The ‘Delta’ Force!

Good Morning,

The “opium of masses”! Chinese state media criticized the online video gaming industry calling it ‘opium’. Tencent, one of the biggest online gaming platforms, tanked 10% before announcing it would impose controls for minors. NetEase and XD slid 15% and 21%, respectively. Another crackdown in the offing?

Got your Zoom meeting bombed by uninvited members? Well, you can get paid for it now! The video conferencing giant will pay people who registered, used, opened, or downloaded the Zoom app in the US, between March 2016 and July 2021 - from a $85m settlement. Your money is a Judge’s nod away!

On ‘Cloud’ nine! The cloud infrastructure market has grown to $42bnin Q2, up by $2bn from Q1, with all major vendors reporting earnings. Synergy Research’s revenue has grown by 39%, Microsoft’s even faster by 51%.

The cloud over Black Friday shopping deepens as recent floods in Europe and China have further constricted the already strained global supply chains. Things you have been planning to buy might have lower discounts on prices or worse, they might be out-of-stock.

The US is averaging more than 63000 new cases of Covid, every day, for the last 7 days. The rising numbers are leaving investors worried vis-a-vis the economic recovery.

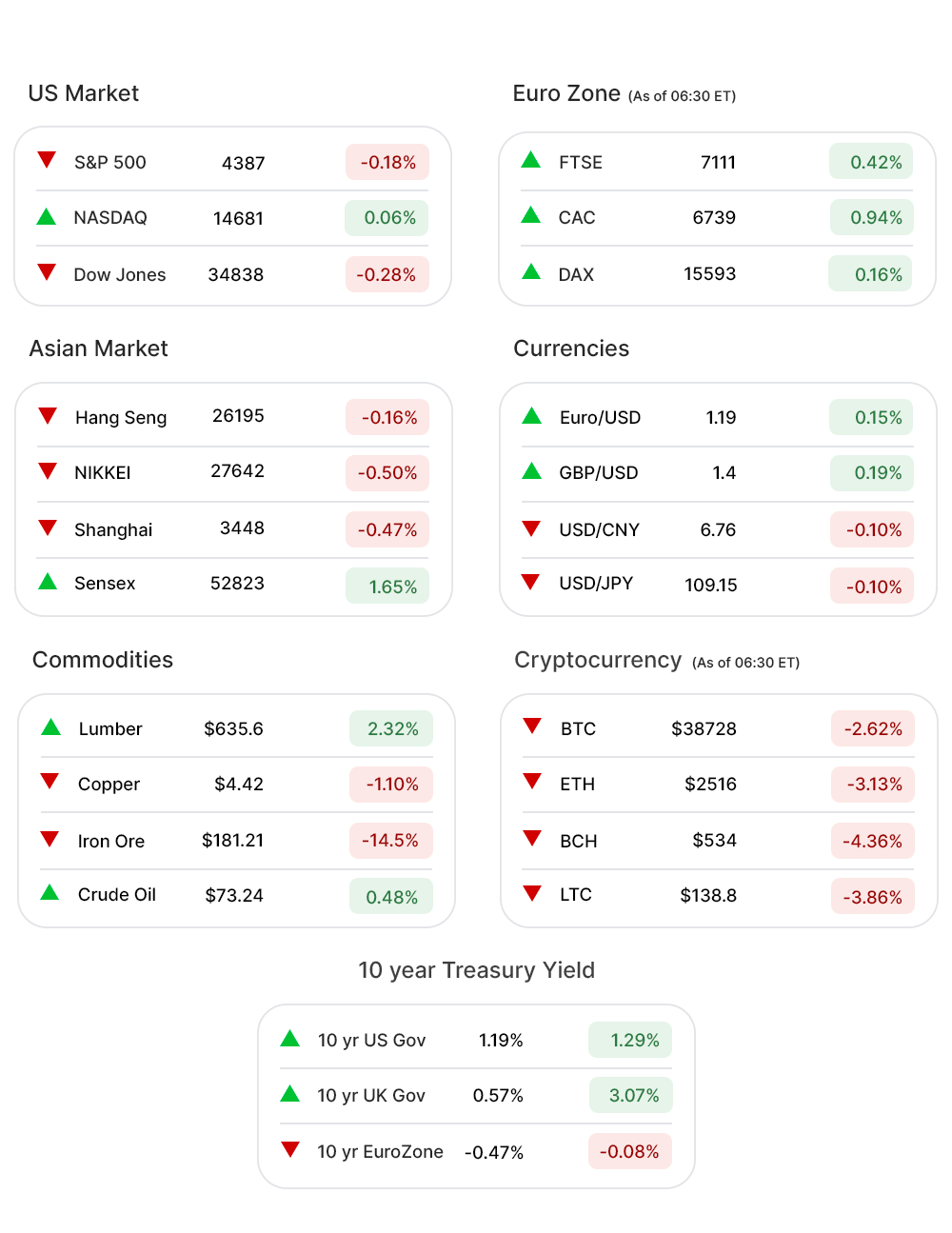

US Markets:

The Markit Manufacturing PMI for July fell to 59.5 compared to 60.6 in June and below the expected 60.9. An above 50 reading, however, means an economic expansion.

The US markets were moving in tandem with a global rebound Monday before a late afternoon selloff pushed major indices, including S&P 500 (-0.18%▼) and Dow Jones (-0.28%▼), into the red zone leaving only Nasdaq (0.06%▲) with slight gains for the day. Not the start investors were looking at for the month!

Sectors at the S&P 500 were mostly red. Consumer Discretionary (0.28%▲), Healthcare (0.17%▲), Real Estate (0.01%▲), and Utilities (0.07%▲) did make some gains but nothing substantial.

Materials (-1.17%▼) led the losing sectors, while Energy (-0.71%▼), Technology (-0.37%▼), Communication Services (-0.18%▼), and Financials (-0.08%▼) followed - pulling the index down.

Futures!

The Futures, despite lower Asian and flat EU markets, showed some promise early Tuesday morning. Dow Futures climbed more than 100 points.

As of 06:45 ET: Nasdaq Futures (0.14%▲), S&P 500 Futures (0.38%▲), Russell 2000 Futures (0.74%▲), and Dow Futures (0.48%▲) looked all set for a fruitful Tuesday.

Key Movers in Small Cap:

Atlas Technical Consultants (ATCX, 27.92%▲) continued to gain after it recently bagged a $10m contract, to provide an on-call consultant for the maintenance engineering and inspection services for the Georgia Department of Transportation. The relative volume of the stock was 39.4.

Immunovant Inc (IMVT, -26.00%▼), a developer of monoclonal antibodies for the treatment of autoimmune diseases, received a cash injection of $200m from Roivant Sciences, which already owns 57% of Immunovant. The relative volume of the stock was 13.5.

Healthcare company TG Therapeutics (TGTX, -21.63%▼) reported a Q2 loss of $78.5m, significantly more than what the investors expected. The relative volume of the stock was 11.3.

DigitalOcean Holdings (DOCN, 10.00%▲), a cloud computing platform, spiked Monday after receiving bullish reports from a research company. The relative volume of the stock was 10.0.

The other movers in the small-cap segment included:

Prosight Global Inc. (PROS, 0.71%▲): Relative Volume 6.9.

CompX International Inc (CIX, 2.10%▲): Relative Volume 6.4.

GreenSky LLC (GSKY, 9.44%▲): Relative Volume 4.7.

US Ecology Inc (ECOL, 4.89%▲): Relative Volume 4.2.

Key Movers in Large Cap:

The financial services and digital payments company, Square Inc (SQ, 10.16%▲), has agreed to acquire Australian lending pioneer Afterpay in a $29bn all-stock deal. The relative volume of the stock was 6.1.

The shares of Global Payments Inc (GPN, -11.18%▼) stock entered the “oversold” territory Monday hitting an RSI reading of 27.9. The relative volume of the stock was 5.1.

The B2B information technology provider, DXC Technology (DXC, 6.58%▲), rose 9.2% Monday ahead of its earnings release slated for August 4. The relative volume of the stock was 4.2.

ON Semiconductor (ON, 11.73%▲) crushed analysts’ expectations for Q2 earnings. Expected to report Pro-forma earnings of $0.49 on sales of $1.62bn, the company reported $0.63 per share on $1.67bn. The relative volume of the stock was 2.9.

The other movers in the large-cap segment included:

Certara Inc . (CERT, -3.97%▼): Relative Volume 4.7.

Fidelity National. (FIS, -6.66%▼): Relative Volume 4.2.

Credit Acceptance (CACC, 8.85%▲): Relative Volume 3.4.

Royalty Pharma Plc. (RPRX, -2.59%▼): Relative Volume 3.1.

Report Card:

Producers of engineered wood products and plywood, Boise Cascade (BCC,-3.83%▼) Monday reported net income of $302.6m, or $7.62 per share on sales of $2.4bn. Last year in the same quarter the company had reported a revenue of $33.6m or an EPS of $0.85, on sales of $1.2bn. The stock soared a little shy of 4% after hours.

Petroleum and natural gas company, Continental Resource (CLR,-1.38%▼) reported an EPS Of $0.91, beating the estimate of $0.57 quite comfortably. The company in the previous year had reported a loss of $0.71 per share. The revenue of $1.24bn was more than 10% above the estimates. The stock climbed by 1% after hours.

CNA Financial Corporation (CNA,-0.48%▼) announced a net income of $368m, for Q2, or an EPS of $1.35 compared to last year’s $151m or an EPS of $0.55. The stock remained flat after hours.

Square Inc (SQ, 10.16%▲) has reported an EPS of $0.66, ahead of the expected $0.47. The revenue of $4.68bn missed the estimates of $4.88bn. The company has said that bitcoin investments had a $45m drag on its operating income. The stock slid a little after hours.

On the Lookout:

The Factory Orders print, due to be released today, is expected to go from 1.7% last month to 1.0%.

Core Capital Goods Orders and Motor Vehicle Sales data are due today as well.

Some IPOs to keep track of:

Nervous System Biotech, Eliem Therapeutics, plans to raise $81m by offering 4.5m shares of its common stock, priced between $17 and $19.

The first responder equipment provider, Cadre Holdings, aims for $125m by offering 7.1m shares of its common stock, priced between $16 and $19.

A developer of antibody-based therapies for infectious diseases, Adagio Therapeutics, is hoping to raise up to $318.6m by offering 17.7m shares of its common stock, priced between $16 and $18.

The blank-check company, Healthwell Acquisition Corp, plans to raise $250m by offering 25m shares of common stock, priced at $10.

Unusually high shorter-term CALL options activity seen on Square Inc (SQ, 10.16%▲), Macy’s Inc (M, 0.47%▲), Tusimple Holdings Inc. (TSP, 3.64%▲), Upstart Holdings Inc. (UPST, 10.48%▲), and Moneygram International (MGI, -3.38%▼) among others.

On the other hand, unusually high shorter-term PUT options activity was seen on Wells Fargo & Co. (WFC, -0.33%▼), Alcoa Corp. (AA, -1.84%▼), Laurentian Bank of Canada. (LB, 0.17%▲), Pitney Bowes Inc. (PBI, 0.37%▲), and United States Steel Corp (X, -5.32%▼).

Other Asset Classes:

Crude Oil prices, after rebounding a little, slumped again Tuesday morning as concerns over CoronaVirus curbs and slowing factory activity in key markets weighed on the sentiment. Brent as well as WTI Crude made slight gains as the day progressed.

US Treasury Yields fell considerably on Monday after the PMI index showed a slowing down of economic growth. The 10 Year US Treasury Yield fell 8 basis points to 1.15% while the 30 Year Treasury Yield slid 5 basis points advancing to 1.836%. The yields were gaining a little early Tuesday morning.

The US Dollar (92.02,-0.03%▼) has gained a little momentum after hovering near a one-month low of 91.77, at 91.97 Monday evening. The greenback dropped 0.88% last week, the worst since early May.

Global Markets

Asian Markets, following a weaker lead from Wall Street and concerns surrounding the spread of the delta variant spooking investors, slid Tuesday after a decent rebound from the previous week’s rout on Monday. A likely crackdown on the online gaming sector by China also weighed the markets down. Nikkei, after advancing around 500 points on Monday, shrugged off 139 points today. Hang Seng slid by -0.30% Shanghai closed 0.47% lower.

European Markets looked flat under pressure, early Tuesday morning, despite encouraging earnings from Oil major BP and auto giant Stellantis. The negativity in Asian markets seemed to be creeping into the EU markets as delta variant remains a concern.

Meanwhile on Researchfin.ai

Trade setups identified by our AI within the past 30 days that reached their respective profit targets yesterday among others : Chipotle Mexican Grill (CMG), Sonic Automotive Inc. (SAH), Bancorp Inc (TBBK), and PerkinElmer Inc. (PKI)

There are many more new trade setups identified by the AI yesterday. Please download our app Researchfin.ai for iOS and Android.

If you enjoy reading our newsletter, do make sure to include researchfin@substack.com in your approved sender’s list and you'll never miss the newsletter.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.