The Earnings Season Commences!

Good Morning,

Google is “disappointed” today! France’s antitrust watchdog has levied a fine of $593 million on the Tech giant for failing to fully comply with orders on providing compensation to the country's news outlets for using their news. The company will have to pay an additional 900,000 Euros per day, if it does not comply.

The ‘black widow’ effect! Walt Disney stock rallied as Black Widowbecame the highest grosser on debut, since the beginning of the pandemic, but theater stocks fell as fans snapped up the movie online.

The China cloud! Commodity prices, which have been rallying in the recent past, tumbled on Monday amid rising concerns about slowing growth in China. The fast spreading Delta Variant also added to the woes!

Virgin Galactic stock tanked17%, a day after CEO Richard Branson soared to space. The company has filed to sell $500 million in common stock.

US Markets:

Buoyed by the expectations of a lucrative ‘earnings season’ ahead, the markets shrugged off early losses and closed at record highs Monday, setting a positive tone for the week ahead.

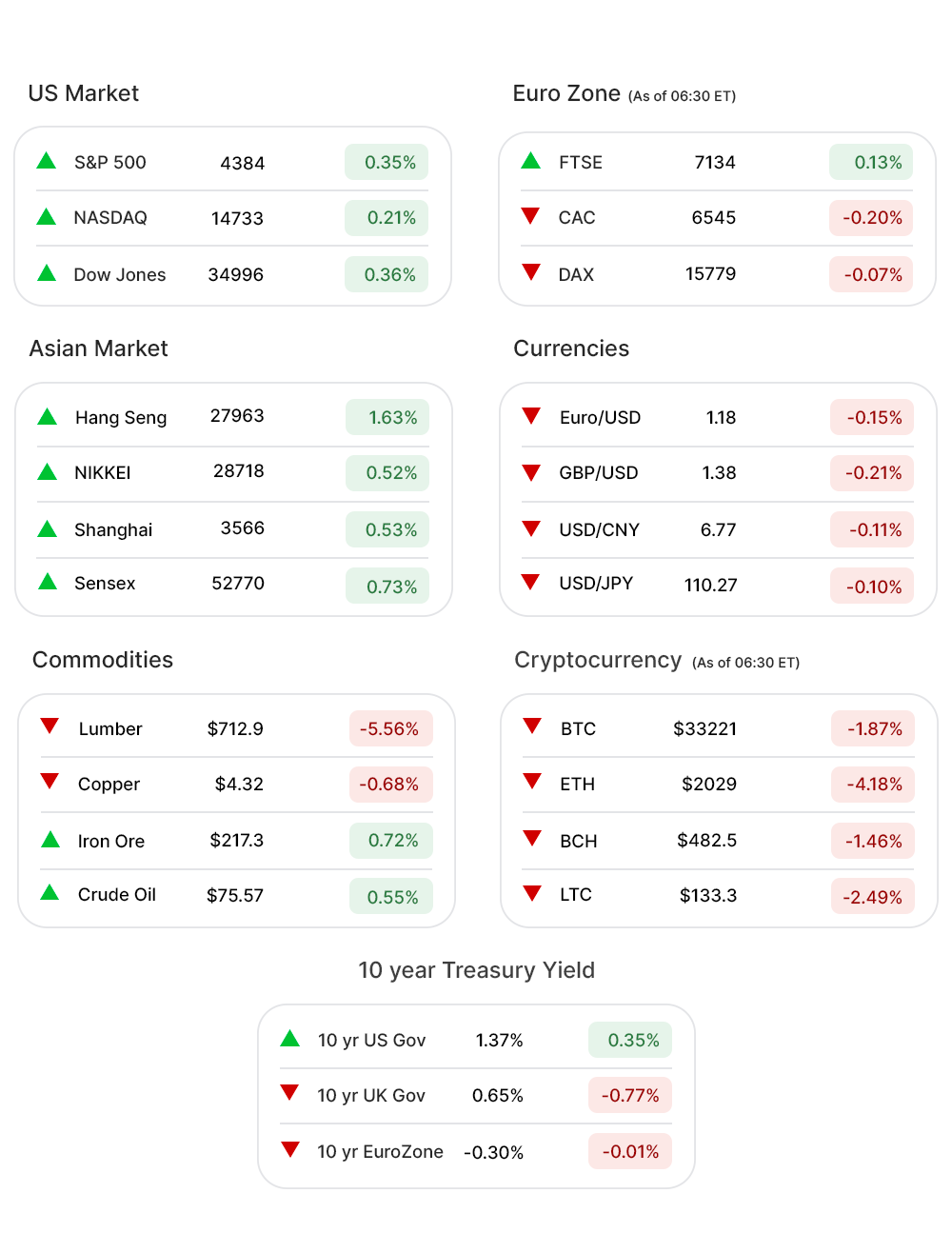

S&P 500 (0.35%▲) rose more than 15 points. Tech-heavy Nasdaq (0.21%▲) and Dow (0.36%▲) had a rather fruitful day as well.

The Materials (2.28%▲), after a slump on Friday, emerged as the front runner among S&P 500 sectors. Financials (0.97%▲), Communication Services (0.90%▲) and Real Estate (0.86%▲) rode on buoyancy in the markets as well.

Technology (0.04%▲) was a bit flat but continued its green run nevertheless even as Energy (-0.11%▼) continued to enjoy the roller coaster!

Apart from the Energy sector, Consumer Staples (-0.21%▼) was the only other sector in red.

Futures!

Hours ahead of the expected key earnings and inflation data, Futures remained a mixed bag of red and green.

As of 07:30 ET, only Nasdaq Futures (0 .34%▲) was in the positive zone. S&P 500 Futures (-0.01%▼), Russell 2000 Futures (-0.29%▼) and Dow Futures (-0.15%▼) were all red.

Key Movers in Small Cap:

State Auto Financial Corporation (STFC, 190.96%▲), the property and casualty insurance company stock skyrocketed Monday, following the news of its acquisition by major stakeholder Liberty Mutual at $52 per share. The deal will add $2.3 billion in premiums to the acquirer. The relative volume of the stock was 53.3.

Celldex Therapeutics (CLDX, 25.49%▲) announced positive results of its ongoing phase 1b clinical study evaluating CDX-0159, in treating two of the most common types of hives. The relative volume of the stock was 4.5.

Verso Corporation (VRS, 10.38%▲) has got a non-binding offer of $20 per share by Atlas Capital Resources, in a 13D filing. The relative volume of the stock was 3.0.

The other key movers in this segment were Clene Inc (CLNN, 20.85%▲), with a relative volume of 6.2; HF Foods Group (HFFG, 12.69%▲), with a relative volume of 8.3 and Alphatec Holdings (ATEC, 11.59%▲), with a relative volume of 2.8.

Key Movers in Large Cap:

Albemarle Corporation (ALB, 6.83%▲), one of the largest Lithium providers for manufacture of EV batteries, made the most of the Biden administration’s announcement to quadruple the share of green energy in America’s economy by 2030. The relative volume of the stock was 4.1.

Alteryx Inc. (AYX, -3.60%▼) slipped on Monday after there was news that Broadcom was in the process of acquiring SAS Institute, a privately held Alteryx competitor. The relative volume of the stock was 2.4.

The Walt Disney Company (DIS, 4.15%▲), with a relative volume of 2.0, rode on the success of its new movie “Black Widow”.

The other key movers in this segment include Qiagen N.V. (QGEN, -3.19%▼), with a relative volume of 3.7; Seaboard Corporation (SEB, -7.70%▼), with a relative volume of 1.9; Upstart Holdings (UPST, 8.25%▲), with a relative volume of 1.3 and IAA Inc (IAA, 4.17%▲), with a relative volume of 1.0.

Report Card:

The earnings season will begin today with some major companies due to release their reports later in the day.

The earnings are expected from JP Morgan Chase (JPM, 1.43%▲), Delta Air Lines (DAL, -0.16%▼), PepsiCo (PEP, 0.02%▲) and Goldman Sachs (GS, 2.35%▲).

On the Lookout:

With the beginning of earnings season today, eyes will also be on the much awaited Consumer Price Index (CPI) .

Despite worries about labor shortage and inflation, the NFIB, small business (optimism) index, has turned out to be 102.5, instead of the expected 99.5, reaffirming that the sentiment of confidence in small business owners prevails.

There are some IPOs we think you should be having an eye on this week.

The biopharmaceutical company, TScan Therapeutics, focused on the treatment of Cancer through immunotherapy will go public on Thursday. The shares are priced between $15-$17.

Sera Prognostics, a developer of ‘PreTRM’ test that can predict an expectant mother’s risk of premature birth, has priced its shares between $15 and $17 as well. It will go public on Thursday.

Another Healthcare company, Stevanato Group, will be the third one to go public on Thursday, with its shares priced between $21 and $24.

Unusually high shorter-term CALL options activity seen on Comcast Corporation (CMCSA, 0.40%▲), Apple Inc. (AAPL, -0.42%▼), Beyond Meat Inc. (BYND, -1.03%▼), and Wayfair Inc. (W, -0.69%▼), AMC Entertainment (AMC, -7.75%▼) among others.

On the other hand, unusually high shorter-term PUT options activity seen on Bank of America (BAC,1.47%▲), 8x8 Inc (EGHT,-1.89%▼), Washington Prime Group (WPG, 0.00%), and Merck & Co (MRK,-0.56%▼) among others.

Other Asset Classes:

As the demand eases and supply expands Lumber, one of the best performing commodities earlier this year, has shrugged all its gains made in 2021. The commodity remained in demand for most part of the year in face of a rising construction activity amid the pandemic. At Monday’s close Lumber was 0.6% in negative for the year.

The 10 Year US Treasury Yield, after hovering around 1.5 for most part of the last month, slumped to 1.25% at one point. The recovery has been slow and at present the print is 1.38%. Have the markets gone too far ahead in the recovery, leaving no scope for the yield cresting to 2% by the end of the year, as was being talked about?

The US Dollar (92.35, 0.10%▲) remains bullish ahead of the CPI data scheduled today.

The Crude Oil seems to have shrugged off negativity surrounding a rise in delta variant cases around the world threatening to hinder the economic recovery. Early Tuesday morning Brent was up 0.73% while WTI gained 0.72%.

Global Markets:

China’s exports rose by 32% y-o-y, for the month of June, beating forecasts expecting it to be around 23%, while imports soared by 36.7%. The news, coupled with the positivity in the US markets on Monday, buoyed Asian Markets further today, with all major indices across the Asia Pacific making gains.

Investors in the European Markets have their eyes fixed stateside with some major banks coming up with earnings today. The Stoxx-600 hovered just below the flat line along with CAC and DAX. Only the FTSE was in the green zone, early morning.

Meanwhile on Researchfin.ai

There are more than 68 new trade setups that were identified by the AI today. Please sign-up on our website to be added to the beta waitlist for our app, if you already haven’t, to learn about these setups.

See you tomorrow!

Warm Regards

Team Researchfin.ai

Disclaimer:Researchfin.ai Opening Bell newsletter reflects the opinions of only the authors who are associated persons of Researchfin.ai and do not reflect the views of Researchfin LLC or any of its subsidiaries. They are meant for informational purposes only and are not intended to serve as investment advice or investment recommendation to buy or sell any security. They are also not research reports and are not intended to serve as the basis for any investment decision. Any third-party information provided therein does not reflect the views of Researchfin LLC or any of their subsidiaries. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns.