande slumped to 11-year lows by about 15% today, as bond-payment deadlines arrive. And as was anticipated, it has spread the rout beyond the real estate industry and well beyond the mainland borders. Asian, European stocks fell Monday as Evergrande’s “moment of truth” arrives. Property developer Sinic halted trading after skidding87%.

Buying competition! US tech giants - including Apple, Facebook, Microsoft, and Amazon - have spent a record $264bn to buy potential rivals under $1bn in 2021, twice the previous record of the dot com boom of 2000. US politicians and regulators prepare to crack down on transactions “under the radar”.

Where are the Energy suppliers of the UK vanishing? At the beginning of 2021, there were 70 Energy suppliers in the country and by the end of the year, only 10 might be left, as wholesale gas prices have soared by 250% since January. The UK government is contemplating offering state-backed rescue loans to these companies, as they acknowledge many suppliers could go bust in the coming days.

With an aim to expand into UAE and Australian markets, the Indian used car platform, Cars24, has raised $450m from Chinese tech giant Tencent, Japanese Soft Bank, and some other investors.

Good, but not enough! From a decade low reading of 70.3 in August, the UMich Consumer Sentiment Index (preliminary) has risen to 71 for the month of September, falling short of the expected 72.

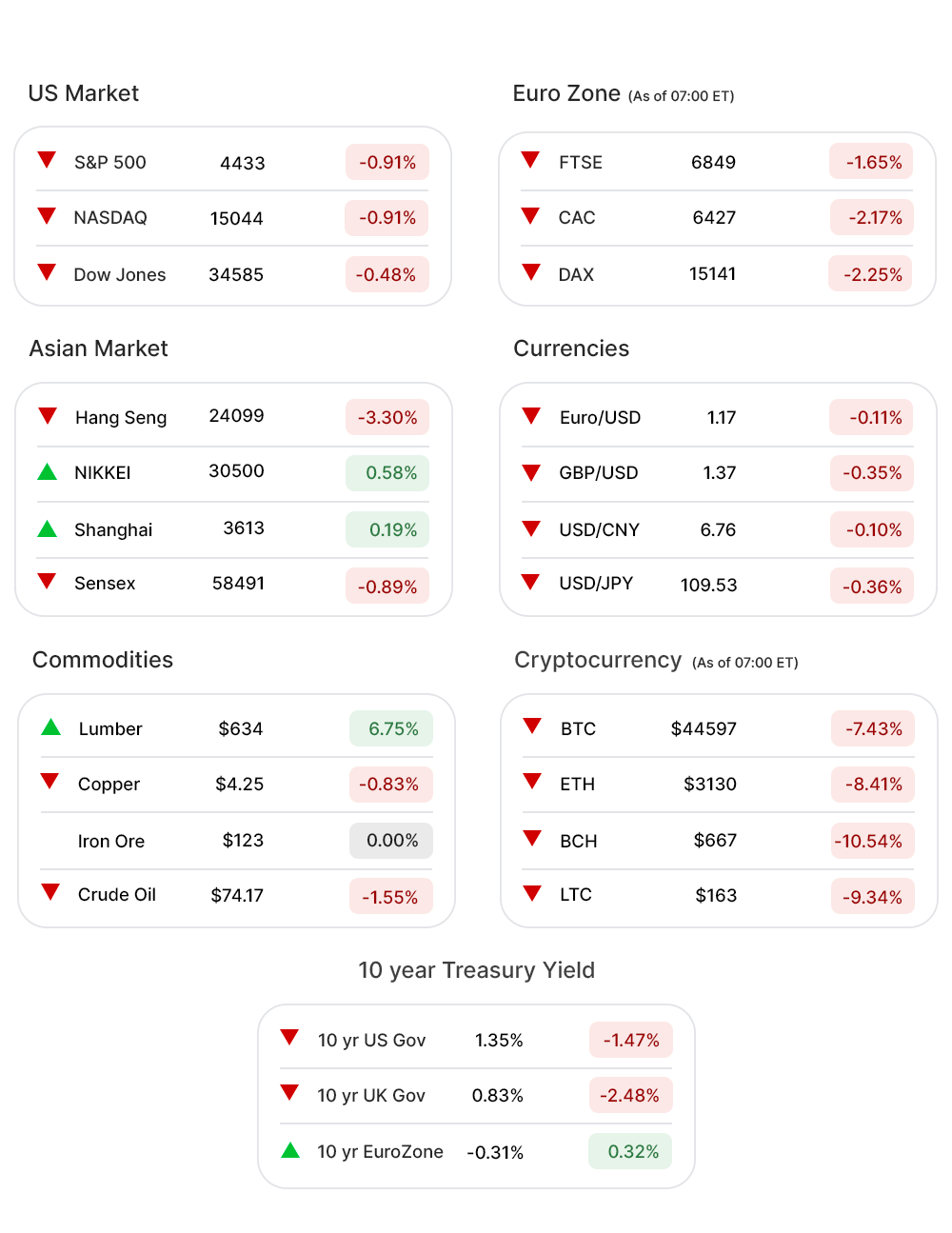

US Markets:

Stocks slumped to record the second week of losses in a row, with a rise in delta variant cases and ahead of the Fed meeting scheduled this week. September has historically been a turbulent month for the stocks.

S&P 500 (-0.91%▼) slid more than 40 points Friday, to drop below its 50-day moving average. Dow Jones (-0.48%▼) tumbled by a substantial 166 points, while the tech-heavy Nasdaq (-1.18%▼) shed more than 182 points for the day.

Nasdaq was pulled down by tech giants including Facebook (FB, -2.24%▼), Apple (AAPL, -1.83%▼), and Microsoft (MSFT, -1.75%▼).

Russel 2000 (0.18%▲) was the only gaining index on Friday.

Sectors at the S&P 500 were all red, barring Healthcare (0.07%▲), which managed to notch thin gains.

Utilities (-1.59%▼) was the worst-hit sector, followed by almost identical losses in Communication Services (-1.26%▼), Industrials (-1.05%▼), Materials (-1.09%▼), and Technology (-1.52%▼).

Other losing sectors included Real Estate (-0.95%▼), Consumer Discretionary (-0.38%▼), Energy (-0.76%▼), Financials (-0.49%▼), and Consumer Staples (-0.53%▼).

Futures!

The Evergrande contagion spread across the Asian and EU markets and was threatening to impact the US stocks as well, with Dow sliding more than 515 points, early Monday morning.

As of 06:00 ET, none of the indices was in green. Nasdaq Futures (-1.05%▼) was down 161 points, Dow Futures (-1.50%▼), S&P 500 Futures (-1.27%▼) down more than 50 points, and Russel 2000 Futures (-1.64%▼) skid more than 35 points.

Key Movers in Small Cap:

Priority Technology Holdings (PRTH, 47.23%▲) has completed the purchase of banking-as-a-service company Finxera Holdings Inc. The relative volume of the stock was 237.0.

The FDA, in response to Tumorigenicity in mice, is shutting down all clinical trials with Rusfertide, the lead candidate of Protagonist Therapeutics Inc (PTGX, -62.00%▼). The relative volume of the stock was 39.0.

Tcr2 Therapeutics Inc (TCRR, -36.45%▼) Friday reported interim results from the ongoing phase-1 portion of its Gavo-Cell phase 1/2 clinical trial for Mesothelin. The relative volume of the stock was 12.3.

The other movers in the small-cap segment included:

Surface Oncology Inc (SURF, 18.14%▲): Relative Volume 14.4.

Primis Financial Corporation (FRST, -6.74%▼): Relative Volume 8.6.

Altair Engineering Inc (ALTR, -0.83%▼): Relative Volume 8.2.

Orasure Technologies Inc (OSUR, 16.65%▲): Relative Volume 7.3.

Key Movers in Large Cap:

United States Steel Corporation (X, -7.98%▼) forecast record third-quarter profits and unveiled plans for a new mill that will start producing in 2024. The relative volume of the stock was 3.2.

The other movers in the large-cap segment included:

Unum Group (UNM, -6.04%▼): Relative Volume 4.7.

Carlisle Companies (CSL, 0.93%▲): Relative Volume 4.4.

Thermo Fisher Scientific Inc (TMO, 6.49%▲): Relative Volume 4.0.

Centene Corporation (CNC, 4.95%▲): Relative Volume 3.6.

DT Midstream Inc. (DTM, -4.80%▼): Relative Volume 3.1.

Curtiss-Wright Corporation (CW, 3.12%▲): Relative Volume 3.1.

Report Card:

Manchester United PLC (MANU, 2.16%▲) Friday reported a loss of $150.5m for the fiscal fourth quarter, while the revenue of the UK-based company came out to be $131.4m. The stock climbed a little less than 2% after hours.

On the Lookout:

Direct to consumer fashion platform, a.k.a Brands Holdings, is looking to raise $263.9m by offering 13.8m shares of its common stock, priced between $17 and $19.

Argo Blockchain is aiming at a valuation of $844m, as the company offers 7.5m shares of its common stock, priced at $18.40 per share.

Brilliant Earth Group, a supplier of jewelry and diamonds, is planning to raise $267m by offering 16.6m shares of its common stock, priced between $14 and $16 per share.

Unusually high shorter-term CALL options activity seen on AES Corp (AES, 1.32%▲), Baidu Inc (BIDU, 1.66%▲), CSX Corporation (CSX, -1.94%▼), United States Steel Corporation (X, -7.98%▼), and the Peabody Energy Corporation (BTU, -5.34%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Uber Technologies Inc (UBER, 0.58%▲), American Airlines Group (AAL, -0.80%▼), Pag Seguro Digital Ltd (PAGS, 1.38%▲), Cameco Corp (CCJ, -6.53%▼), and Palantir Technologies Inc (PLTR, 0.28%▲) among others.

Other Asset Classes:

Crude Oil Prices - Friday’s losses were extended early Monday morning in wake of a stronger US dollar and increasing US Rig Count, following the havoc wreaked by two back-to-back hurricanes. Brent was down by 1.01% while WTI crude traded 1.24% lower.

The US Dollar (93.38, 0.19%▲) reached a three-week high Monday morning as the Fed is expected to exhibit a hawkish stance in FOMC meet, scheduled this week.

The US Treasury Yields trod a little lower for the same reason that propelled the US dollar higher, Monday morning. The 10 Year US Treasury Yield was trading at 1.341%, in the negative territory, but considerably ahead of the 1.28% level last week.

Global Markets:

Asian Markets: A rout in the property stocks, as Evergrande slid, and ahead of the policy meetings of central banks in China, Japan, Taiwan, Indonesia, and the Philippines, scheduled this week, most of the markets in the Asia Pacific tumbled on Monday. Hang Seng, dropped more than 4% intraday, trimming losses to 3.3% by the close. Shanghai and Tokyo's Nikkei were up 0.19% and 0.58%, after a choppy day.

The European markets followed the overall negative outlook in Asia dropped the most in a month. Investors in the UK were watching Energy stocks as the government considers offering emergency state-backed loans to companies as wholesale gas prices soar. The FOMC meeting in the US played heavily on investors’ minds. FTSE was down 1.30%, CAC slumped 2.18%, DAX shed 1.96%, and the pan-EU index Stoxx-600 plunged 1.77% early Monday morning.

Meanwhile on Researchfin.ai

Find new trade setups, identified by the AI yesterday. Download our app Researchfin.ai for iOS and Android and never miss a trade setup! Signup, we have a 30-day free trial.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.