The ‘Delta’ Between Aspirations and Reality!

Good Morning,

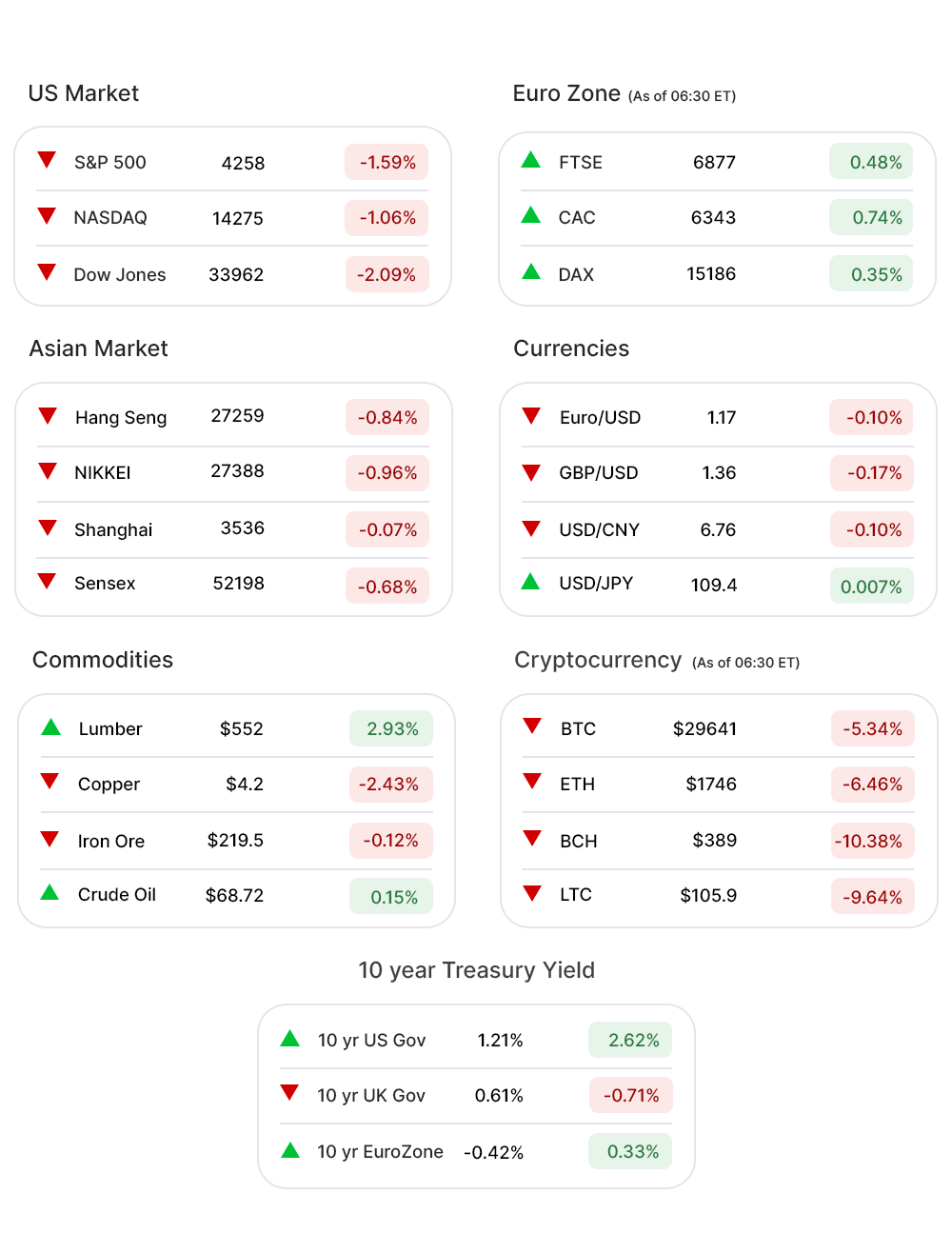

Poof! Where did all the money go? $100bn has been wiped off the CryptoCurrency market as Bitcoin fell below $30,000 for the first time since June 22, dragging the other currencies even lower.

Covid misinformation! Twitter has suspended Republican Marjorie Taylor Green, from its platform for 12 hours after she posted two “misleading” tweets about Covid, days after President Biden called out Facebook and said social media networks were “killing people” by hosting this misinformation.

Behave in the CyberSpace! US and allies have accused China of irresponsible, disruptive, and destabilizing behaviour in CyberSpace. The alleged “global hacking spree” by China poses a “threat to national and economic security”.

By the way, Jeff Bezos is soaring to space today!

US Markets:

The resurgence of Covid! Delta variant cases have been rising sharply in almost all states in the US, with a 10% surge over last week nationwide and several states with a 50% increase. Four states - Arkansas, Florida, Nevada, and Missouri - are amidst a full-blown outbreak.

Investors’ worries, about the impact of delta variant over economic recovery, culminated into a selloff in the US markets Monday. Major indices tanked!

Dow (-2.09%▼) slumped more than 900 points during the day but closed with a loss of 725 points.

The S&P 500 (-1.59%▼) shrugged off 68 points while Tech-heavy Nasdaq (-1.06%▼) slid over 150 points, to mark the first day of the week in the red. The indices were in red Friday, as well, registering a week of losses after three winning weeks in a row.

All 11 sectors at the S&P 500 were red, without an exception, with Energy (-3.59%▼) leading the downward slide, again! Financials (-2.80%▼) followed.

Heavy losses were also witnessed in Materials (-2.18%▼), Industrials (-2.14%▼), Technology (-1.39%▼), Healthcare (-1.07%▼), Real Estate (-1.59%▼), and Communication Services (-1.66%▼).

Futures!

The surge in European equities might be inspiring a rebound in US markets, after Monday’s fall. Futures looked green through and through, early Tuesday morning.

As of 06:30 ET: Nasdaq Futures (0.50%▲), S&P 500 Futures (0.49%▲), Russell 2000 Futures (0.89%▲), and Dow Futures (0.58%▲) were a pretty picture.

Key Movers in Small Cap:

California-based developer of ‘muscle activators and muscle inhibitors’, Cytokinetics Inc. (CYTK, 40.41%▲) announced positive topline results from its phase-2 trial of CK-274, a heart disease drug. The phase-3 trial will begin by the end of this year. The relative volume of the stock was 37.1.

SPX FLOW Inc. (FLOW, 22.29%▲), a developer of customized chemical processes equipment, has announced that it received and rejected Ingersoll Rand’s unsolicited, conditional and non-binding buy-out offer worth $3.6bn. The relative volume of the stock was 15.1.

The REIT company, Kite Realty Inc. (KRG, -9.99%▼) has announced a merger agreement with Retail Properties of America, valuing the latter's shares at a 12.6% premium and a market capitalization of $2.8bn. The relative volume of the stock was 7.5.

Orasure Technologies Inc. (OSUR, 1.29%▲) gained more than 12%, during the day Monday, following rumors that the medical device maker declined an acquisition offer by Quidel Corporation. The stock shed much of the gains prior to the day’s close. The relative volume of the stock was 5.8.

Health and Wellness service and products provider, OneSpaWorld Holdings (OSW, -7.37%▼) announced the pricing of its secondary public offering at $9.50 per share. The shares will be sold by certain affiliates of the company called “selling shareholders”. The relative volume of the stock was 5.6.

The other movers in the small-cap segment included Coastal Financial Corporation. (CCB, -5.27%▼), with a relative volume of 5.4; Retail Properties of America Inc. (RPAI, -1.04%▼) with a relative volume of 5.2, Landos Biopharma Inc (LABP, 12.06%▲), with a relative volume of 4.3 and GP Strategies Corporation (GPX, 0.25%▲), with a relative volume of 4.1.

Key Movers in Large Cap:

Five9 Inc. (FIVN, 5.92%▲), a provider of cloud contact center software is all set to be acquired by Zoom Inc in an all-stock deal valuing the company at $14.7bn. This is the second biggest tech deal of the year in the US. The relative volume of the stock was 22.3.

The Department of Justice has dropped an antitrust probe in the $27.7bn acquisition of Slack Technologies Inc. (WORK, 1.03%▲) by Salesforce. The merger is set to close on July 21. The relative volume of the stock was 4.5.

The takeover of Five9 by Zoom has increased competition concerns for cloud-based communications company RingCentral Inc. (RNG, -6.13%▼). The relative volume of the stock was 4.0.

Amid rising cases of the delta variant in the country, vaccine maker Moderna Inc. (MRNA, 9.48%▲) and some other companies involved in the fight against CoronaVirus outperformed the market. The relative volume of the stock was 3.3.

The other stocks in this category included AutoNation Inc. (AN, 3.65%▲), with a relative volume of 3.6; Tractor Supply Company (TSCO, -4.26▼), with a relative volume of 3.2; Lamb Weston Holdings (LW, -4.57▼), with a relative volume of 3.0; Carnival Corporation (CCL, -5.74▼), with a relative volume of 2.9; and Six Flags Entertainment (SIX, -8.53▼), with a relative volume of 2.6.

Report Card:

The computer hardware company IBM (IBM-0.71%▼) has reported a revenue of $18.75bn, beating estimates of $18.29bn, a 3% growth y-o-y, fastest in 3 years. The adjusted EPS was $2.33, higher than the estimated $2.29. The stock advanced about 4% after hours.

AutoNation Inc. (AN, 3.65%▲) has comprehensively beaten EPS estimates of $2.85 and reported an EPS of $4.83. The retail and wholesale revenue of the company for Q2 is $6.98bn, higher than $4.54bn in the same quarter last year. The stock remained in green after hours.

Crown Holdings (CCK,-2.34%▼), the maker of metal beverage and food cans, has beaten the EPS estimate of $1.80 and has reported an adjusted EPS of $2.14, considerably up from $1.33 in the same quarter last year. The revenue of 2.86bn has missed the estimate by 1.12%. The stock advanced more than 4% after hours.

The revenue of JB Hunt Transport Services (JBHT,-3.19%▼) has increased 36% y-o-y for Q2 to $2.91bn. The diluted EPS of the company $1.61 or an earning of $172.2m surpassed last year’s diluted EPS of $1.14 or an earning of $121.7m. The stock entered the green zone after hours.

Netflix (NFLX, 0.37%▲) earnings report is due today.

On the Lookout:

The Building Permits Survey, which provides data on the number of new housing units authorized by building permits, is due today along with the Housing Starts, providing a look into the number of residential construction statistics.

Here are some upcoming IPOs:

A maker of Zero Calorie soft drinks, Zevia PBC, is planning to raise $200m by offering 14.3m shares at a price ranging between $13 to $15.

Brazilian Communication Technology company, Zenvia Inc, is offering 11.5 million shares of its common stock, priced between $13 to $15, in a bid to raise $145.4m.

Xponential Fitness, which positions itself as the country’s largest ‘boutique fitness franchisor’, is going public offering 13.3m shares of its common stock, priced between $14 to $16.

Another Brazilian company VTEX, a Digital Commerce platform, is eyeing a $3.2bn valuation as it is set to offer 19m class A common shares, priced between $15 to $17.

The Swiss Bioinformatics company, Sophia Genetics, has priced its initial public offering of 13m common shares between $17 to $19, for anticipated gross proceeds of $221m.

Unusually high shorter-term CALL options activity seen on Southwest Airlines Co. (LUV, -2.83%▼), Freeport-McMoRan Inc. (FCX, -2.41%▼), Golar LNG. (GLNG, -4.54%▼), Qualcomm Inc. (QCOM, -0.66%▼) and Community Draftkings Inc. (DKNG, 1.99%▲) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on American Airlines (AAL, -4.14%▼), TAL Education Group (TAL,-5.79%▼), Sabre Corporation. (SABR, -1.18%▼), American Eagle Outfitters (AEO,-0.33%▼), and American International Group (AIG,-4.20%▼) among others.

Other Asset Classes:

The agreement to improve Crude Oil production by 400,000 barrels a day between OPEC+ countries led to a major pullback in oil prices. The WTI crude fell to $66.53 on Monday, its lowest since March as rising Covid cases have also put a shadow over demand for the commodity. Brent Crude was down to $69.48, per barrel, early Tuesday morning.

The US Dollar (92.97, 0.08%▲) had a volatile day Monday, falling to 92.80 before recovering and reaching a high of 92.95. The surgeon Covid has further lent legs to the risk aversion factor that can drive the dollar beyond the 3 month peak of 93.

As the markets tumbled, amid concerns around economic recovery, the 10 Year Treasury Yield, fell to its lowest level in five months Monday, losing 11 basis points to reach 1.189%. The yields climbed a little, early Tuesday morning.

Global Markets:

The BloodBath in Asian markets continued today, following the worst day in months in the US markets Monday. Fears of slow global economic recovery are thought to be the culprit in the Asia Pacific region as well. Nikkei lost 264 points, Hang Seng 230 points and Taiwan 260 points as the markets closed in red.

Surprisingly, European Markets have been able to shrug off the negativity infused by rising Covid cases across the world and restored some sense of normalcy, Tuesday morning. Stoxx-600 was up more than 1% in early trade as Swiss Banking Giant UBS reported a net profit, attributable to shareholders, of $2bn for the second quarter.

Meanwhile on Researchfin.ai

There were five new trade setups identified by the AI today. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com

in your approved sender’s list and you'll never miss the newsletter.

Will see you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.